Not Boring by Packy McCormick - The Gang Captures Washington

Welcome to the 141 newly Not Boring people who have joined us since last Tuesday! If you haven’t subscribed, join 211,865 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by…Mercury Mercury is banking engineered for startups. But they go beyond banking, providing the resources and connections startups need to become success stories. We’ve used Mercury at Not Boring since day 1…and frankly, it’s very rare I see a startup that doesn’t. As the banking platform of choice for startups, Mercury has a unique perspective on the fundraising landscape today. They published those insights in this article – highlighting the metrics and milestones investors care most about today. The headline is that investors are still looking for opportunities, but have shifted exactly what they’re looking for. Soif you’re a startup founder, nail your next investor convo by locking in on what investors are looking for by reading Mercury’s full free article. Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group and Evolve Bank & Trust; Members FDIC. Hi friends 👋, Happy Tuesday! What a weekend. We were at my parents’ celebrating my mom’s birthday this weekend. Our car got stolen out of the driveway early Sunday morning. The police were great, we tracked the car down with an app, and we got it back yesterday. There was some damage, but all-in-all, we got lucky. That does mean that a lot of the time I would have spent writing was spent tracking down the car, so I had to go a little off the dome with this one. Last week, I wrote about the idea that capitalism is good and capitalism can evolve. As Bill Gurley highlighted, one of the best ways to evolve capitalism is to fight back against regulatory capture in order to unlock an Age of Miracles. This piece digs into that idea. It’s meant to be a starting point for a discussion, not to have all the answers. Let’s get to it. The Gang Captures Washington

Last week, Benchmark partner Bill Gurley gave a talk at the All-In Summit on regulatory capture.  He wrapped it up with a banger: “The reason Silicon Valley has been so successful is because it’s so fucking far away from Washington, DC.” That’s a great line. It brought the house down. Regulatory capture sucks. I was listening to it on a run, and when he said it, I did a very little, inconspicuous fist pump. But when I thought about it once the endorphins wore off, it seemed more like the end of a chapter. Silicon Valley may have been so successful to date because it’s so fucking far away from Washington, DC. It’s been the plucky, underestimated, unwashed underdog, and when you’re the plucky, underestimated, unwashed underdog, you can use that status to rack up surprise wins. But when you’re the favorite, when you’re expected to win, when opponents design strategies to prevent you from winning, the game changes. You can’t just rack up surprise wins far away from Washington, DC anymore. You need to accept that you have a target on your back, and do everything it takes to win by competing directly. That’s where Silicon Valley is today. It’s coming for the big prizes – trillion-dollar industries like energy, finance, healthcare, defense, telecommunications, education, manufacturing, automotive, and white-collar work – and facing savvy incumbents at every turn. We have the opportunity to live in an Age of Miracles. Cheap energy. Abundant intelligence. Supersonic transportation. Distributed opportunity. Longer, healthier lives for billions. To realize that opportunity, though, is going to take a lot of messy, bare-knuckled work that Silicon Valley has had the luxury of being unaccustomed to. If Silicon Valley really wants to make the world a better place, it needs to recognize that it can’t avoid Washington, DC anymore. It has a responsibility to fight the regulatory capturers on their own turf and win. That’s a hard transition. Let me tell you a story about my experience failing to make it. Fat Kid RunningI was a fat kid for most of middle school. I say “most of” because occasionally I’d do Weight Watchers or skip lunch for a week during basketball camp or train for the one cross country race our league hosted each year. In eighth grade, I got skinny and fast and won. So on the first day of cross country training camp my freshman year at a new high school, when Coach McAlpin told the returning runners that there was a new kid who might be pretty fast, Packy McCormick, one of the guys who had been a year ahead of me in middle school said, “Packy? He’s fat.” I showed up to camp in a not-fat phase, and on that first run on the trails at Haverford College, I hung with the varsity runners. I ran varsity all year, the only freshman to make the cut. I finished Second Team All Main Line. Over the next couple of years, I got faster. I was First Team All-Main Line my sophomore year, and finished sixth in the league championship. I beat the juniors and the seniors. My junior year, I was the fastest on the team more often than not. I finished third in the Pennsylvania Independent Schools Championship, surprising even myself, and then won the league 3200 Meter Championship in the spring. Not bad for a fat kid! Senior year, I was captain and I was feeling good. I was going to win everything. And then… I didn’t. I distinctly remember kicking a batting cage at Fairmount Park after a particularly disappointing race in which I lost to a junior on our team. I did OK at States, but I didn’t win, and I didn’t finish third. I think I finished seventh. This section from a rival school’s geocities site sums up that year well:

My memory isn’t great, but that race is still seared in there. It was a hot May day. I’d run a 9:42 earlier in the season – in an invitational with much faster kids, where I wasn’t expected to win and the pressure was off – and if I just did it again, I’d set the league record. As soon as the gun went off, though, I knew it wasn’t going to be a record day, that I’d have to fight just to win it again. Malvern knew that my strength was my endurance – I could get a lead early and keep it – and that my weakness was top-end speed – I had no kick – and designed a strategy to beat me. They had three strong runners. Two of them boxed me in, bumped me, and slowed me down so that the third could outkick me in the final 800. If I tried to break away, one of the two sprinted back in front of me, and then slowed down to mess up my pace. It worked. Duffy, a junior, won, and I finished second in the last race of my high school career. It was devastating. I learned a painful lesson that season: it’s a lot easier being the up-and-coming underdog than it is being the leader with a target on your back. Luckily, the stakes were low. It didn’t matter to the world if I ran two miles faster than another kid. The stakes are higher for Silicon Valley. It needs to win. To start, it needs to know what it’s up against. And I think Gurley was right: it’s regulatory capture. Regulatory CaptureBack to Gurley’s talk and regulatory capture. Regulatory capture occurs when a regulatory agency, created to act in the public interest, acts in the interest of incumbents instead. Gurley gives some colorful examples, like COVID tests. Germany approved 96 different antigen rapid test vendors; in the US, the FDA approved three. Tests cost less than $1 in Germany; they cost $12 in the US. Unsurprisingly, the person at the FDA responsible for approving antigen test vendors, Timothy Stenzel, had worked for two of the three approved companies. Does that annoy you? Yeah! Does it make you mad? Hell yeah! Does it make you mad enough to call your representative, switch your vote, protest in Washington, or organize a lobbying group that will show up year after year with millions of dollars in campaign donations so that it never happens again?! Errrrr… uhhhh… no. That’s the challenge with regulatory capture in a nutshell. In his talk, Gurley cites the work of George Stigler, the University of Chicago economist who coined the term “regulatory capture” in The theory of economic regulation in 1971. In a 1989 follow-up, Stigler’s collaborator Sam Peltzman wrote that The theory of economic regulation’s main conclusion was:

Gurley asked the audience to repeat “regulation is the friend of the incumbent” after him. I’m going to ask you to repeat this one after me. If you’re at your desk, you can whisper, or type it out, or tweet it. OK, on the count of three. One, two, three: “The compact organized interest will usually win at the expense of the diffuse group.” This one insight more than any other describes the bottleneck to progress in America. It means that a few loud, angry, well-organized people can make things worse for everyone else. We all care about a lot of things a little bit, which gives the advantage to people who care about one thing a lot. This has bugged me for a while. I wrote about it in How to Fix a Country in 12 Days. I tweeted about it in August after Illinois announced it was keeping its moratorium on new nuclear in place: When you’re the underdog, you can avoid captured areas, or blame defeat on regulatory capture. You can stay so fucking far away from Washington, DC. At some point, though, you need to play to win. Taking the Fight to WashingtonThere’s an emergent recognition in Silicon Valley that we’re at this turning point, even if they’re not saying it directly. In the past week alone, four of the most-discussed pieces of content in my corner, in addition to Gurley’s talk, were:

One talk about circumventing the regulators altogether, one story about how dangerous it would be to let Europeans regulate AI, one podcast (in two parts) about how the tech tribe can take back cities, and one book about the one person who’s been able to break through multiple captured industries. My Spidey Sense is tingling. This conversation is bubbling up all over the internet. The government itself is often portrayed as the enemy in these discussions, but I think that’s a misplaced and futile fight. Washington is an algorithm; there are rules, even if they’re sometimes opaque. If Silicon Valley wants to bring about the Age of Miracles, it’s going to need to learn those rules and win the game on the field. I don’t pretend to know exactly how Silicon Valley can beat the incumbents at their own game. I’m already way out of my depth here. But I know that a few things will matter whatever the specifics. Being well-resourced and well-organized matters. In one of my favorite essays, Choose Good Quests, Trae Stephens and Markie Wagner write about the moral imperative for founders who’ve gained experience, resources, and connections building easier companies early in their careers to use their experience, resources, and connections to tackle really hard, civilizationally important problems in their second act. They call these “Good Quests.”

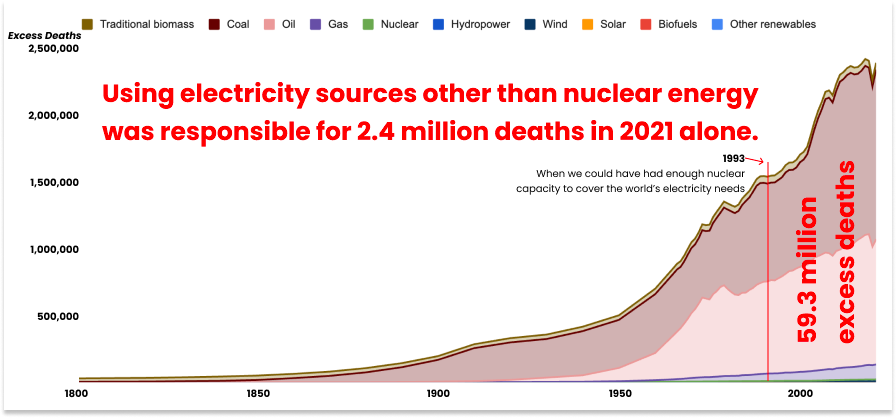

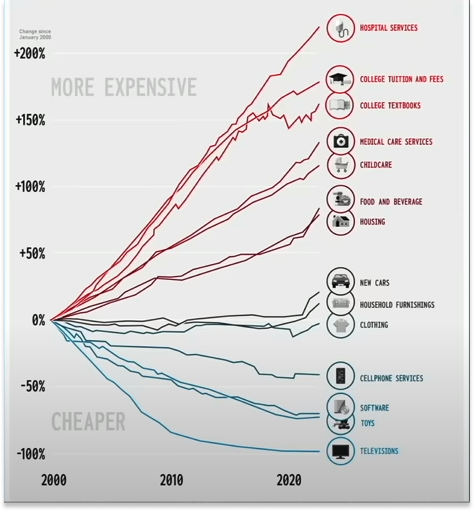

Silicon Valley is going through the same arc on the meta-level, accumulating experience, resources, and connections over the past half century that it must now put towards Good Quests. This is already underway at the company level – I can name multiple companies attacking each of the challenges listed in the quote – but in order for them to have the greatest odds of success and largest impact, Silicon Valley has to give them air cover on the regulatory front. Silicon Valley is well-resourced, but it needs to be better organized. Currently, it faces the same challenge of diffused support that Stigler wrote about in 1971. “Tech” is a loose collection of people and companies that use technology to try to improve something. They take different approaches and attack different industries. While tech calls some of the largest companies in the world – Apple, Amazon, Google, Meta, Nvidia – its own, each individual company facing an established industry likely faces better-resourced and better-organized incumbents. Crypto startups face a regulatory apparatus captured by the financial services industry, as evidenced by Elizabeth Warren’s Anti-Crypto Army. Nuclear fission startups face a regulatory apparatus captured by oil and gas companies and the environmentalists they back, and fusion is likely to face the same. When the All-In hosts asked him about fusion after the talk, Gurley didn’t seem optimistic. Silicon Valley now has the resources, and it needs to capture a regulatory apparatus of its own, starting with getting clear about what it stands for and rallying people around that mission. This is as good a quest for entrepreneurs to embark on as any particular technological innovation. I think the e/acc movement is working in the right direction here. As much of an optimist as I am, I realize that battle lines need to be drawn, and the idea of acceleration versus deceleration or growth versus degrowth is a clarifying one. It’s as strong a Schelling Point as I’ve seen in tech. It’s also too jargony to go mainstream. Thermodynamics, AGI, and Karshdev Scales work to rally the in-group, but to garner the necessary popular support, the message needs to go mainstream. Passionate popular support matters. Silicon Valley needs to both share an optimistic vision of the world it can create with and for people, which it does an OK-but-not-great job on, and make people aware of what’s at stake when incumbents block progress out of their own self-interest. Hope and Anger. On the anger side, people need to be acutely aware of the fact that regulatory capture is definitionally anti-consumer. When it occurs, a small group receives benefits at the expense of the larger population. The stories that Gurley shared about regulatory capture demonstrate this. More expensive COVID tests mean three companies benefit at the expense of hundreds of millions of people paying more. Comcast blocking city-wide WiFi means that Comcast benefits at the expense of 1.5 million Philadelphians. Epic making healthcare providers use shittier software means that Epic benefits at the expense of millions of people who have a harder time dealing with an already complex healthcare system. All three examples stand in contrast to the competition that helps make America great. These stories should make people angry, and they’re not the worst of them. Back in June, I did a quick and dirty analysis of the number of deaths caused by using more dangerous energy sources instead of nuclear, and it’s something like 59 million deaths over the past 30 years. That should make people furious, but that story doesn’t have the same resonance as images from Chernobyl or Fukushima, which were far, far less deadly. The fact that tens of thousands of depressed people in the US commit suicide each year when we’ve known of the benefits of psychedelics with talk therapy when treating depression for decades but classified them as Schedule I drugs should make people furious. Just last night, Roon made a similar point about self-driving cars: This chart comparing the prices of goods in heavily-regulated versus less-regulated industries should make people furious. It should be plastered across cities and towns throughout the country, and even though it’s already shared often online, it should be shared more. One of Silicon Valley’s challenges is that counterfactuals are hard to comprehend. It’s difficult to grok what could have been if things had gone differently: all of the people who wouldn’t have died if we used more nuclear instead of coal, all the people who would still be alive if research into psychedelics had continued, how cheap healthcare and education could be if those industries weren’t captured. Silicon Valley will need to figure out how to spread that message. And then there’s hope. At the same time, Silicon Valley needs to do a better job describing what could still be in ways that demonstrate the real impact on peoples’ lives today. That starts, of course, with building technology that clearly improves peoples’ lives. Safer self-driving cars, cheaper energy, cheaper housing, better medicines. Cheaper and better across the board. In the underdog phase, social media and SaaS were valuable stepping stones, but in the leadership phase, Silicon Valley needs to make a clearer positive impact on the day-to-day. Of course, there’s a chicken and egg here. Regulatory capture can make it hard to actually do the things that Silicon Valley wants to do, so it needs to yell loudly whenever roadblocks are thrown in its way. Gurley’s point on the need for increased transparency and communication on regulatory capture is a good one. The message needs to be clear: if you let us cook, and come cook with us, we will make everything cheaper and increase all of our standards of living. On a podcast recently, someone made the point that billionaires and regular people all use the same iPhone connected to the same internet. That can be true for pretty much everything except land. People need to be motivated enough to call their representatives, switch their votes, protest in Washington, or organize lobbying groups that will show up year after year with millions of dollars in campaign donations so that it never happens again. Again, I don’t have the answers for how we do this, but Silicon Valley needs to get popular support on its side. The good news is, while the scams and blowups get the headline, I genuinely believe that Silicon Valley has truth on its side. Its incentives are better aligned with the general population’s than the incumbents’ are. Tech companies win when they’re able to provide better, cheaper things to more people. Playing the long game matters. Silicon Valley’s luminaries like Jeff Bezos talk about the importance of playing the long game. That’s more important in this battle than it is for any particular company. This war certainly won’t be won overnight. It will take years of strategic organization, clear communication, and most importantly, delivering on promises. When Silicon Valley is successful in defeating regulatory capture in a certain industry, it needs to show that it actually delivers results. Every time it does that, it will gain support for the next, harder battle. Techno-capitalism and America, at its best, go hand-in-hand. It’s Silicon Valley’s responsibility not to overthrow the system, but to improve it, to get pro-growth candidates elected, work with regulators to help them do their job by protecting the interests of the American people, and prove that government and industry can work together for the benefit of all. And if it succeeds in capturing Washington, it will need to do the hardest imaginable thing: use that capture for the good of innovation and the good of the people. It will need to somehow open source regulatory capture and open itself up to disruption from the next up-and-coming underdog. The fact that leading tech companies already try to use regulatory capture for their own benefit demonstrates how difficult this challenge will be, but it’s crucially important. If Silicon Valley’s mission really is to make the world a better place, it must recognize its responsibility to lead, fight on behalf of the people against incumbents, and do what it takes to win. Then it will have earned the right to show what’s possible. That’s the game on the field: capture Washington back and change it for the better. In the coming decades, Silicon Valley will need to be successful by getting so fucking close to Washington, DC that it can improve it from the inside. Thanks to Dan for editing! That’s all for today! We’ll be back in your inbox on Friday with the Weekly Dose. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #60

Sunday, September 17, 2023

Breakthrough Prizes,K2-18 b, Building Stuff in America, Nougat, MDMA, Lithium Treasure

Capitalism Onchained

Tuesday, September 12, 2023

What is the ideal state of crypto?

Weekly Dose of Optimism #59

Friday, September 8, 2023

Crusoe, Frontier, Moon Sniper, China Slowdown, Fury

Weekly Dose of Optimism #58

Friday, September 1, 2023

Inventing Sailboats, Cover Homes, AI Drones, Aalo, Incompetent Cynics

I, Exponential

Tuesday, August 29, 2023

Building Modern Cathedrals

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month