Not Boring by Packy McCormick - Momentum, Consolidation, and Breakout

Welcome to the 27 newly Not Boring people who have joined us since last week! If you haven’t subscribed, join 217,559 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by…Merge Merge is a single API to add hundreds of integrations to your app. In fact, it’s the only leader in the Unified API space, according to G2. It’s loved and used by companies like Ramp, Navan, and literally hundreds of other tech companies. Here’s why:

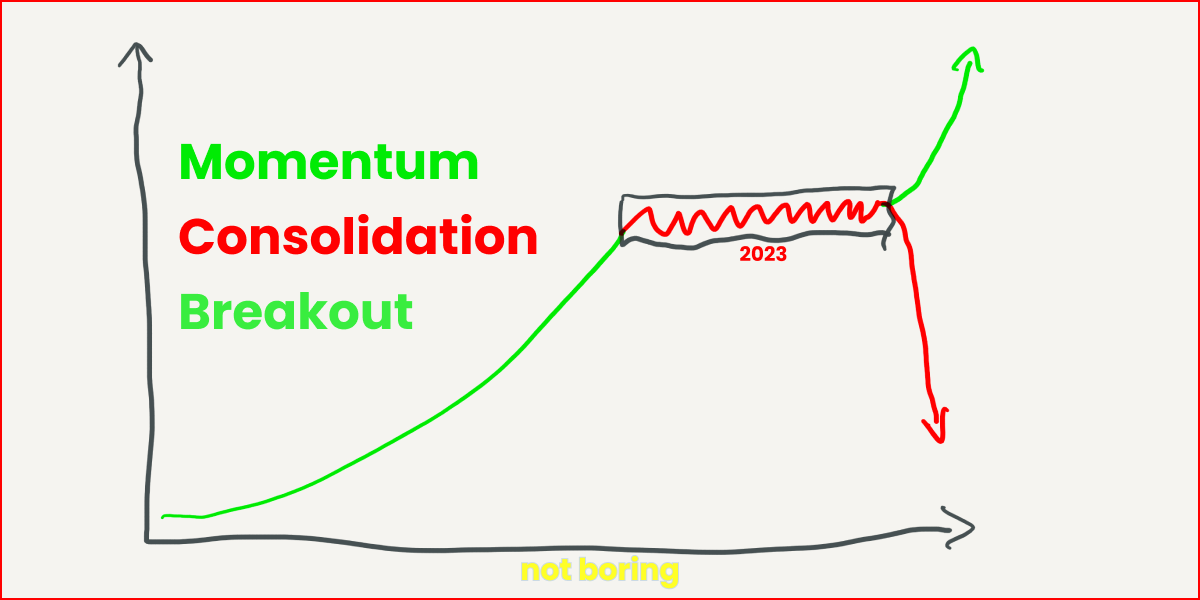

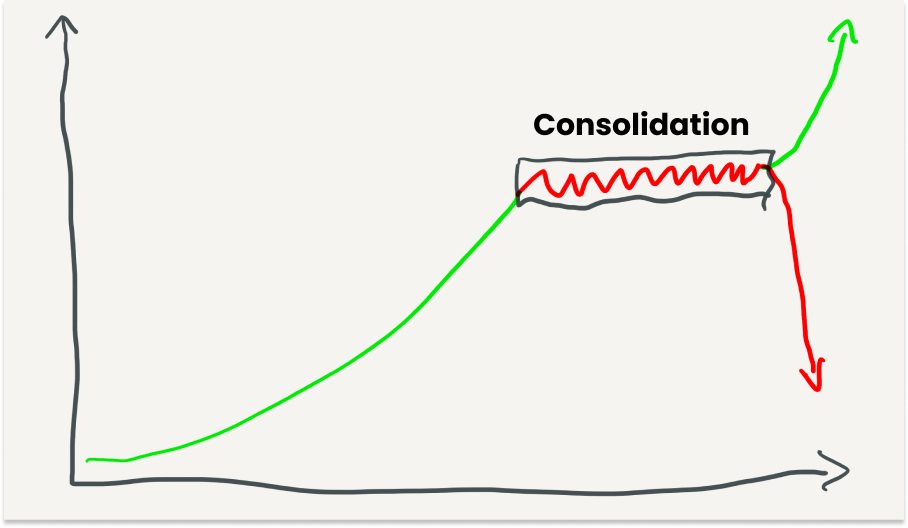

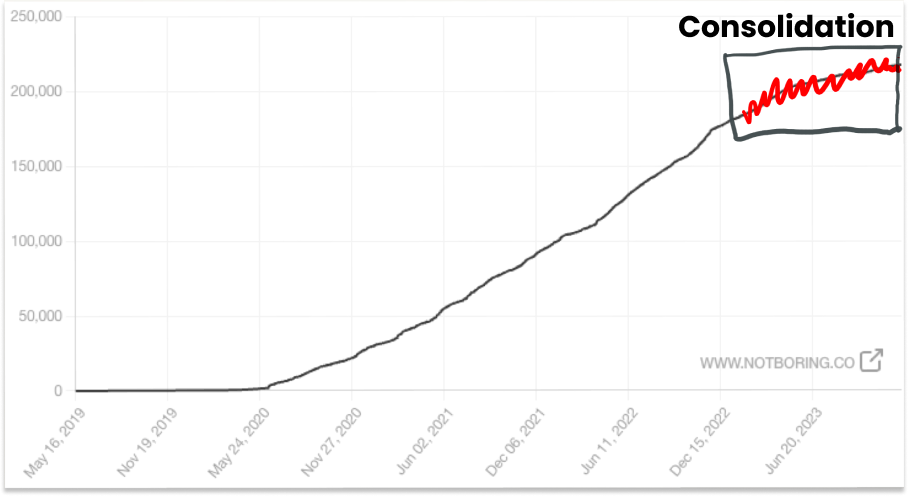

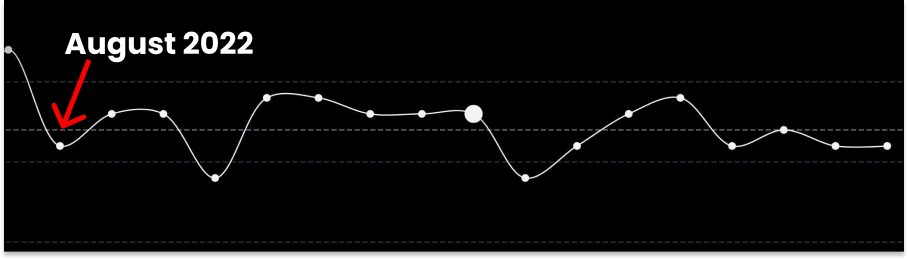

Stop wasting your engineering team’s time building out dozens of bespoke, complex integrations and please just use Merge – it’ll save you time and money. And here’s the kicker, Merge is offering Not Boring readers a $5,000 credit on annual plans. Hi friends 👋, Happy Tuesday! This is the last Not Boring essay of 2023. Normally, in the last essay of the year, I write about how next year is going to be even wilder than this one was. That’s been true every year since I started writing Not Boring, and I don’t think it’s going to change any time soon. This year, I’m doing something a little bit different, because this year was a little bit different. I felt the momentum slow, and maybe you did too. So I figured I’d go full transparency, tell you about the hard stuff, and then tell you why I think the slowing momentum is actually a good thing. I’m fired up for 2024, and I can’t wait to see you on the other side. Let’s get to it. Momentum, Consolidation, and BreakoutI have to be honest with you, 2023 was the hardest year of my life. It wasn’t a bad year. It was a great year in a lot of ways. But it was hard. The best way to describe it might be with a trading concept: consolidation. After a big run up in the price of an asset, the momentum runs out and the price churns in a range for a while before breaking out or breaking down. The first three years of Not Boring were a magical, momentum-filled run. It felt like a dream. I captured some of my disbelief at my good fortune on the newsletter’s one year birthday in A Not Boring Adventure, One Year In. In early 2020, I’d quit my job at Breather, which would end up getting sold for pennies during COVID, thought about starting something with physical spaces, which got killed by COVID, and found myself unemployed, uninsured with a case of COVID, with a kid on the way. So I started writing a free newsletter full time. Somehow, over the next few years, the newsletter grew way bigger than I thought it could, I got to meet and become friends with founders and investors I’d admired from afar, joined a team that I respect deeply at a16z crypto as an advisor, built Not Boring into a real business, and launched Not Boring Capital to invest in the types of startups I’d been writing about. The momentum was palpable. I wrote about whatever I was most interested in, however I wanted to, and people read it! And shared it! And even people whose writing I loved shared it! The number just kept going up, the momentum just kept building. I remember thinking, “I shouldn’t take any opportunity that presents itself that would lock me into anything because the opportunities being presented just keep getting better.” That sounds cockier than it felt. I was just in awe of the magic of writing on the internet. Saying it out loud, though, it sounds an awful lot like not taking some profit on a winning trade. Anyway, thinking that is just one of the many mistakes I made because I thought that the momentum would continue forever as long as I kept working really hard. That’s not how momentum works, though, and it felt like my momentum hit a wall in 2023. You can see it in the subscriber graph. It’s not perfect, but it looks a lot like consolidation. That’s why I say that this year hasn’t been bad – I’m trading in a range that I never would have expected to trade in a few years ago, and I feel incredibly lucky to get to do this – but that it’s been hard – I’ve never experienced something like having momentum and losing it before. I debated whether or not to write this piece, because even when the momentum slows, you want to make it seem like there’s momentum to the outside world. Strength leads to strength. And we do optimism here at Not Boring! But as I wrote in Optimism, the kind of optimism we’re talking about is “the very optimistic belief that things will inevitably go wrong, but that each new challenge is an opportunity for further progress.” So I’m writing it, because I think a lot of people have felt similarly this year. I’ve had a ton of conversations with founders, fund managers, and others over the past year who have been feeling the same thing. Maybe you are too. And I’m writing it because I plan on breaking out in 2024 – I’ve been more energized over the past couple weeks than I have all year – and I’ve learned a lot this year that will be helpful when I do. Hopefully it’ll be helpful for you too. Plus, if I’m going to share the wins when things are going really well, I need to share the losses when they aren’t. So fuck it, let’s do this, get it out of the way, and get back to growing. 2023If I had to summarize what made 2023 hard in a sentence, it would be this: Two things kept me up at night this year, one literally and one figuratively, and the exhaustion they caused showed up in my writing. Literally, what’s kept me up at night is Maya. Maya is the greatest little girl in the world. She’s 16 months old and she already has a bubbly, spunky, funny, loving little personality. Her vocabulary might be bigger than mine, and she’s stringing together sentences like “Want give milk to Christmas tree.” Getting to talk to a person that little is the funniest thing, it’s like having a cute little robot that keeps getting smarter. That Puja and I get to hang out with Maya and Dev is the greatest joy in my life. Having said that… Maya might be the worst sleeper I’ve ever met. For her whole sixteen months, she’s woken up at some point between 10:30pm and 2am screaming bloody murder until we give her milk. Then, often, she wakes up again to scream a little bit more. Then, most days, she or Dev or both wakes up for good between 5:45am - 6:15am. She wakes up fresh as a daisy and wonderful, and I wake up feeling like an extra from The Last of Us. Anyway, see if you can spot where Maya was born in my Oura ring data: Look at that dropoff! And I’m not even fun! I barely drink and rarely go to bed after 10pm. Working tired is always hard, but in a normal job, you get to zombie out in meetings or have someone tell you what you need to get done, which you can do kind of on autopilot. Coming up with creative topics every week and writing thousands of words about them has not been easy, and I think it shows. There’s this sequence that’s almost become a routine in our house. I’ll stay up late Monday night and wake up really early on Tuesday morning to finish an essay, often rewriting it entirely from 5am - 8:50am when the narrative structure finally shows itself. I’ll hit send, tweet about the essay, and then refresh Twitter for a while to see if it’s picking up steam. Puja will ask how the piece is doing, and I’ll say, “Fine. It’s doing OK.” Some of that is just flat momentum. Sharing Not Boring pieces was novel and fun when it was new, you felt like you were sharing something that people didn’t know about. That naturally decays over time. Put faux-quantitatively, s=q*x/n, or something, where s is shareability, q is quality, x is novelty, and n is the number of your pieces people have read. After you’ve written a bunch, the piece needs to be higher quality or more novel or both for people to share it. That’s exacerbated by the fact that there’s a ton of great writing on startups out there now, much of which is written by new people with novel perspectives. And if I’m being realistic, I think my writing this year has been fine. I’ve written some pieces that I really like, and that I think will stand up well to the test of time, but I do feel like generally, I’ve lost a little heat on my fastball and haven’t thrown enough screwballs. This isn’t just in my head. I talked to a really perceptive founder the other day who has been reading Not Boring since the early days, and he asked me how I felt my writing has changed. While I thought about it, he said he had a thought: on the one hand, it had gotten more confident as I’ve learned more, but on the other, it was lacking the wild, fresh ideas that I had when I started in 2020. You know what? He was absolutely right! I’d been thinking the same thing and thought that maybe I was going crazy. It was surprisingly refreshing to hear it from someone I respected. I actually like that answer a lot more than general decay, because I can do something about it. If the bar is higher, I need to up my game. I’m not an LLM. IT’S TIME TO DIFFERENTIATE. Figuratively, what’s kept me up at night is fundraising. In the beginning of 2023, the very first post I wrote, I announced that I was raising Not Boring Capital Fund III, a $30 million fund. Almost a year later, I still haven’t closed the fund. We’ve done rolling closes and have been investing, but we’re nowhere close to the $30 million. It’s hard to admit, but it’s true. Fundraising has been absolutely brutal. Early on, I had a $5 million commitment drop to $1 million and then drop out completely because of the market. I’ve had multiple people commit to invest $2 million in the fund and either back out or simply disappear. Countless smaller commitments have ghosted when it came time to sign and wire. I won’t even try to count the “No”s. If you’ve been following the venture news, you’ve probably read that it’s a brutal market for venture fundraising, that it’s particularly brutal for emerging managers, and that it’s triply brutal for emerging managers who raised their first funds at the peak in 2021. All of that is true, but it isn’t productive and it doesn’t help me sleep at night. I’m more convinced than I was coming into the year that the strategy – investing in hard startups, mainly crypto, bio, and deep tech startups – is the right one, and the right one for Not Boring Capital specifically. But as a lot of founders have learned over the past year, a good strategy is necessary but not sufficient. You need the capital to execute it. And not having it is fully on me. I made the assumption that I’d have enough momentum to raise Fund III quickly, and when that didn’t happen, the process dragged out. The more any fundraising process drags out, the harder it gets. I’ve never felt like I had less leverage or momentum than I have throughout this process. You can’t manufacture momentum. Especially in a market like this, people can smell it. What’s kept me up at night isn’t the lack of leverage or the rejections; it’s the fact that there have been great companies and founders that I’ve wanted to invest in but couldn’t because I didn’t run a tight process. While I put a ton of time, thought, and effort into our investing strategy, and I think it’s the right one for us, I didn’t put enough into our firm building strategy. On the bright side, limited funds have also enforced a healthy discipline that I might not have deeply understood without living through this market. We’ve built a very strong early stage portfolio in Fund III, and a smaller fund means that it’ll be easier to return capital to LPs. I just think that we’re in one of those rare paradigm shift periods, the biggest yet, and I would like to be deploying more aggressively into it. Nobody owes you the right to be in market, though. You need to earn it. There are a bunch of lessons I’ve taken from this process that can be boiled down to the idea that to earn the right to manage a fund over the longer term, you need to be good at all aspects of fund management, including and maybe especially having capital to deploy when others aren’t. There’s no venture capital without capital. More generally, when momentum is on your side, people focus on your strengths and forgive your weaknesses. When the momentum stops, they scrutinize the whole thing. This is true for stocks, funds, people, and even essays. That’s good! It’s healthy. It forces you to get fit, to shore up weak points, and to tighten up arguments. It forces you to master your craft. With the benefit of hindsight, I think the move is to use momentum when you have it to build things that last no matter the market or your personal circumstances. Personally, I wish that instead of meeting a million people, I’d spent more time building strong relationships with a handful of people I admire. Instead of investing in hundreds of companies to not miss the winners, I wish that I’d focused more on a smaller number that I think will really matter. Instead of taking the easier path of being a non-institutional fund, I wish I’d spent time meeting with institutional LPs learning what they look for long before ever trying to raise from them, and raising my bar to meet theirs. Instead of assuming that I didn’t need to be great at fund administration, I wish that I’d spent the time to study the art and science of building an enduring venture firm. When all doors are open to you, it’s important to pick the right doors. One of the questions that’s tortured me this year is whether I’ll get another shot at doing those things the way I wish I had with the benefit of hindsight, or whether you only get one shot at a first impression. That question has kept me up at night, too. The answer I’ve come to is one of the reasons I view this as a year of consolidation and not breakdown: yes, I will, if I earn it. When I started writing Not Boring, I thought that my friends had a secret group chat where they made fun of me for writing a newsletter. They didn’t. The truth is that nobody thinks about you nearly as much as you think about you. If you do mediocre work, no one thinks about you. On the rare occasions when you do great work, people do. You can always earn that right back by doing great work. Write great essays, invest in great companies, and stay alive long enough for them to prove you right (and return money to LPs). I’ve found the thing that I want to do for the rest of my career – investing in and telling the stories of the companies shaping the world – and the fact that I still love it despite the difficulty of this year is a great thing to learn. I’m not going to quit; I’m more motivated to do what it takes to become great at it, momentum or not. As Leo said: Breakout TimeSo to recap, this has been a hard year. I think it’s been a hard year for a lot of people. It feels silly to call this hard when there are wars happening; hard is relative. I consider myself very lucky that it’s been hard in the ways it’s been hard: getting to write this newsletter, raise a fund, and raise Maya are all priceless privileges. Throughout the year, as I’ve agonized over the loss of momentum, I’ve wondered if this is it. Once the momentum slows, is it so over or is it possible to be so back? If you know me, you know I think it’s possible to be so back, but from inside of 2023 it’s been hard to grok that. Thinking about this as a consolidation has clarified it for me. Consolidation can go one of two ways: breakout or breakdown. The momentum isn’t guaranteed to pick back up, but it’s possible, if you play it right. In writing this piece, and using it as an opportunity to reflect on this year, I actually think it’s been a really productive consolidation period. I did a lot that I’m proud of, despite the sleep deprivation and anxiety, and we’re coming out of it with more assets than we came in with. Age of Miracles. We launched a new podcast, Age of Miracles, that’s gotten over 100k downloads in its first season. I know a lot more about energy, particularly fission and fusion, than I did coming in, and thinking about energy has improved the way that I think about the rest of the tech landscape. That’s shown up in pieces like Tech is Going to Get Much Bigger and The Morality of Having Kids in a Magical, Maybe Simulated World. I got to work with an amazing co-host, Julia DeWahl, meet incredibly smart people across the energy landscape, including founders and investors, and built a strong partnership with Turpentine. Creating a narrative podcast was more challenging than I expected it to be – tons of interviews, script writing, recording, pickups – but we got so much better at it as the season went along. I think we can grow Age of Miracles into something special for listeners that also benefits the fund as I get smarter on frontier industries. Newsletter. Although I think I lost some heat on my fastball and didn’t bring the freshness I’ve brought in years past, I wrote a lot of essays that developed the way that I think about the world and the outlook for tech. Some of my favorites are the two I mentioned above, Tech is Going to Get Much Bigger and The Morality of Having Kids in a Magical, Maybe Simulated World (which I think actually had the most new ideas of any piece I wrote but a bad title), OpenAI & Grand Strategy, Riskophilia, Capitalism Onchained, I, Exponential, Sci-Fi Idea Bank, WTF Happened in 2023?, In Defense of Strategy, When to Dig a Moat, How to Fix a Country in 12 Days, Small Applications Growing Protocols, Intelligence Superabundance, Attention is All You Need, The Fusion Race, Love in the Time of Replika, and Differentiation. Going through the list to pick these, I actually think there was a bunch of good stuff and new ideas in Not Boring this year! I just need to make the writing pop a little more. We’ll see how they stand the test of time. Deep Dives. One of my favorite types of pieces to write is the Deep Dive, sponsored or not. There’s nothing I enjoy more than getting to dig in with founders to understand a complex business deeply enough to explain it well. And I think we really raised the bar on the quality and potential importance of the companies we wrote about to align with our new, tightened fund thesis. I wrote pieces on Varda and Atomic AI (with Elliot), Wander, Array Labs, Anduril, LayerZero, Ezra, and The Browser Company. Besides Anduril and LayerZero, which are already there, there are at least a couple billion dollar-plus companies in that group. I want to do more Deep Dives in 2024, particularly on our portfolio companies, and become the best in the world at telling the stories of complex, ambitious tech startups. Not Boring Capital. Despite sluggish fundraising, we’ve managed to build a portfolio of pretty fantastic companies, in Fund III and prior funds. As you read this, Not Boring Capital portfolio companies are building foundation models for RNA and for gene interactions (👀), creating physics-based AI chips, building hyperlogistics networks under cities, manufacturing drugs in space, accelerating manufacturing to make parts for space, growing cabbages that produce GLP-1, crafting Von Neumann universal constructors, rebuilding the school system and giving parents choice in their kids’ education, decentralizing ID to build a more human economic system, bringing abundant energy to Africa, infusing AI in code, bringing real world assets onchain, creating virtual worlds, reimagining how the physical one gets built, and using light and DNA barcodes to measure biology in context. This list is non-exhaustive. A few of our Fund I and II portfolio companies have shut down this year, but those writedowns are more than outweighed by the markups other portfolio companies have received, even in the bear market. Both portfolios, but especially Fund II, are chock full of breakout and potential breakout companies, and the crypto portion of the portfolio is performing particularly well as that market thaws. We tried to back solid projects with real use cases, like Worldcoin and DIMO among others, and it’s starting to pay off. There will be more to come here. On the team side, working with Elliot and learning about the mind blowing things happening in bio has been a highlight. Elliot’s combination of science, code, writing, investing discipline, and ability to dream about the future is incredibly rare, and I fully expect him to be one of the best techbio investors to ever do it when all is said and done. I’m incredibly bullish on our strategy as the most important companies shift from pure software companies to those that combine bits and atoms, and as the world shifts from centralization to decentralization. We can live in an Age of Miracles, and we want to continue to back the founders who are going to bring it about. The crazier the better. We’re still raising (I’ll probably be raising until I die). Get in touch if you want to be a part of it. Optimism. One of the things I’m proudest of is that we planted an optimistic flag early and we’ve stuck with it through thick and thin. As the markets tumbled and wars raged, it was very easy to get views and listens by telling people how awful things were. Pessimism will always sound smart and responsible. Showing LPs that you’re being cautious builds trust, even if it’s the wrong move at precisely the wrong time. As I wrote in the first ever Not Boring, Not Boring Newsletter #1 – delayed by a couple of days because I caught early COVID: I feel very lucky to get to work with my brother on putting out the Weekly Dose of Optimism every week to share the amazing things humans are doing in the world (all while he’s been slinging millions of creatine gummies). We didn’t freak out during the beak market, didn’t tell people the world was ending, recession was coming, or to pivot to AI. We just kept publishing the good stuff and stayed true to our conviction that things would get better. I’ve heard from a lot of people that they’ve appreciated the optimism in the face of so much doom and gloom. Now, the techno-optimism is spreading. e/acc is taking off. Marc Andreessen wrote The Techno-Optimist Manifesto. Jason Carman launched S3 News. Pirate Wires is killing it. We love to see it. Optimism shapes the future, and I’m happy to do our small part to spread it. It was a hard year, but looking back, it was a year of good and necessary consolidation. We built up assets that are going to be valuable as the momentum returns. The most valuable asset I’ve built up during the consolidation may be the lessons:

Both riding momentum and agonizing over its loss are low-agency moves. I can write better essays, invest more in relationships, and learn to manage Not Boring Capital like a fund that’s going to be investing no matter the market. All of that is in my control. I’m fired up for 2024. Expect fresher essays, even if it means that I write fewer of them. I can’t wait to let you know when I close the full fund, even if it kills me, and to share the stories of the world-bending companies we back from it. I’m going to take a couple weeks off from writing over the holidays to plan out exactly what all of that looks like, try to get some sleep, and recharge the batteries for a big year ahead. Not Boring is going to be here for a long time, and when we look back in a decade, I have a sneaking suspicion that 2023 is going to look like one of our most important years. Momentum is intoxicating but impermanent. Consolidation is critical. I think that will be the case for a lot of us. So go consolidate for a couple more weeks, rest, reflect, and plan, spend time with family and friends, and get ready to break out in 2024. Thanks to Dan and Puja for editing (and putting up with me this year)! That’s all for today, and the last essay of the year. But don’t go anywhere, we’ll be back in your inbox with a Weekly Dose on Friday. Happy holidays! Thanks for reading, Packy |

Older messages

Weekly Dose of #73

Friday, December 15, 2023

Nuclear AI, Approved CRISPR, Diabetes Implants, Morning Sickness, MDMA Application, FunSearch

LayerZero: The Language of the Omnnichain

Friday, December 15, 2023

A Deep Dive on the TCP/IP for Blockchains

Weekly Dose of Optimism #72

Friday, December 8, 2023

Gemini, Qubits, Brain Implants, saRNA, Biotech on Mars, Age of Miracles

The Morality of Having Kids in a Magical, Maybe Simulated World

Wednesday, December 6, 2023

Why the Climate Crisis May Be Proof We're In a Simulation

Weekly Dose of Optimism #71

Friday, December 1, 2023

GLP-1s, Loyal, Material Discovery, Fervo,AI Optimism, Energy

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month