Meson Network: Revolutionizing Web3's Bandwidth Landscape

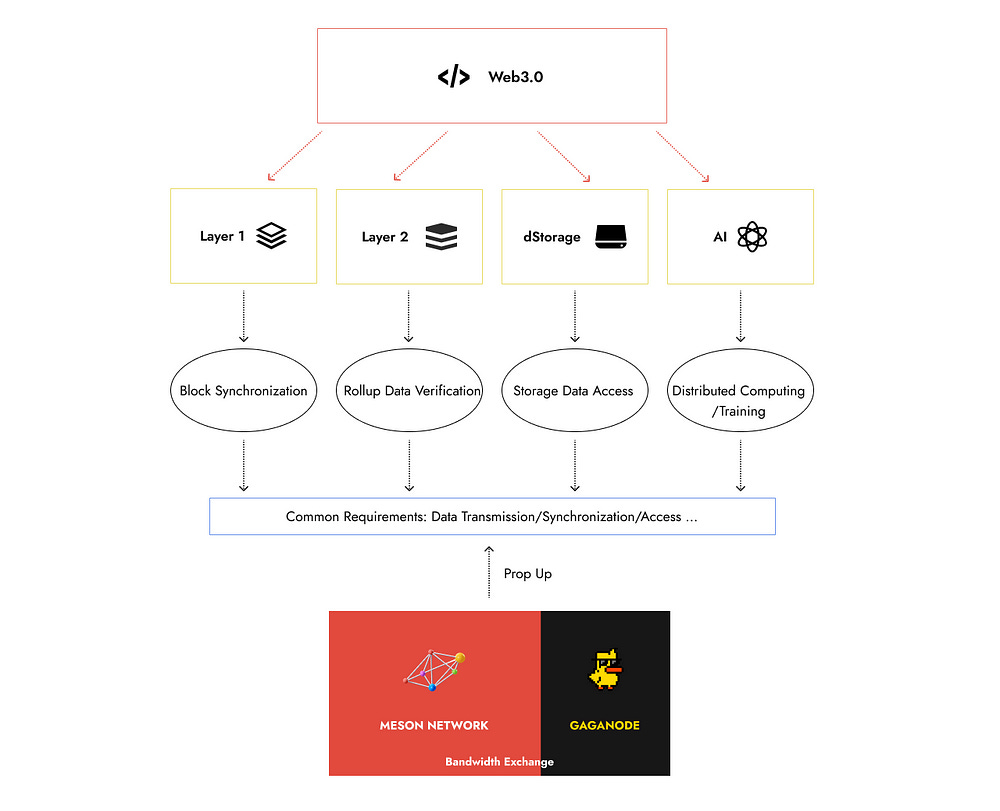

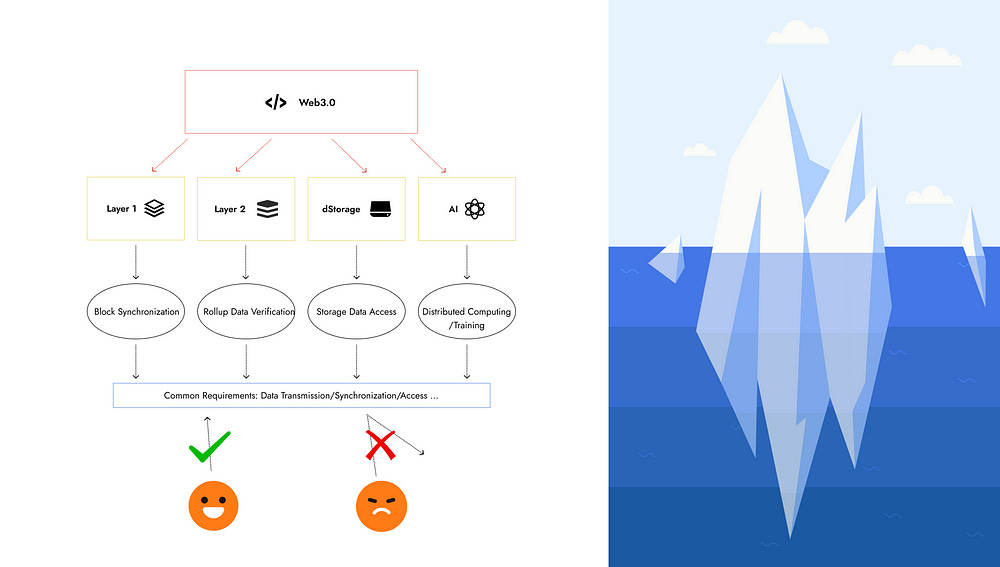

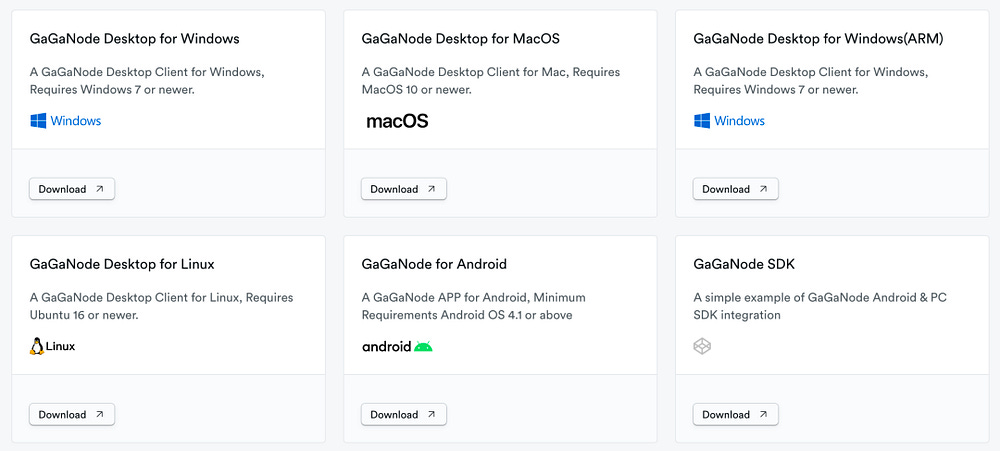

Arthur Hayes recently observed a surge in funds flowing into AI, particularly favoring decentralized storage like Filecoin due to AI’s hefty computational demands. Despite industry enthusiasm, the practical experience for regular users, especially during the NFT craze, often involves slow loading or crashes on IPFS or Filecoin due to server congestion. Addressing these user experience issues could unveil promising projects. Imagine if accessing a small image stored on Filecoin could be significantly improved by caching it locally. Beyond decentralized storage, Meson Network quietly safeguards various Web3 infrastructures and applications. (This article is provided by Meson Network and does not represent the views of WuBlockchain) In this analysis, we’ll explore Meson Network’s unique position, its foundational role, and its significance in addressing the bandwidth needs of the Web3 world. “Timeless Challenges in a Modern Era” This analysis will explore Meson Network’s role in addressing the bandwidth needs of the entire Web3 world. The crypto industry has evolved significantly, with developments in L1/L2 functionality, NFTs, decentralized storage, and the convergence of AI and cryptocurrencies. Meson Network addresses the efficiency and user experience challenges faced by decentralized projects in accessing and utilizing data. However, in this new era, previous challenges become more exposed. The more specialized the field, the more the ecosystem develops, and decentralized projects face challenges in terms of data access efficiency and user experience. For L1, the emergence of more public chains also means that nodes from different regions worldwide need to synchronize the entire ledger’s state more quickly. The challenge lies in efficiently synchronizing states among a large number of nodes for snapshots. With the increasing presence of L2 solutions, it implies that more transactions need to be aggregated and passed on to L1. The issues now revolve around how to verify this data faster and securely cache it for future needs. Returning to the decentralized storage mentioned earlier, users from different regions accessing NFT image data also require a consistent experience, at the very least without buffering and crashes. As for AI, with the reality of multi-party computation and model training incentivized by blockchain, users from various regions need faster data download and synchronization speeds. In Web3, the decentralized nature poses challenges, particularly related to data access and usage efficiency. Users and projects across different global regions face inconsistent experiences in accessing, transmitting, and retrieving data due to physical distances. This inherent limitation emphasizes the common demand among Web3 projects — the need for suitable and abundant bandwidth resources to ensure decentralized data access. Ultimately, the security and usability of cryptocurrencies depend on fundamental hardware resources dictated by basic economic principles. Meson Network addresses the fundamental need for bandwidth resources in the Web3 industry. Using a simplified analogy, imagine the market is filled with various short videos (Dapps) and content platforms (L1/L2), but inadequate cell towers (bandwidth support) lead to buffering and unavailability. The industry requires a bandwidth resource provider that intelligently allocates resources based on geographical locations to ensure a seamless data transmission and access experience. This is precisely the role Meson Network is exploring. Meson Network: Powering Web3 with Bandwidth Resources To supply bandwidth for the entire Web3 world, Meson Network advocates leveraging and integrating resources. By aggregating idle bandwidth globally through a long-tail market and a sharing economy model, Meson Network distributes this combined bandwidth locally based on specific rules, creating a decentralized bandwidth resource network. Meson Network ensures the participation of nodes with diverse attributes and devices globally. At the product level, any residential or commercial bandwidth globally, including IDCs and data centers, can become nodes contributing bandwidth. Even personal devices like phones and computers can join, significantly reducing entry barriers. Meson Network has also quietly adapted to different operating systems and device models, simplifying the process of joining the network and contributing bandwidth. Exploring why nodes are willing to contribute bandwidth ultimately leads to the classic blockchain topic of incentives and distribution. With the condition that their bandwidth remains idle, contributing bandwidth for others’ use becomes a source of corresponding income. The specific earning methods are tied to the project’s economic and business models, which will be elaborated in subsequent sections. The online duration and timeframes of different nodes may vary, but the vast network scale formed by the sheer number of nodes allows Meson Network to have more relaxed scheduling flexibility when facing bandwidth demands in different regions. At the same time, within this network scale, we observe a “non-typical path” in the development of a Web3 infrastructure project: In a less conspicuous track, with no marketing or token airdrops, solely relying on a sufficiently low entry barrier and a standardized onboarding process, Meson Network acquires a large number of authentic, stable, and valuable “running water” users. These users are not synonymous with product consumers; instead, they constitute a part of the product’s capabilities. With a sufficient number of nodes providing bandwidth resources, Meson Network’s product capabilities can better assist other Web3 projects. To facilitate understanding, let’s use the example of NFT small images stored in decentralized storage.

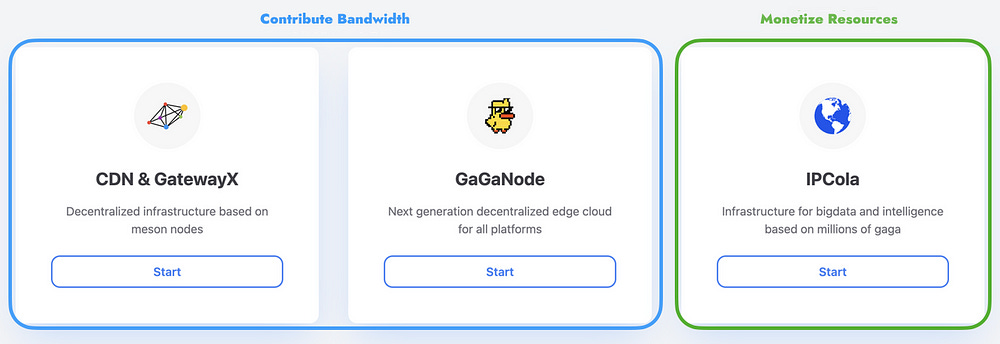

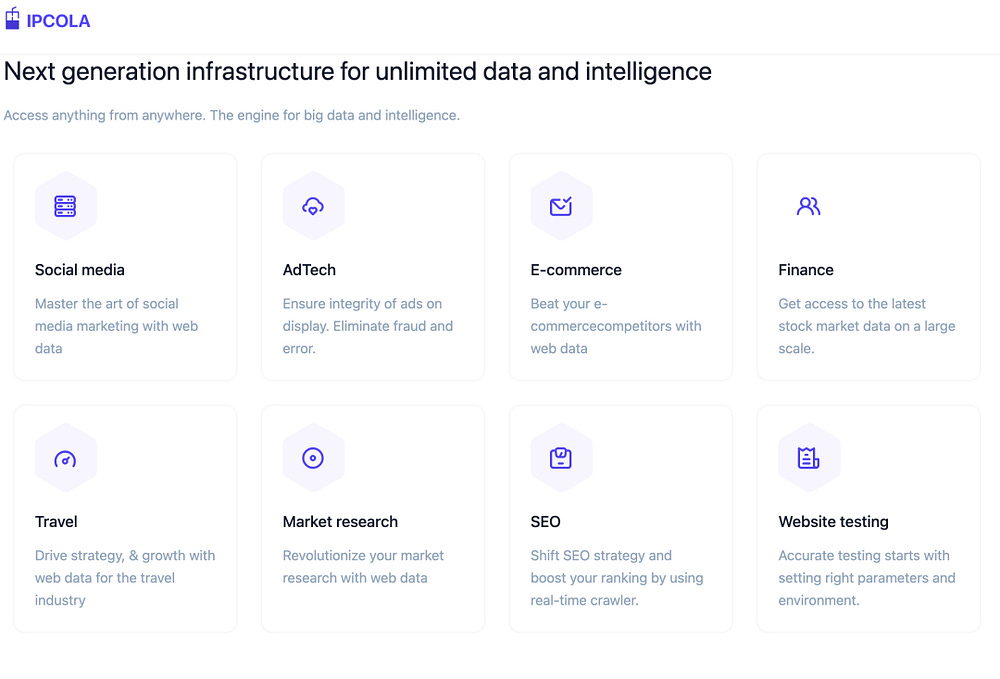

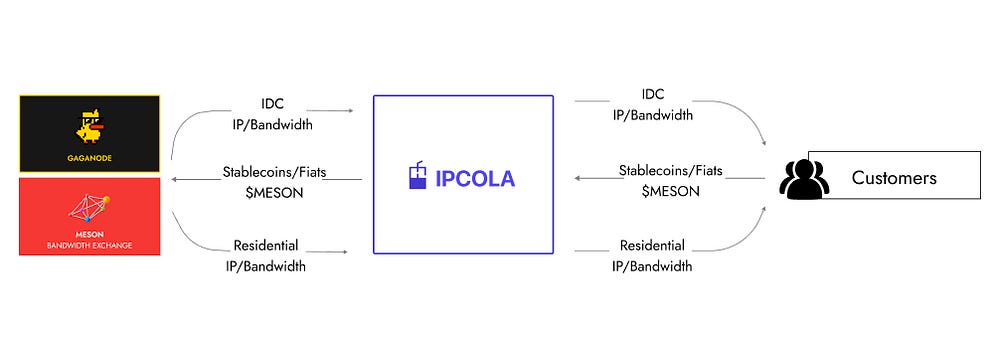

Furthermore, the most noteworthy aspect is that the services provided by Meson Network are not selective based on the nature of the service project. Whether it’s infrastructure or applications, large or small in scale, as long as it involves activities like the transfer, access, and retrieval of data in different regions, the near allocation of suitable bandwidth resources becomes invaluable. But the next question that piques our interest is whether its business model is sustainable. In the give-and-take of encouraging users to contribute bandwidth and rewarding contribution behavior, is the project’s profitability healthy? “Monetization to Reciprocate Contribution” If we understand Meson Network as a bandwidth resource pool, then the two sides of the pool can be seen as the supply and demand parties. The former contributes bandwidth, and the latter uses bandwidth. In Meson’s specific product structure, two products receive the contributed bandwidth from different nodes globally, while one product monetizes these aggregated bandwidth resources. Digging deeper into the business model behind its products, you will discover that Meson has established a relatively complete and coherent business cycle. IP Cola: Monetizing Business Based on a Large-Scale Node Network Therefore, Meson’s another product, IP Cola, essentially takes on the task of generating profits. It utilizes the income from service monetization to reward the contributors of bandwidth resources in the preceding two products. As Meson possesses a large number of nodes from global data centers and home networks, it can aggregate and redistribute these idle IP and bandwidth resources through a bandwidth trading market. This, in turn, brings value to users in different regions in areas such as data acceleration/caching, anti-ad fraud, network security, and anti-data scraping. Considering that this part involves knowledge of IP, data, and network principles, we won’t delve too deeply into it here.We can simply understand it as follows: Meson aggregates resources, packages them, and forms services for various scenarios. Others pay on-demand to use these services, thus constituting Meson’s source of income. According to information revealed by Meson Network team members, although IP Cola is still some distance from the annual revenue of traditional companies like Brightdata, which exceeds a hundred million dollars, it is growing rapidly, with overall revenue surpassing one million dollars since its launch six months ago. This can be considered a form of real-world income generation, signifying a business model that is not entirely reliant on tokens and is non-Ponzi.

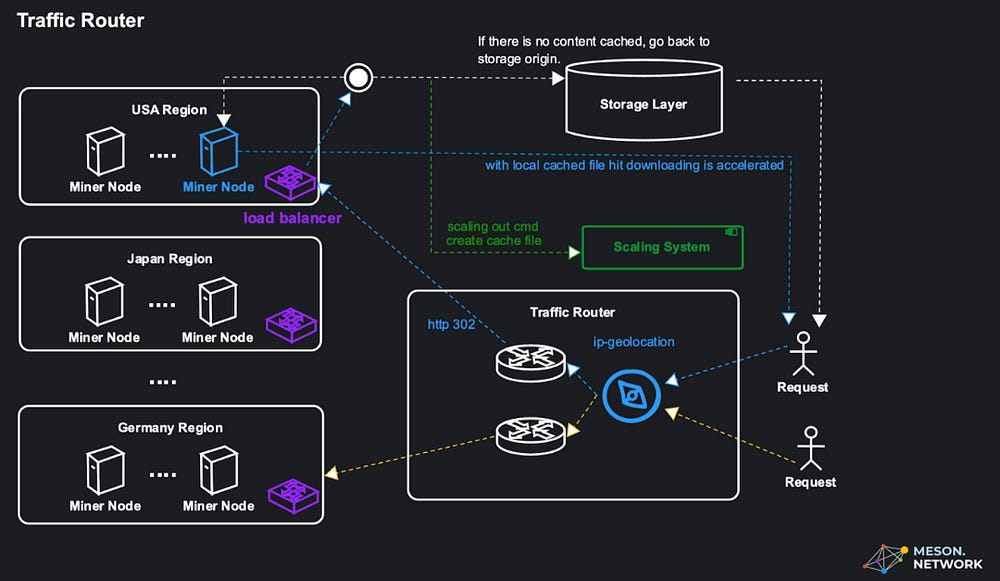

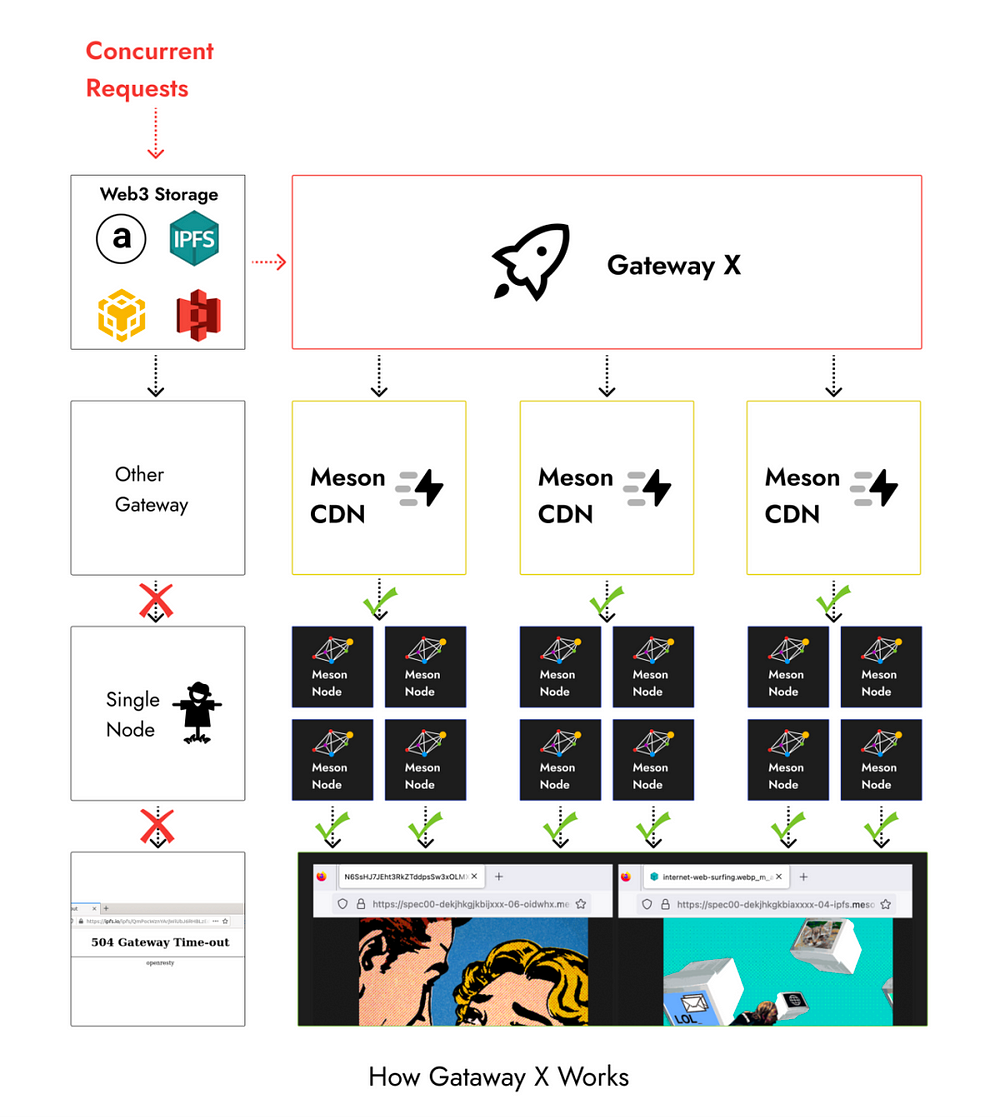

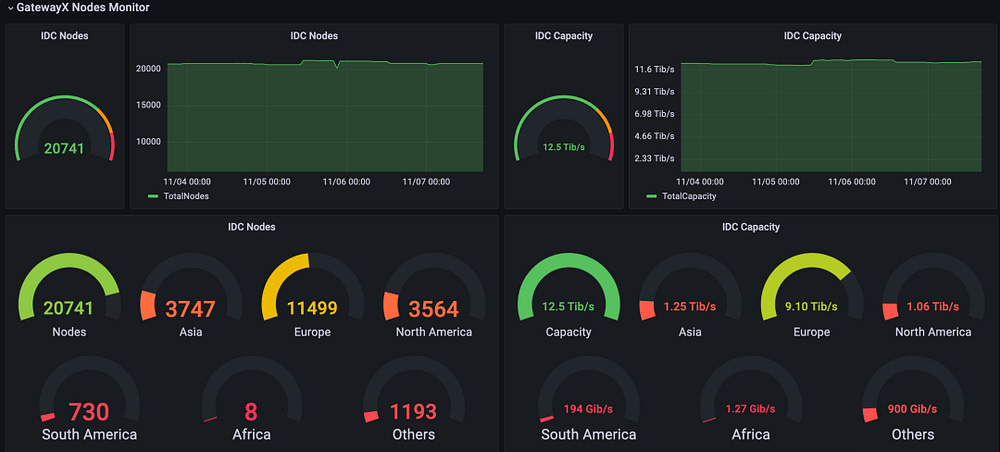

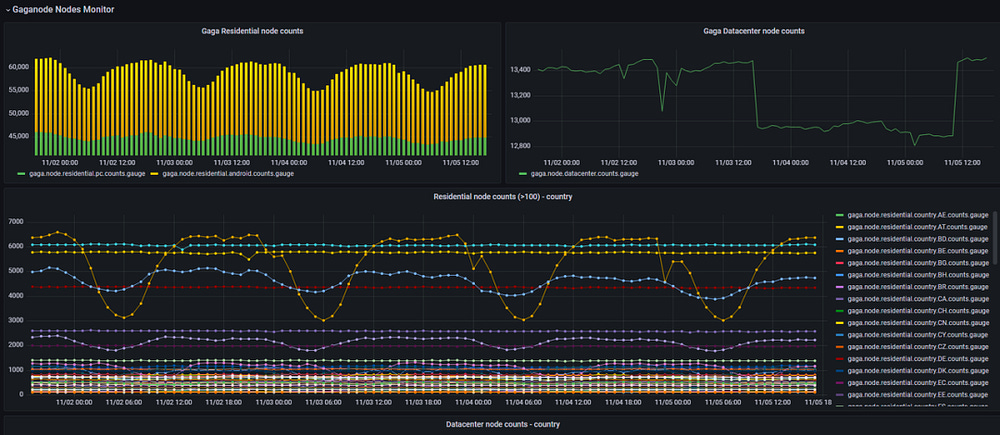

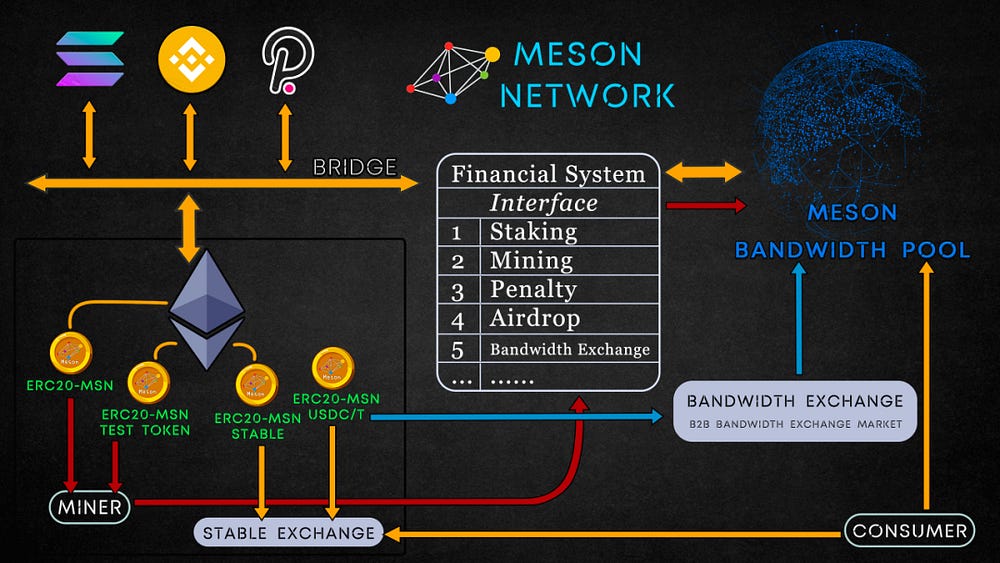

As a bandwidth resource platform with clear supply and demand ends, coupled with a healthy and scalable revenue model, the more participants on the platform, the more evident the network effects become, leading to the expansion of the project’s scale. Gateway X: Aggregating Commercial Idle Bandwidth, Providing dCDN Services This product is primarily targeted at global commercial idle bandwidth. For instance, resources in enterprise-level data centers (IDC) inevitably experience surplus during periods of low utilization. IDCs can contribute their idle resources to meet the file transfer needs of others. The most typical use case is CDN services: caching the required files near the target user in IDCs and utilizing the bandwidth at that location for transmission when users access them. From Meson’s dashboard, it can be observed that there are currently over 20,000 IDC nodes connected worldwide, forming a data transfer capacity of 12.5 Terabits per second. Gaga Node: Leveraging Residential Bandwidth for Edge Computing This product, as mentioned earlier, allows small devices such as home routers, computers, and even smartphones to connect, forming a more extensive long-tail market. The product’s name itself reveals its function: each little duck can make a “gaga” sound, just like each small device possesses certain computing and transmission capabilities. In essence, this resembles the composition of a DePIN and IoT network, where numerous devices become edge nodes in the network, serving edge computing scenarios. Applications can be initiated directly on these devices, resulting in faster network service responses, meeting fundamental requirements in real-time business, application intelligence, security, and privacy protection across various industries. Whether it’s Gateway X or Gaga Node, these contributors of substantial commercial and personal bandwidth are evidently not engaging in charity; they also aim to generate income while contributing their idle resources. Bandwidth Exchange Marketplace: A Grand Blueprint Breaking Physical Boundaries Meson Network has achieved a certain level of success with its current products, but it is still a distance away from its ultimate vision. Let’s not forget that Meson currently doesn’t have a token, which to some extent means that the potential based on blockchain and token incentives has not been fully unleashed. The current model of bandwidth resource contribution and distribution can evolve in the future toward a blockchain-based, self-organizing, and automatic bandwidth trading market:

With such a bandwidth trading market, Web3 projects can leverage a more Crypto Native approach to break the physical distance boundaries brought about by decentralization. Different projects, linked by tokens, can achieve a better data access, transmission, and utilization experience, ensuring the data availability of business through less perceptible pathways:

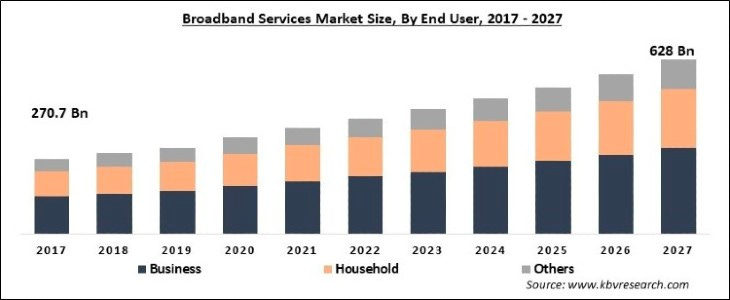

It needs to be emphasized again that the use cases for bandwidth resources are not as simple as CDN acceleration for watching videos; they are more closely related to the frequently mentioned concept of “data availability” recently. From an external perspective, the global bandwidth market is a colossal entity with a potential market value in the hundreds of billions of dollars. If Web3 projects can secure a small piece of this pie, it would indeed paint a grand blueprint. This also underscores from another perspective that Massive Adoption may not necessarily happen first at the application layer. When there is a bandwidth demand at the resource layer, economic incentives with token rewards, and nodes willing to join and contribute continuously, a healthy business model might be more robust and enduring than unsustainable short-term narratives. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

IOSG Founder: My Thoughts on the Current State and Challenges of L2 Ecosystem

Friday, November 17, 2023

Author | IOSG Founder Jocy Source: https://twitter.com/JinzhouLin/status/1720017923744698628 L2 Summer or Predicament? Recently, I heard complaints from several friends working in the crypto airdrop

In-Depth Analysis of USDV: A Community-Driven New RWA Stablecoin

Tuesday, November 14, 2023

Author: Wade Stablecoins are the “crown jewels” of the crypto industry. How will the new stablecoin USDV, issued by the Verified USD Foundation, impact the industry? Can it stand out among the many

CEX Data in Oct, volume increased by over 40%, while traffic increased by 16%

Monday, November 13, 2023

According to statistics gathered by the WuBlockchain: For October, the spot trading volume of major exchanges rose by 57.5% month-on-month, hitting a new high since April of this year. The top three in

Asia's weekly TOP10 crypto news (Nov 6 to Nov 12)

Sunday, November 12, 2023

Author:0xMingyue Editor:Colin Wu 1. SBI to Launch ¥100 Billion Yen Fund for Investment in Web3 and Emerging Companies link On November 9th, according to CoinPost citing Nikkei News, the Japanese

Weekly Project Updates: Ordinals Gain Momentum, Starknet Forms DeFi Committee, Ava Labs Conducts Large-Scale Layof…

Saturday, November 11, 2023

1. Bitcoin On-Chain Inscriptions Sentiment Heats Up a. November 7th Bitcoin Ordinals Market Sees Trading Volume Surpass $15.3 Million link According to the @domodata data panel, on November 7th, the

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏