A Peek Into the State of Ethereum's Layer 2 | Layer 2 Review

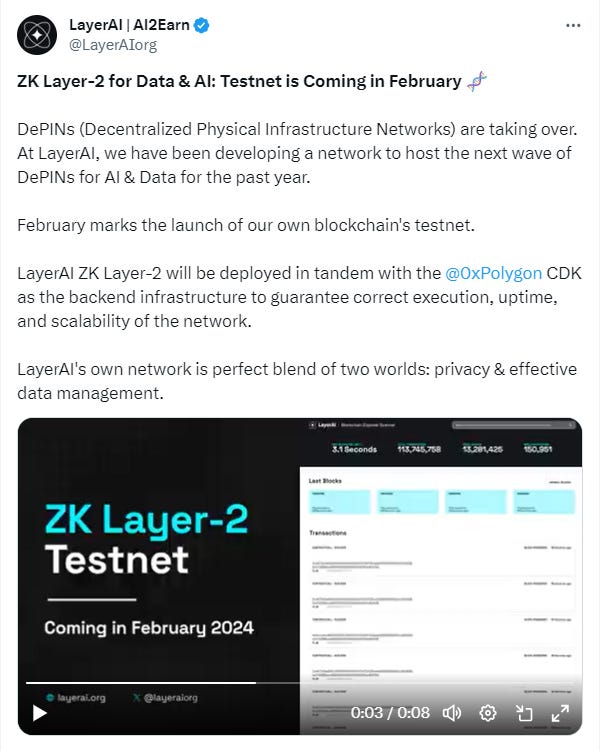

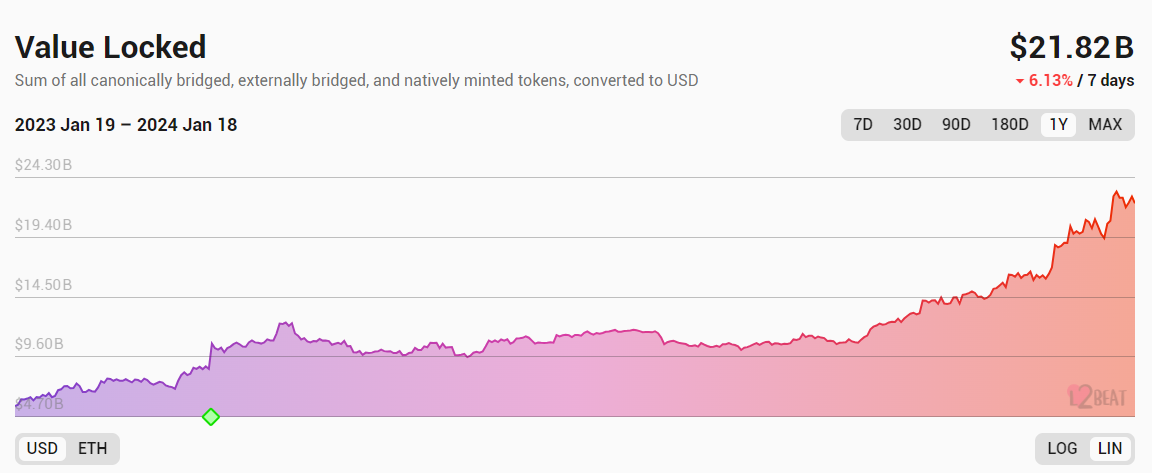

A Peek Into the State of Ethereum's Layer 2 | Layer 2 ReviewQuick Reads and Hot Links Covering the People and Projects Who Are Scaling EthereumDear Frens, Happy New Year and welcome back to all things L2🎉. A lot has happened since the last issue, one of which is the Bitcoin ETF getting approved! This act has cleared the path for innovation, growth, and mass adoption. Excitedly also, Ethereum's Layer 2 solutions are rapidly scaling the network, boasting over 36 active networks with almost $22B total value locked. Although while enhancing transaction speed and lowering fees, L2s face challenges like centralization and interoperability issues. Find out more in this issue’s editorial as we take a sneak peek at the current state of the Layer 2 ecosystem. That said, recent headlines about Gitcoin-backed Public Goods Network (PGN) winding down operations highlight the difficult economics protocols face. This Layer 2 solution on Ethereum is planning to wind down all operations within the next six months, targeting a complete shutdown by mid-2024. This scenario highlights the pressing need and importance of public goods funding like that of the Optimism RetroPGF. The recently concluded Round 3 of the RPGF granted 30M OP to contributors building the public goods that power the Optimism Collective. The announced PGN shutdown might be depressing, but it also shows the cycle of products, organizations and let’s face it — life. Nevertheless, the L2 momentum is undeniable. Follow along with this issue as we dive into the newest developments propelling Layer 2 forward. Contributors: Warrior, Tonytad, jengajojo, Boluwatife, Kornekt, WinVerse This is an official newsletter of BanklessDAO. Please subscribe and share to help us grow our audience as we fulfill our mission to build user-friendly crypto onramps. 🗞️ Ecosystem Updates💰 Optimism Distributes Over $100m in RetroPGF Round 3 🚀 Nayms Launches the First Institutional Tokenized (Re)insurance Marketplace on Base ↪️ Manta Pacific Flips Base as Fourth Largest Layer 2 Solution as TVL Surges to $845 Million 🔀 Arbitrum Surpasses Ethereum in Daily Decentralised Exchange Volume for First Time ➿ Taiko Launches Final Testnet Ahead of Planned Mainnet Release By Q1 End ⚡ Bitcoin Layer 2 Network Bitfinity Raises $7 Million ⭕ Arbitrum Orbit Chains Can Now Use Select ERC-20 Tokens For Transaction Fees 🔥 Hot News🌡️ LayerAI's ZK L2 Testnet Launch - The Future of Private, Scalable AIThe emergence of the bull is bringing about major moves in the world of privacy-preserving AI and data! 👀 Decentralized infrastructure networks (DePINs) are on the rise, and LayerAI has been developing an innovative solution tailored to AI and data needs. In just a few weeks, LayerAI will be unveiling the testnet for their highly anticipated ZK-Rollup Layer 2 blockchain. This specialized network promises to enable the private, correct, and scalable execution of data-intensive applications. By combining zero-knowledge proofs with Polygon's industry-leading CDK backend, LayerAI strikes the perfect balance between privacy and effective data management. The launch of LayerAI's ZK Layer 2 testnet marks a massive milestone on the path to web3-powered AI. Check the tweet below to view the awesome awareness trailer and to get further information! 🏛 Governance💬 Proposals in DiscussionArbitrumOptimismPolygonStarknetCELOA Peek Into the State of Ethereum's Layer 2Author: Kornekt Layer 2 solutions have taken Ethereum by storm and are increasing in number and stability day by day. With the general goal of scaling, these L2s have taken unique paths to solving the issues currently associated with using Ethereum, paving the way for global adoption. Layer 2s try to scale Ethereum in different ways — some are sidechains like Polygon, Optimistic Rollups like Arbtruim and Optimism, ZK-Rollups like Starknet, and state channels like the Raiden Network. According to L2beat, there are over 36 active Layer 2 networks with a total value locked of about $22B at the time of writing. More are still in the works, preparing for a super emergence into the scaling market. How Well Have L2s Been Faring?If you consider all the scaling efforts being put out by these L2s, one can't help but ponder how well things have been playing out. Sure, L2s have been doing amazingly well at increasing the number and speed of transaction processing. The drastically low fees we pay to enjoy this service are equally exhilarating. While L2s seem to be the holy grail addressing Ethereum's shortcomings, they have not been without some drawbacks — from centralization issues to interoperability, not to talk of how complex it is to understand the underlying technology. Let's talk about some of these issues more specifically. Centralization Again?Starting with the big fish in the pond: centralization. One of the key principles behind blockchain technology is decentralization. That is the eradication of a single point of failure and other risks associated with depending on one or only a few systems for operation. At many L2s however, centralization is at the core of their operations. For instance, sequencers (used to order and batch transactions on rollups before submitting them to the Ethereum mainchain) of rollups like Arbitrum and Optimism are operated by centralized entities — often the team behind the rollup. Side chains like Polygon are currently operated by only a few validator sets. Polygon currently operates a permissioned validator set, with only 100 active validators at a given time. Compare that with Ethereum's almost 900,000 active validators. Besides all these, there is the issue of governance centralization due to the significant influence the foundational teams have over governance decisions. These centralization issues create censorship risks, reduce security, increase downtime possibilities, and contradict the overall ethos of trustless, permissionless systems. Thinking of all these, you may be wondering, why would these L2s go the centralized route when it outrightly negates the ethos? For many of these L2s, the idea of starting in a centralized fashion is due to the ease of operations. Centralized components can help initially bootstrap growth, offer initial security guarantees, and establish functionality while research continues on fully decentralized alternatives as they transition to progressive decentralization. It is worthy of note that these Layer 2 projects are actively trying to address these centralization issues. This includes efforts towards decentralizing sequencer operations, increasing validator sets, and a detailed path like that of Optimism towards complete decentralization. How long it will take before they attain full decentralization and what that will mean for the Ethereum chain is what we have to wait to find out. L2-L2 InteroperabilityOne other challenge currently facing L2s is the issue of interoperability. This is all about a seamless exchange of data and assets between the different Layer 2 solutions. In an attempt to define L2 interoperability, a proposal at Ethereum Research puts it this way: "Layer 2 Solution A (L2S-A) and Layer 2 Solution B (L2S-B) are said to be interoperable if Alice, or one of her delegates, can transfer one or more fungible or non-fungible assets from L2S-A to Bob, or one of his delegates, on L2S-B without having to exit the asset(s) to the underlying blockchain(s) and in an, ideally censorship-resistant, manner such that neither Alice, nor Bob, nor one of their delegates can double-spend the asset(s) at any point before, during and after the asset transfer on either the participating L2Ss or the (permissionless) Blockchains used by either L2Ss.” L2-L2 interaction is still a major challenge. This is a result of several technical hurdles associated with the development of secure and efficient mechanisms for cross-rollup communication and data verification. Besides, the differing architecture of L2s and their rapid emergence makes it difficult to achieve standardized interoperability protocols. Without addressing interoperability, composability, which is another pressing issue, would still be a long way off. Some of the solutions in use to tackle interoperability include the use of Bridges, which act as gateways enabling cross-rollup communication. Examples include the Orbiter Bridge and Hop Bridge. These bridges allow for the transfer of limited forms of assets between major Layer 2 networks. This is still far off from the broader interoperability idea though. Further research is ongoing into developing standardized protocols for L2 interoperability. The Future is BrightWhile L2s have been doing a great job at increasing Ethereum's throughput, it's obvious that there's more to be done to make them achieve the purpose of scaling in a user-friendly manner without compromising core blockchain ethos. It's exciting to see that these projects are continuously doubling down their efforts with defined roadmaps to address many of the pressing issues and build the decentralized future. We hope to see these efforts play out well on this path towards scaling Ethereum. 📈 DataTotal Value Locked on L2s surpasses $20 billion!

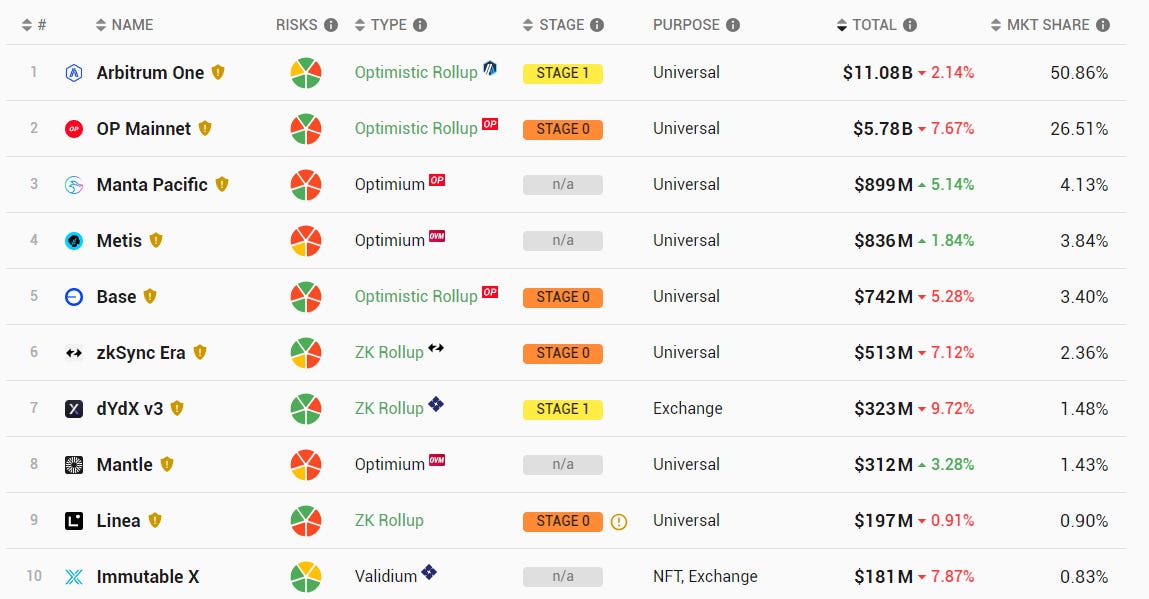

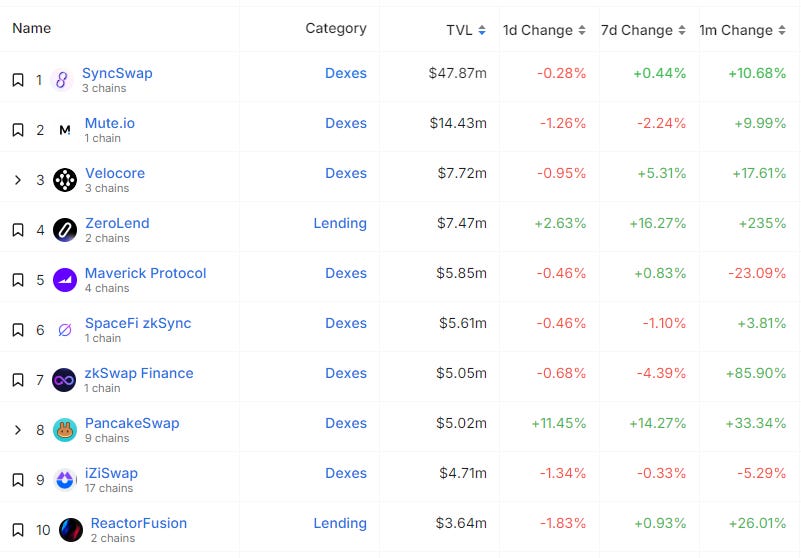

Top Ten Projects by Total Value Locked:

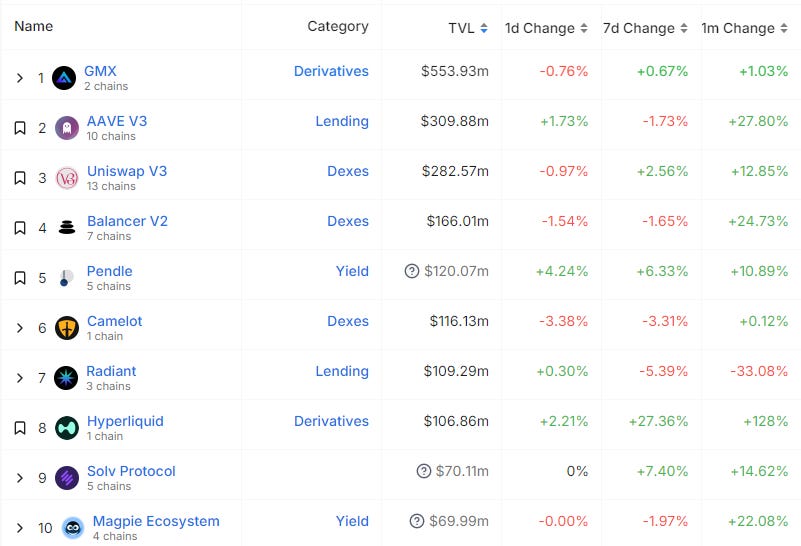

🔭 Project WatchArbitrumTop Projects by TVL

OptimismTop Projects by TVL

zkSyncTop Projects by TVL

Polygon zkEVMTop Projects by TVL in the Last 7 Days

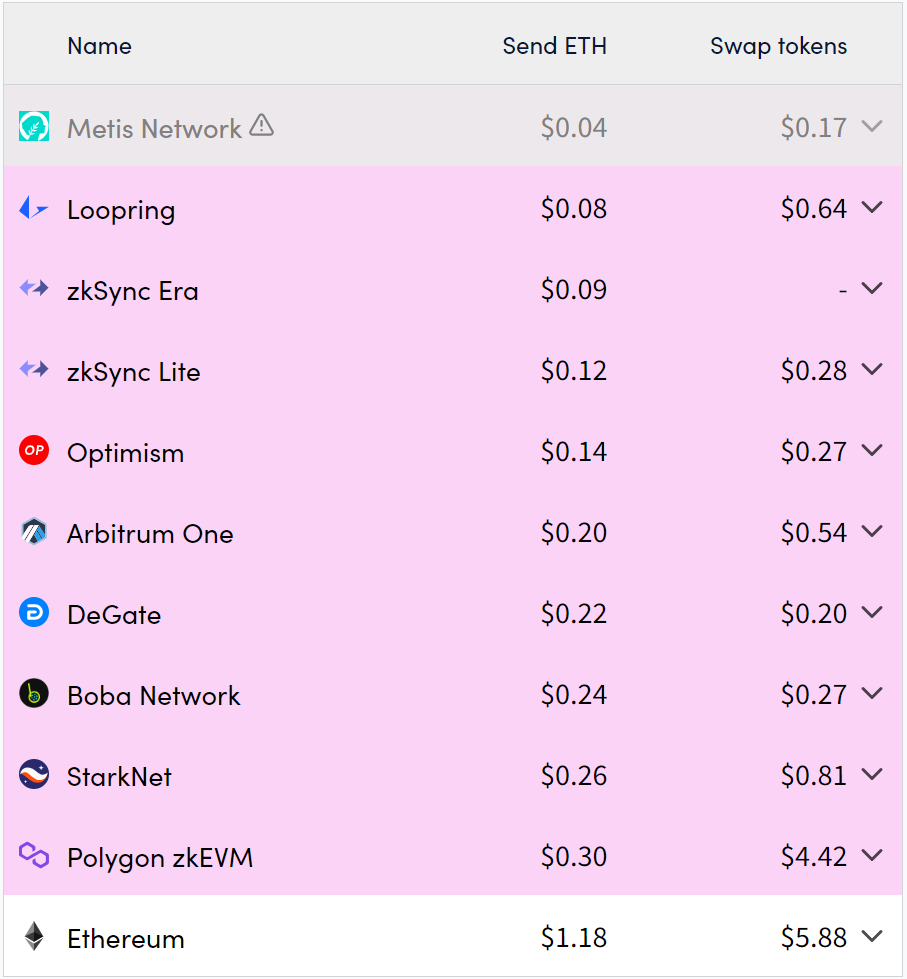

🔥 L2 Fees and Costs UpdateTransaction Fees as of January 17, 2023:

|

Older messages

Marvel's Inspiring BanklessDAO Journey | BanklessDAO Weekly Rollup

Saturday, January 13, 2024

Catch Up With What Happened This Week in BanklessDAO

Clarifying the Bankless Brand | BanklessDAO Weekly Rollup

Saturday, January 6, 2024

Catch Up With What Happened This Week in BanklessDAO

New Beginnings? | BanklessDAO Weekly Rollup

Sunday, December 17, 2023

Catch Up With What Happened This Week in BanklessDAO

Keep DAOing It | BanklessDAO Weekly Rollup

Saturday, November 25, 2023

Catch Up With What Happened This Week in BanklessDAO

DID You Boost Your Gitcoin Passport Score?

Saturday, November 25, 2023

Exploring Decentralized Identity Providers To Maximize Matching Funds

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏