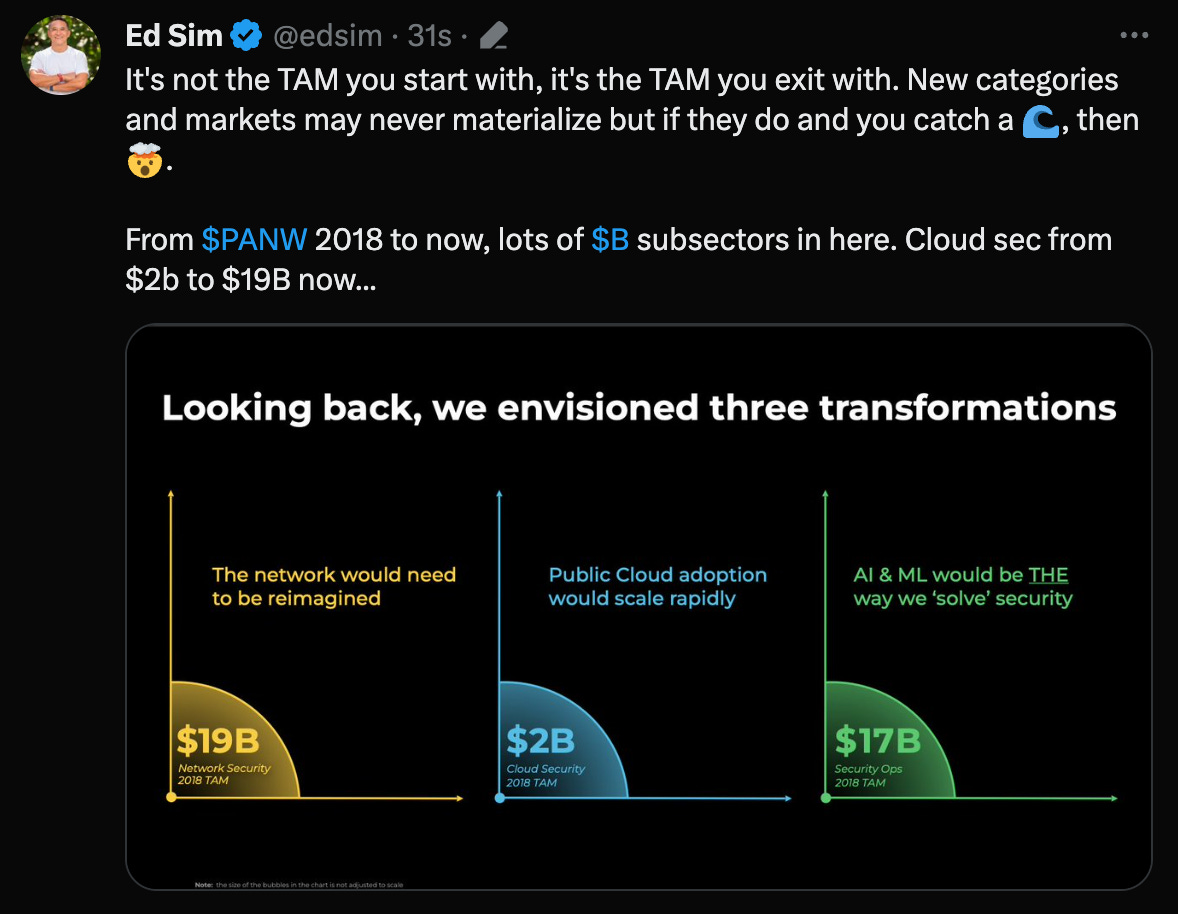

| Palo Alto Networks, one of the leading cybersecurity companies, made an unusual move by hosting its earnings call after market close on a Friday citing its desire to share results before its sales kick off (SKO) on Sunday. While I won’t go into details here, this Q&A from Nikesh (CEO of PANW) highlights what companies even at $2B revenue know - while kick ass products matter, you need sales people who are competitive and can sell - you need to arm them to win, you need to feed your sales people, and they need to make money. Brad Zelnick Thank you so much Walter. So many questions to ask, but I'm going to keep it high level. Nikesh, heading next week into sales kickoff, you're going to once again rally the troops to perform even better next year, topping a fantastic fiscal '23. What are the highest level messages that you're going to focus on to ensure that they really step up their game and can overachieve and do even better next year? Nikesh Arora Brad, sort of how I worked in sales and interacted with salespeople, majority of my life, salespeople like to win. And I think what has become apparent in fiscal '23 for our teams that can -- that we can win in each of these categories. They were used to winning in firewalls. I will tell you, our win rates have gone up tremendously in SASE. I mean we did $1 billion in SASE this past year. Winning in XSIAM has been a phenomenal surprise and a delight to all of us. And literally, I'm telling you what's going to happen on Sunday, every salesperson is going say, I want to be able to sell that product. This product is selling with an average ACV of $1 million hasn't happened in security before. So I think the just generating enthusiasm towards all these capabilities and solutions is kind of a key message for our team. There are some structural changes. Like last year, we took the SASE team and merged that with the core team, and you saw the outcomes. We managed to do that seamlessly without an impact to our business, in fact grew faster. We're doing that next year with Cortex. We're taking our Cortex team, and making them part of core. That's why Dipak talks about these constant ability to improve operating margins is we've hit sort of scale economics in our business. We've hit scale. Everybody has to do these deals. It's no longer a firewall business. So our teams want to do cross-product deals. So the message really is, we're winning in major categories, go out and win those deals. The message is cross-platform is working for us. The message is you are now empowered and trained to sell everything. And every year, we use the opportunity to tweak certain things, which have worked better than the others. So I mean, honestly, like sorry to drag you out on a Friday day afternoon, but I think it's important for a few thousand people next week that we shared all these results with them, and we just got caught in the trap. We're trying to get a Board meeting done and do that on Sunday, so here we are on Friday. But all I -- if it gives you any comfort, Dipak and me and the team are going to be working all Saturday and Sunday as well.

Along those lines, let me share with you one of the biggest mistakes I see from founders just getting started. I encourage you to check out the LinkedIn post as there are also some great comments from founding head of sales at Snyk and Kustomer. In addition, here’s more on when to hire your first reps: We love it when founders can close the first $1m of sales (not a hard and fast number) but point is founders are usually best sales person, you can't hire AEs unless you know what pain you are solving and for whom and understand how to message that, many times how you sell may change - bottom up vs. top down or maybe different entry point in org - engineering or data or security - can dictate type of experience you are looking for.

Of course, not every technical founder is great at selling so you can bring help earlier but don't expect a rep to magically help you take a tech and do all the discovery work of selling for you.

I know Ethan Schechter and Vikas Bhambri may have some strong feelings as well!

As always, 🙏🏼 for reading and please share with your friends and colleagues. Share

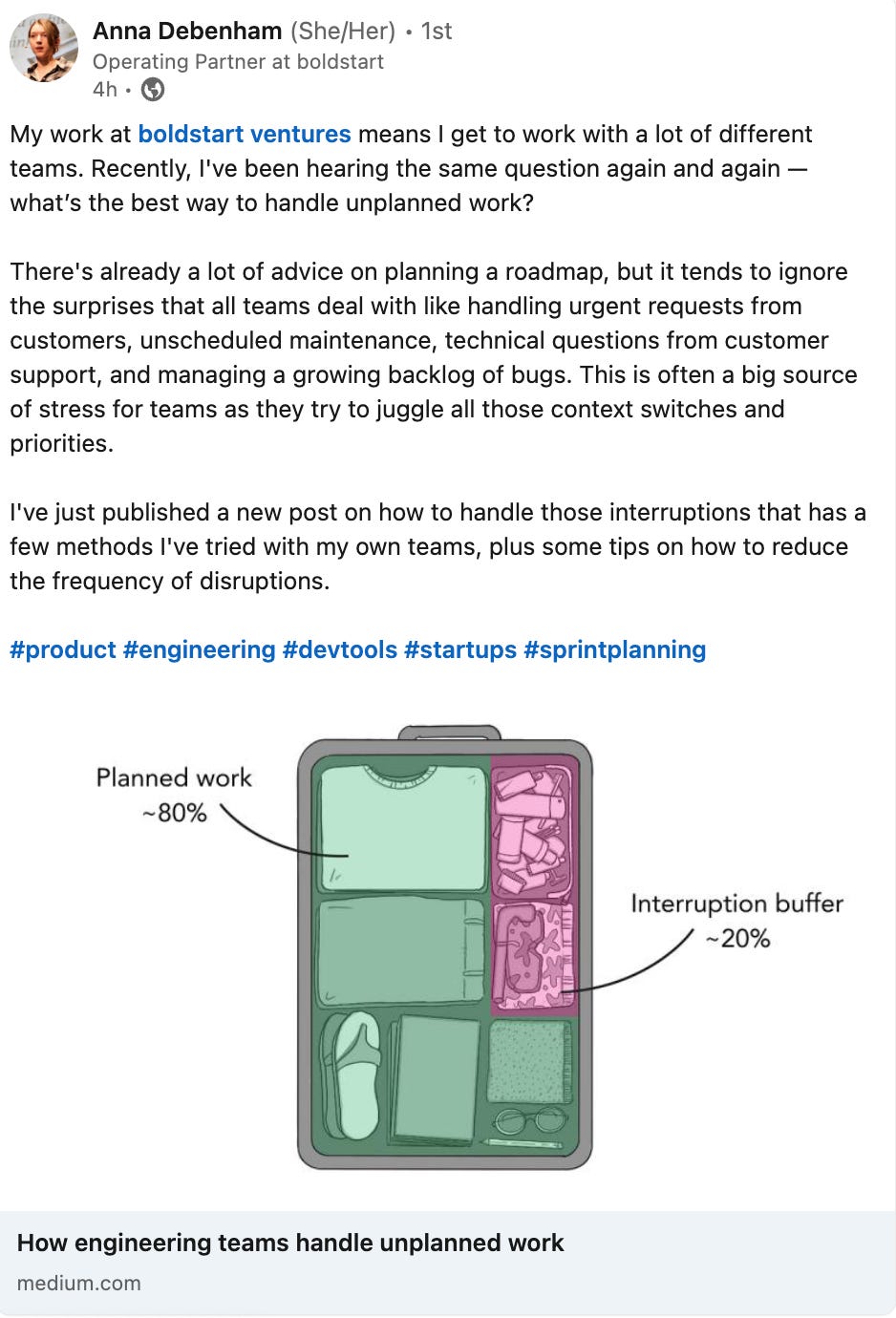

This is one of my favorite series by far and thanks to Lenny Rachitsky for sharing stories from some of the fastest growing enterprise startups including 2 boldstart port cos, Snyk and Front… 👋 Hey, I’m Lenny and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career. Welcome to part two of kickstarting and scaling a B2B business. Here’s where we’re at… 4 days ago · 133 likes · 4 comments · Lenny Rachitsky 👇🏼 must read - Every startup faces this issue: How engineering teams handle unplanned work? From the boldstart ventures Dev Tools Founders Toolkit Series. Anna shares some frameworks for how to prioritize roadmap with disruptions/interruptions - the urgent requests from customers, the unscheduled maintenance, the technical questions from customer support, or the accumulating stream of bugs…

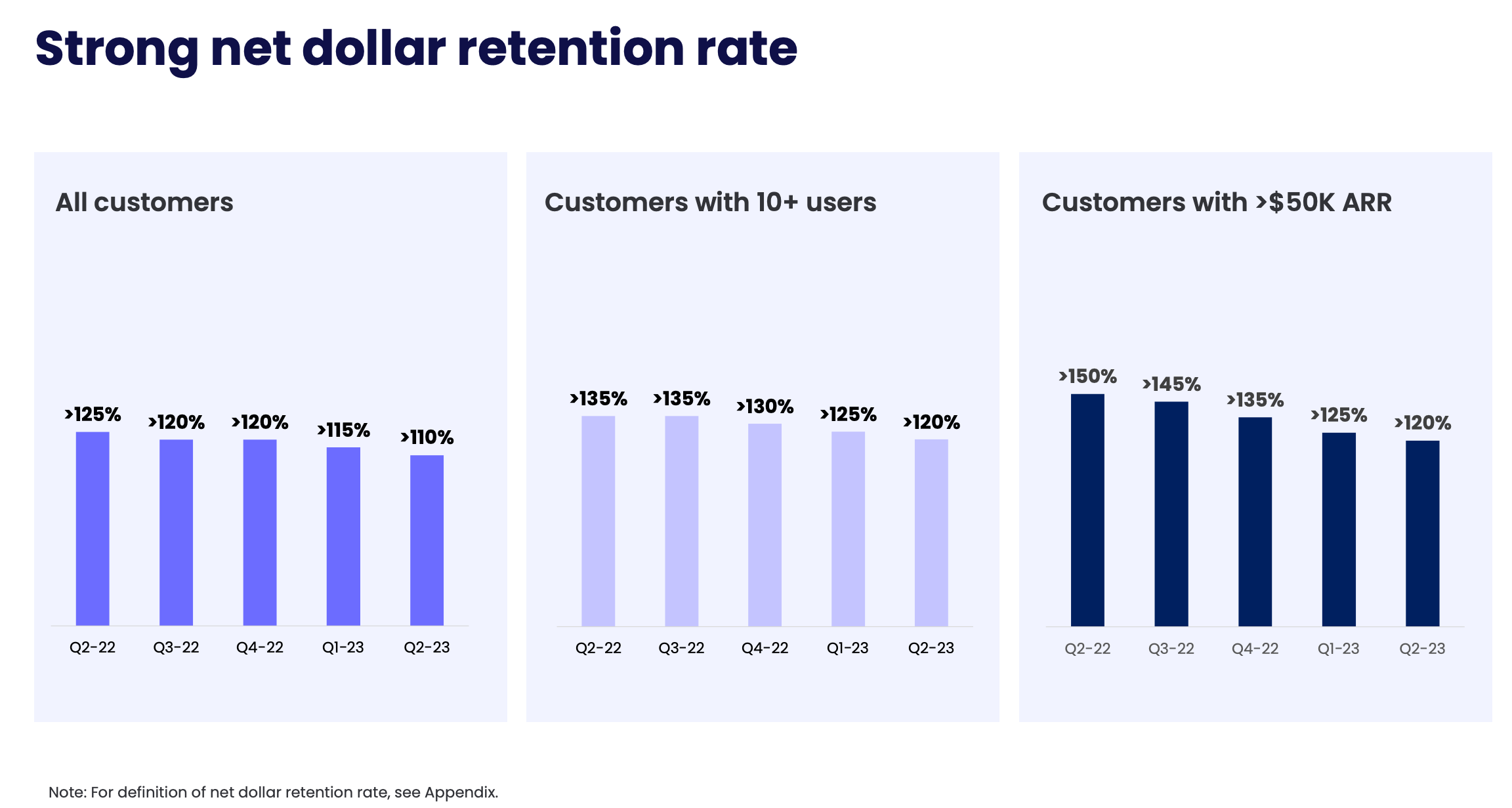

Best in class Net $ Retention continues to trend 📉 - Monday.com (deck) from Q2 Earnings release…but perhaps stabilizing after all customers dips below 110% in coming quarters…(earnings transcript) Eliran Glazer -- Chief Financial Officer Excluding the impact of foreign exchange, revenue grew 43% year over year. Our overall net dollar retention rate declined in Q2, reflecting a continued slowdown in customer seat expansion amid the challenging macroeconomic environment. We continue to expect some pressure on NDR in the second half of fiscal year '23, and our guidance now assume full year NDR slightly below 110%. As a reminder, our NDR is trailing four-quarter weighted average calculation.

Hi, Jason. So, with regards to the recovery, I believe that during the last year and a half with macroeconomy that was challenging, you know, there was a decline that now we see the effect. If you think about the way we look at our net dollar retention, it's trailing 12 months and then weighted average. And now, we're starting to see a kind of a pickup from -- you know, if you compare to a year ago.

So, pretty much, there is some positive signs of getting back into the deals, and we're starting to see the group cohorts that actually joined at the end of last year. Now, we are seeing the positive impact. And this is what drives civilization in the NDR that we are seeing. Still not calling a trend, but positive signs.

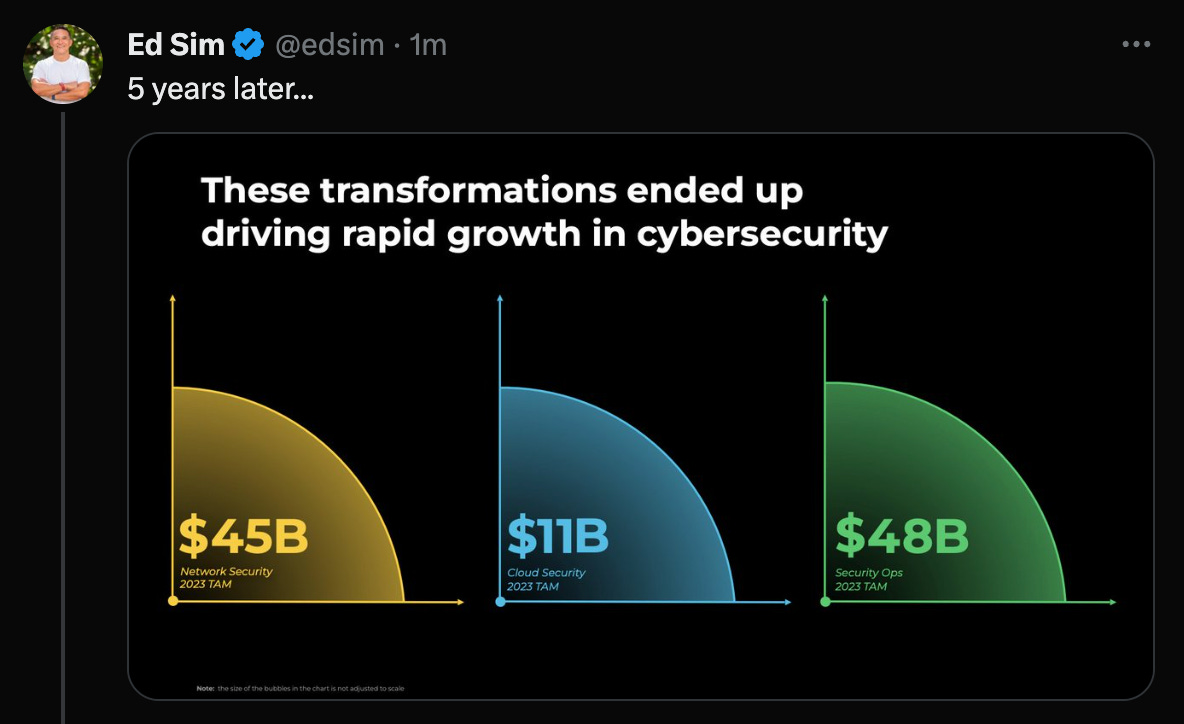

More on this topic from What’s 🔥 #329 Future of cybersecurity from Palo Alto Networks earnings call on Friday - massive upside next 3-5 years from new markets like SASE, cloud, developers + reinventing old like networks - roadmap for all cybersecurity cos in terms of where 💰 will be. Slide deck here as well. Really 🔥 up about the response to Hashicorp’s change in license from open source to BSL - the community is powerful and has responded with OpenTF.org - cool to see competitors get together and bond to help make OpenTF a success (port co Env0 along with Spacelift, Scalr) and >60 other orgs have joined. Please join, read and support! Terraform was open-sourced in 2014 under the Mozilla Public License (v 2.0) (the “MPL”). Over the next ~9 years, it built up a community that included thousands of users, contributors, customers, certified practitioners, vendors, and an ecosystem of open-source modules, plugins, libraries, and extensions. Then, on August 10th, 2023, with little or no advance notice or chance for much, if not all, of the community to have any input, HashiCorp switched the license for Terraform from the MPL to the Business Source License (v1.1) (the “BUSL”), a non-open source license. In our opinion, this change threatens the entire community and ecosystem that's built up around Terraform over the last 9 years.

Our concern: the BUSL license is a poison pill for Terraform.

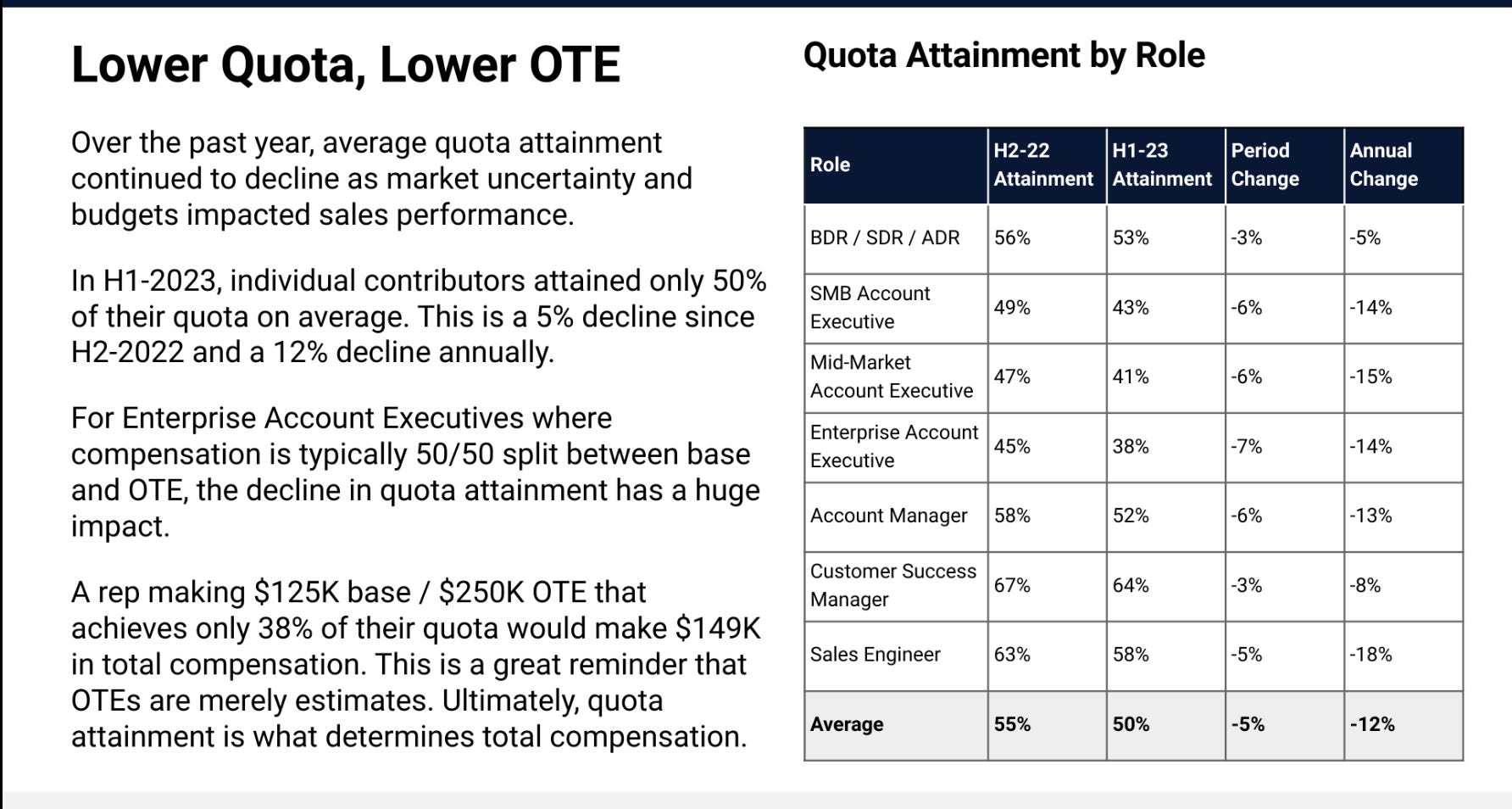

Sales data from friends at CloserIQ with data from over 900 orgs like Asana, Sisense, Datadog, Pendo…also reminder is sales folks need to make money on their OTE so if not selling enough, then they will go to the next place Insight Partners Ignite State of Enterprise 2023 survey from leading C-Level Tech Execs - covers security, data/AI, infra/developer tools, customer experience trends As I’ve always said, there is no AI in enterprise without AI security - AWS now going after this “Leaked document reveals 'Maverick,' a new Amazon AI security initiative led by Uber's former CISO” (Insider) The project is led by four executives, including John "Four" Flynn, VP and chief information security officer of Amazon's retail business. Flynn was Uber's CISO until 2020 before joining Amazon. "In Q2 2023, Amazon Security created the Maverick program to ensure LLM based experiences uphold our high security standards to protect customer data and trust. Maverick's approach is to partner with teams exploring GenAl opportunities, centralize and share security best practices, and be the Center of Excellence for developing GenAI securely at the scale of Amazon," the document said. In an email to Insider, Amazon's spokesperson, Adam Montgomery, said Amazon has a "deep commitment to the safe, secure, and responsible development and deployment of generative AI." "Our company-wide approach to secure AI development paves the way for a future that enhances the benefits of AI and helps minimize risks," the statement said.

AI’s usability problem from Rachel Woods, ex-Facebook Research Data Scientist, and founder of AI Exchange One way enterprises will let developers ship Gen AI features - Intuit CTO (Runtime) Now those teams are playing around with generative AI tools in hopes of improving productivity. While Intuit still considers itself in the experimental phase when it comes to tools like GitHub's Copilot, some interesting applications are starting to pop up. "There's a lot of different places where you can actually use natural language to accelerate the pace at which things are going," Balazs said. "Things like, can you auto generate the documentation of an API? Or can you actually even auto generate the API itself by inspecting the services themselves?" But Intuit developers that want to participate in the generative AI era are forced to use its own application runtime called GenOS, which automatically builds unique security and privacy features into Intuit applications developed with generative AI when they are deployed. "You can't go natively to any of the GenAI providers," Balazs said. Unlike most of Intuit's development rules, the path to apps with generative AI "is a walled road.

THIS IS HUGE! Meta will release Code Llama, open source code generator a la Github Copilot - lots of enterprise use cases ahead to train models on own data… Code LLaMa aims to make it easier for developers to create AI assistants that automatically suggest code, potentially luring customers away from paid-for coding assistants such as Microsoft's GitHub Copilot, which is based on Codex. As an open-source coding model, larger companies may prefer to develop their own coding assistant to protect their source code.

Fintech Ramp is Raising Capital at $5.5 Billion Valuation, Down 30% (The Information) - IMO - down rounds are ok, especially if you need cash to create much higher longer term value. Clean deals, no structure - I’m all for it if one needs the cash. More to come frankly… Fintech startup Ramp is raising several hundred million from investors at a $5.5 billion valuation, measured before the investment, according to two people familiar with the matter. That’s a 32% cut to the $8.1 billion at which Ramp was valued at in early 2022, reflecting how startup values have fallen in the past two years.

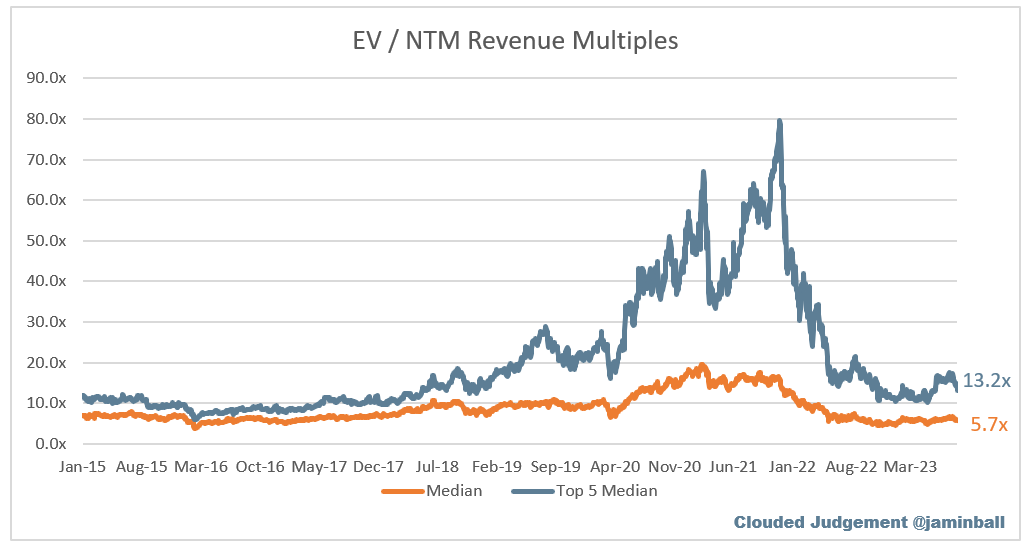

State of valuations - was at 18x forward just a month ago and back to 13.2x for Top 5 Median (MongoDB headlings, then Snowflake, Cloudflare, Datadog, Samara) - more here from Jamin Ball/Clouded Judgement

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. Pledge your support | |