Coin Metrics’ State of the Network: Issue 231

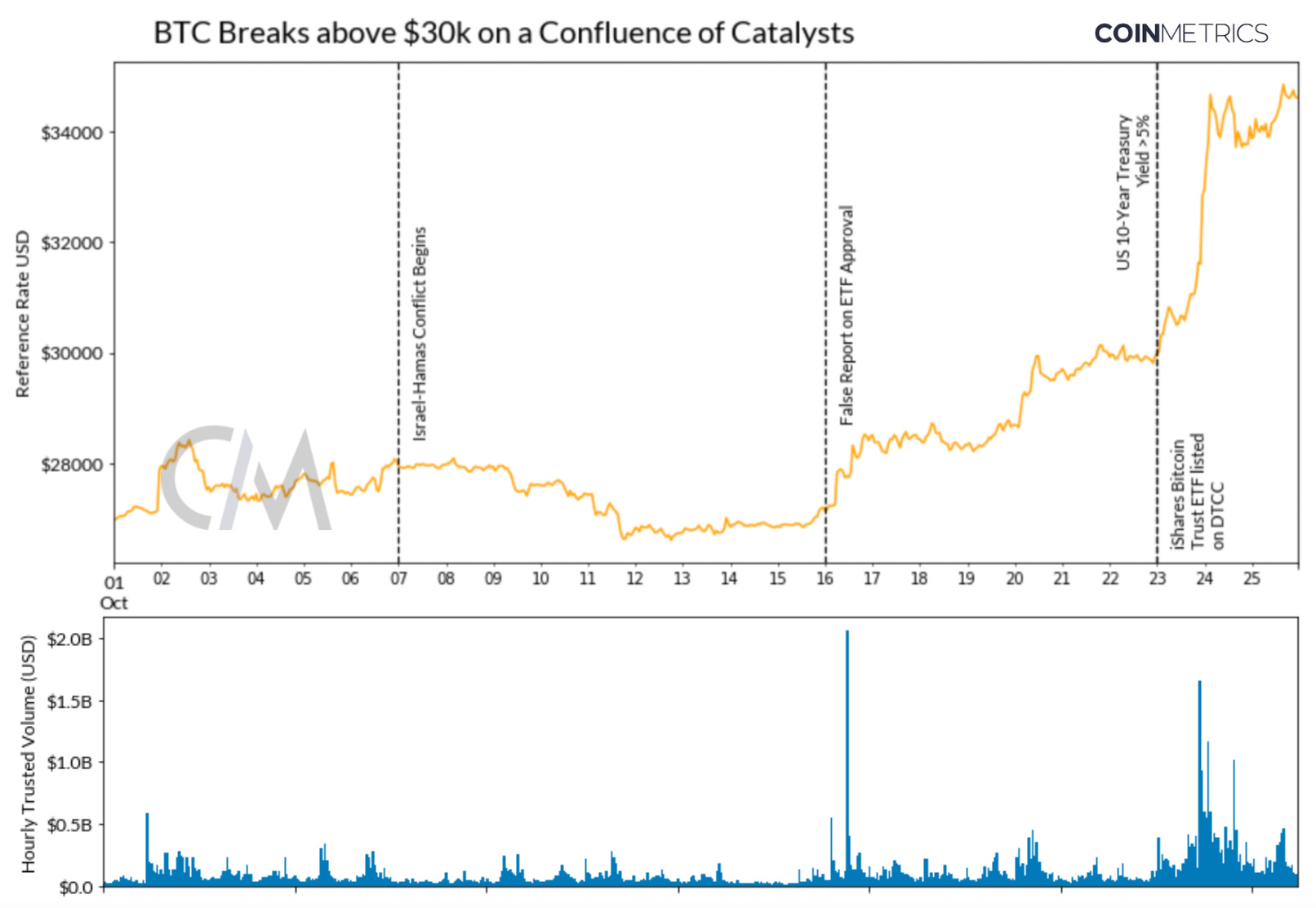

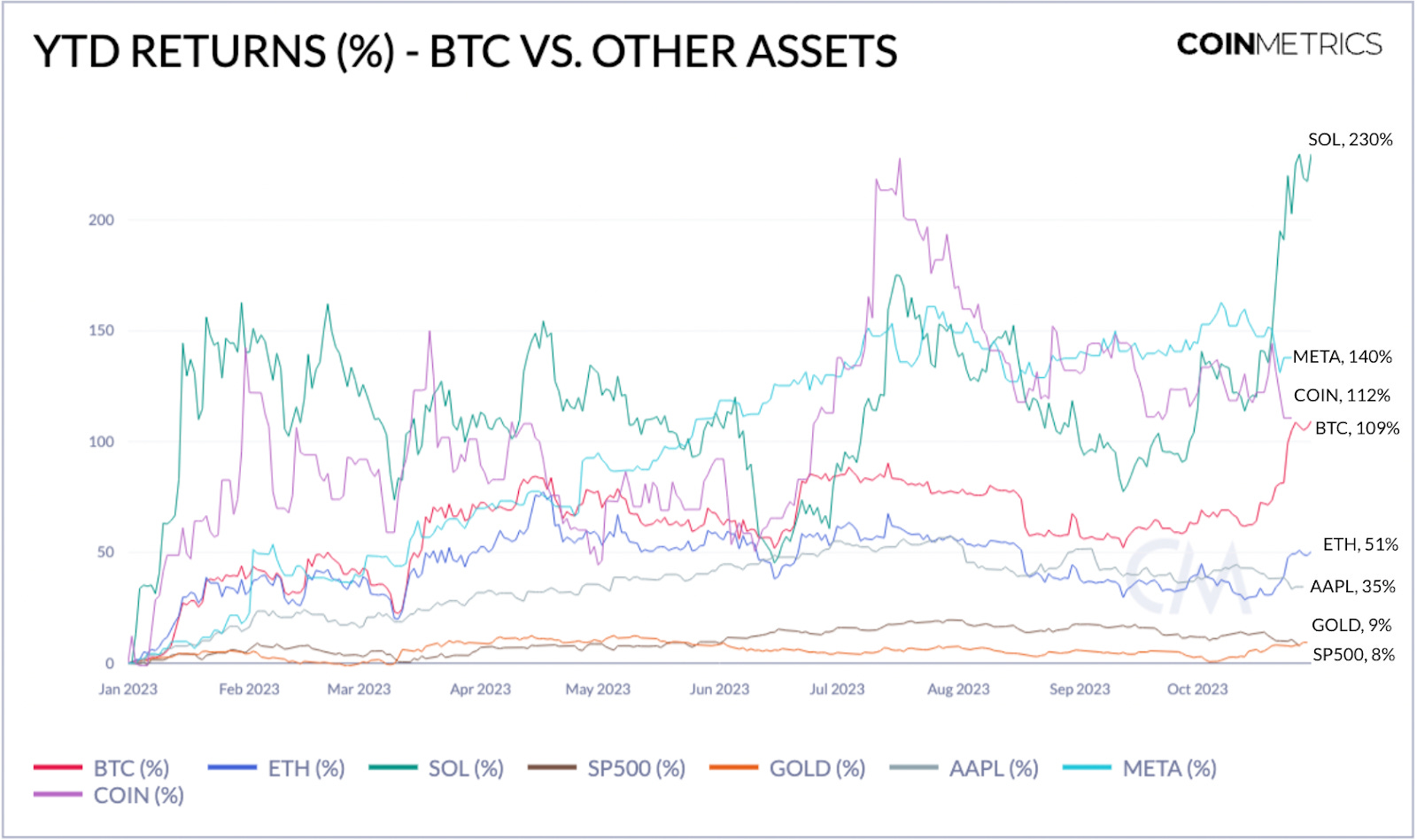

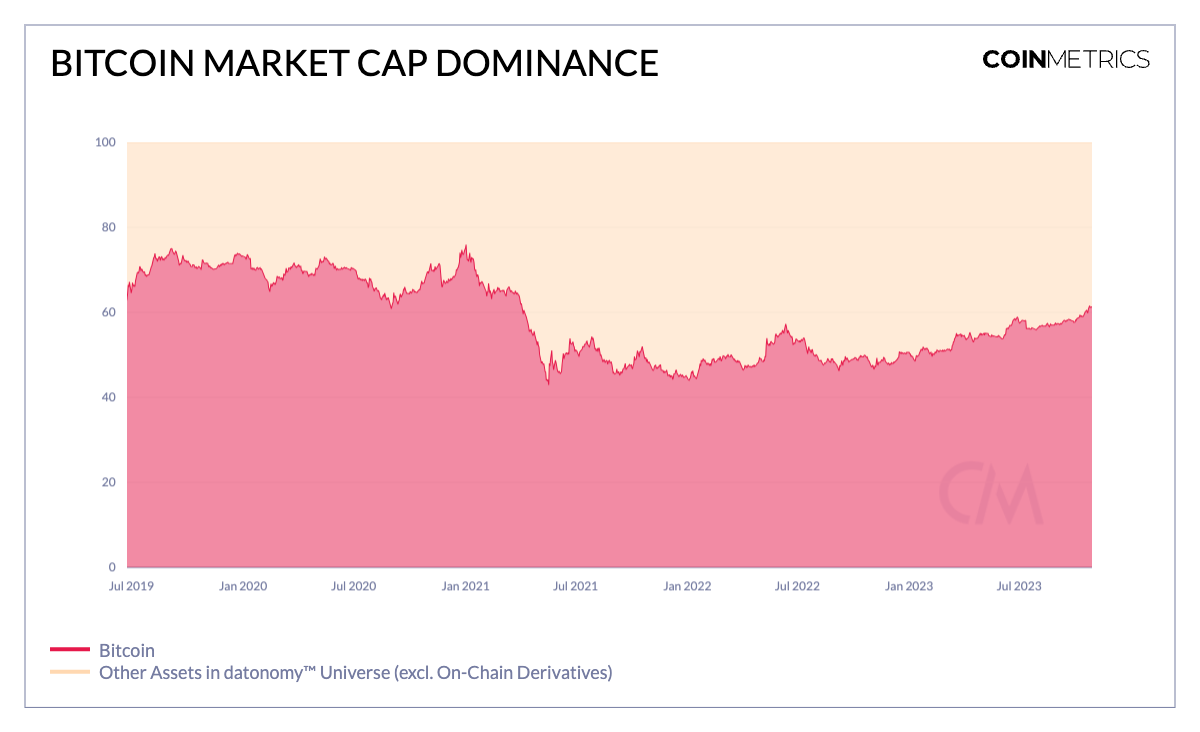

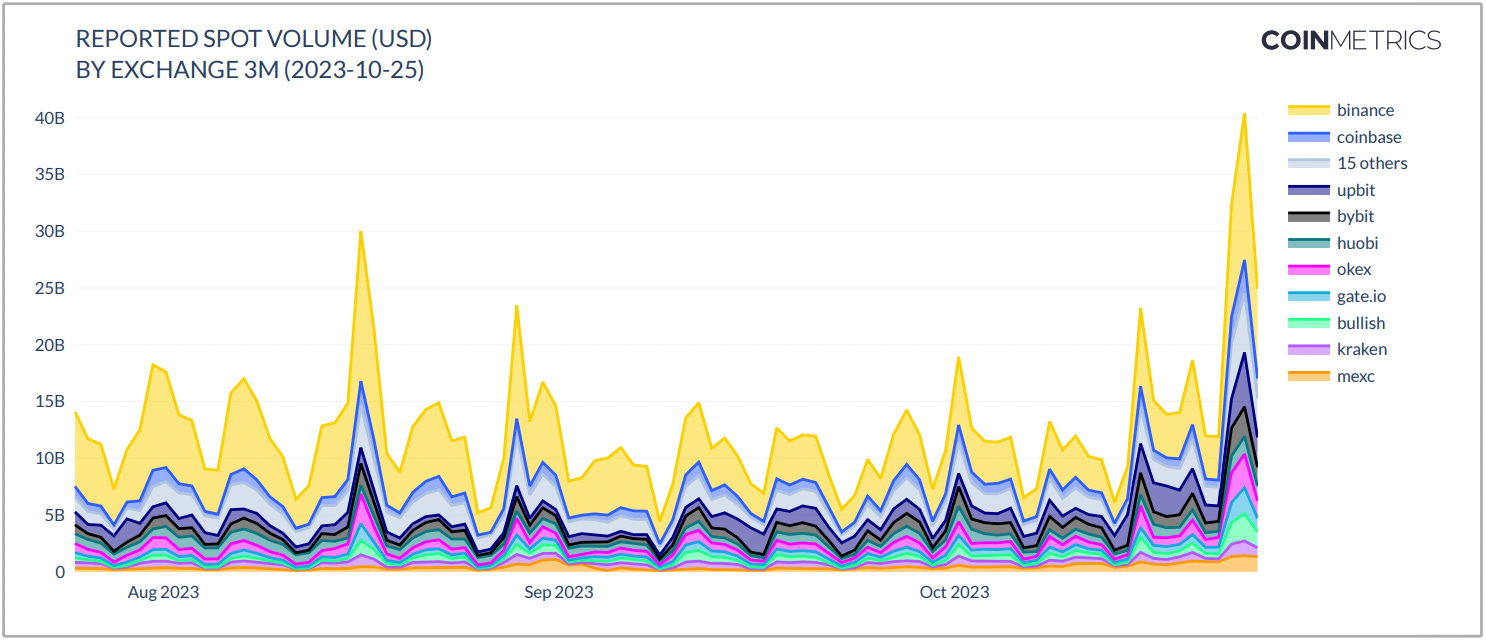

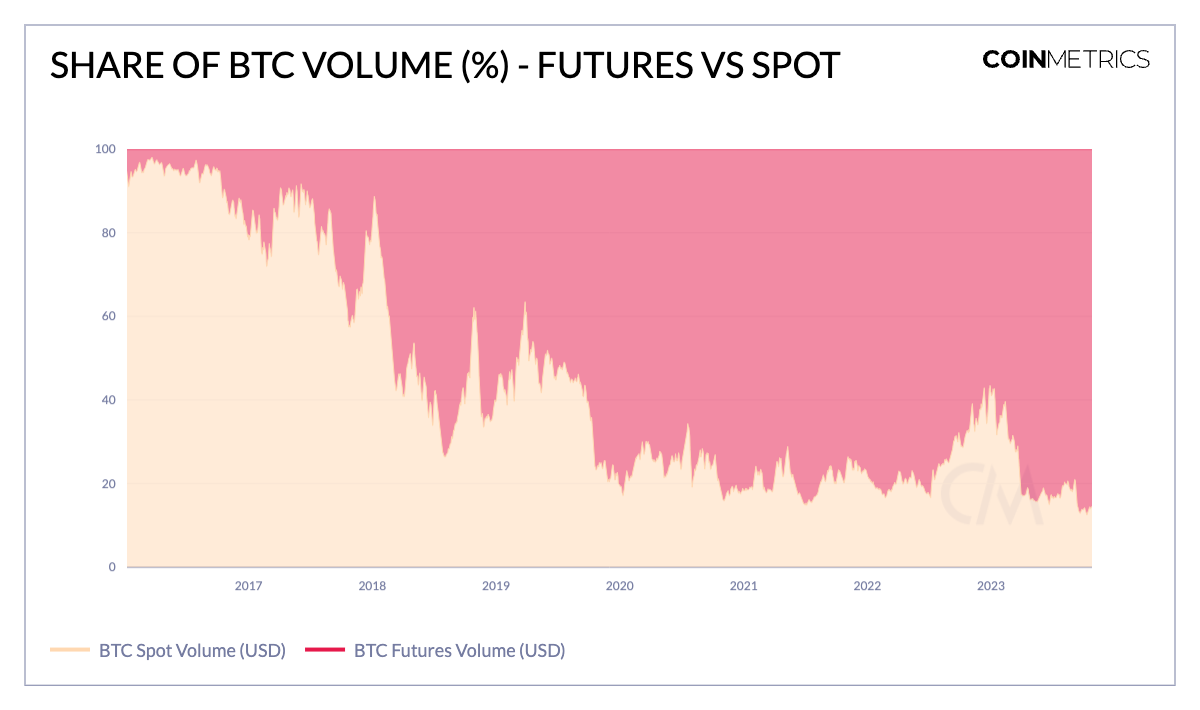

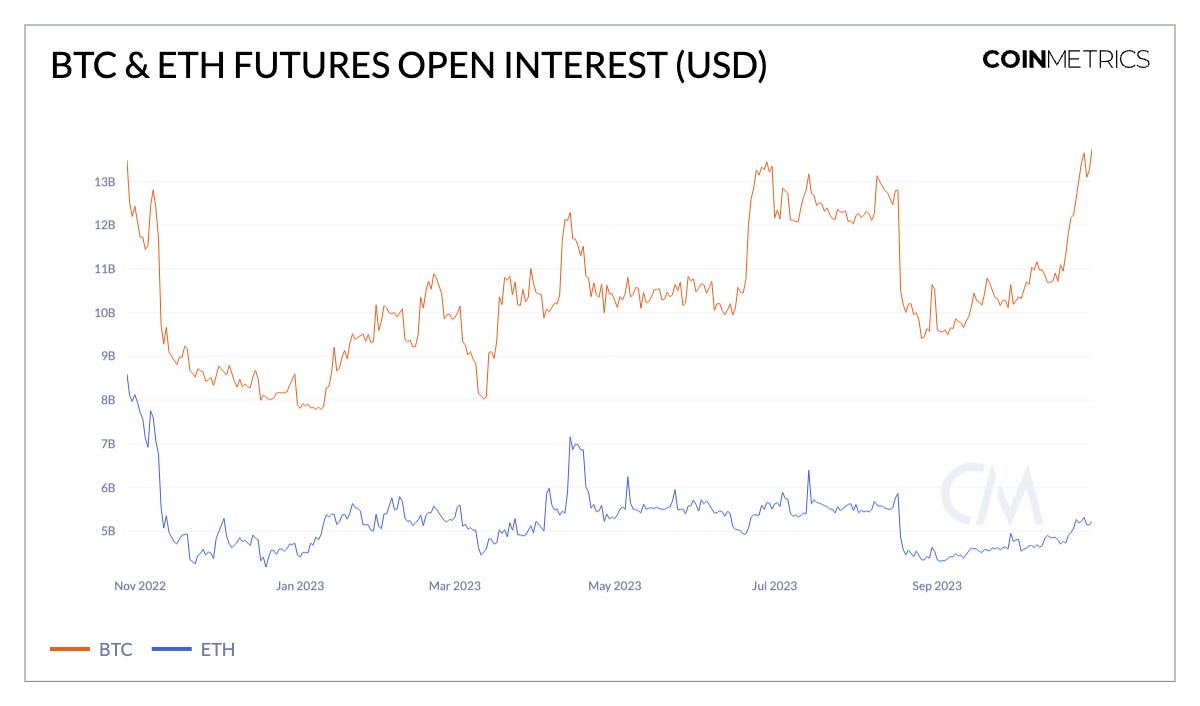

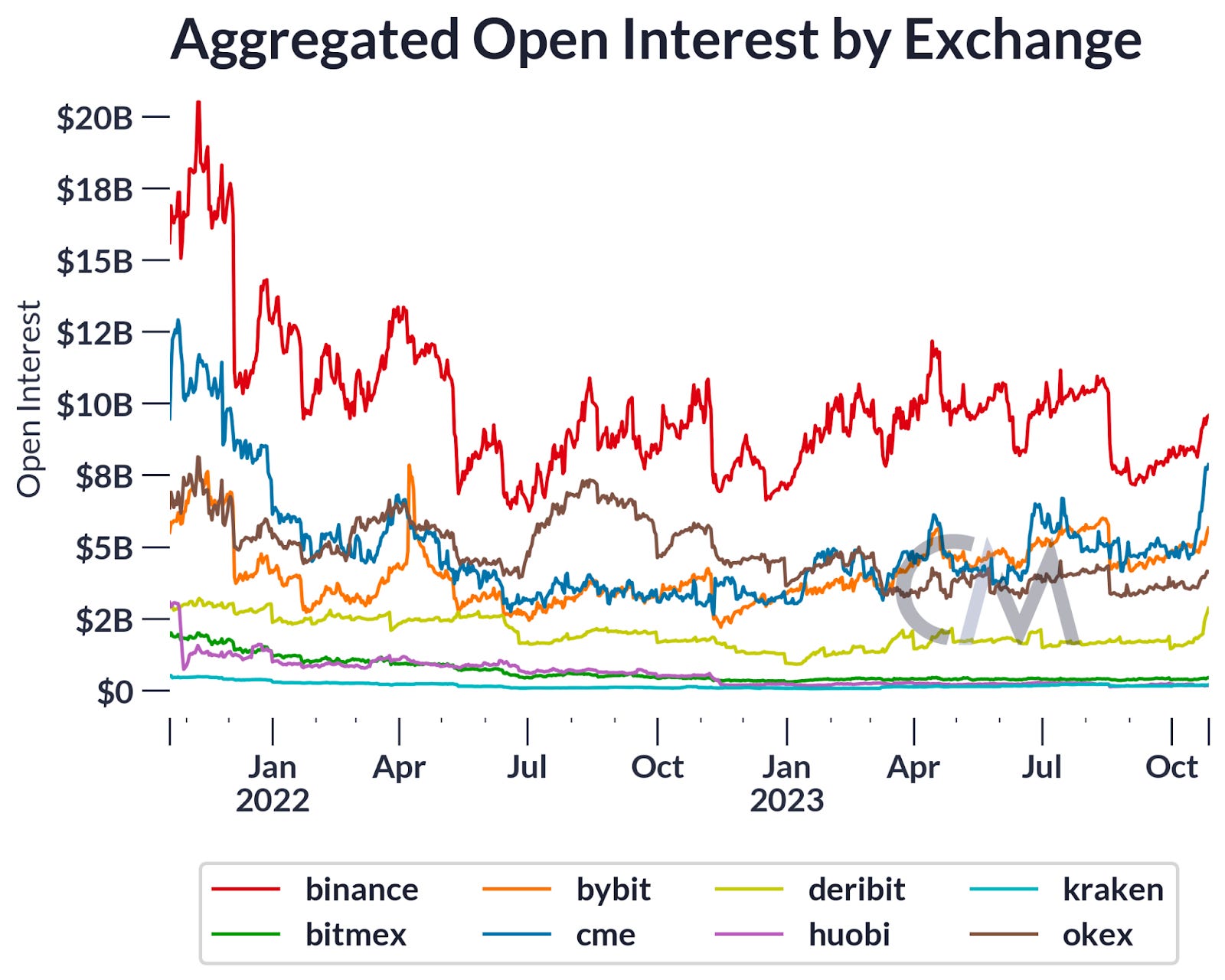

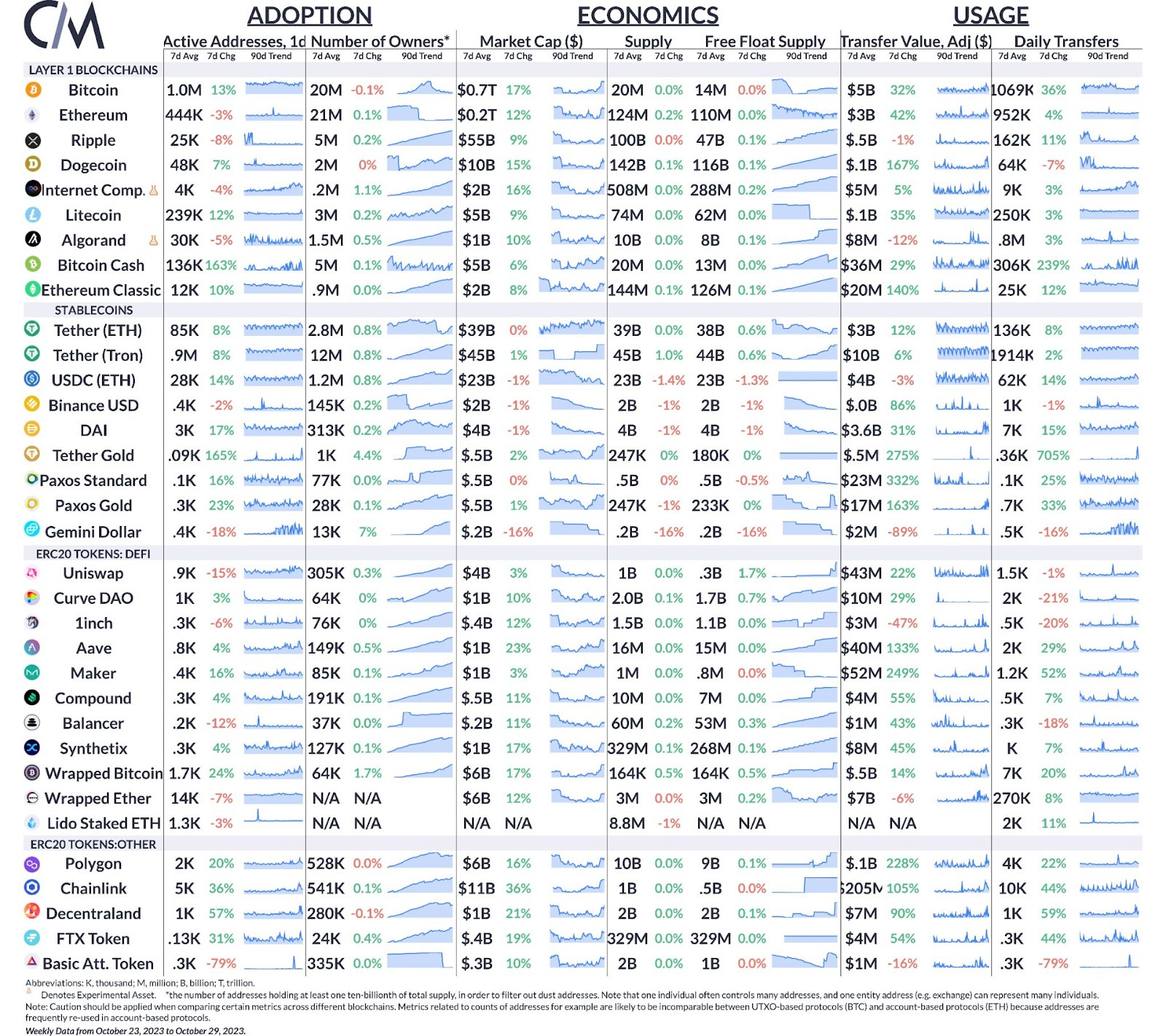

Get the best data-driven crypto insights and analysis every week: Unpacking the Forces Behind the Market RallyBy: Tanay Ved Over the past week, digital asset markets experienced a significant upturn with Bitcoin spearheading a sharp rally to $35k. This surge, driven primarily by growing anticipation around a spot Bitcoin ETF and a combination of other tailwinds, has caught the eye of retail and institutional participants alike. This market movement suggests renewed confidence and indicates a potential shift in the dynamics around digital asset markets. As we explore the factors behind this surge, it's essential to consider both broader macroeconomic influences and sector-specific developments contributing to the rise. In this issue of Coin Metrics’ State of the Network, we offer a data-driven market update, focusing on both spot and derivative markets to grasp the factors behind this rise and its wider implications for the digital asset ecosystem. Breaking Down the SurgeThis past week saw BTC break the crucial $30k price level, with large intraday moves momentarily pushing the largest digital asset by market capitalization above $35k—a level not seen since May 2022. This sharp increase can be attributed to several factors, including the build-up of sector specific momentum, liquidations of shorts and the influence of macroeconomic shifts contributing to the 28% surge since October 1st. Source: Coin Metrics Reference Rates & Market Data Feed One significant factor propelling the recent market movement is the escalating anticipation around the approval for a spot bitcoin ETF. Optimism started to build in August when Grayscale emerged victorious over the SEC; the Court of Appeals for the D.C. Circuit ruled unanimously in Grayscale's favor, a boost to Grayscale’s endeavor to transform the $17B bitcoin trust (GBTC) into a spot ETF. In October, this victory was formalized as the SEC chose not to appeal this ruling—a development that saw GBTC's discount to NAV tighten from -40% in June to approximately -15% as of October 26th. Over the past week, however, two other events amplified this optimism. Anticipation reached fever-pitch on October 16th as BTC surged 10% within minutes, spurred by a false report regarding BlackRock's spot Bitcoin ETF approval. As seen in the chart above, this coincided with a spike in spot volumes, reaching $2B as measured by Coin Metrics’ hourly trusted spot volume. Adding to the momentum, it was observed that the iShares Bitcoin ETF Trust, bearing the ticker $IBTC, made its appearance on the Nasdaq clearinghouse website. Following this news, a cascade of short-sellers were liquidated helping propel BTC price closer to the $35k territory. Although these events didn’t lead to any material alterations, they highlight the robust market sentiment for such an investment product and hint that its eventual approval may not yet be fully priced in by market participants. Moreover, an uncertain macroeconomic backdrop with US 10-Year Treasury yields climbing over 5% and rising geopolitical tension have also arguably added to the narrative of BTC as a “safe-haven” asset—further contributing to the market shift. Bitcoin in FocusThis confluence of catalysts has resulted in BTC returning 110% year-to-date, with 47% of the rise occurring since the beginning of October. When compared to other crypto-assets, traditional assets and indices, BTC’s performance year-to-date remains noteworthy—even when looked at from a risk-adjusted basis. The only assets to outperform it thus far have been technology oriented equities fueled by the boom in artificial intelligence (i.e NVDA, META) and Solana (SOL)—experiencing outsized gains since being suppressed by the FTX fallout in November 2022. BTC remains resilient in the face of equities experiencing a reversal from their highs of late. Indices and assets like the Nasdaq, S&P 500 and Gold, in comparison, have gained 22%, 8% and 9% respectively. Source: Coin Metrics Reference Rates Another metric to note is Bitcoin’s market cap dominance as measured against the rest of the datonomy asset universe (excluding on-chain derivatives). BTC dominance has risen to 61%—its highest level since April 2021. Typically, during the initial phases of a market cycle, Bitcoin tends to outpace other crypto assets. This dominance serves as a vital barometer, providing insights into the overall health and directional trends of the broader digital asset ecosystem. Source: Coin Metrics Formula Builder, datonomy™ The ETH/BTC ratio illustrates the performance of ETH relative to BTC. As indicated in the chart below, ETH's relative underperformance becomes apparent with the ratio nearing 0.051, a pivotal level last encountered on May 1st, 2021. BTC's current momentum is propelled by several tailwinds: the likely approval of spot ETFs, prevailing macroeconomic uncertainty, an uptick in illiquid supply, and a confident long-term holder base. These dynamics, explored in depth in a joint research report by Bitcoin Suisse & Coin Metrics, are further amplified by the upcoming halving—creating a critical juncture between demand and supply for the largest digital asset. Source: Coin Metrics Formula Builder Spot Volumes ReturnSource: Coin Metrics’ State of the Market, Market Data Feed This price rally was accompanied by a notable increase in spot volumes. As seen above, aggregated spot volumes across exchanges reached $40B on the back of this surge, rising to a 6-month high. Other than BTC, trading volume on altcoins also contributed significantly to the overall uptick in spot volumes. Liquidity across major exchanges like Binance and Coinbase have remained relatively stable over the past few months, despite falling from levels seen earlier this year. Source: Coin Metrics Market Data Derivatives MarketTurning to derivatives markets, its dominant role in this surge is noticeable with the increase in BTC futures open interest. BTC futures open interest topped $13B as of October 25th and continues to gain steam. The increase in ETH futures open interest pales in comparison, once again highlighting the differences in current market structure between the two assets. Source: Coin Metrics Market Data ConclusionThe recent surge in digital asset markets, primarily led by Bitcoin, reflects a pivotal evolution in market dynamics and investor sentiment. The anticipation around spot Bitcoin ETFs—an investment vehicle absent from prior cycles is poised to open the doors to new capital inflows, further propelling the mainstream adoption of digital assets. The observed macroeconomic headwinds and sector-specific catalysts not only emphasize the intrinsic adaptability and resilience of digital assets but also highlight their increasing relevance in a rapidly shifting global financial landscape. As we move on from this momentous rally, participants will be keen to understand if this momentum sustains and the extent to which these dynamics will shape the trajectory of digital asset markets. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Bitcoin active addresses rose 13% while Ethereum active addresses declined 3% over the week. On-chain activity experienced a broad increase over the week as asset prices rose across the ecosystem. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 230

Tuesday, October 24, 2023

Navigating the Liquidity Landscape: Insights into Digital Asset Markets

[Report] Coin Metrics’ State of the Network: Issue 229

Thursday, October 19, 2023

Coin Metrics ⨉ Bitcoin Suisse—Exploring Supply Transparency

Circle's Silver Lining: Unpacking USDC's Supply Drop in an Era of Rising Rates

Tuesday, October 10, 2023

Circle & USDC in an Era of Rising Rates

Coin Metrics’ State of the Network: Issue 227

Tuesday, October 3, 2023

A data-driven overview of the events from Q3 2023

Coin Metrics’ State of the Network: Issue 226

Tuesday, September 26, 2023

Tuesday, September 26th, 2023

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏