A Short Guide to Bitcoin On-Chain Data for ETF Newcomers

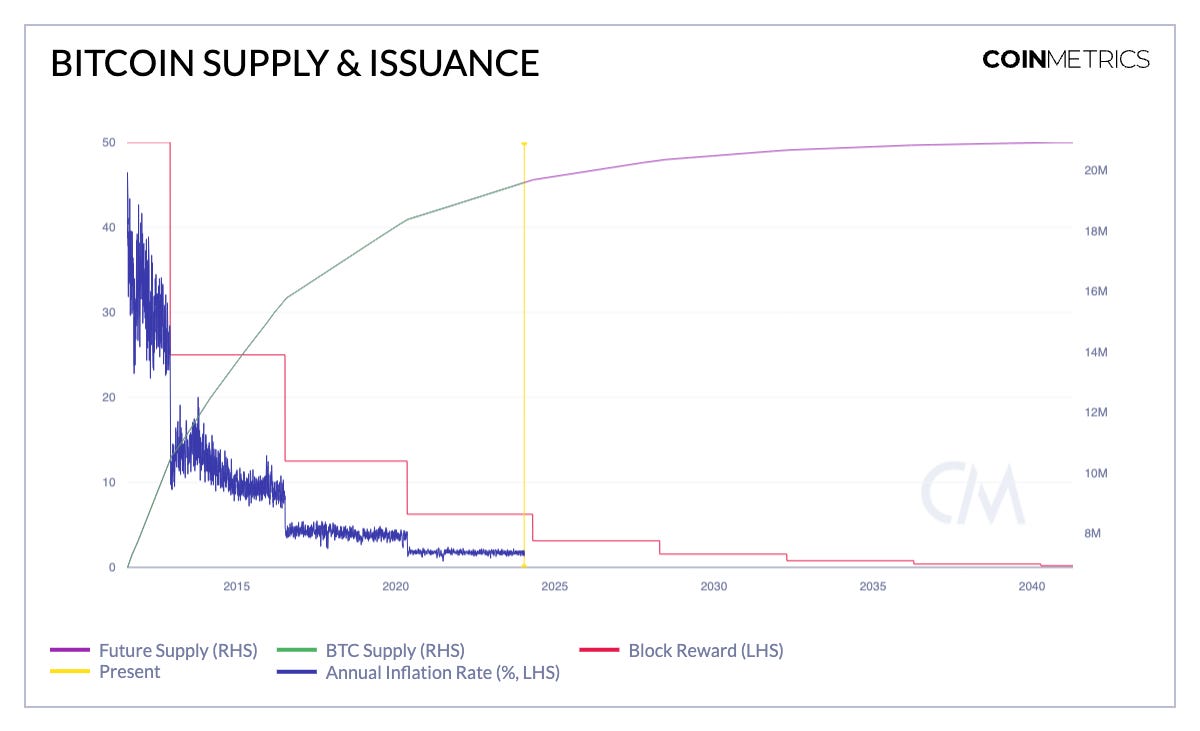

A Short Guide to Bitcoin On-Chain Data for ETF NewcomersData on bitcoin adoption, economics, supply, usage, market valueGet the best data-driven crypto insights and analysis every week: A Short Guide to Bitcoin On-Chain Data for ETF NewcomersBy: Kyle Waters IntroductionLast week’s approval and launch of spot bitcoin ETFs like BlackRock’s IBIT, Fidelity’s FBTC, and a further eight additional spot ETF products, marked a historic moment in Bitcoin’s history. The ETFs provide investors with a new option to access bitcoin through traditional brokerage accounts while reducing the friction for asset managers to gain exposure to BTC. In total, the ETFs have now traded ~$10B across three complete trading days, with BlackRock’s offering seeing close to half a billion dollars worth of inflows in two days' time. With greater accessibility, Bitcoin is bound to reach new corners of the financial world. To the uninitiated taking their first look, Bitcoin might seem daunting. Terms like UTXO, Byzantine Generals, and Proof-of-Work are often tossed around, signaling a great deal of technicality when researching Bitcoin the protocol. But a distinctive feature of bitcoin the asset lies in the nature of its data, which is transparently available from the blockchain. This is a type of data commonly referred as “on-chain” data in the industry lexicon. The nature of the Bitcoin blockchain allows for the precise tracking of each coin’s movements, offering a level of transparency and analysis rarely seen in other asset classes. In this edition of State of the Network, we turn our attention to the cohort of ETF newcomers now taking a closer look at bitcoin. Our focus is to introduce or reacquaint some to the field of on-chain data, underscoring the properties that make bitcoin an intriguing asset to research. Supply: Age BandsBitcoin age distribution bands, sometimes referred to as "HODL waves," are instrumental in monitoring Bitcoin's velocity and supply liquidity. HODL waves group bitcoin's supply based on the duration since its last movement, providing a macro perspective of the shifts in bitcoin's supply distribution over time. For example, the bottom red band shows that about 1-2% of the total bitcoin supply tends to move on-chain in a given day, while the top dark purple band indicates that about 9% of the bitcoin supply has never moved since it was mined—a large portion of which is believed to have been mined by Satoshi in the early days of Bitcoin’s history. Source: Coin Metrics Network Data Pro Adoption: Address CountsTypically, the number of unique owners of an asset is a difficult data point to ascertain. There are some nuances (one address doesn’t always map to one individual); however, we can get a proxy for Bitcoin adoption with the number of addresses holding some balance amount. The chart below shows the total number of Bitcoin addresses with at least 1 BTC, which recently surpassed 1M, rising from 800K in 2022. Source: Coin Metrics Network Data Pro Usage: On-Chain Settlement ValueQuestions about Bitcoin's purported utility are not uncommon amongst its critics. However, a clear quantitative demonstration of its usage can be observed by examining the amount settled on-chain each day. Today, Bitcoin settles billions of dollars every day without any intermediary, rivaling some other value-transfer systems. For example, on the day of the spot ETF launch, Coin Metrics observed $11B worth of bitcoin moving on the blockchain, after adjusting for change and pass-through accounts. Source: Coin Metrics Network Data Pro Monetary Policy: Issuance & InflationBitcoin’s transparent and predetermined issuance schedule is one of its defining characteristics. Easily auditable, we can perfectly predict the future bitcoin supply and declining inflation rate as it progresses through its halving schedule, where issuance is cut in half roughly every four years. The 4th halving is quickly approaching this year, and is set for late April. Source: Coin Metrics Network Data Pro Realized CapRealized capitalization, one of Coin Metrics’ flagship metrics introduced in 2018, perfectly demonstrates the unique analyses offered by blockchain data. Realized cap is conceptually similar to a traditional market cap, but with a spin. Instead of multiplying the entire supply by the current market price, realized cap is calculated by valuing each unit of bitcoin individually based on the price at the time it last moved on-chain. This means that coins which moved during periods when prices were lower are discounted. Realized cap can be thought of as a gross approximation of bitcoin’s aggregate cost basis, and gives a more long term and slow moving measurement of bitcoin’s total valuation. Bitcoin’s realized cap today stands at $440B, compared to its market cap of $830B. Source: Coin Metrics Network Data Pro Market Value to Realized Value (MVRV)Building off realized cap, the market value to realized value (MVRV) ratio is another on-chain metric carrying interesting properties. The MVRV is found by dividing bitcoin’s market capitalization by its realized cap. Though future performance need not reflect the past, historically, MVRV has been a reliable gauge of market cycles because it can provide insight into the behavior of bitcoin owners with profits or losses. A high MVRV ratio suggests that bitcoin’s market value is significantly higher than realized value, indicating that many holders might be in substantial profit and could potentially sell, leading to market tops. Conversely, a low MVRV ratio has suggested that the realized value is holding its ground compared to market value, signaling that the capitulation has ended, historically coinciding with market bottoms. With our previous comment in mind regarding future performance, MVRV values of 1 and 4 have historically corresponded to market lows and highs, respectively. Source: Coin Metrics Network Data Pro Supply DispersionAs stated earlier, every Bitcoin transaction recorded since the network’s inception is maintained on a publicly shared ledger that anyone can access by running their own Bitcoin node. This allows node operators like Coin Metrics to construct detailed breakdowns of the bitcoin supply, like below. The chart below shows the amount of bitcoin held by that address size. While this transparency is remarkable compared to other assets, it also allows for increased scrutiny on the concentration of supply, which can be easily misjudged without additional nuance. Source: Coin Metrics Network Data Pro ConclusionFifteen years ago on January 11th, 2009, Bitcoin had only just emerged as a nascent open-source project, its user base consisting of just a small cadre of cryptographers. There were no crypto exchanges, no marketplaces to buy or sell bitcoin, and the digital currency’s existence was mostly unknown to the world. Fifteen years on, the launch of the first spot bitcoin ETFs in the US last week marks an incredible milestone in Bitcoin’s evolution from idea to the linchpin and driving force behind an entire emerging digital asset class. As Bitcoin continues to evolve and mature, the imperative to critically research it grows correspondingly. This article provides a foundation to start this on-chain journey. To follow the data used in this piece and explore our other on-chain metrics check out our charting tool, formula builder, correlation tool, and mobile apps. You can also explore all of Coin Metrics’ research insights here: https://coinmetrics.io/insights/ Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro The free float supply of Tether (USDT) across the Ethereum and Tron networks has hit 93B, continuing its upward march past new all-time highs. This coincides with remarks from Cantor Fitzgerald CEO Howard Lutnick at the World Economic Forum's annual gathering in Davos, Switzerland. In a conversation with Bloomberg, Lutnick indicated that Cantor's analysis corroborates the backing of USDT by Tether's assets, aligning with the issuance figures recorded on-chain. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Market Structure on the Cusp of Spot Bitcoin ETFs

Tuesday, January 9, 2024

Exploring Crypto Market Data on the Road to the spot Bitcoin ETF

State of the Network’s 2024 Outlook

Wednesday, January 3, 2024

The Arrival of Spot ETFs | The 4th Bitcoin Halving | EIP-4844 | Stablecoins & Emerging Applications | Policy Outlook

Best of State of the Network in 2023

Tuesday, December 26, 2023

Coin Metrics' State of the Network: Issue 239

State of the Network’s 2023 Year in Review

Tuesday, December 19, 2023

Coin Metrics' State of the Network: Issue 238

State of the Network’s Q4 2023 Mining Data Special

Tuesday, December 12, 2023

Coin Metrics' State of the Network: Issue 237

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏