Thoughts On The Bitcoin ETF That No One Is Talking About

Today’s letter is brought to you by Dream Startup Job!

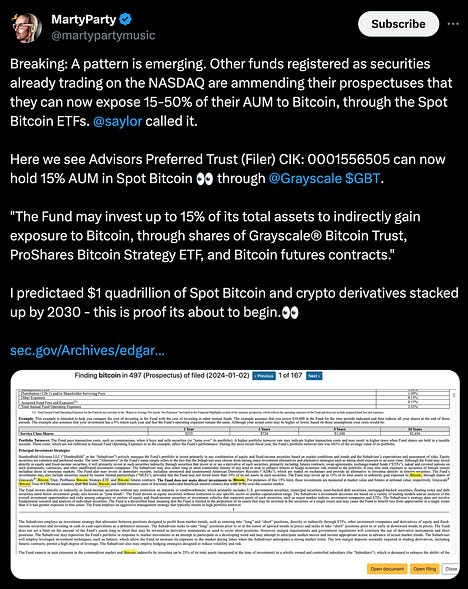

To investors, The speculation around spot bitcoin ETF approvals is intensifying. Market participants are preparing for the applications to get a green light from regulators. At the same time, the mainstream media is interested in predicting whether the digital currency price will go up or down upon approval. I shared my thoughts on CNBC’s Squawk Box this morning but figured it would be valuable to expand those thoughts here for all of you. First, the short term price action of bitcoin is a non-story in the grand scheme of things. I explained to Becky Quick that I anticipate the same thing happening whether the applications are approved or denied — there will be severe short-term volatility and then bitcoin will get back on track with the current medium-to-long term trajectory. Regardless of whether the price goes up or down thousands of dollars on decision day, the movement will look like a small blip on the chart after a year or two has passed. Keeping this in context of the broader picture is important. Second, it is important to warn Wall Street investors of the volatility bitcoin presents to the market. The great team over at Reflexivity Research explained what happened yesterday when more than $1 billion of open interest was wiped from the market, leverage was flushed out, and bitcoin went down thousands of dollars in mere minutes. (Highly recommend subscribing to Reflexivity by clicking here) All of the investors who thought it would be as easy as “go long with leverage into the ETF approval” started Wednesday morning with a surprise. Remember, bitcoin was $1,000 in 2017 and it has experienced a 45x increase since then. Along the way, there were two different drawdowns of about 80%, multiple 50% drawdowns, and five separate 30% drawdowns in 2021 alone. Bitcoin’s volatility is unlike anything else in traditional finance — that is attractive to some investors, but will ruin others. Third, most of the public conversation is focused on the primary flows from retail and institutions into the bitcoin ETF. Those flows will be measured in tens of billions of dollars in the coming years. But another area of fresh demand will be what I call “secondary flows.” These are inflows to the ETF that will come from other publicly traded funds. Earlier this week we saw one of these funds amend their prospectus so they can allocate up to 15% of their AUM to the bitcoin spot ETF when it is approved. Given that bitcoin is the best performing asset over the last 15 years, there are likely a lot of existing funds that would love to add a small exposure into their fund to juice returns. Fourth, Wall Street sales teams and meme accounts on Twitter/X are going to be reading from the same script for years to come. The talking points have become clear over the last few years, but the messenger is going to change once the ETFs are approved. We have never had large financial institutions spending hundreds of millions of dollars to market bitcoin to their clients. That effort is going to lead to capital inflow, but it is also going to do quite a bit to drive investor education as well. Lastly, bitcoin has had an impressive financial performance without the persistent bid of large financial institutions allocating to the asset. That is going to change with endowments, pension funds, insurance companies, sovereign wealth funds, and other large organizations buying the spot ETF. The benefit from this will be that bitcoin’s unlikely to continue to see large 80% drawdowns in the future. The downside is that some of the volatility of bitcoin will be taken away, which means it is unlikely to be as asymmetric to the upside as well. Bitcoin will continue to do very well, but as I explained on television this morning, don’t anticipate the asset to go to $1 million over night. Thankfully, it probably gets there over time though because the government won’t stop printing money. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Darius Dale is the Founder & CEO of 42Macro. In this conversation, we talk about global liquidity, Wall Street investors on bitcoin ETF, Macro Weather Model on asset prices in 2024, and more. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here My CNBC Appearance From This Morning - Bitcoin Welcomes Wall Street To The Party Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Trade Of Our Generation

Wednesday, January 3, 2024

Listen now (4 mins) | To investors, The US national debt crossed over $34 trillion yesterday, which is the highest it has been in history. This all-time high milestone is not one to celebrate. Charlie

The State of Bitcoin Heading Into 2024

Tuesday, January 2, 2024

Listen now (3 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Powerful Technology Is Moving Into The Hands Of Retail Investors And It Will Revolutionize Markets

Friday, December 29, 2023

Listen now (4 mins) | To investors, This is my last letter to you of 2023. I figured I would leave you all with some alpha on how to put yourself in a better financial position during the new year.

Asset Prices Are The Crouched Lion Approaching Their Prey

Thursday, December 28, 2023

Listen now (5 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

My Top 10 Books From 2023

Wednesday, December 27, 2023

To investors, I try to read as much as I can. Sometimes I sit down and read a single book all the way through to the end. Other times I am reading two or three books at the same time. Given everything

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these