Earnings+More - No pressure: Entain awaits its new boss

It's been a long, a long time coming, but I know a change gon' come. What next for Entain?Leaderless and with activist investors demanding change both from within and without, Entain faces a tricky start to 2024. First things first: The company needs a new CEO after Jette Nygaard-Andersen quit with immediate effect at the end of 2023. The board has shown a desire to break from the old regime by appointing non-executive director Stella David as interim CEO, rather than deputy CEO and CFO Rob Wood.

Others to have been given mentions in despatches include:

Hospital pass: The board might consider some to be too untested – at FTSE 100 level at least – while all might well have questions about the attractiveness of the role given the current backdrop.

Hot mess: The alternative view, as expressed by one advisor, is the job is an “organizational challenge.” “There are people who know big businesses and have the clarity of thought to bring all of Entain’s acquired businesses together. Gambling sector knowledge is not a must-have.”

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Jette propelledHow did we get here? Nygaard-Andersen resigned after pressure from activist investors and an FT report that revealed her internal nickname as ‘Private Jette’ because of the frequency of her private flights.

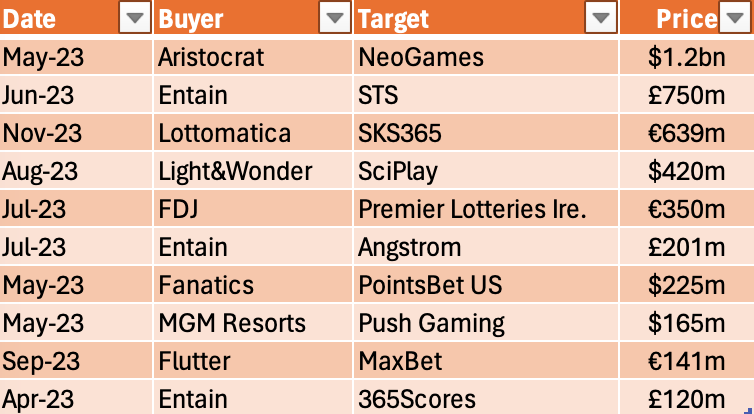

That camel’s back was already loaded down with seven acquisitions Entain made during 2022 and 2023:

Strategic rights and wrongs: The bolt-on spending spree followed a change in the European gambling market as a new breed of national champions rose to challenge Entain and peers such as bet365 and Flutter.

Peel Hunt analyst Ivor Jones told E+M: "Different shareholders want different things at different times. The board took the decision to seek higher levels of sustainability and less risk. “If this is the priority then the strategy makes perfect sense. If you are a shareholder that wants as much money as possible in the short term then that position is difficult."

In the in-tray: The new CEO will need to focus on getting the most out of the acquired businesses. With no M&A on the horizon, group director of M&A Nick Batram left the company shortly after Nygaard-Andersen. The dabbling with diversifying away from gambling (see Unikrn) is also dead in the water.

“There have been so many changes of organization and restructurings over the past couple of years,” said an analyst source. “They need to decide who is responsible for what. What is local and what is central? You need that to be very, very clear.”

Sportsbook operators & providers - Are you looking to up your risk management & trading game in 2024? Set a meeting with Matchbook at ICE 2024 February 6th-8th to discuss any of the following:

Matchbook B2B - Because the best price is for everyone. Visit http://www.matchbook.com/promo/b2b or get in touch at b2b@matchbook.com +More dealsGolden Entertainment has announced the completion of the previously disclosed sale of its distributed gaming operations in Nevada to an affiliate of J&J Ventures Gaming for $214m in cash. Australian minnow BlueBet is in discussions regarding “strategic initiatives” with the Australian Betr and other potential partners. Recall, the Matt Tripp-led Betr has long been rumored to be a potential bidder for PointsBet’s Australian business. Table talk: Another rumor given an airing late last year – and providing a question which is yet to be answered – is whether Playtech was considering jettisoning its B2B arm in order to effect a merger with William Hill. M&A in 2023Poetic license: The remnants of Entain’s prior bolt-on strategy litter the chart of M&A deals in 2023 like archaeological remains in the desert. But it was the second deal in the list of top buys – the £750m splashed out on STS – that ultimately led to the defenestration of Nygaard-Andersen and the parallel ending of the company’s erstwhile bolt-on strategy. 🎯 The top 10 M&A deals in the gambling space in 2023

The Italian front: The purchase of SKS365 in November became something of a bunfight, with Playtech going public on its desire to be considered a bidder and rumor circulating that Flutter was also in the market to augment its existing Italian market positioning.

The way forward: Of significance further down the list are the $225m Fanatics laid out for PointsBet US and the $165m MGM Resorts stumped up for Push Gaming.

Calendar

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth? Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

To buy or not to buy, that is the question

Monday, January 15, 2024

M&A outlook, Bally's tumble, analyst takes, startup focus – Lucra Sports +More

ESPN Bet on course for second-tier status

Friday, January 12, 2024

ESPN Bet numbers, LiveScore earnings, analysts outlooks +More

Startup funding slumps by two-thirds in 2023

Tuesday, January 9, 2024

Startup funding in 2023, startup picks for 2024, Yolo funding, Inside the raise – Pro League Network +More

Bet365 completes pandemic bounceback

Monday, January 8, 2024

Bet365 annual results, 2024 outlooks, New York by the numbers, startup focus – Game Safety Institute +More

Activists on the inside at Entain

Friday, January 5, 2024

Entain board move, BlueBet/Betr discussions, Penn analyst take, EKG predictions +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these