Earnings+More - BetMGM ‘can stand on its own two feet’

BetMGM ‘can stand on its own two feet’BetMGM business update, DraftKings’ fireside chat, Aspire in court +More

Now I'm feelin' how I should, Never knew single could feel this good. BetMGM business updateBetMGM management insists the company doesn’t need more cash from its parents, as they plot a path to $500m profit in 2026. Brass in pocket: BetMGM CFO Gary Deutsch said the company was “done taking cash” from joint venture partners MGM Resorts and Entain, as it said in a business update it would be generating adj. EBITDA of ~$500m by 2026 after another “year of investment” next year. Riddle me this: The comments appear to contradict those from Entain CEO Jette Nygaard-Andersen, who said during her company’s Q3 trading update that it was prepared to inject more cash into the JV.

Efficiency drive: Asked directly whether that might relate to potential M&A activity, CEO Adam Greenblatt said BetMGM was “not actively evaluating” any deals right now. But he added it was “incumbent upon us to maximize the opportunity for our shareholders at all times”.

The military two-step: But the analysts weren’t wholly convinced. In the words of the team at Deutsche Bank, when looking at the current market share level of ~17% vs. BetMGM’s own target of 20-25%, “it would appear investment is necessary”.

By the numbers: Revenue for 2023 will come in at $1.9bn, in the middle of the previously forecasted $1.8bn-$2bn and representing a YoY uplift of 39%. The company said it would achieve adj. EBITDA profitability in H223. Same-state growth hit 18%.

What happens in Vegas: Next year is the “year that Nevada comes to life for BetMGM”, said Greenblatt. He added that, subject to approval, the company hoped to launch in the state and that Las Vegas was now “more relevant” than ever for sports betting.

He noted that adding Nevada to the equation was one of the reasons the company was confident in its 2026 forecasts. “We haven’t made any heroic assumptions for 2024,” he said. “We think we have tremendous headroom in acquiring more players at or around the CAC that we currently achieve.”

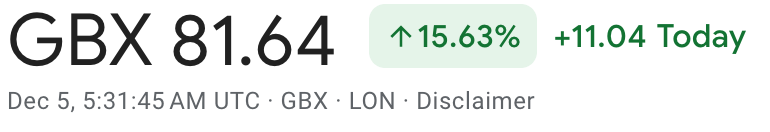

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs. EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets. +MoreShares watch: 888 received a share price boost yesterday, up nearly 16% after reports at the weekend that it had been the subject of a bid from Playtech in the summer. Earnings in briefAllwyn said this morning that revenue for Q3 rose 98% to €2bn driven by recent acquisitions. Ex-these, revenue was down 1% to €1bn. Adj. EBITDA was up 16% to €368m. Career pathsSportradar has appointed former SciPlay CFO Jim Bombassei as its new senior vice-president, investor relations and corporate finance. On socialChris Grove from Acies Investment and EKG suggested that, based on channel checks, “the early days of ESPN Bet feel closer to the home run Jay Snowden is hoping for than the flop some were predicting”. Via LinkedIn. What we’re readingBitcoin surges past $42,000 driven by three letters – ETF. More BetMGMBy the power of Angstrom! Much has already been said by both Entain and MGM Resorts about the difference that will be wrought by adding the capability of Entain’s Angstrom acquisition, bought in July for £203m including the earnout.

Monte Carlo simulation: Greenblatt noted that in iCasino the business was “going from strength to strength”, suggesting scale in iCasino is “one of” BetMGM’s advantages. He added that two of the company’s four themes for ensuring it hit its 2026 adj. EBITDA target include exclusive games and in-house content such as the iCasino/B&M product Dual Play Roulette.

Let’s get it Ontario: One surprise was Ontario where BetMGM broke cover on its market share, saying that based on its own internal estimates it controls ~22% of the total market. “We weren’t surprised by our performance,” said Greenblatt.

DraftKings fireside chatItch: Speaking at the Craig-Hallum Online Gaming Conference yesterday, CEO Jason Robins repeated the message from the company’s investor day that DraftKings had seen waves of competition and that Penn and ESPN Bet had been “pretty rational” up to now.

Mousetrap in development: Robins indicated DraftKings had already established a competitive moat. “If you have products or a product that is clearly viewed as best in class, you get all sorts of organic benefits to LTV and CAC, which then reinforces the advantage,” he said.

Always look on the bright side of life: He added results in the NFL had gone against the sportsbooks: “The only problem's been the sport outcomes, which I'm sure also is probably helpful to actives and handles.” Sleeping beauty: Robins said DraftKings hasn’t “even started to scratch the surface” with iCasino. “I think a lot of people are sort of sleeping on it a little bit and maybe are just focused on how big the sports side can be and not realizing the iGaming side can make the business even larger,” he said Cut Ad Costs, Boost ROI: Target Returning Customers Now Working with a leading European sportsbook, we found that 97% of their digital marketing spend, specifically on branded campaigns, was consumed by clicks from existing customers who had already made their initial deposit. This means your brand campaigns are reaching an audience that's already loyal, needlessly inflating costs. With TrafficGuard's innovative solution, you can pinpoint returning customers after a set number of clicks. Redirect them to your organic searches or lower CPC campaigns, effectively cutting expenses and optimizing your ROI Discover more about improving LTV (Lifetime Value) and reducing CAC (Customer Acquisition Cost) here: https://www.trafficguard.ai/resources/returning-users-in-sports-betting-and-improving-ltv-cac Aspire legal disputeCourt in the act: The co-founders of BtoBet have filed a legal challenge in the High Court against Aspire Global that alleges Aspire breached the terms of the agreement that governed its €20m purchase of the business in June 2022.

You just haven’t earned it yet baby: Alessandro Fried and Igor Lestar claim Aspire neglected its obligations related to how it valued the earnout incentives that were part of the agreement. Those terms committed Aspire to paying €15m in cash with a further €5m earnout based on BtoBet’s performance in the 12 months following completion.

Projections and expectations: It adds that this arrangement would disproportionately benefit the buyer by reducing the earnout consideration for any amount above €20m. The claimants assert these services should have been factored into the earnout since “the buyer would stand to benefit from 100% of the revenue generated from this investment in the years following 2022”.

Analyst takesLight & Wonder: After meeting with management, the team at Macquarie said there was confidence in the estimated $1.4bn in 2025 EBITDA target after a strong Q3 “showed momentum across all of LNW's businesses”.

Building your database of betting-inclined players is more important now than ever. Fill the top of the player funnel and retain existing players with personalized pre-match, player prop and live staking experiences… all backed by Chalkline’s proprietary BI and automated engagement platform. Learn how Chalkline can build loyalty for new and existing players at chalklinesports.com. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Was Playtech prepared to jettison B2B?

Monday, December 4, 2023

Playtech/888 bid rumor, Fanatics in Connecticut, UK stats, startup focus – BettorOff +More

ESPN Bet: big numbers, smaller market impact

Friday, December 1, 2023

OSB market analysis, Kindred call recall, MGM Resorts fireside chat +More

Kindred shutters North America

Wednesday, November 29, 2023

Kindred's strategic shift, PointsBet AGM, ESPN Bet analysis +More

The future is murky for esports betting

Tuesday, November 28, 2023

Esports betting examined, Bragg's third-party benefit, analyst takes +More

The price of black market activity: £615m

Monday, November 27, 2023

Entain settlement, UK taxes, earnings in brief, Startup focus – The Racing App +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these