Bitcoin Miners Are Dominating Public Markets

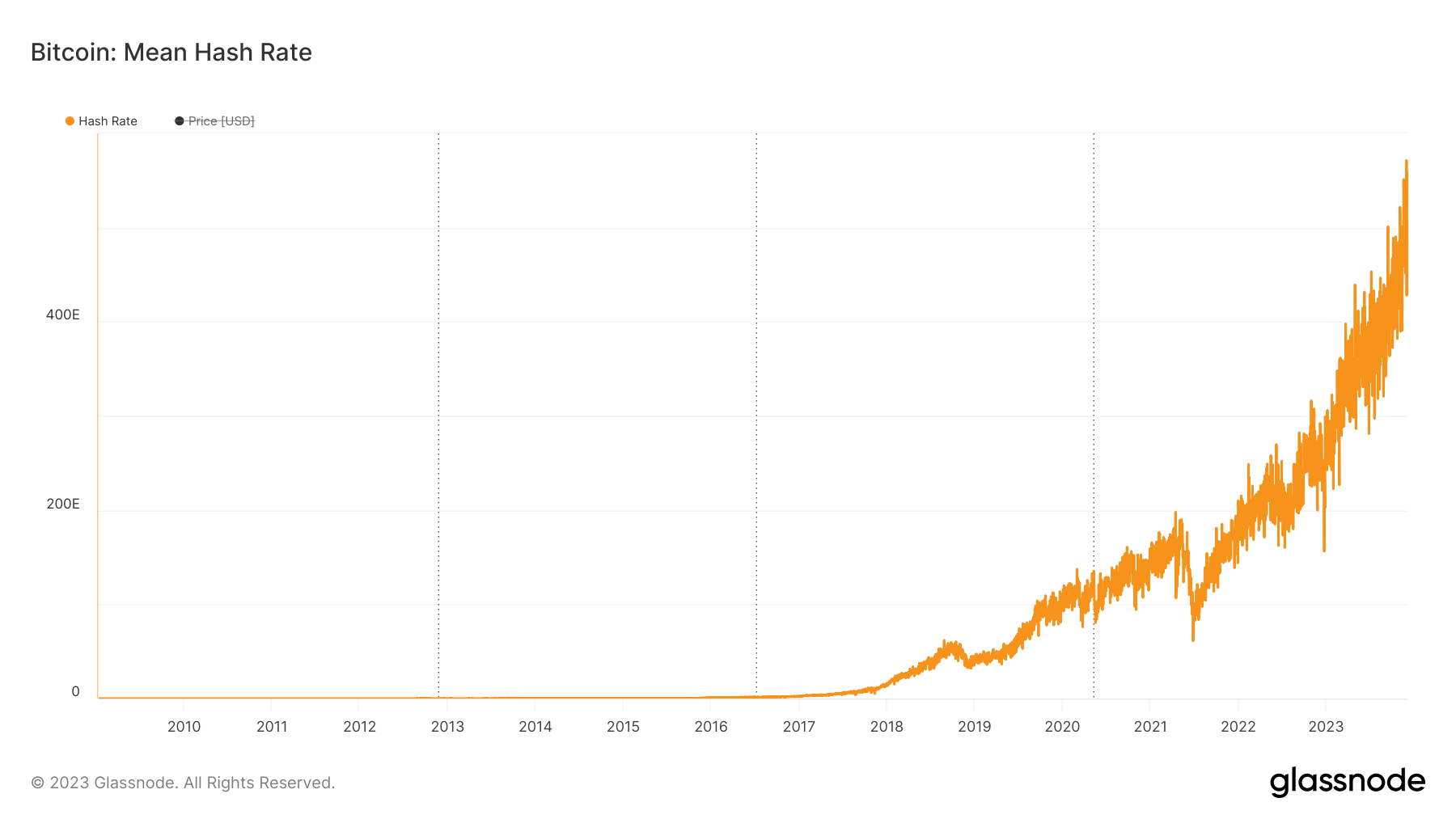

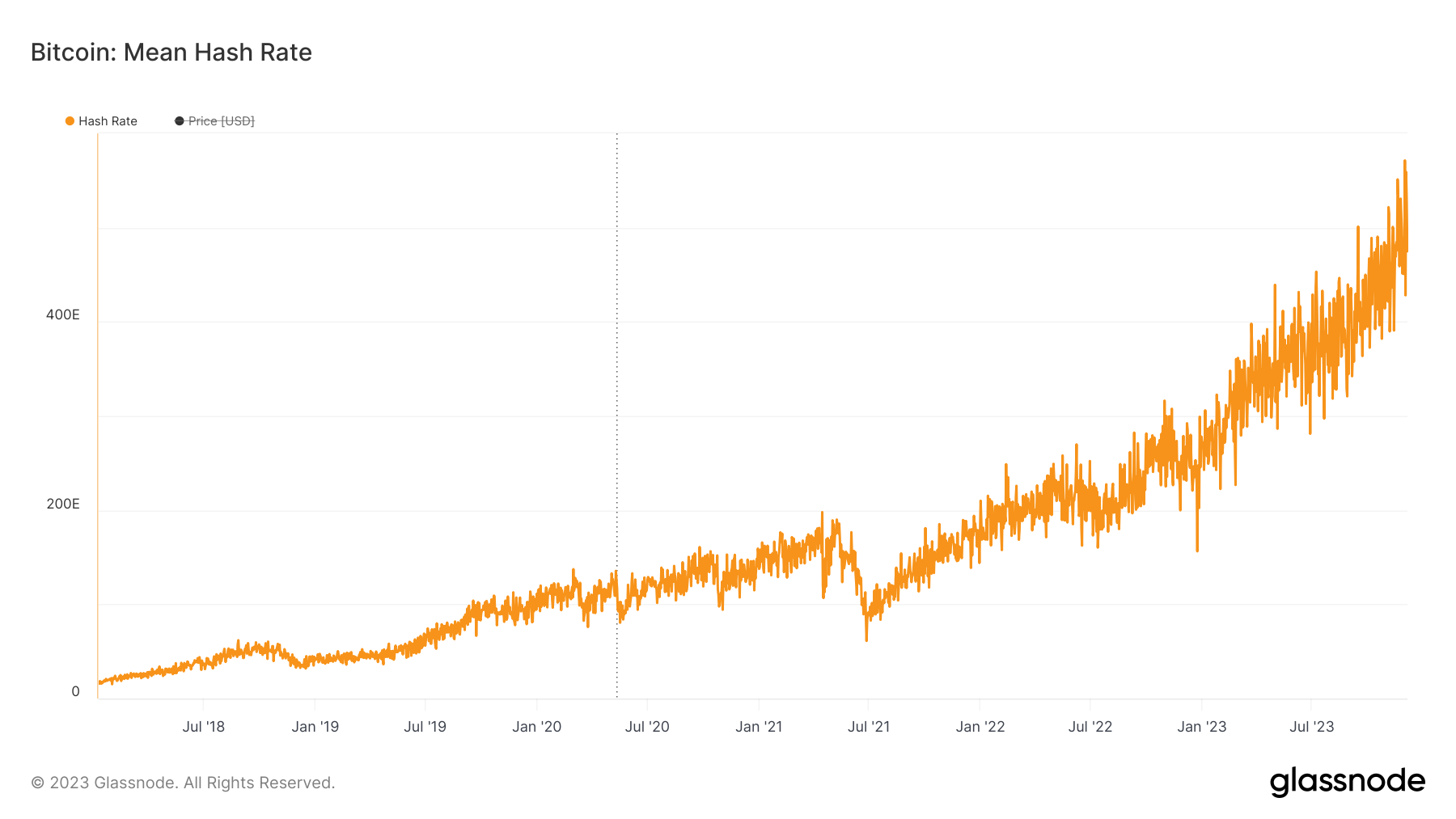

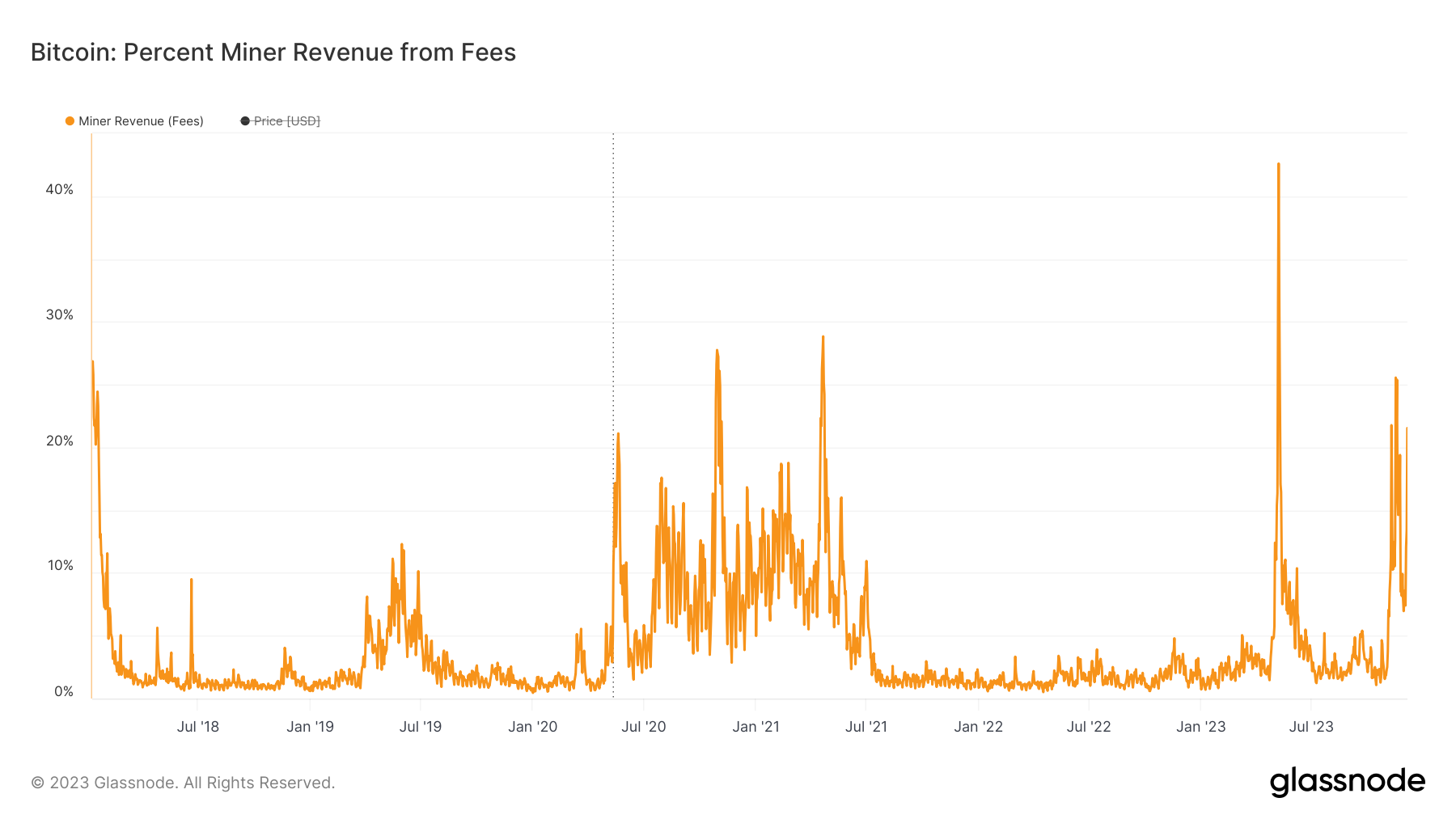

Today’s letter is brought to you by Trust & Will!Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of thousands of families create their estate plans, and they’re just getting started. Trust & Will enables every American to create a plan that’s customized to fit their needs, their life, and their legacy. Their mission is to make estate planning simple, affordable, and inclusive. All of Trust & Will’s documents have been designed and approved by estate planning attorneys to meet the highest legal standards. Their process is simple, secure, complete, and customized for your specific needs and state requirements. To investors, Bitcoin mining continues to be an area worth paying attention to, regardless of what role you play in the market. First, we can see the hash rate has been parabolic since the launch of the bitcoin protocol in 2009. This trend is even more pronounced if you zoom in on the timeframe from the 2018 bear market to today. You can see that hash rate has continued to accelerate even though China banned bitcoin mining when more than 50% of all mining was within the country’s border. As hash rate increases, competition for the block subsidy becomes more intense. What exactly is the financial reward for winning that competition today? There was $40.4 million paid out in the last 24 hours to miners. That is $14.7 billion annualized. There is almost no scenario where hash rate is going to stop growing when more than $14 billion in revenue is up for grabs on an annual basis. Another area to pay attention to is miner revenue from transaction fees. Usually transaction fee revenue would spike in the bull market — tons of people are trying to use the blockchain during the euphoric phase of the market cycle, so you have to pay higher prices to use the finite amount of block space. Recently, we have seen two major spikes in transaction fee revenue although we are in a bear market though. These are largely driven by Ordinals/Inscriptions, but still signal a significant departure from past trends and it has provided additional economic incentive for miners to continue competing for revenue. So how exactly have miners been performing? We can look at publicly traded miners to get a sense of how the industry players are doing this year:

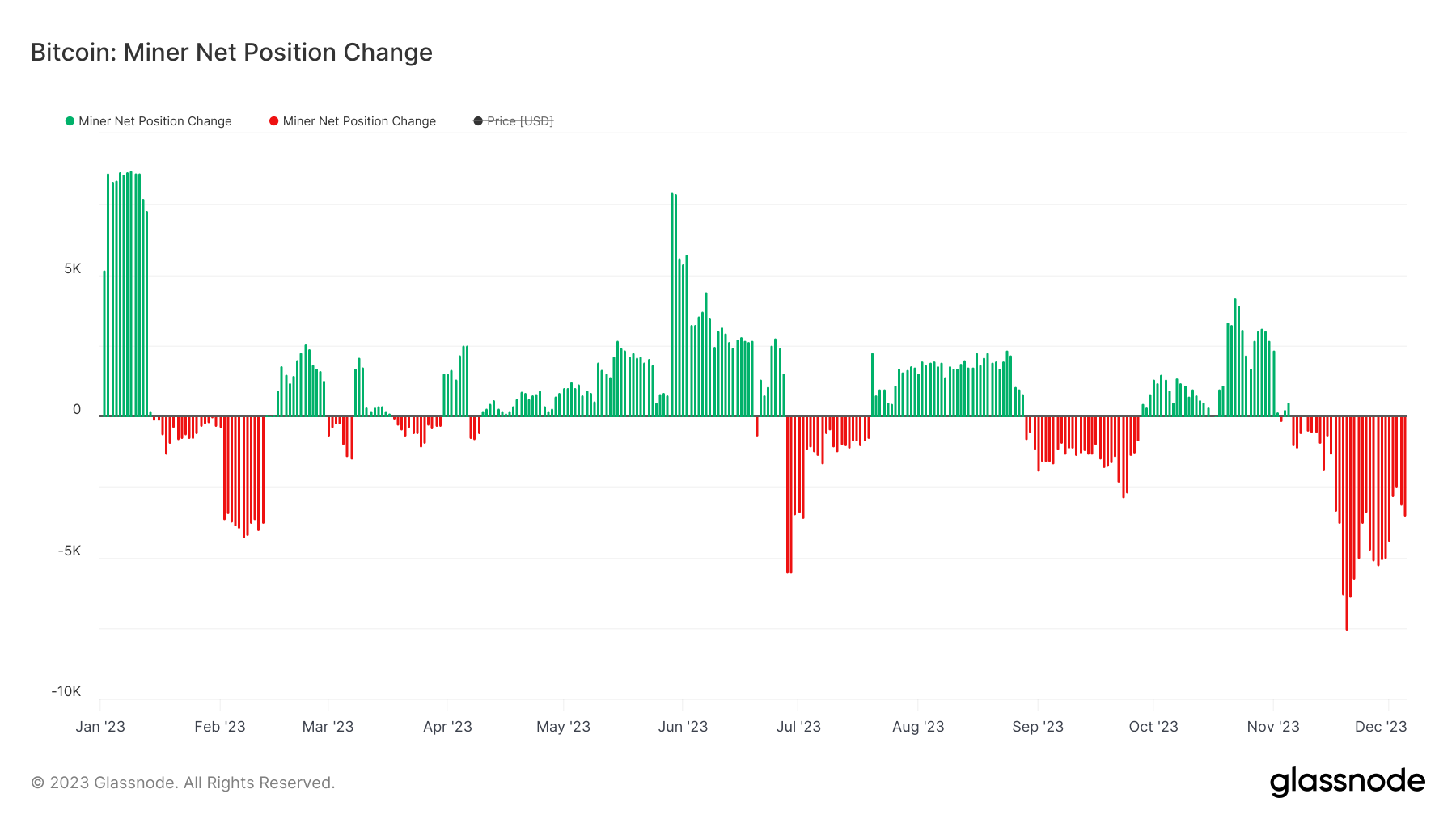

This type of financial performance is impressive by itself, but it becomes even more eye-opening when you realize that 5 of the 7 companies listed have more than doubled the performance of bitcoin year-to-date. Another interesting data point is how miners are handling the bitcoin on their balance sheet. You can see that miners have been net sellers since the start of November, which suggests that these organizations are taking advantage of the recent price appreciation and selling into the strength to drive further cash reserves. Overall, bitcoin mining seems to be in a great spot. Hash rate is at all-time high levels. Miners are pulling in $14+ billion in annualized revenue. The stock price of publicly traded companies is wildly outperforming bitcoin’s price performance. And we have not yet experienced the bitcoin having slated for early Q2 2024. The narrative in the bitcoin community of buying and exclusively holding bitcoin sounds good as a talking point, but it is essential that you think critically about what you are trying to accomplish from an investment perspective. It is hard to ignore the benefit of bitcoin miners based on the market factors and stock performance. The gold community has long debated the pros and cons of holding gold vs buying gold mining stocks. The bitcoin community is following fast on their heels with a similar debate. But as with most things in life, maybe the truth can be found closer to the middle ground than the extremes. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin. Bradley Tusk is a venture capitalist, political strategist, writer, and owner of P&T Knitwear bookstore. In this conversation, we talk about his brand new book, called “Obvious in Hindsight.” It is all about a fictional story of innovative technology, flying cars, and what they have to go through with politicians, mafia members, etc. This is a great conversation about how technology meets politics, and the reality on the ground. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here Anthony Pompliano’s CNBC Appearance From Yesterday Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Podcast app setup

Monday, December 4, 2023

Open this on your phone and click the button below: Add to podcast app

Bitcoin Is Surging And Holders Refuse To Sell

Monday, December 4, 2023

Listen now (5 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Are Stablecoins Saving The Treasury Market?

Friday, December 1, 2023

Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative companies. Search over

Crypto Equities Are Outperforming Bitcoin By 2x

Wednesday, November 29, 2023

Listen now (4 mins) | Today's letter is brought to you by Trust & Will! Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of

Consumers Ignore The Fed On Black Friday

Monday, November 27, 2023

Listen now (5 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these