Bear Market Best Practices | State of the DAOs

Bear Market Best Practices | State of the DAOsYou're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.If variety is the spice of life, then a bear market is the bran cereal of crypto — you know it’s necessary to keep the cycle moving but it can be hard to swallow in large doses. Bear markets are tough going, that’s for sure, but in this issue’s editorial, you’ll get some exposure to best practices that will help you minimize, if not eliminate, the pressure. It’s a little unusual for the editorial not to focus squarely on DAOs and/or the DAO ecosystem, but as communities that are made up of individuals, DAOs are affected by bear markets just as much, if not more, than their contributors. As usual, there are ecosystem articles to explore further and a look at some of the new tools available to DAOs, as well as a spotlight on Aragon DAO. You are forgiven if you’re today years old and just finding out that the Aragon Network Token is known as ANT; the beauty of this space is that we’re all learning new information all the time! For those wanting to learn more of the acronyms floating around crypto, don’t miss the Essential Web3 Glossary article featured below. Put some time aside to read the thought-provoking piece on communities and don’t miss 0xJustice’s elegant take on the four pivotal areas of disintermediation: communications, currency, contracts, and companies. It’s a must-read for anyone interested in the current state of the DAOs. Contributors: Josh Du, Tonytad, angelspeaks, KingIBK, Warrior, Boluwatife, Kornekt, trewkat, siddhearta, HiroKennelly This is an official newsletter of BanklessDAO. To unsubscribe, edit your settings. Bear Market Best PracticesAuthor: Josh Du

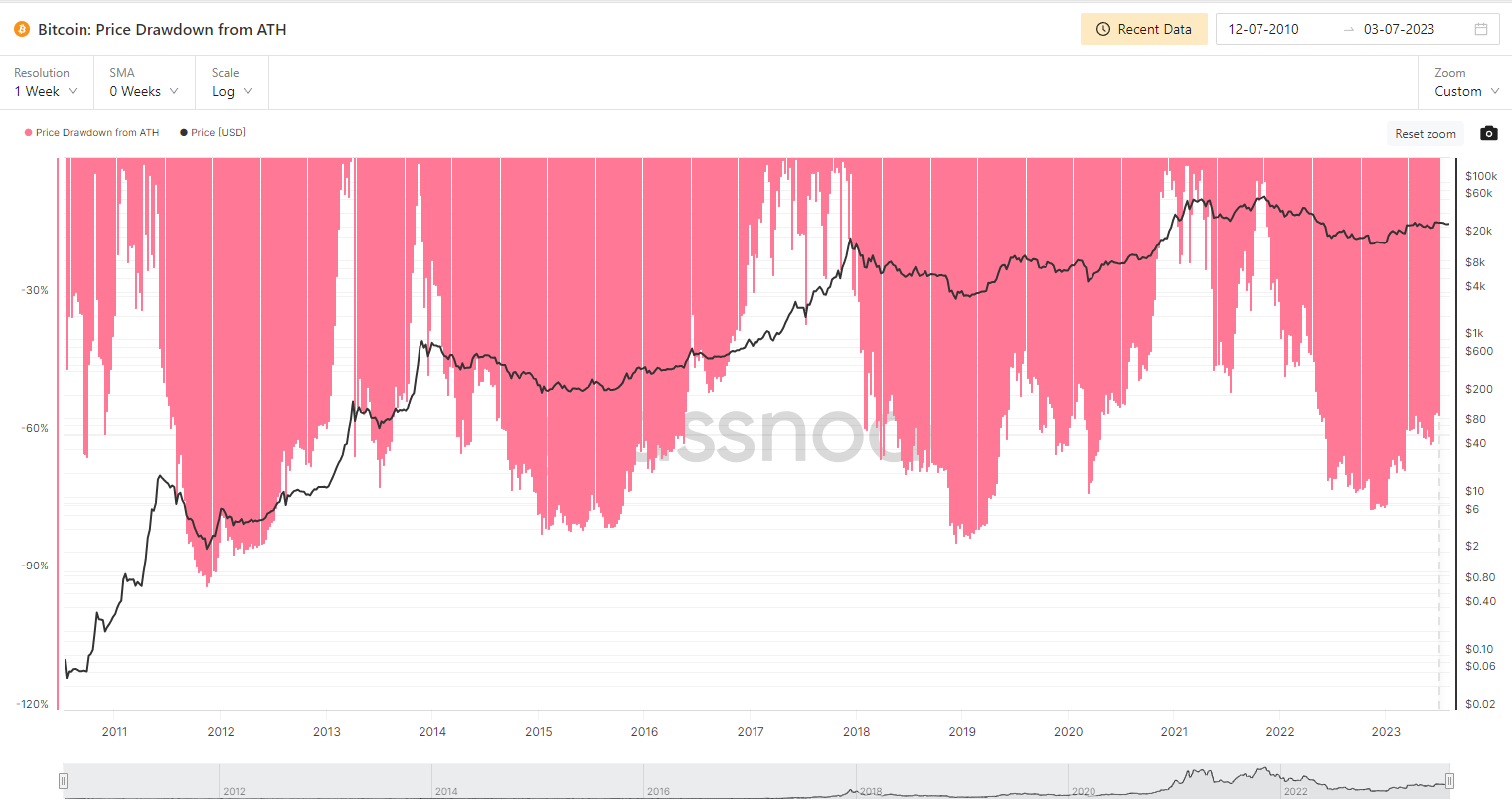

If you've managed to stick with the world of crypto through a year of unrelenting hacks, regulatory curveballs, and portfolios awash in red, give yourself some credit. You're either a masochist or a true believer — possibly both. As for why you're still here, perhaps it's resilience, savvy, or a mixture of the two. Whatever the reason, you're in a unique position to capitalize on the opportunities that bear markets often present. Before we delve into these, it's important to note: always do your own research. The insights shared here should never replace tailored financial advice. Still, as professionals actively navigating this tumultuous landscape, we believe these bear market best practices are crucial, and we wanted to share some of our tips for being able to do just that. Understanding the Crypto LandscapeLet's be absolutely clear: whether you're a seasoned web3 investor or a Wall Street savant, cryptocurrencies warrant your attention as part of a diversified portfolio. Historically speaking, we've seen this asset class recover remarkably well from 80%-90% drops in value. Not only do they bounce back each time, but they also reach new all-time highs. That's a level of resilience you can't ignore. Now, onto the cycle of bear markets. If you're looking for stability, you won't find it here, and that's not necessarily a bad thing. Bear markets in crypto are recurrent, and like winter they’re harsh, but vital for the ecosystem. We've already survived a slew of crashes, each followed by a healthier recovery, topping previous records. This isn't the speculation-driven bubble of the past years though. We are standing on the precipice of concrete developments, with projects touching everything from DeFi protocols to NFT-based gaming experiences and even Real World Assets being tokenized. We've moved from the realm of 'what could be' to 'what is,' and that's a leap forward that is worth taking a moment to appreciate. Let's also appreciate the wisdom of the ancient Persian adage, "This too shall pass". In the crypto universe, we should all have these words printed and framed on our walls. Why? Because crypto is the epitome of antifragility. Each crash, each scam, and each piece of FUD (Fear, Uncertainty, and Doubt) only serve to strengthen this ecosystem. A bottom-up structure, as exemplified by the web3 community, will always outshine a top-down system in terms of resilience, especially during bear markets. The investors and developers who remain are the ones creating infrastructure that can weather even the harshest of storms. Lastly, but by no means least, we have to talk about volatility. It scares away many traditional investors, but in a nascent space like crypto, volatility is as natural as breathing. Here's the kicker: it's also a double-edged sword. You stand to lose, but you can also gain in exponential multiples. Those who understand this duality are the ones who ride the waves successfully; those who don't will become the subject of cautionary tales. Learning to surf these financial waves may involve a few wipeouts, but the ones who stick around are the ones who ride the biggest waves. Best Practices For Weathering Bear MarketsWhether you're new to the crypto world or a seasoned investor, bear markets present unique challenges and opportunities. The practices outlined below are time-tested strategies that apply to portfolios of all sizes, from the fledgling "guppy" to the seasoned "whale."

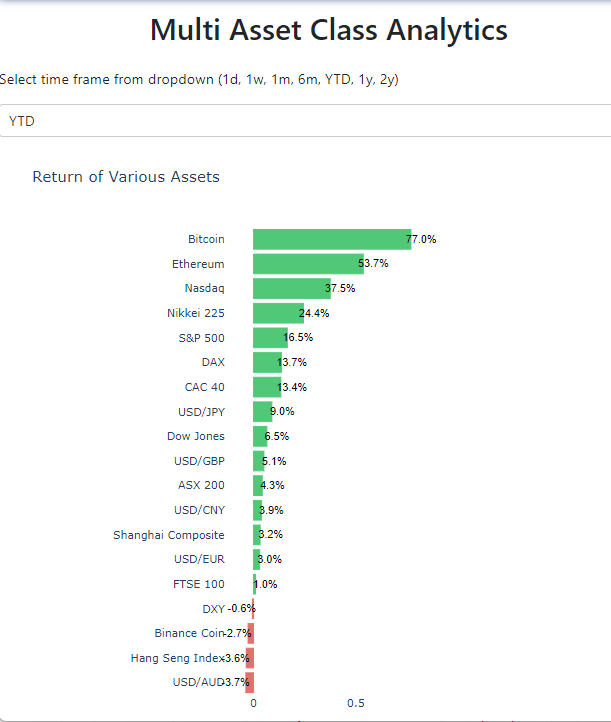

These foundational principles are not quick fixes but are aimed at ensuring you're not just surviving the bear market but thriving in it. By adhering to these practices, you'll be better positioned when the market cycle inevitably shifts. If all else fails, just remember that year-to-date, Bitcoin and Ethereum have significantly outperformed other asset classes as can be seen in the image below. Lights At The End of The TunnelNavigating through the foggy conditions of a bear market can be daunting, but it's crucial to remember that every tunnel has a light at the end of it. Several key catalysts are emerging that could significantly influence the crypto market's trajectory in the coming months and years.

So, as we navigate through the current bear market, it’s essential to keep an eye on these potential catalysts. Each has its own timeline and speculative risks, but together they offer a compelling case for renewed optimism in the crypto market. Regulated Onramp Channels Being Established in Hong KongThe Hong Kong government has been very public about their intention of making the city the world’s web3 hub, with multiple initiatives already launched over the past year. In fact, implementation is already underway. Just a month ago, Hong Kong granted licenses to the first regulated crypto exchange catering to retails, with the ability to on/offramp fiat directly from banks. These are the first-ever legal and regulated onramp channels in the entire Greater China for retail investors, paving the way for capital inflows from investors who may have been put off by the recent troubles that have rocked crypto exchanges. In addition, the government has stated their intention to launch HKD stablecoins as soon as next year, making it even easier to onboard additional users. Leading all of this is the recently setup Web3 Task Force headed by the HK Financial Secretary himself. Suffice to say that Hong Kong is diligently building in the bear market to help promote web3 in the region Striking the Balance Between Caution and OptimismIn conclusion, remember that this article is not intended as financial advice—always do your own research (DYOR) before making any investment decisions. The core principles to guide you through a bear market — patience, selectivity, risk management, and wise investment of your time — are designed not just for survival but for long-term success. While the current market may seem like an endless downward spiral, adhering to these principles will position you well for when the tide turns. While some indicators suggest that the bearish phase might be nearing its end, a longer bear market can actually be an advantage. It offers more time to reassess, learn, and allocate your resources optimally for when the upswing inevitably comes. Josh is Animoca Brands’ Head of Digital Assets, responsible for managing Animoca’s digital asset treasury, balance sheet optimization and yielding activities, as well as group market making and trading operations. Animoca Brands is a global leader in gamification and blockchain with a large portfolio of over 450 investments and with the mission to advance digital property rights and contribute to building the open metaverse. Prior to Animoca, Josh’s background includes more than 15 years as an asset manager in traditional finance having work at both hedge funds as well as investment banks like Morgan Stanely. Ecosystem Takes

The Essential Web3 GlossaryAuthor: beejorama 🔑 Insights: Beginning your journey in crypto can be daunting because of the strange new terms and abbreviations. If you’re finding it hard to keep up and communicate in the space then this glossary is for you. The author has carefully curated a large and diverse array of terms to get you up to speed and converse like an OG.

The Last Throes of LeviathanAuthor: 0xJustice.eth 🔑 Insights: The author discusses the concept of decentralisation and its potential to transform traditional power structures, particularly the role of the state. He emphasises that decentralisation is not an end in itself but aims to eliminate intermediaries and prevent the exploitability of valuable systems.

Redefining Incentivisation With KPI Token CampaignsAuthor: Carrot 🔑 Insights: Carrot offers an efficient way to align token emissions with tangible project goals. It is more than just a platform, it’s a new way of thinking about incentivization and community growth.

Secret Societies, Network States, Burning Man, Zuzalu, and More: Thoughts on New Political CommunitiesAuthor: Matt Prewitt 🔑 Insights: The author argues that constructing new, intentional communities is vital for social progress, but it must be done responsibly and in relationship with the broader society. The article further expands on these points:

New Standards for Onchain EngagementAuthor: 0xJustice.eth 🔑 Insights: This article introduces GroupOS by Station Express, a DAO launcher that aims to enhance engagement and user experience through the use of new token standards and Polygon's scaling technology. The article highlights the significance of DAO tooling as a core business infrastructure for the 21st century.

DAO SpotlightAragon DAO was founded in November 2020 and has more than 300,000 community members to date. Running on the Ethereum blockchain, Aragon is a platform that allows users to create and manage their DAOs. It provides a set of tools and templates that make it easy to set up a DAO, as well as a range of governance features that allow members to vote on proposals and make decisions about the DAO’s operations. Flexibility is one of the key features of Aragon. It can be used to create a wide range of DAOs, from small, tightly-knit communities to large-scale organizations. It is trustless, permissionless, and transparent. Aragon is highly scalable, it can handle a large number of transactions without slowing down or becoming congested. Due to their open source code, the platform is secure as it is being audited by different people to remove vulnerabilities and bugs. At the heart of Aragon is its token, ANT, which is used to pay for transactions on the platform. ANT holders have the right to vote on proposals and participate in the governance of the network. To create a DAO on Aragon, you first need to create a proposal that contains all the details of your DAO, including its rules, structure, and purpose. Once your proposal is approved by the network, your DAO will be created and you’ll be able to start using it. Now, once your DAO is up and running, you can start managing it using the tools provided by Aragon: Aragon Court to resolve disputes, the Aragon Voice to vote on proposals, Aragon Nest to fund teams, and Aragon Client to build and manage DAOs. Visit the Aragon website to learn more, and follow them on X. |

Older messages

GM, HODL, WAGMI | Bankless Publishing Recap

Wednesday, September 20, 2023

Top-shelf Educational Web3 Content Shipped Directly to Your Inbox

The Optimism Collective’s RetroPGF Learning Journey | Layer 2 Review

Sunday, September 17, 2023

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum

#Permissionless2 — A Whole Lotta Love | BanklessDAO Weekly Rollup

Sunday, September 17, 2023

Catch Up With What Happened This Week in BanklessDAO

Bear in Mind These Three Tips from RSA | BanklessDAO Weekly Rollup

Saturday, September 9, 2023

Catch Up With What Happened This Week in BanklessDAO

The Endgame or the Beginning of Infinity? | State of the DAOs

Wednesday, September 6, 2023

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏