Startup funding slumps by two-thirds in 2023

Startup funding slumps by two-thirds in 2023Startup funding in 2023, startup picks for 2024, Yolo funding, Inside the raise – Pro League Network +More

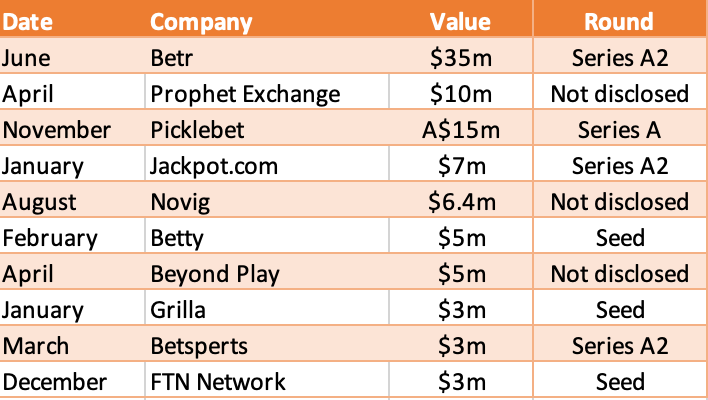

We're hungry for a life we can't afford. Startup funding in 2023Funding for betting and gaming startups slowed to a trickle last year. So it came to pass: The truth of the chatter among the founders and funders throughout last year about how much more difficult the funding environment was in 2023 vs. the year before was proven, as fund-raising by betting and gaming entities fell by two-thirds.

Times are tight: As was predicted by many market observers, the interest rate environment and uncertain economic backdrop last year clearly crimped money-raising efforts. Of the deals tracked, only three were in double figures.

🏜️ Well gone dry: the top 10 sector funding rounds in 2023 Heads up: Next month, Earnings+More will take a look at how the experts think the funding environment for the sector will shape up in 2024. ICE London 2024 will be MEGA with Soft2Bet! We look forward to showcasing our Motivational Engineering Gaming Application (MEGA), the best gamification package in the iGaming industry. We also invite partners and delegates to visit our brand new stand, where our senior leaders will be hosting workshops that will highlight our state-of-the-art technology, platform and services and of course MEGA. See you at Stand S6-210! https://www.soft2bet.com/news/soft2bets-mega-is-coming-to-ice-london Startups for 202410 to look out for: The funding environment in 2023 might have been difficult, but there were a lot of quality companies that have either emerged or strengthened their positions in the past year. In no particular order, here are the companies E+M considers to be the pick of the bunch. PikkitPick a winner: Calling itself the “ultimate sports-betting community”, Pikkit provides an app that allows users to sync all of their sportsbooks, monitor and interact with their friends’ picks, share their own bets with the larger community and tail the top performers in the industry.

KonquerCapturing the flag: The LA-based gaming developer announced a couple of licensing deals in September, with Galaxy Gaming and ODDSworks, as the company began to make good on its promise of providing the most innovative and “coolest” games. Cloud CrafterDon’t lose your head: It is very early days for Cloud Crafter, which has just released the iGaming industry’s very first headless CMS, Contentless. Headless tech allows developers to keep pace with evolving technology and seamlessly deliver content across multiple platforms and devices. Cloud Crafter has integrated and built a generative AI that will bring a fresh approach to the casino lobby, among other things. Up next is a unified PAM. CompliableUncomplicated: The evolving and complex regulatory landscape is making increasing demands on the compliance teams of organizations large and small. Hence, the excitement around providers such as Compliable, which deploys technology to help clients manage multiple licensing processes via a single platform.

PicklebetGenZ, mate: The Australian-based next-gen betting and media company positions itself as being at the nexus of esports, sports and internet culture. Having closed a A$15m ($10m) Series A round of financing in late November, the stage is set for the company to make some noise in the year ahead. Print StudiosCopier cats: Like Quickspin before it, Print Studios’ three co-founders emerged from Kindred Group and hit the ground running with slots that already have it standing out among the crowded field of slots providers. Valuing quality over quantity might seem a basic virtue but it has paid dividends with hits such as Darkness and the Pine of Plinko and Royal Potato series. 10starTwinkle, twinkle: The sportsbook development space is one where there is understandably a huge level of interest given the sale of odds-provider Angstrom to Entain for over £200m last year. Similarly involved in the area of market making and risk management, 10star was launched in early 2023 by industry veteran Magnus Hedman with the aim of “bringing a breath of fresh air” to the space. RithmmLeveling up: Nothing is hotter at the moment than AI and in Rithmm’s case it is being utilized to provide bettors with the tools to make more informed decisions. A July 2023 $2m Series A fund was led by Boston Seed Capital, a founder investor in DraftKings, which believes Rithmm is set to disrupt by providing everyday bettors with advanced analytics previously the preserve of professionals. MetaBetThe Austin, Texas-based company provides betting tools to help publishers unlock value in their sports coverage, including widgets that can integrate live scores and stats alongside odds information. MetaBet currently works with 40 partners across sports media, sportsbook operators, performance marketers and betting publishers. The UnitFrontend counts as much as backend on sports betting, but standing out from the crowd is easier said than done. Hence, providers such as Ireland-based The Unit, which brings industry expertise to bear on the areas of software development and marketing.

Yolo fund raiseNew money: Late in December, Yolo Investments (an E+M sponsor) announced the launch of a second flagship fund with a plan to raise €100m, half of which comes from current general partners and the other half from new investors. The fund is not wholly aimed at betting and gaming and will also look at fintech and blockchain-based enterprises.

Yolo has enjoyed success with its initial fund, which has invested in more than 100 companies and now has assets under management of over €600m with an IRR in excess of 40%. Einroos says that “substantiates the viability of the underlying investment strategy.”

Einroos says identifying synergies across sectors is part of the investment strategy. The gaming industry has “long been deprived of having access to cutting-edge financial services due to a perceived high-risk profile.”

The way ahead: Einroos notes Yolo has lined up a target of up to 30% of capital to be deployed in five to seven opportunities across the three sectors. “We’re going to be actively in the hunt for 15-20 investment opportunities in the next three years,” he adds. Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia. Book a meeting with Optic Odds at ICE and receive complimentary access to our trading screen for one month - no strings attached. Includes:

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request. Book a meeting here or get in touch at ryan@opticodds.com. Inside the raise – Pro League NetworkWho are you? Pro League Network is currently in the process of raising $1m in order to further its ambitions in 2024, including the recent launch of its first branded studio set-up out of Branson, Missouri, the home of PLN’s combat sports, which include the SlapFight Championship. Who’s got the money? The new funding round is led by previous investors Roger Ehrenberg and EBerg Capital, with participation from Chris Grove, and Kevin Garnett and Big Ticket Sports. The latter is also behind PLN’s latest sport, called str33t, a new streetball league. Media, gambling or both? “We consider Pro League Network to be a sports entertainment company that owns, operates and produces fun, bettable sports,” says head of comms, Pete Axtman.

Slap happy: In the past six months, Pro League Network has taken “some significant steps” to broaden its media offerings, including acquiring the SlapFight Championship, which is one of the most viral sports in recent years. It also announced a partnership with BrinxTV, the rising platform for the next generation of sports, entertainment and gaming programing,

Meeting demand: Axtman points out the appeal of minority sports to sportsbooks is they help fill the scheduling gap when action from the major leagues isn’t available. “By owning and operating the production of our sports, we’re able to schedule competitions to be offered at under-optimized parts of the sports-wagering calendar,” he says. Street life: Next up is the debut of str33t. “We’re finalizing some details for the league, including our broadcast partner, wagering offerings, schedule, uniforms, rosters and more,” Axtman says.

More watch-n-wager content will be forthcoming. “Most international mature betting markets have seen watch-n-wager successfully implemented and we believe there’s a market for this type of experience in the US.”

Sportsbook operators & providers - Are you looking to up your risk management & trading game in 2024? Set a meeting with Matchbook at ICE 2024 February 6th-8th to discuss any of the following:

Matchbook B2B - Because the best price is for everyone. Visit http://www.matchbook.com/promo/b2b or get in touch at b2b@matchbook.com Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Bet365 completes pandemic bounceback

Monday, January 8, 2024

Bet365 annual results, 2024 outlooks, New York by the numbers, startup focus – Game Safety Institute +More

Activists on the inside at Entain

Friday, January 5, 2024

Entain board move, BlueBet/Betr discussions, Penn analyst take, EKG predictions +More

Activist HG Vora rattles the cage at Penn

Tuesday, January 2, 2024

Activists at Penn, by the numbers – Nevada, a big month for Flutter, startup focus – Sporting Risk +More

Brazil finally nods through OSB legislation

Friday, December 22, 2023

Brazilian legislation, DFS upstarts, ESPN Bet assessment, Durango plaudits +More

Affiliate M&A is a buyer’s market – and that buyer is Better Collective

Tuesday, December 19, 2023

Affiliate M&A, activists get active, (not) the month in transactions +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these