Earnings+More - Boyd’s ‘softness’ sparks a rout

Boyd’s ‘softness’ sparks a routBoyd’s wobble, Evolution delays, Betsson’s boost, PointsBet regeneration +MoreGood morning. On the early Weekender agenda:

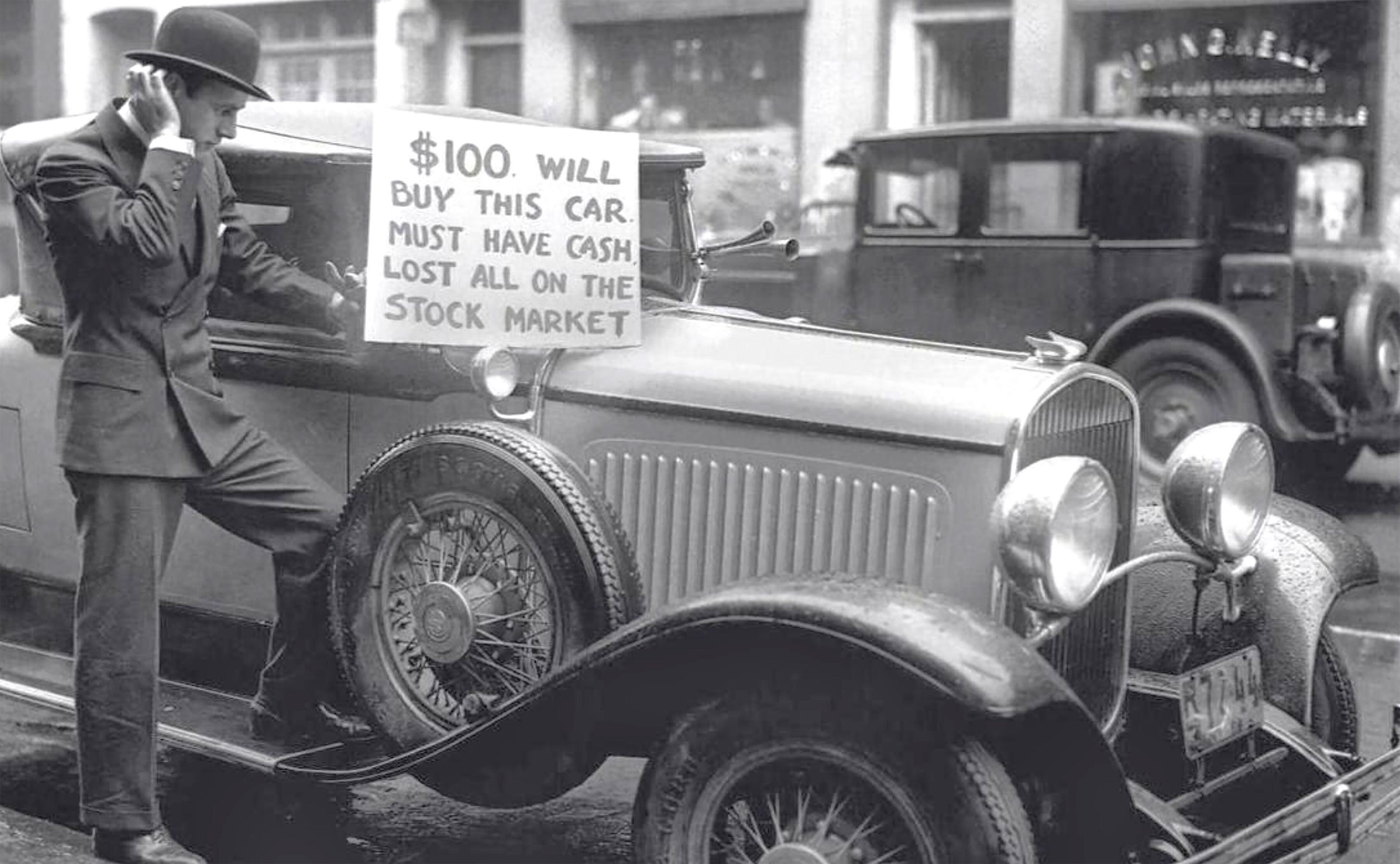

There's no way to delay that trouble comin' every day. Boyd causes routThe much anticipated consumer downturn has finally arrived, according to Boyd Gaming’s Q3 statement. Soft touch: Asked about the “retail softness” that affected Boyd’s Las Vegas Locals, Downtown, and midwest and south segments, CEO Kevin Smith said it was “not isolated or unique to any one set of properties” after the company missed analyst forecasts with a near-5% fall in adj. EBITDA to $321m.

⚠️ Gone soft: Boyd Gaming wilts on consumer softness Hanging around: Noting the softness occurred largely in the unrated players – which Smith said represented ~40% of Boyd’s casino revenues – he said this was “definitely related to the economic impact”. The company was “trying to paint a picture” of stable expenses and a “stable consumer environment”.

Online booster: Revenues rose 3% to $903m, largely down to the 73% rise in online revenue to $90.3m, while Downturn Las Vegas was flat YoY at $49.5m, the Locals segment was down by 1.8% to $222m, and the midwest and south was off by 2.8% to $513m. The managed segment, including the Sky River contract in California , was up to $28.5m.

** SPONSOR’S MESSAGE ** The 2023 edition of the American Gambling Awards is pleased to announce the full list of 11 winners recognized for their leadership and innovation within the regulated, online U.S. gambling industry. The American Gambling Awards is produced by Gambling.com Group (Nasdaq: GAMB), a leading performance marketing company for the regulated global online gambling industry. The Group champions the development of a responsibly regulated, competitive online gambling market in the U.S. and the Awards help bring positive attention to the leaders making this a reality. Earnings in briefChurchill Downs: Steadying the sector ship, Churchill Downs came in with in-line revenues and adj. EBITDA of $573m and $218m, respectively. The stock rose over 2% in after-hours trading. However, Jefferies noted the figures for gaming suggested a similar “weakness” in some markets. But Wells Fargo analysts said it was a “clean print” and “certainly better than feared”. Note: Churchill Downs’ analyst call takes place later today and E+M will report on what is said on Monday. VICI: The REIT said its revenues increased 20% YoY to $904m. CEO Ed Pitoniak said the results reflected the company’s “sustained, sustainable commitment to accretive growth and capital deployment through acquisitions and strategic financing activity”. Note: VICI will also be hosting its earnings call later today. Bet-at-home: Poor soccer margins mean revenues for the period Aug-Oct will be at €44m-€48m vs. previous estimates of €50m-€60m. However, EBITDA for the full year is expected to still come in at the top end of the previously announced estimate of €1m-€3m. Playgon Games: The live dealer minnow said it saw a 10% QoQ increase in handle during Q3. Evolution’s supply chainHold-ups in planned studio expansions and continuing lackluster RNG performance spoil an otherwise positive report. Supply and demand: The good news is there is a higher demand for live casino than Evolution can currently deliver, said CEO Martin Carlesund. “We’re in an investment phase, and we will continue to invest as fast as we can,” he added, pointing to new studio developments across the globe.

Asian contagion: Live casino revenues grew 12% YoY to €386m while RNG games continued its sluggish progress, down 2% to €66.8m. Growth in margins to over 70% helped push adj. EBITDA up 22% to €319m.

Fantastic voyage: Carlesund made a pitch for Evolution’s live casino product to be considered part of the streaming revolution. “We need to add product that will go up against streaming services and social media platforms for players' time,” he said.

PointsBet regenerationThe inheritance from the US adventure is a “market-leading” platform, says CEO. It’s about the journey not the destination: “We’re at an important stage in PointsBet’s journey,” said CEO Sam Swanell as he promised the now ex-US operator would not need any further capital injections from investors. As it stands, the operations in 10 states have already been handed over to Fanatics, with the remaining four awaiting regulator approval.

Back of the net: With the remaining Australian and Canadian business, total net win rose 18% to A$58.2m, helped by a more-than-doubling of iCasino net win in Canada to A$3m. In Australia, an “improved generosity” backdrop helped towards an 11% increase in net win to A$52.8m. A pullback on promo spend meant gross win fell 2% to A$72m. Canadian net win rose 212% to A$5.4m.

Missing word competitionTurkey is not mentioned by Betsson despite being a key revenue and profit driver. Not talking turkey: While there was no mention of Turkey in either the report or the earnings call, the central and Eastern European and central Asia segment was the key driver in Betsson’s Q3 uplift. CEECA revenues rose 23% to €97m, helping to boost total revenues to €238m. Group EBITDA rose 42% to €68.9m.

No(r)way: Problems continued in the Nordics where revenue was down 14% to €46.1m. Betsson was one of the brands the Norwegian authorities said had exited the market in September. Better news came from the LatAm region, up 33% to €51.7m. However, in Chile a recent Supreme Court decision means the company will be forced to end its sponsorship of the local soccer league.

** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. Datalines – MichiganHalf-way to a three-way: Total OSB GGR for September fell 13% YoY to $44m on handle that rose 19% to $458m, implying hold of 9.6%. Promo expense was $25m, representing 4.4% of handle and 62.5% of GGR, while NGR came in at $18.7m, a YoY drop of 37%. iCasino came in up 29% at $166.4m.

Fourth wall: In OSB, DraftKings outspent FanDuel in promos by $9.4m to $7.7m or 81% of NGR vs. 46%. FanDuel’s AGR came in at $9.1m, nearly quadruple DraftKings’ $2.3m. Indeed, DraftKings was beaten into fourth place in AGR terms by both BetMGM and Caesars, with each generating $2.8m. Analyst takeESPN Bet: Looked through the lens of download data, the team at JMP suggested the effectiveness of the marketing campaign for the upcoming launch will show through in the very early weeks.

What we’re readingYou just want to see his face: DraftKings, FanDuel and others have given the Nevada sports-betting market a swerve due to the regulatory requirement for in-person registration. ** SPONSOR’S MESSAGE ** Calling all sportsbooks! Are you:

Stop falling behind your competitors! Matchbook pricing and brokerage service is your connection to the sharpest pricing and global liquidity, helping you to manage risk and fortify your margins. Matchbook pricing is proven to be resistant to market changes. Matchbook B2B, because the best price is for everyone. Find out more at http://www.matchbook.com/promo/b2b or email b2b@matchbook.com NewslinesThis is Latvia calling: Playtech has signed a deal for live casino provision with FanDuel for which Playtech has built a dedicated studio in Riga, Latvia. Light & Wonder said on Tuesday it has completed its previously announced acquisition of the remaining approximately 17% of SciPlay it didn’t already own for $22.95 per share in cash. Sportradar will power the launch of Sinclair’s Tennis Channel’s direct-to-consumer streaming platform. Meanwhile, the company also announced it had reached an agreement with BetMGM for the provision of NBA optical trading data for use in prop markets and same-game parlay offerings. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

OSB’s reality show

Tuesday, October 24, 2023

In-depth look at Q3 datalines, analyst takes – DraftKings and FanDuel +More

Taxing times for Smarkets

Monday, October 23, 2023

Smarkets tax liability, Evolution Q3 preview, analyst takes – LVS and 888, BroThrow's beef, Startup focus – SharpSports +More

DraftKings leads the way

Thursday, October 19, 2023

All change at the OSB top, More DK wins, LVS revenue boost, 888 slump, G2E analyst takes +More

BetMGM re-ups its promo spend

Thursday, October 19, 2023

Maryland data, MGM 'blip', G2E down rounds warning, startup focus – Units +More

Fantasy threads the needle

Thursday, October 19, 2023

Daily fantasy sports market analysis, the latest analyst takes +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these