The Pomp Letter - Why Is Bitcoin's Price Going Up?

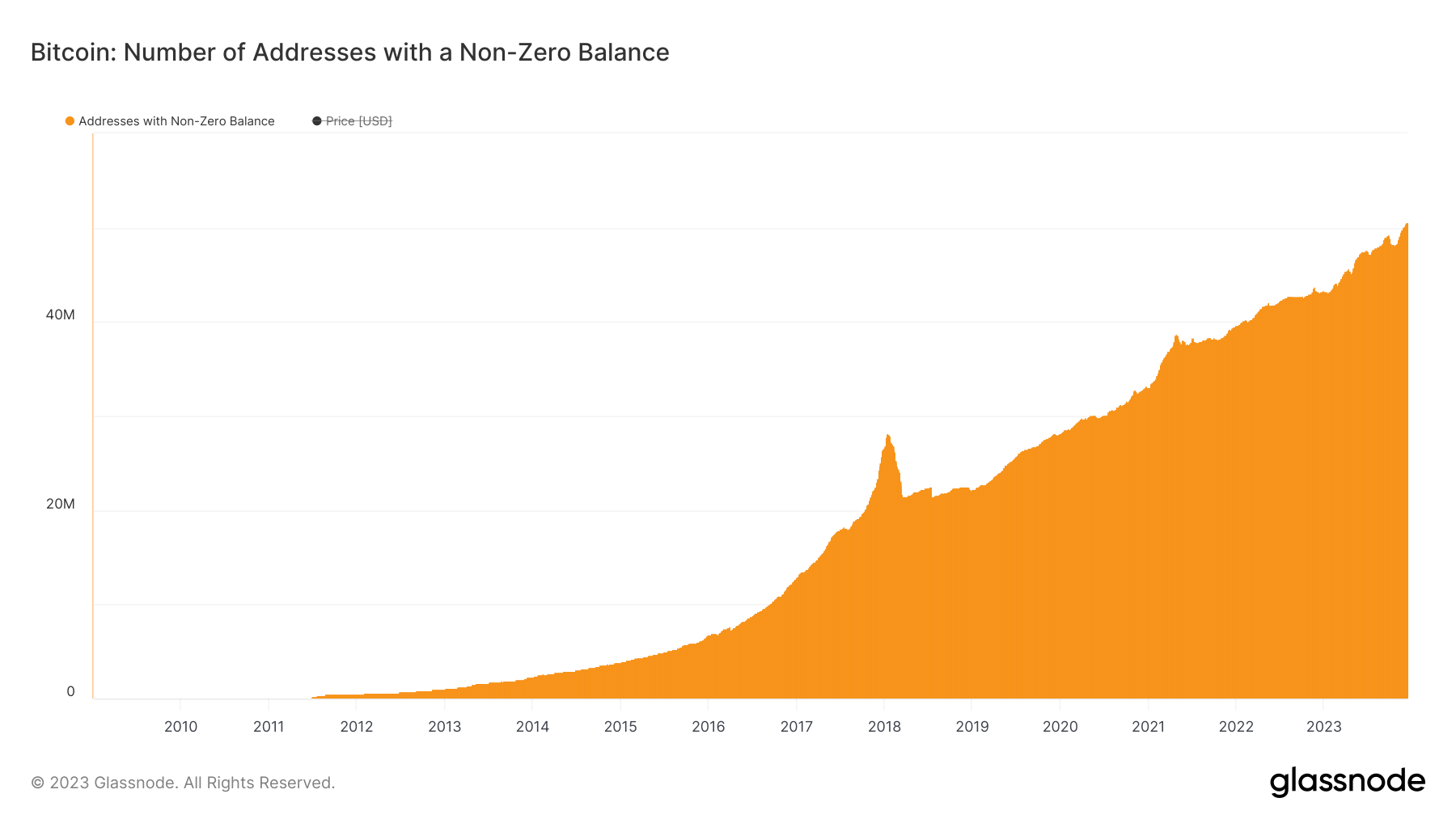

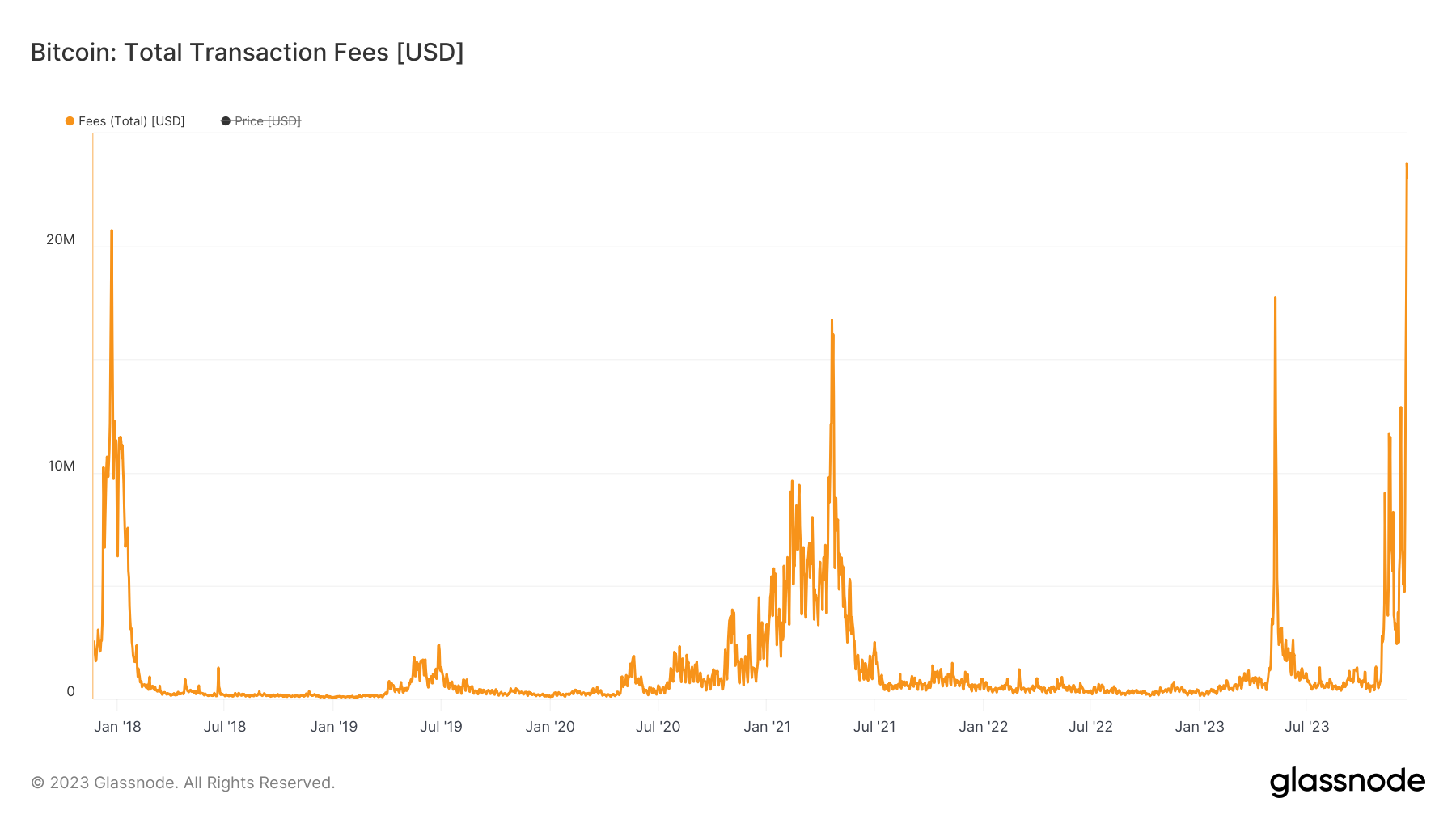

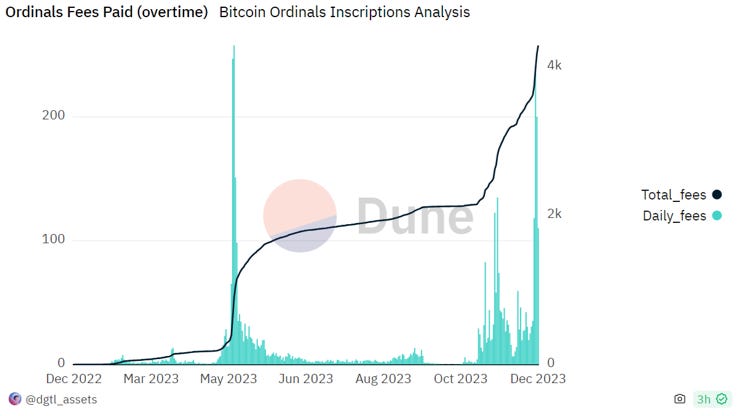

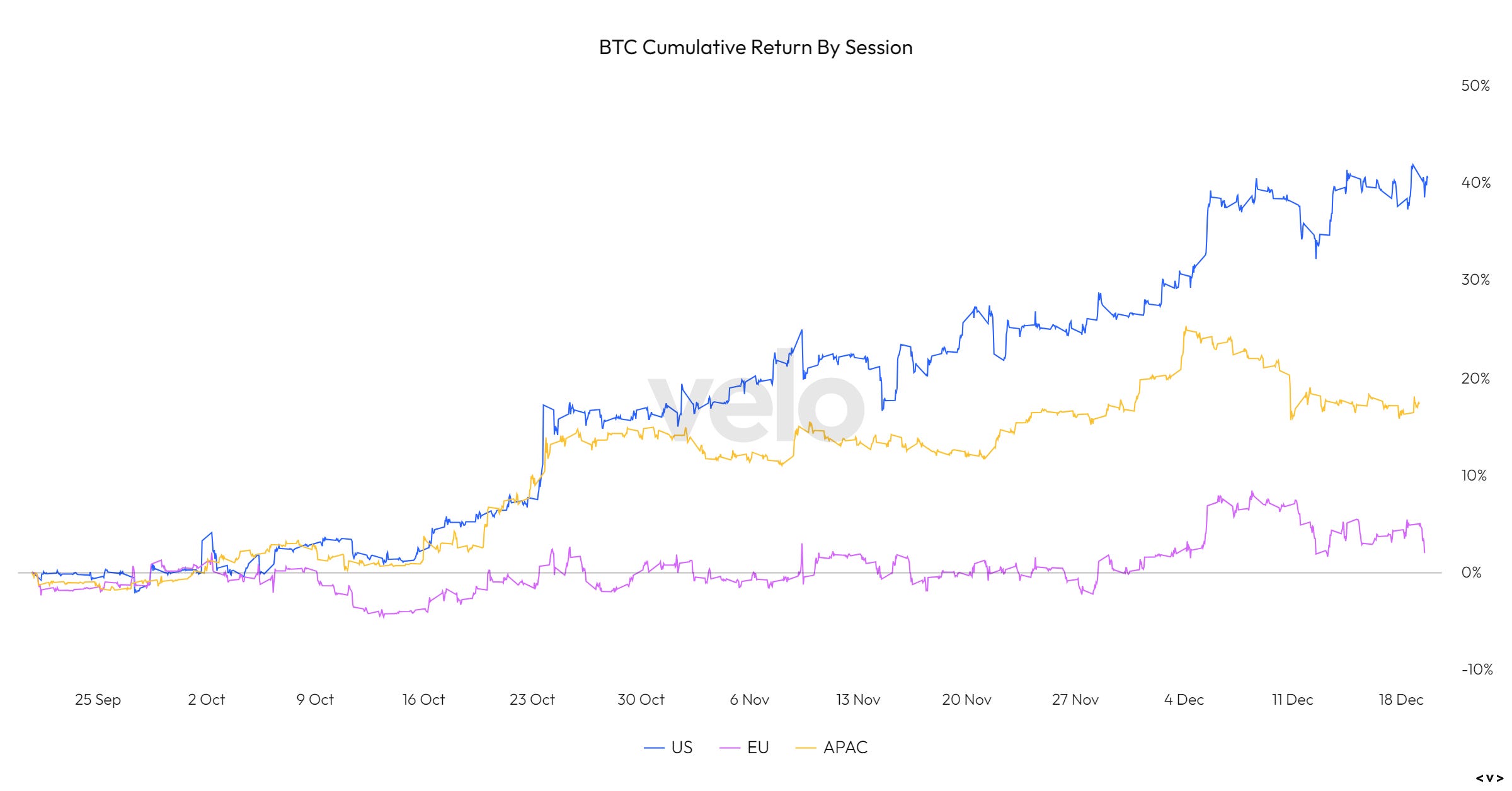

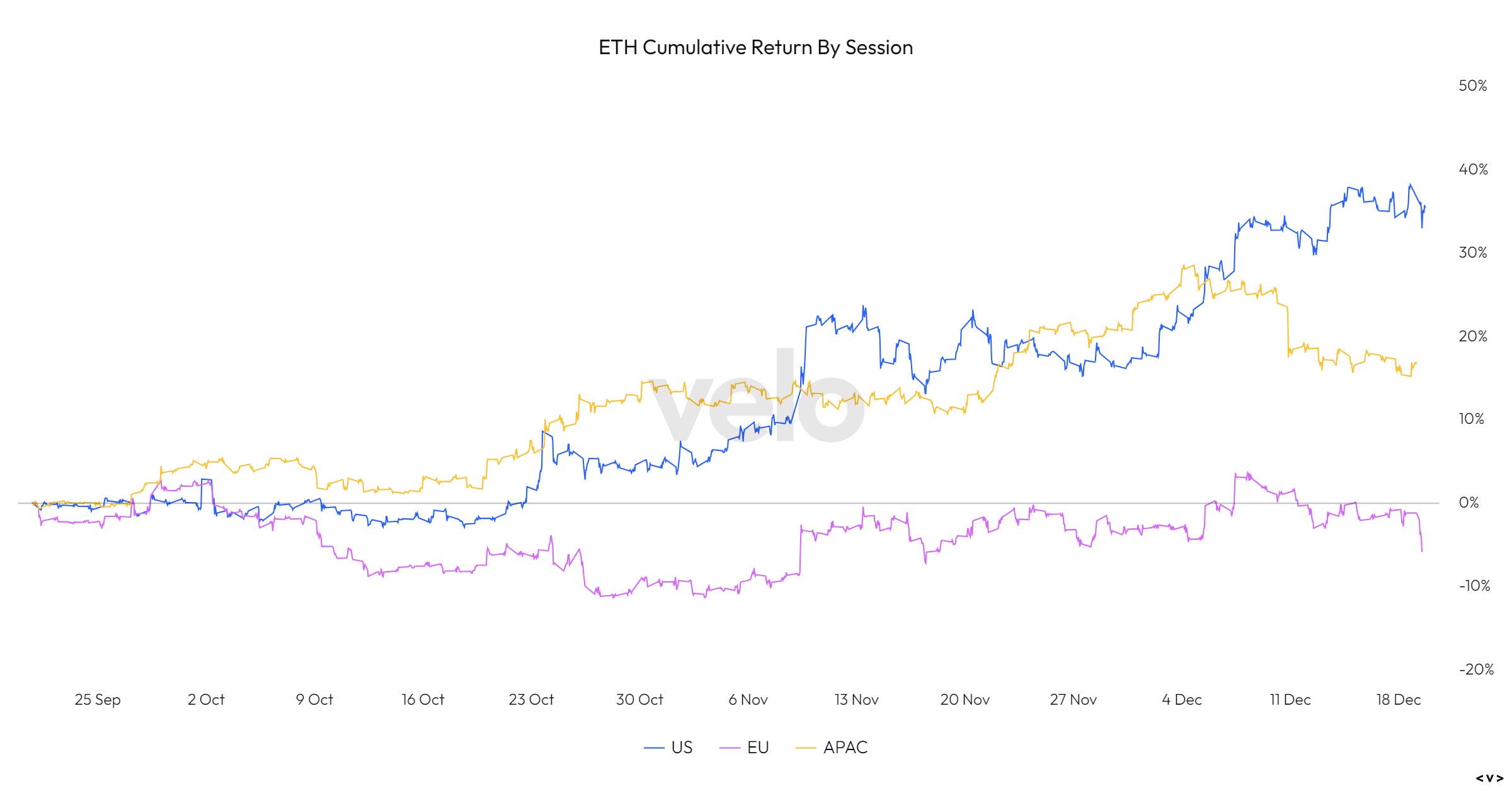

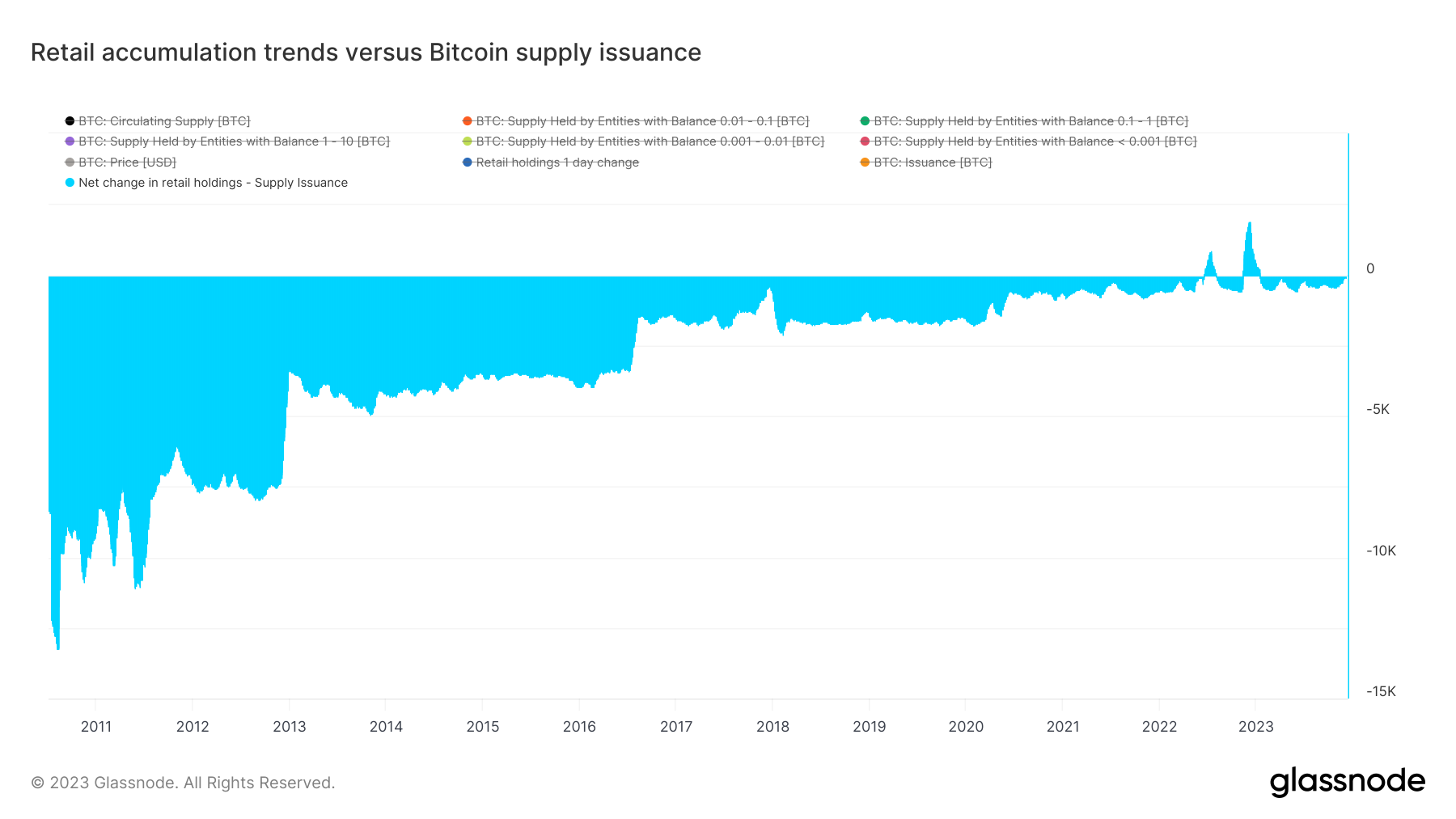

Today’s letter is brought to you by Trust & Will!Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of thousands of families create their estate plans, and they’re just getting started. Trust & Will enables every American to create a plan that’s customized to fit their needs, their life, and their legacy. Their mission is to make estate planning simple, affordable, and inclusive. All of Trust & Will’s documents have been designed and approved by estate planning attorneys to meet the highest legal standards. Their process is simple, secure, complete, and customized for your specific needs and state requirements. To investors, Reflexivity Research’s Will Clemente put together an overview below of the bitcoin market that can help explain why price has been rising in recent weeks, along with a few surprises to consider going into 2024. According to Will: Over the last few weeks, the Bitcoin network crossed a major milestone with 50 million addresses with a balance of greater than 0 BTC. This perpetual rise is one way to measure Bitcoin’s accelerative growth as an emerging digital monetary network. User adoption is not the only thing growing in the bitcoin ecosystem though. This week Bitcoin transaction fees surged to their highest single day reading of all time at $23.6 million. What’s behind the spike in Bitcoin network transactions? Ordinals inscriptions have caught a second wind, as shown in both the daily and cumulative values of transaction fees derived from ordinals inscriptions. Inscriptions have now generated over $175 million in transaction fees for the Bitcoin network. What are the implications going forward? Bitcoin miner revenues are made up by the block subsidy paid out from the protocol as well as transaction fees paid by users to get their transactions included in the next block on the blockchain. While higher transaction fees on Bitcoin’s base chain may price out small purchases, more miner revenue up for grabs means that more miners will plug in machines to capture the surge in fees; ultimately making the network more secure. Does this solve Bitcoin’s “security budget issue”? This also brings into question the concerns some pundits have expressed around Bitcoin’s security budget issue; the theory that Bitcoin will run into a security issue once Bitcoin rewards are longer being issued after the 21 millionth coin has been mined. The idea of sustained transaction fees from inscriptions combats this theory. It is also worth noting that should there ever be a substantial drop in miner revenues and hash rate comes offline, the difficulty adjustment that takes place every two weeks would bring block times back in line with the amount of hash rate; the China mining ban of summer 2021 is a great example of this. The theoretical debate lies on whether there is a quantifiable threshold of “sufficient security”. Speaking of China, country-by-country flows are something to always keep an eye on. In the charts below, showing cumulative return by geographic trading sessions, we can see that the US has led the way for both BTC and ETH; with the EU clearly falling behind. So who is buying? One interesting development to continue to keep an eye on is the trend within on-chain wallet cohorts by size. The chart below compares the daily net change in on-chain wallet clusters with 1 Bitcoin or less to the daily issuance of Bitcoin that is rewarded to miners. As you can see, this spread has continues to push towards positive territory. With the upcoming halving set to cut issuance in half, should accumulation from “fish”’ persist at current rates, this would offset the entirety of Bitcoin’s block issuance of the first sustained period of time ever. Pomp note: It is very compelling to see so much activity and adoption happening weeks before a potential spot bitcoin ETF and months before the bitcoin halving. These underlying metric point to an increase in demand in a variety of ways, which should only be amplified by the two events on the horizon. The first half of 2024 should be packed with developments. If you want to subscribe to Will Clemente and Reflexivity Research, who do great work in my opinion, then you can click here to get their weekly insights. Hope each of you has a great day. I’ll talk to you tomorrow. -Anthony Pompliano If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin. Eric Jorgenson is the author of, “Almanack of Naval Ravikant” and “Anthology of Balaji.” He also serves as CEO of Scribe Media, and General Partner at Rolling Fund writing checks to high-tech startups. In this conversation, we talk about his books, the process, Scribe Media, and then we dig deep into the ideas and takeaways of Balaji Srinivasan. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here Balaji Srinivasan’s Big Ideas on Bitcoin, Tech & Media Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Bitcoin Spot ETF May Not Be As Bullish As You Think

Wednesday, December 20, 2023

Listen now (3 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

US Citizens Had To Become Market Speculators

Tuesday, December 19, 2023

Listen now (3 mins) | Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative

Governments Need Revenue And More Taxes or Printing Is Not The Answer

Monday, December 18, 2023

Listen now (5 mins) | Today's letter is brought to you by Sidebar! Do you want to level up your career in 2024? As we all know, navigating a big career transition is hard to do. Sidebar is a

The Greatest Marketing Blitz In Finance History Is Coming

Friday, December 15, 2023

Listen now (3 mins) | Today's letter is brought to you by Trust & Will! Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of

Certainty In Markets Ushers In New All-Time Highs

Friday, December 15, 2023

Listen now (3 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these