Coin Metrics’ State of the Network: Issue 221

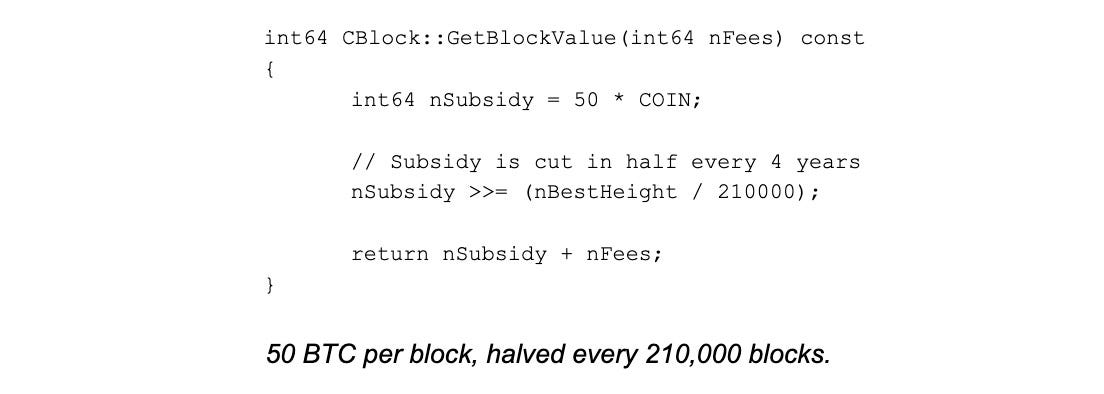

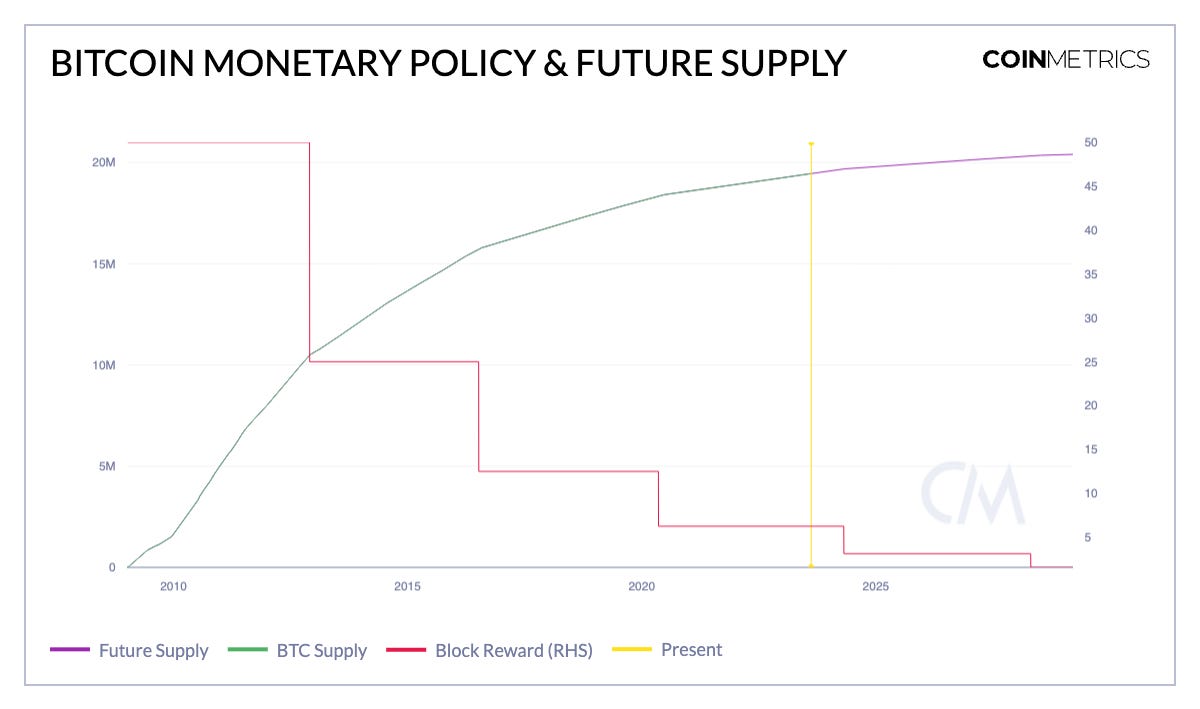

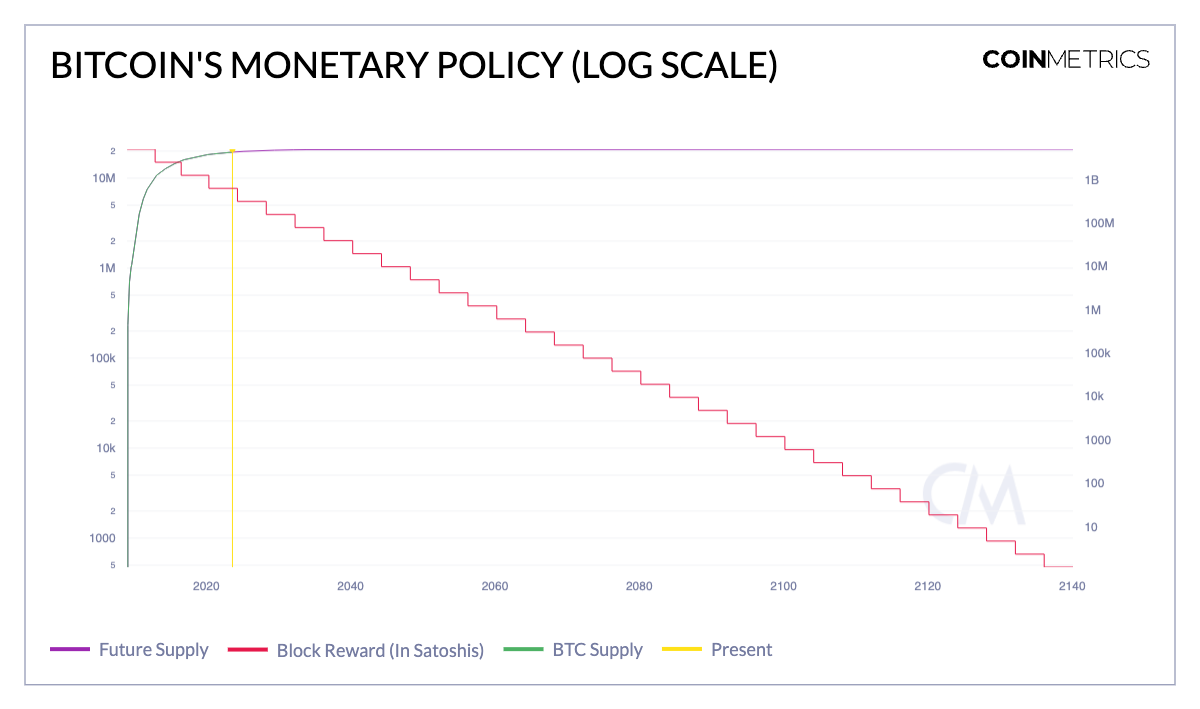

Coin Metrics’ State of the Network: Issue 221Beauty in Predictability: Understanding Bitcoin's Halving CycleGet the best data-driven crypto insights and analysis every week: Beauty in Predictability: Understanding Bitcoin HalvingsBy: Kyle Waters and Tanay Ved IntroductionHistorically, central banks have controlled monetary policy, adjusting money supply, interest rates, and serving as lender of last resort to guide the economy towards stability and growth. In 2009, Bitcoin introduced an alternative: a decentralized digital currency not steered by a small group of human decision-makers but by immutable rules set in code. This shift challenged the conventional reliance on central authorities: Bitcoin’s monetary policy was pre-determined at its creation and governed thereafter not by policymakers, but by its underlying open source code which all can see and attest to. Many of the core facets of Bitcoin’s monetary regime are by now well known. Perhaps best known is Bitcoin’s fixed supply of 21M units to ensure scarcity in the digital realm. Many also know that the protocol issues bitcoins in a predictable manner, with issuance gradually decaying over time. At the heart of Bitcoin’s monetary policy is a key concept known as the "halving”. In this issue of State of the Network, we give an overview of the concept of halvings, their implications, and examine some data in the current halving epoch as Bitcoin approaches its 4th halving next spring. What is a Bitcoin Halving?On average, every 10 minutes a new Bitcoin block is added to the blockchain. To incentivize miners for adding new blocks to the chain, they are rewarded with newly minted bitcoins. This reward is essential for not only incentivizing the mining process, but keeping the network secure. However, this reward doesn't remain constant. Every 210,000 blocks, or approximately every 4 years, this reward is cut in half. This event is now often referred to in the digital assets ecosystem as a "halving." We can see this by simply looking at the code. Going to one of the earliest backups of Bitcoin’s code, we see the now-legendary formula that sets the limit on block rewards. These concise lines of code effectively set Bitcoin’s supply at 21M BTC: The first three halvings occurred in November 2012 (50 to 25 BTC), July 2016 (25 to 12.5 BTC), and May 2020 (12.5 to 6.25 BTC). As of August 17th, 2023, the Bitcoin blockchain was at a block height of 803,662 and the next halving will occur at block 840,000—currently projected for April 2024. Source: Coin Metrics Formula Builder Why do Halvings Occur?Halvings are essential to control supply. Just as central banks use monetary policies to prevent hyperinflation, Bitcoin's design aims to prevent inflation in its ecosystem. This ensures that Bitcoin issuance reduces over time, mimicking the scarcity properties of precious resources like gold. Halvings mathematically guarantee the finite cap of 21M bitcoins. One of Bitcoin's unique properties is its capped supply; that there will only ever be 21 million bitcoins. The halving schedule ensures that we don't reach this cap too quickly, prolonging the mining incentive structure. In fact, the exponential decay of the block reward means that most of Bitcoin’s supply has already been mined. BTC’s supply is ~19.45M today, and the remaining 1.5M BTC will be mined over the course of the next 120 years. The last halving will effectively occur around 2140 when the block reward drops below the lowest BTC denomination of 1 Satoshi—or 1/100,000,000 of a full bitcoin. The chart below (plotted on a log scale) shows the predictable rhythm of the block reward halving ever 4 years until 2140. Source: Coin Metrics Formula Builder Interestingly, the specific decision of a 21M supply cap was—in Satoshi’s own words—a fairly arbitrary choice. The quote below comes from an April 2009 email exchange between Satoshi and early Bitcoin developer Mike Hearn.

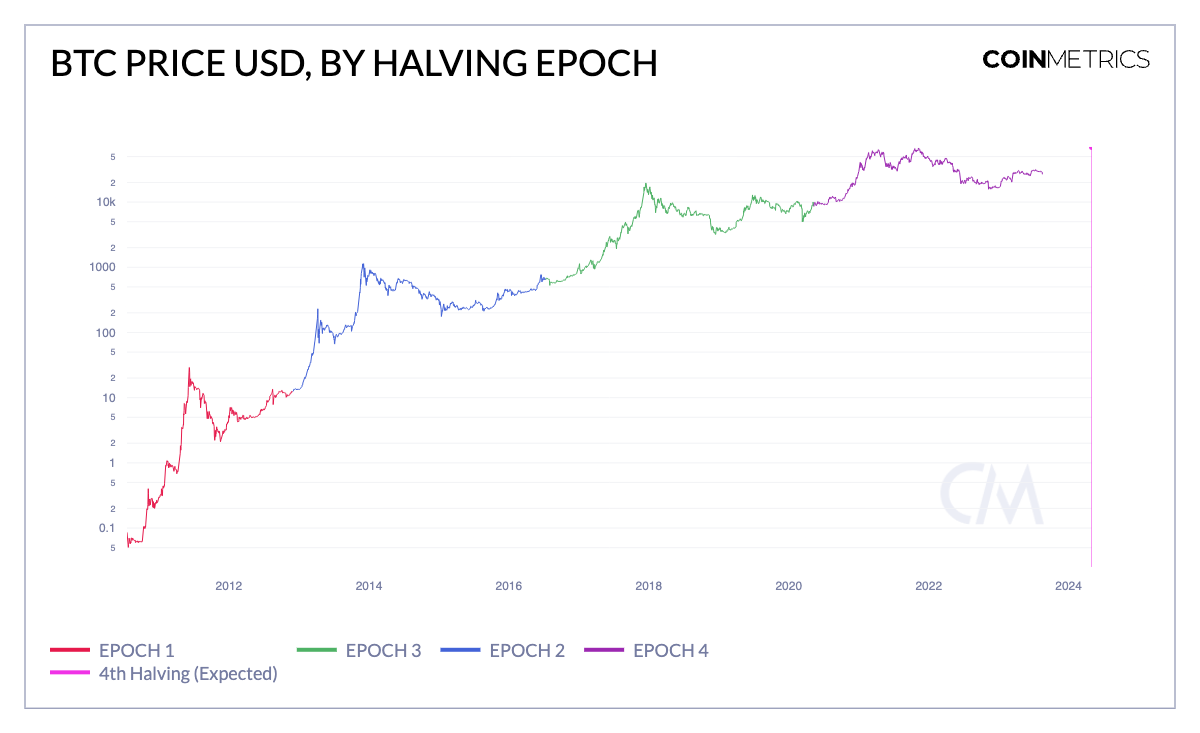

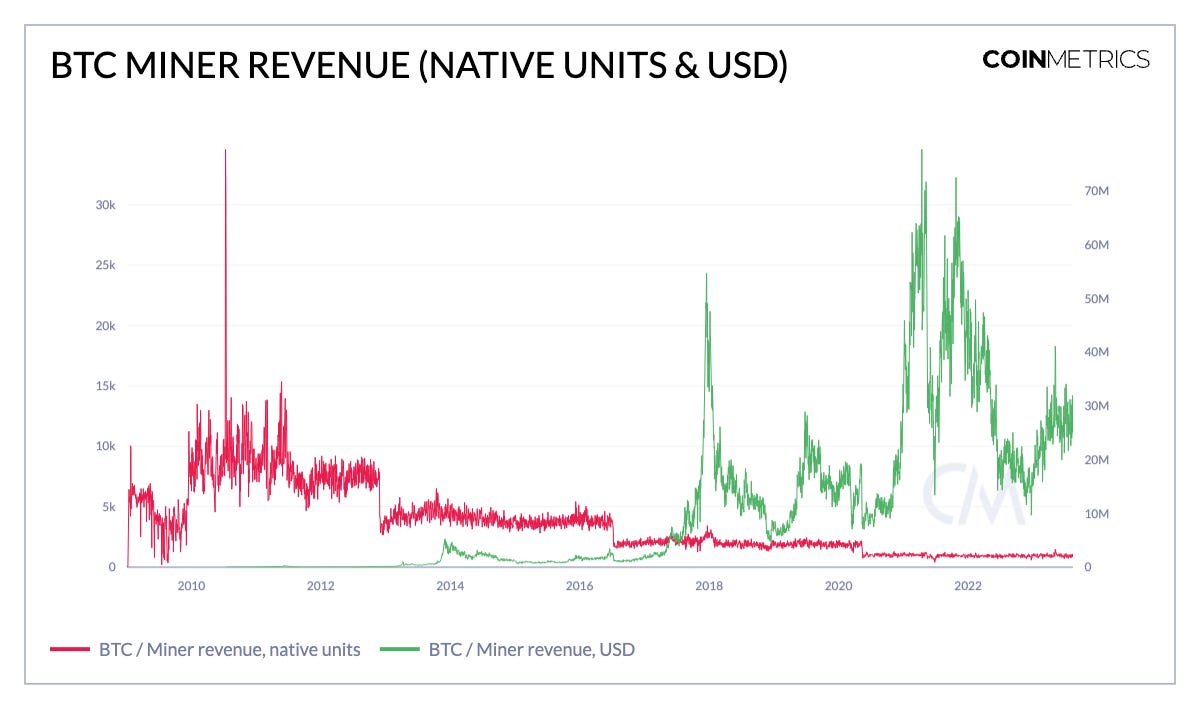

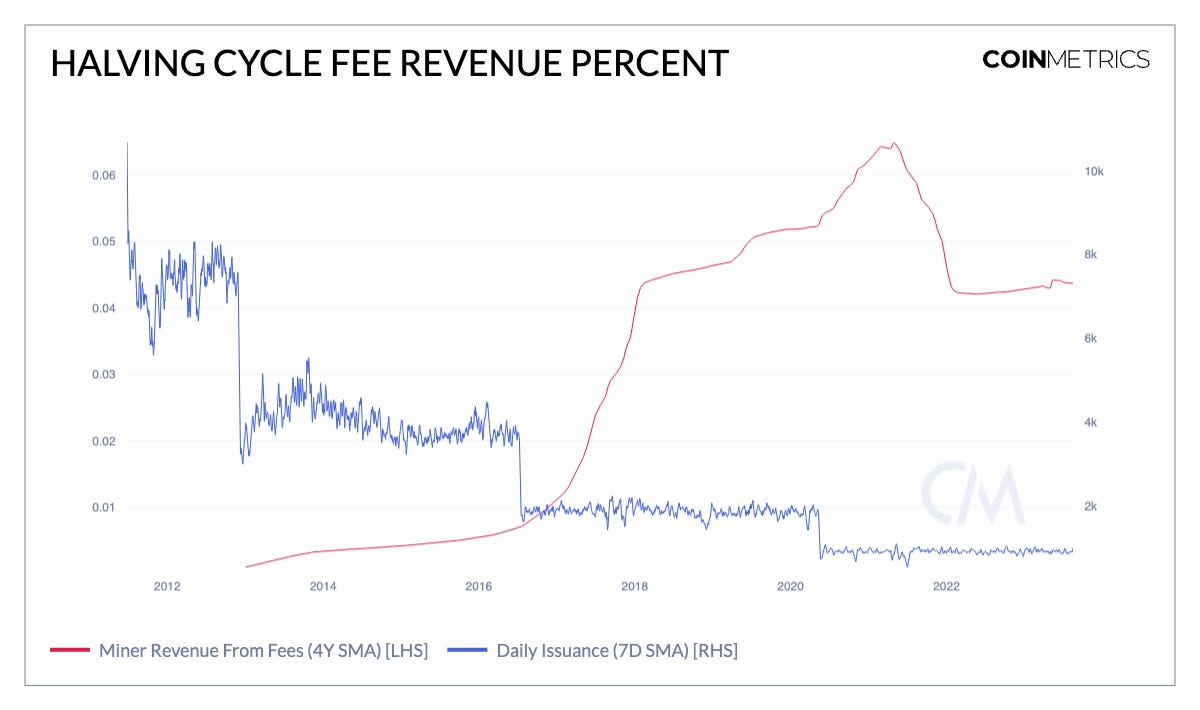

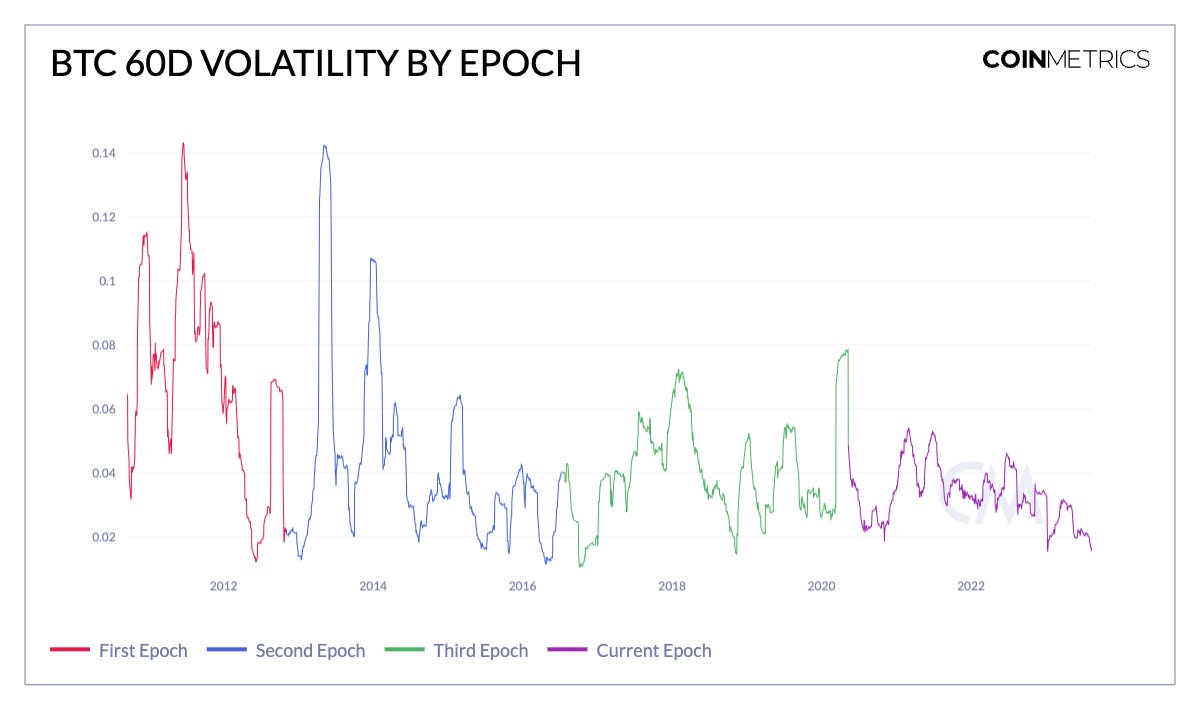

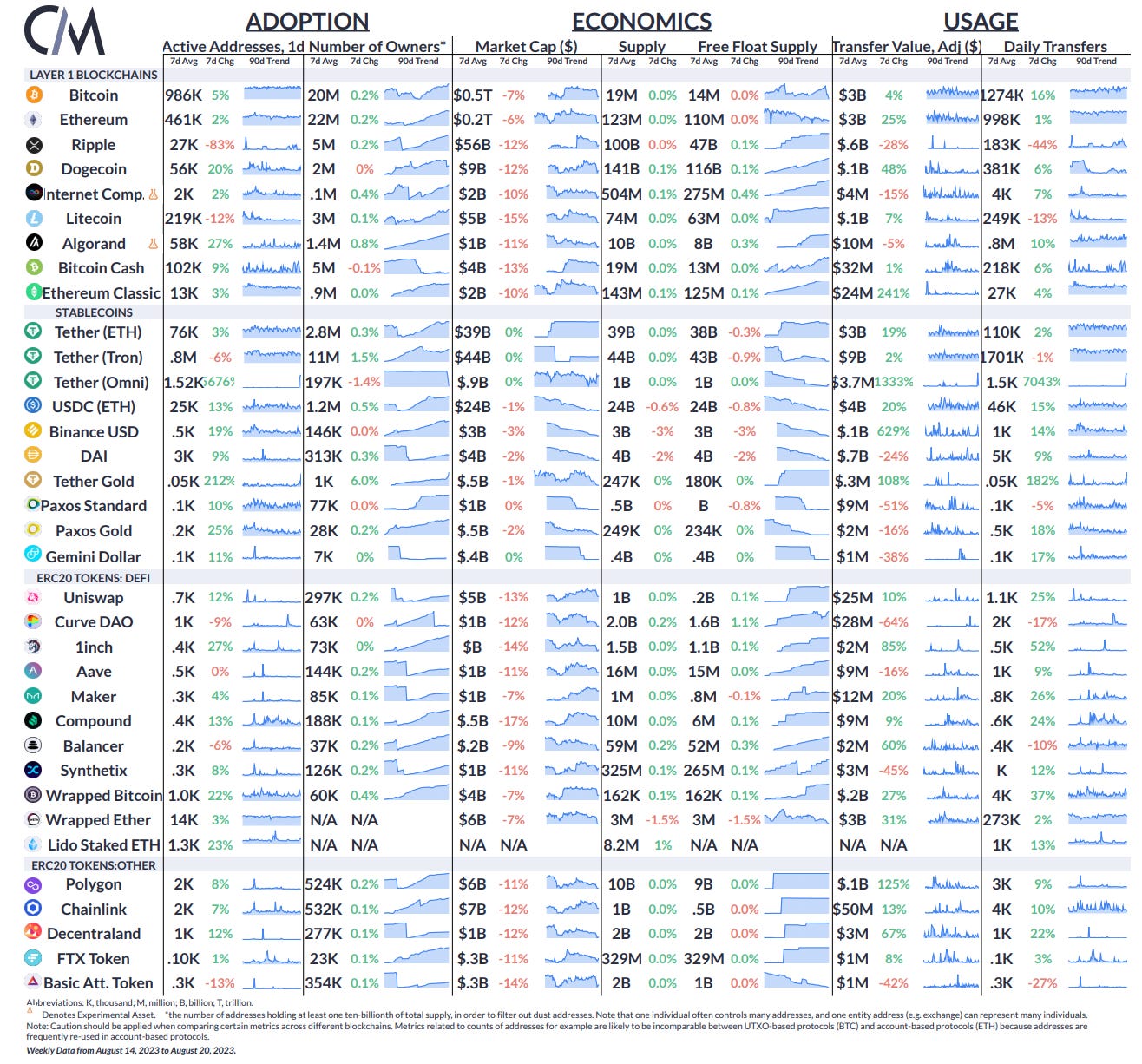

Halving ImpactsHalvings & the Efficient-Markets Hypothesis (EMH)The first major implication of halvings is the (oft-debated) impact on bitcoin’s supply and demand dynamics. With each halving, fewer bitcoins enter circulation, and if demand remains constant or increases, less supply entering the market in theory implies upward pressure on price following basic economic principles. As such, investors and market observers keenly anticipate each Bitcoin halving in hopes of witnessing price appreciation. The past halving events in 2012 and 2016 saw significant price increases in the months following the halving. However, it's essential to consider that various other factors might have contributed to these price increases. Therefore, extrapolating past performance to predict future price actions may lead to inaccurate outcomes. Source: Coin Metrics Formula Builder In principle, a Bitcoin halving is a known event encoded in the protocol’s rules (as we saw earlier), and the crypto-economic sector is increasingly characterized by sophisticated participants who are likely to price-in the anticipated supply reduction ahead of the actual event. On the demand side, various developments can impact bitcoin's price post-halving. The growth of cryptocurrency adoption, regulatory changes, and broader macroeconomic factors, such as level of global economic uncertainty and performance of other asset classes, can all affect the demand for bitcoin. Yet the core influence on bitcoin's price in the wake of a halving event is likely to come from whether the perception of its value proposition is enhanced or reduced among a critical mass of market participants. If bitcoin is increasingly seen as a reliable store of value, with the halving mechanism underlying its scarcity, this could attract more participants into the market and subsequently drive the price up. One other potential economic factor is the behavioral change of Bitcoin miners who might hoard BTC in anticipation of perceived higher future prices. As we’ll see, miners play a crucial role in the Bitcoin system and are especially impacted by halvings. Miner IncentivesAs block rewards diminish, miners might initially be less profitable, especially if the price of BTC doesn't compensate for the reduction. The chart below shows daily Bitcoin miner revenue in both native BTC units and USD terms. Despite the reduction in block rewards, USD revenue has increased simply due to the price appreciation of BTC. Source: Coin Metrics Formula Builder Additionally, miners are compensated from transaction fees. Implicit in Bitcoin’s security model is an expectation that over time, fees will adequately make up for the loss in block rewards, increasing their proportion of total miner revenue. This was observed after both the second and third halvings, but the compression in fees post-2021 has dampened this effect. The introduction of ordinals and inscriptions on Bitcoin has helped increase fees at times this year, but a long-term sustainable uptick in fee revenue percent is needed as block rewards continue to diminish. Source: Coin Metrics Formula Builder (courtesy of crypto researcher Data Always’ open source repository of CM Formula Builder examples) Block rewards are still sufficiently high for most miners, but that being said, miners cannot simply assume a specific BTC price and fee rate into their future models. In short, halvings have a real impact on the long-term viability of operations. Currently a block (excluding transaction fees) is worth 6.25 BTC or ~$160K at today’s price of $26K per BTC. After the halving, it will be worth 3.125 BTC or ~$80K. Some large mining companies have already started commenting on potential acquisition opportunities ahead of the 2024 halving, implying that some miners may struggle to adequately position themselves. Luckily, miners have time to prepare, but it is just another variable to juggle in a complex calculation along with input energy costs and ASIC fleet management. As the data from our June report The Signal & the Nonce shows, miner efficiency continues to increase, making it all the more important for miners to stay ahead of the curve. What to expect going towards the 2024 halving?With less than one year to go, we expect the discussion around Bitcoin’s halving to pick up soon. With the potential for the first spot bitcoin ETF approval in the US also coinciding with the halving, there is the possibility of heightened volatility. The chart below shows the realized 60d volatility for BTC. Currently, despite a move downward last week, volatility remains historically low. Whether volatility increases around the next halving will be of interest. While there is no technical risk event like in the lead up to last year’s Ethereum Merge, it will be important to follow the markets nonetheless. Source: Coin Metrics Formula Builder As seen with previous halvings, we also expect the discussion around Bitcoin’s security budget to also heat up as the 4th halving approaches. Analyses of miner economics will also come to the forefront. Studying the efficiency of the network at large will be important as will the profitability for each ASIC model. Conclusion: Halvings are the core force of Bitcoin’s Monetary PolicyIn traditional finance, central banks can adjust policies based on economic conditions, through measures like quantitative easing (QE) or tightening (QT) to expand or contract the broader money supply, aiming for goals like maximum employment or price stability. This flexibility can be both an advantage and a liability, depending on the decisions made. But Bitcoin operates differently; Bitcoin's monetary policy is hardcoded and predictable. Everyone knows when halvings will occur and how the supply will change. This transparency can reduce uncertainties typically associated with central bank decisions. Further, no single entity, government, or organization controls Bitcoin's monetary policy. This decentralization aims to reduce the political and economic mismanagement risks that might plague traditional currencies. At the core of this, is the rhythm of halvings, a concept all Bitcoiners should understand well, especially as spring 2024 and Bitcoin’s 4th halving approaches. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Active addresses for Tether (Omni) rose by 5676% as the stablecoin issuer discontinued its support for Omni. Activity on Bitcoin and Ethereum increased by 5% and 2% respectively, while their market capitalization experienced 7% and 6% declines over the week. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 220

Tuesday, August 15, 2023

From East to West: the Global Pulse of Stablecoin Transactions

Coin Metrics’ State of the Network: Issue 219

Tuesday, August 8, 2023

DeFi's Double-Edged Sword

Coin Metrics’ State of the Network: Issue 218

Tuesday, August 1, 2023

Decoding the Digital Dollar: Unraveling the Risks of Stablecoins

Coin Metrics’ State of the Network: Issue 217

Tuesday, July 25, 2023

Can On-Chain metrics help determine which Cryptocurrencies are Securities?

Coin Metrics’ State of the Network: Issue 216

Tuesday, July 18, 2023

A data-driven look at digital asset markets after a milestone ruling in SEC v. Ripple

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏