Not Boring by Packy McCormick - A Market For (Almost) Everything

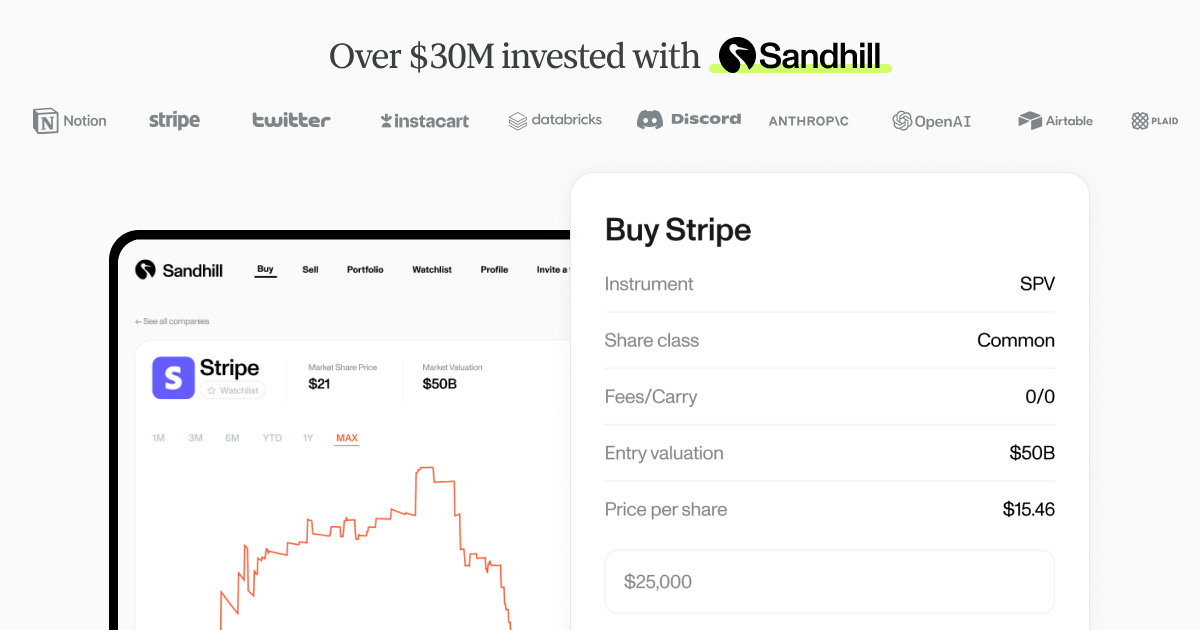

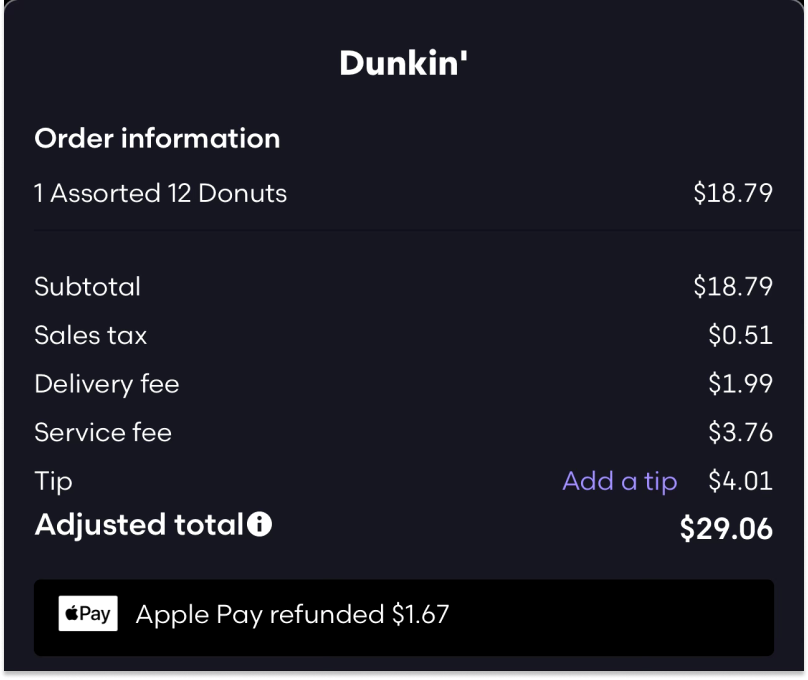

Welcome to the 414 newly Not Boring people who have joined us since last Tuesday! If you haven’t subscribed, join 210,924 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… Sandhill Markets The top blue-chip startups like Stripe, SpaceX, OpenAI, Instacart, and Databricks have created hundreds of billions in value in the private markets. Their shares have been nearly impossible to access for non-institutional investors. Sandhill Markets gets you into those deals. Sandhill Markets is a “Robinhood for Private Markets” with the Top 25 pre-IPO blue chips – all of the companies above, plus Epic, Discord, Anduril, and Neuralink. And they’re backed by top investors like a16z, Floodgate, and Matrix. Skip the $100K minimums and 2/20 fees. With Sandhill, you get low $5K minimums, with 0% management fees, 0% transactions fees, and 0% carry. The first 100 Not Boring readers who click get a discounted monthly fee of just $99 (down from $149). Claim here. Hi friends 👋, Happy Tuesday! We’re in the thick of August, so I hope this email finds you either on a beach or working on something you don’t want to stop working on. In either case, I hope you have better things to do than read a long newsletter. Plus, yesterday was Puja’s birthday – happy birthday Puj!! So I had better things to do than to write one. So let’s keep it short and give you something to chew on on the beach. Let’s get to it. A Market for Almost EverythingUsed to be, a man wanted something to eat, he grew it or killed it and cooked it for himself. Millennia ago, there was no market for food, no buyers or sellers. A man couldn’t, at the end of a long day, say, “Let’s just order tonight.” Couldn’t even go to a grocery store to get the ingredients and cook it himself. There was no price he could pay for a meal but his own direct labor. Today, we do this: That’s a real screenshot from my phone yesterday, and look, I fully admit $29.06 is an absurd amount of money to pay for a dozen donuts, but I had a choice:

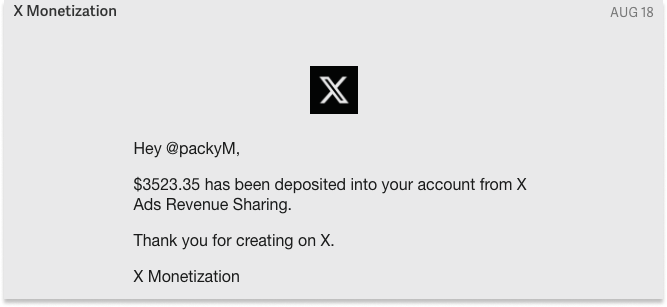

It was Puja’s birthday and she loves Dunkin’ Donuts, so A wasn’t an option. I chose C. As much as people love sharing screenshots of food delivery fees in horror, there’s something kind of great about them. There’s now a market – I can pay some price to get what I want. It’s legible – my time was clearly priced at the $9.76 fee + tip bundle. And it’s liquid – as soon as I decided I wanted the donuts, there was someone willing to get them for me for that $9.76, in less time than it would have taken me. Something similar is happening, has happened, and will continue to happen everywhere you look: donuts, dating, stocks, jobs, revenge. It’s like a law of physics, or at least a law of capitalism: Markets emerge for almost everything and become more liquid and legible over time. Take views. On Friday, I was sitting there minding my business, when I got an email from X: The company formerly known as Twitter paid me $3,523.35 for tweeting, something I’ve been addicted to doing, for free, for years. That’s like a pack-a-day smoker waking up one morning to a big check from Marlboro simply for smoking a pack-a-day. (Tweeter beware: that does actually happen sometimes, but when it does, it’s because Marlboro gave you cancer.) Twitter has always been very valuable to me. Not Boring and Not Boring Capital probably wouldn’t exist without it. But that value was indirect:

I couldn’t have told you how much a view was worth. It wasn’t legible. And I couldn’t convert views directly into dollars. It wasn’t liquid. With Creator Payouts, it’s both. Roughly 15 million views at $0.0002 per view, paid directly into my account. That combination – legibility and liquidity – is as alluring as it is dangerous. It can tempt you into short-term moves at the expense of long-term ones. In The Great Online Game, I wrote that, “Medium-level Twitter is Threads and engagement hacks. Twitter Mastery is indistinguishable from an ongoing game.” Now, medium-level Twitter, the threads and engagement hacks, gets you paid. There are playbooks you can follow and accounts you can copy to build a following and produce mindless view fodder as predictably as a delivery person can make $9.76 for bringing me donuts. You do so at the risk of getting stuck on medium, polishing away exactly the unique and weird curiosities and obsessions that might attract the other people with the same weird curiosities and obsessions. And you do so at the risk of being labeled, subconsciously, as an engagement hacker by the very people whose engagement might matter most to you. As markets get more liquid and legible, it’s too easy to be mid, to be the rat in Steve Cutts’ Happiness:  But that’s not you! Resisting the temptation is more valuable now, too, because it’s harder. As people contort themselves to please the algorithm for short-term payouts, there’s even more of the less legible, less liquid, but ultimately more important long-term value up for grabs for you if you continue to just be yourself and talk about whatever lights your fire, algorithm be damned. Don’t get me wrong. I think it’s great that Twitter is sharing revenue with the creators who drive it, and I’ll happily take the money. I got donuts to buy. And I love that some people are making more money from tweeting than they do in their day job; what a world! It’s just that Twitter is an easy toy example to make a bigger point: It's useful to be aware of the trade-offs and incentives pulling at you as (almost) everything turns into a liquid and legible market. Liquid and legible markets are, on balance, a great thing. They’re a sign of progress’ march. The market for sending things to space is now liquid and legible. The market for compute is now liquid and legible. The market for intelligence is even becoming more liquid and legible. Nine times out of ten, the right move is to simply and gratefully take advantage of that legibility and liquidity. Buy a SpaceX rideshare instead of building your own rocket. Use AWS instead of racking your own servers. Plug in OpenAI’s API instead of building your own foundation model. Hell, go farm views on Twitter to make the money to do that thing you really want to do, that only you can do. If the liquid and legible market is in something that’s not core to who you are or what you want to do, by all means, squeeze that liquidity and legibility for all they’re worth. If paying someone $9.76 to pick up donuts means I get to spend 30 minutes writing or playing with my kids, I’ll make that trade all day. If Twitter wants to pay me to do exactly what I’d do anyway, awesome. Just beware of the temptation to take the liquid and legible path ten times out of ten. As markets become more liquid and legible, beta improves while alpha erodes. The average person in those markets is better off, but it’s harder to outperform. It’s easier than ever to make $1,000 by tweeting threads, and harder than ever to stand out as unique by doing so. Know what you want to stand out for, how you’re different, what you can do that no one else can that can’t be captured by an algorithm or simple market signals, at least not yet. There’s a market for almost everything. The most valuable things will always be the ones that are hardest to price. Thanks to Dan and Puja for editing! That’s all for today! We’ll be back in your inbox on Friday with the Weekly Dose. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #56

Friday, August 18, 2023

Jobs Biden, Pink Floyd, Pig Kidneys, Humanoids, Coinbase Futures

Sci-Fi Idea Bank

Tuesday, August 15, 2023

3567 Sci-Fi Ideas Waiting to Be Brought to Life

Weekly Dose of Optimism #55

Monday, August 14, 2023

Ignition (Remix), Semaglutide MACE, Martian Climate, Joscha Bach, Nueralink, Lasso & Jolt

Weekly Dose of Optimism #54

Friday, August 4, 2023

The Float, Cancer Drugs, WTF Happened in 2023, Nuclear Importance, WattCarbon, Vial

WTF Happened In 2023?

Wednesday, August 2, 2023

From Great Stagnation to Great Acceleration

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month