Earnings+More - The future is murky for esports betting

The future is murky for esports bettingEsports betting examined, Bragg’s third-party benefit, analyst takes +MoreEsports betting was the future once – at least in some optimistic circles – but a recent weeding out of some big names within the sub-sector leaves some question marks about its prospects. With Unikrn and Luckbox giving up the ghost and Midnite pushing the button on lay-offs, experts suggest the rest of the sector now has a job to do to prove it can fulfill its promise of attracting a younger generation of bettors. And there ain't no magic pen, To get back what you lost. Between the linesOnce pitched as the next big thing in sports betting, is esports being quietly forgotten? Sector shake-up: The pool of relevant esports operators has started thinning out. Several bookmakers bowed out of the space last month within days of each other, casting uncertainty around the segment and its future.

Inside scoop: The sequence of events is less indicative of the segment’s longevity as much as it highlights mismanagement among the aforementioned businesses, according to Esprouts author Ollie Ring.

Entain acquired Unikrn for £50m in 2021 but put the platform on ice until December of last year when it relaunched the brand. Any market share Unikrn had at the time of its purchase was cut off at the knees when it was taken offline for more than a year.

💸 Stop Wasting Ad Budgets! Insider Insights from Top Betting Operators Revealed.. In the realm of online gambling, the challenge of invalid traffic remains significant, often overlooked by marketing teams. From fraudulent bots to existing customers using paid search results for direct website access, the landscape is rife with potential budget drains. Insights gathered from over 30 global sports betting giants like William Hill, Entain, and Tabcorp paint a revealing picture:

Discover how TrafficGuard empowers companies to mitigate these challenges and enhance their LTV (Lifetime Value) and CAC (Customer Acquisition Cost): Learn More. Dealing in fractionsReality check: While esports is seeing some regulatory tailwinds in Nevada and elsewhere that will help drive growth over time, the reality today is the segment only makes up a fraction of the global sports-wagering industry.

Show me the money: Established bookmakers such as Pinnacle, Betway and bet365 continue to maintain their esports offerings and invest in the space, but they also aren’t wholly reliant on it.

Leading the pack: Rivalry, the Toronto-based operator hanging its hat on Gen Z, has staked a claim for this strategy. Esports accounted for more than 90% of the company’s sportsbook handle in FY22, and the segment is driving big gains for the business.

Standout: What has set Rivalry’s acquisition and engagement apart from competitors is an organic media strategy focused on creative marketing and entertainment. The company mostly forgoes the expensive team and league deals in favor of partnering with hundreds of gaming creators on Twitch that it can collaborate with on viral content and reach customers directly.

That strategy has worked so far, helping the company attract a youthful user base where 80% of its active users are under 30 years old. While the approach is easy to digest, Salz noted that it’s not as easily replicated.

Bottom lineStroke of genius: Rivalry’s masterstroke, and what we can glean from it, is positioning a betting brand within esports and gaming culture through content, partnerships and activations versus just selling a product within it can drive the value that makes this segment worthwhile at its current vector.

The esports market may not stand up to sports today, but the consumer opportunity marks a path forward for operators to engage a new audience and future-proof their business with the next generation of fans. And as regulations ease, consumer awareness grows and game publishers continue to warm up to regulated betting, the market will become more substantial. Building your database of betting-inclined players is more important now than ever. Fill the top of the player funnel and retain existing players with personalized pre-match, player prop and live staking experiences… all backed by Chalkline’s proprietary BI and automated engagement platform. Learn how Chalkline can build loyalty for new and existing players at chalklinesports.com. The month’s most read

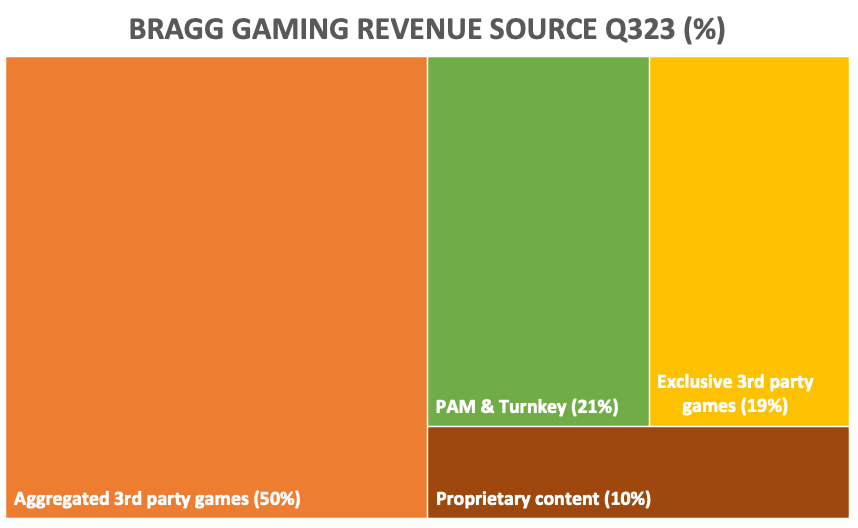

Third among equalsIt’s in the game: Bragg Gaming received a share price boost last week after activist shareholder Raper Capital went public with its concerns about the company’s trajectory – and its lowly rated share price – and called for a sale.

🎰 Majority of Bragg’s revenues come from supplying 3rd-party content Recent analyst takesDraftKings: Reaction to the company’s investor day was generally positive with only Deutsche Bank marking the card for the few remaining bears on the stock, saying the bull case rests on same-store GGR growth remaining “robust”.

IGT: Noting a recent sharp 8.5% fall in the company’s share price, the team at Jefferies suggested the end of the week tumble may have been prompted by comments at Flutter’s Italian away day with analysts last week that its Italian subsidiary Sisal might bid for the contract to run the country’s lotto. Rush Street: JMP said the improvements in the underlying product offering in iCasino lay behind the company’s successful Q3 and noted “success is being driven through multi-player games, creating engagement and loyalty to the platforms”. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

The price of black market activity: £615m

Monday, November 27, 2023

Entain settlement, UK taxes, earnings in brief, Startup focus – The Racing App +More

Shall we vote? Hedgies harry Entain, badger Bragg

Friday, November 24, 2023

Entain and Bragg activist calls, affiliate M&A, ESPN Bet data, Product+More – Kambi's Tzeract +More

Billion-dollar babies

Tuesday, November 21, 2023

What happens to the US market when the leaders start to throw off cash?

Rumors swirl over PointsBet bid

Monday, November 20, 2023

Takeover rumors, New Jersey October, Vegas GP, Flutter fundamentals, startup focus – Comparasino +More

ESPN Bet’s ‘extremely strong start’

Friday, November 17, 2023

ESPN's first day, Affiliate futures, DraftKings reaction, earnings in brief +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these