Aziz Sunderji - Buy or Rent?

Welcome to Home Economics, a data driven newsletter about the American housing market. This edition arrives in your inbox three weeks later than originally scheduled: we ended up spending more time than anticipated—100+ hours—building the ‘Buy vs Rent’ model that powers the analysis below. Was it worth the wait? Let us know on Twitter, leave a comment, or hit ‘reply’ to this email. This is a free edition—you are welcome to share it with your clients and colleagues, and if you’ve been forwarded this email yourself and would like to subscribe, you can do so here. There are a couple of goodies in today’s edition exclusively for paying subscribers of Home Economics:

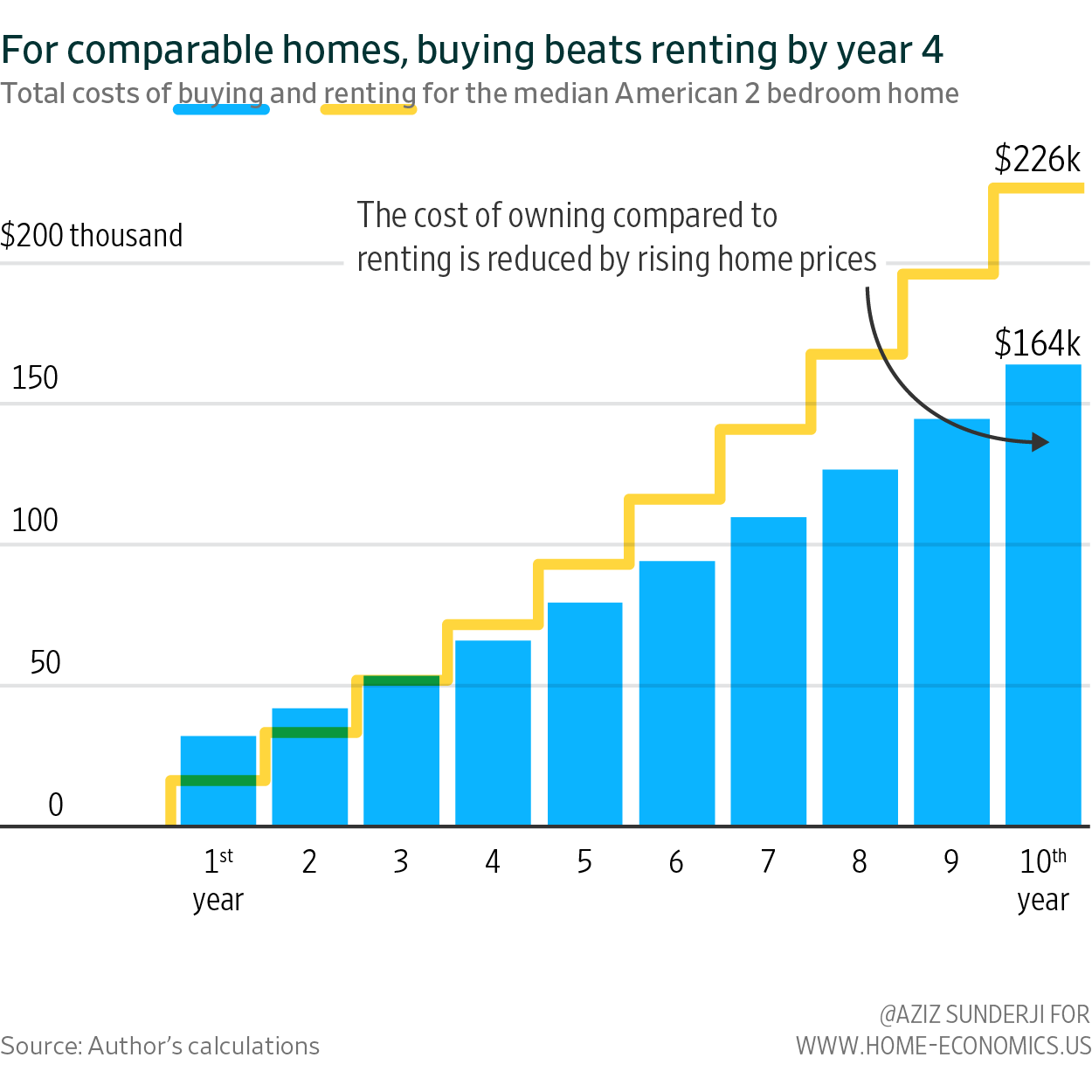

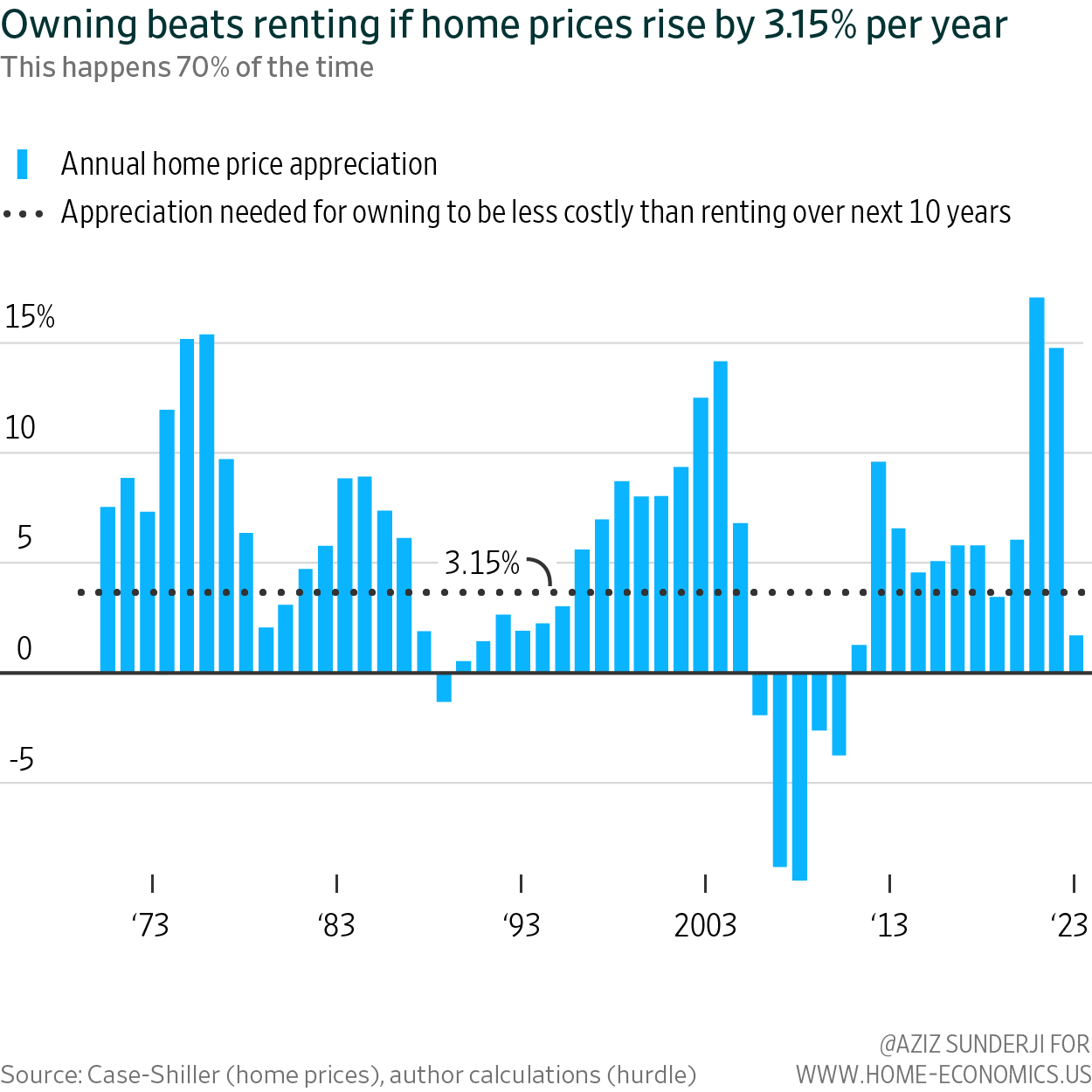

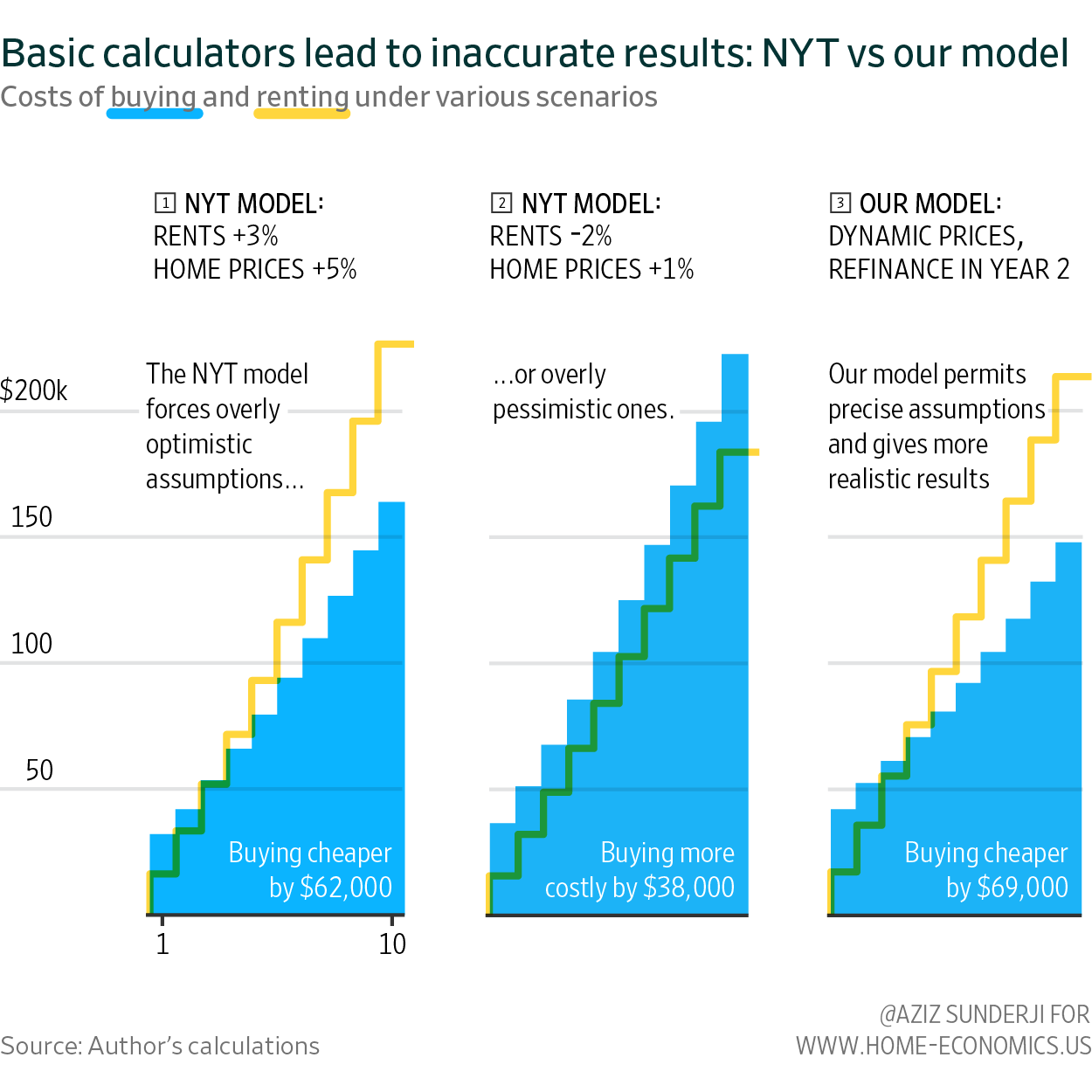

SPEED READI have mostly happy memories of high school in Toronto, except for one: Mr. Sumner, my 10th grade math teacher, asking me to solve questions in front of the class. I wasn’t bad at math, but struggled to give the right answers when put on the spot. Many of my classmates also suffered from math performance anxiety. When my friend Omar was called on, he would stall by complaining he couldn’t see the blackboard (his vision was fine, and ironically he is now an ophthalmic surgeon). Peter, a scrawny but talented tennis player, would look furtively towards the door, saying he had to go to the bathroom. But Spencer, who wore clear glasses to look smart, had the most entertaining coping mechanism. When asked for the answer, he’d immediately blurt out what appeared to be the first number that occurred to him. Incredibly, he would often give a response that wasn’t even in the right format—16.24 instead of 4%, for example. Spencer’s answers were always extremely precise (to several decimals), but totally inaccurate (he was rarely even in the right ballpark). This “give an answer, any answer” approach is what most are doing today when it comes to solving an admittedly thorny dilemma, albeit one related to housing, not algebra… Under today’s conditions, is it better to buy or rent your home?It depends who you ask. The New York Times, The Economist, and The Wall Street Journal all argue—along with many others who employ the same logic—that the math has shifted in favor of renting because monthly payments to own a home are now higher than monthly rents. But this is nothing new. Mortgage payments have been higher than rents for most of the past 25 years. This is a return to the norm, not a new development. And, like Spencer’s answers in math class, these are precise responses that don’t answer the question. The answer to ‘buy or rent?’ has to take into account both the higher costs but also the financial benefits of ownership. After all, owners spend more than renters every month because they are financing an asset (a house), and one that—with a few, brief exceptions—has consistently risen in value over time. In fact, for most of the past 30 years, the levered return on housing has been high enough to more than offset these higher monthly costs. This is one reason homeowners are on average 44 times wealthier than renters. If renting is now the more economical choice, it will be because changes in current conditions (prices, rents, and financing costs) or changes in the way these evolve over time will leave owners worse off than they’ve been historically. Is this time different?Maybe things have changed. After rising by almost 40% over the past few years, homes are now steeply priced compared to rents. Financing costs are much higher. Maybe—even accounting for the likely rise in home prices in the future—renting is now the better choice? It doesn’t seem so. Our model shows that, at least for the median two-bedroom home, buying is more economical than renting by the end of year four. There will certainly be some places, types of homes, and other conditions under which renting makes more sense. The ownership advantage is smaller than it was just a few years ago. Still, under reasonable assumptions, and for the median home—owning beats renting for all but the shortest holding periods. DEEP READIn order to make an apples-to-apples comparison, we assume the would-be buyer and renter are the same person with the same financial means—namely, a down payment saved up and ready to put towards a house. If they don’t buy, we assume that (as renters) they are 100% disciplined, investing all of this downpayment, and all the savings from the lower monthlies from renting, in financial markets (renters are much less disciplined in the real world, but for modeling purposes we give them the benefit of the doubt). Caveats and disclaimersWe only model the financial aspects of the buy versus rent decision. There are other considerations—flexibility, pride of ownership, etc—and individuals should factor those into their decision. The goal here is merely to quantify the economics. Our analysis uses the median two-bedroom home price ($267,887, from Zillow) and the median two-bedroom rent ($1,317 per month, from ApartmentList). We use two-bedroom units as our base case because we have reliable pricing on both the sale and rent side. This is a conservative approach, since rentals are typically of lower quality than homes for sale. We use the national median across the other assumptions we have to make in order to arrive at an answer: a 14% downpayment, a 30 year fixed rate mortgage, property taxes of 1.1%, annual maintenance of 1%, HOA fees $217 per month, insurance of 0.57%, buying costs of 2%, selling costs of 6%, and a capital gains tax rate of 15%. We assume a marginal income tax rate of 30%. We make best-guess assumptions about the future for the other relevant variables: inflation of 2% and market returns on invested cash of 6% pre-tax. For the estimate shown above, we assumed home price appreciation of 5% per year and rents rising by 3% per year, but these are critical inputs and we stress-test them below. A word about assumptionsBack to high school. The only thing I still remember from Chemistry class is my teacher Dr. Damji’s catchphrase: when you ‘assume’ you make an ‘ass’ out of 'u’ and ‘me’. One way of avoiding making asses of ourselves is by stress-testing our assumptions. We assumed in our original analysis shown above that home price appreciation is 5% (that’s roughly the long run average). But what if home prices grow more slowly? By our calculations, buying becomes more economical than renting if home prices rise by 3.15% on average every year. If the future looks even remotely like the past, this is an achievable bar to clear. In almost 70% of the years since 1970, house prices have risen by at least this much. But it’s not impossible for renting to winThat said, there are reasonable scenarios where renting wins over ten years. For example, in the original analysis (in which owners end up $62,000 richer than renters), we assumed annual home insurance of 0.57% (the national average). But in recent years insurance costs have soared for owners in climate-vulnerable regions. What if insurance is actually 2% per year? Holding all the other variables constant, 2% insurance costs cause the ownership advantage to disappear entirely—over 10 years, renting and owning become almost exactly equally costly. The details really matter. So modeling the specific properties, their running costs, and the characteristics of the individual (like their marginal tax rate) is critical, and there is only one way to do that: using a customizable ‘buy versus rent’ calculator. Online ‘buy versus rent’ models can quickly spit out answers…You can see for yourself how tweaks to these assumptions change the results—sometimes quite meaningfully—using one of the many online ‘buy versus rent’ calculators. Zillow and NerdWallet provide these, but The New York Times model is the most comprehensive. The Zillow and NerdWallet calculators model the costs of owning and renting over time based on user specifications. The NYT model is a bit smarter: it asks the user to specify the length of time the individual will hold the home, and spits out a level of monthly rent that should leave them indifferent between buying and renting (“if you can rent for less than ‘$x’ per month, you should rent”). Compared to other online tools, the NYT model is more intuitive, and the back end is more sophisticated, yielding more accurate results. …but they might be the wrong answersThat said, even the NYT’s model has some severe limitations. Take the situation today: mortgage rates are close to 7%, but it’s exceedingly likely anyone buying a home will have a chance to refinance at a lower rate sometime in the coming years. Allowing for refinancing meaningfully changes the picture. But online calculators—even the NYT’s offering—don’t allow you to model the buy versus rent decision taking refinancing into account. Or consider the path for home prices and rents. These have a big impact on the buy versus rent decision (especially the path of home price appreciation). Online calculators allow you to specify how fast prices and rents will grow—but they assume that pace of growth forever. Instead, if you’re like me, you might imagine that rents stay subdued next year as multifamily units hit the market, and that home prices also grow slowly amidst weak economic activity, but that they both pick up in 2025, with home prices outpacing rents because of demographics, ongoing strong demand for homeownership, and scarce supply. In order to model these specific situations, we need a more customizable tool. The Home Economics Buy or Rent modelWe didn’t want to reinvent the wheel, but it turns out the wheel that people have been using kind of sucks. So we built our own. Our model is based on the same framework as the NYT’s, but allows us to model nuanced, specific—and, we think—much more realistic scenarios. Take a look at the three shown below. The first scenario is based on asking the NYT model which strategy is better—buying or renting—if rents rise at 3% per year, homes appreciate by 5% per year, and we make all the assumptions about mortgage rates, inflation, market returns, etc. described above. In this scenario, over ten years, buying saves $62,000. That’s too optimistic: there is a glut of apartment supply; rents are falling. Meanwhile, even optimists concede the risk of recession next year is higher than usual—so assuming home prices rise by the usual 5% is too aggressive. What if we tweak our expectations to better reflect reality? Well, the NYT model allows the user to specify the path for rents and prices. We do this in the second scenario: we assume rents fall by 2%, and homes rise by a tepid 1%, and suddenly buying becomes more expensive than renting. That’s because the NYT model assumes that rents will fall by 2%, and homes rise by only 1%, every year for the entire decade. That’s far too pessimistic towards ownership. A more realistic result, based on our model, is shown in the third scenario. The reality we want to evaluate is a near term softening in both rents and prices, but then a return to normal—prices rising at 5%, rents at 3%—for the rest of the decade. We had to build our own model to allow us this flexibility. The other crucial assumption our model allows us to incorporate into the calculation is the benefit of refinancing. If the owner refinances at 5% by the end of her second year in the home, the cost of owning drops by about $35,000. By our calculations—which we think are much more realistic about prices and financing than most online ‘buy or rent’ calculators—for this $268,00 home, buying beats renting over 10 years by $69,000. Give an answer, any answer?This is a falsely precise conclusion. Even small tweaks to the assumptions can lead to different results. But the wide range of possible answers to the question of “buy or rent” shouldn’t tempt us into settling for a simple but misleading one. The correct answer is two-fold: first, it depends—on the properties under consideration, who’s buying, and what the future holds. And second: let’s model it. Home Economics is a reader-supported publication. Please consider upgrading to a paid subscription to support our work. Paying clients receive access to the full archive, forecasts, data sets, and exclusive in-depth analysis. This edition is free—you can forward it to colleagues who appreciate concise, data-driven housing analysis. |

Older messages

A Renter’s Paradise—but for how Long?

Monday, December 18, 2023

A temporary tilt in the balance of power

Growing Pains for Home Prices

Friday, December 8, 2023

Could valuations stagnate for years?

This bird is cooked

Thursday, November 23, 2023

Rising unemployment is bad news for the economy and for home prices

How to Make Great Charts

Friday, November 17, 2023

An entirely biased view

Another Reason Mortgage Rates will Fall

Friday, November 10, 2023

As rate vol dips and the yield curve steepens, prepayment risk will abate

You Might Also Like

(sorry)

Monday, March 10, 2025

now with the link this time ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

an equinox stretch

Monday, March 10, 2025

everything you need for Wednesday's workshop ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

9 Strange Tax Deductions You Might Actually Qualify For

Monday, March 10, 2025

Easiest Ways to Spot an Unpaid Tolls Scam Text. Good news: The IRS might allow you to deduct all those gambling losses. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY

Maybe You Fund The People Who *Will Start* Families

Monday, March 10, 2025

At best, the DOT's new funding priorities get causation wrong ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“In this Poem, We Will Not Glorify Sunrise” by Sarah Freligh

Monday, March 10, 2025

nor admire the apples that blossom / during a February heat wave ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Glen Powell to the (couture) rescue

Monday, March 10, 2025

— Check out what we Skimm'd for you today March 10, 2025 Subscribe Read in browser But first: our editors' cult-status products Update location or View forecast Good morning. While we might

Deporting Undocumented Workers Will Make Housing More Expensive

Monday, March 10, 2025

The effect will be most pronounced in Texas and California ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend

Monday, March 10, 2025

So edgy. The Zoe Report Daily The Zoe Report 3.9.2025 The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend (Hair) The Viral "Jellyfish" Haircut Is 2025's Most

Reacher. Is. Back. And Alan Ritchson's Star is STILL Rising

Sunday, March 9, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE THIS WEEK'S MUST-READ Reacher. Is. Back. and Alan Ritchson's Star is STILL Rising. Reacher. Is. Back. and Alan Ritchson's Star

12 Charming Movies to Watch This Spring

Sunday, March 9, 2025

The sun is shining, the tank is clean – it's time to watch some movies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏