What If The Fed Already Won The Fight Against Inflation?

Today’s letter is brought to you by ResiClub!

To investors, There is strong debate in the market about the US economy. One side believes the Federal Reserve will pull off the impossible and guide us towards a soft landing. The other side thinks the economy is showing significant red flags and is destined for a recession. The truth is that no one knows what is going to happen. That won’t stop people from trying to figure it out though. There are trillions of dollars, and many reputations, on the line in this debate. Take Anne Walsh, the Chief Investment Officer for Guggenheim Partners Investment Management, who told Bloomberg last week “we still see a recession coming, although our base case is a mild recession, and as a result we still see rate cuts [coming]. We are actually predicting they start sooner rather than later.” James Solloway, the Chief Market Strategist at asset management firm SEI, told Marketwatch last week that the big problem in the economy today is how many people are expecting these interest rate cuts. His view is that 3% inflation is not problematic as long as the market believes the Fed will keep interest rates at the current level or potentially raise them further. These are just two anecdotal opinions though. What does the market believe? Ann Saphir writes for Reuters:

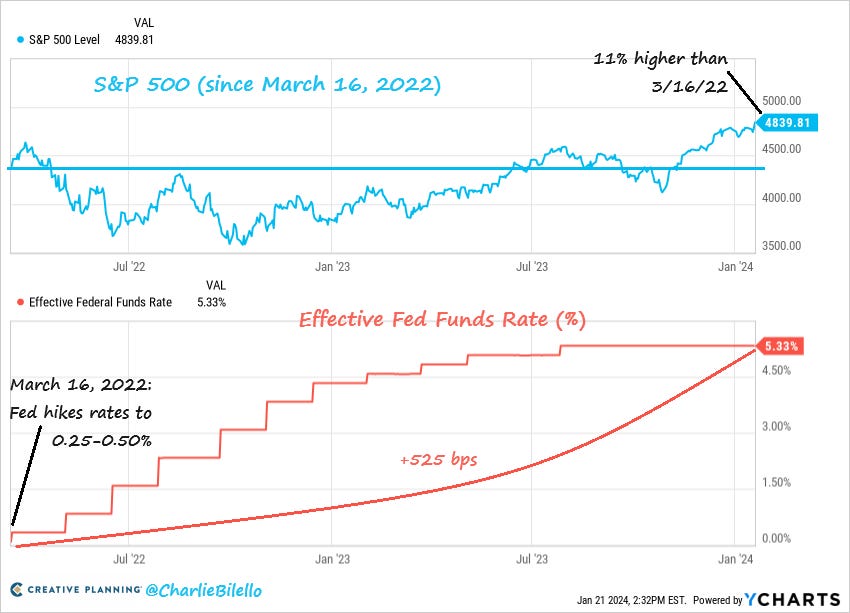

That pesky inflation continues to rear it’s ugly head. Another interesting point comes from Creative Planning’s Charlie Bilello who explains “the S&P 500 is now 11% higher than where it was when the Fed started hiking rates in March 2022.” But there is one factor that most people are not considering at all — what if the Federal Reserve and the entire market is operating with bad data? What if inflation is already back to the 2% inflation target? Truflation, the leading alternative inflation measurement, is showing the current inflation rate is 1.86%. That is nearly 50% lower than the Fed’s current reading of 3.4%. This is noteworthy because almost no one is considering this possibility. If the Fed has already accomplished their goal of getting inflation back to the 2% target, and there are meaningful signs of a potential recession, it would be prudent for the Fed to start cutting interest rates sooner than the market expects. Some of you may ask me — what signs of a recession exist today? Paul Davidson of USA Today points out the following:

Each of these signs are worth paying attention to, but none of them guarantee a recession will happen. This is the beauty and difficulty of financial markets. Uncertainty rules the day. Regardless of whether a recession comes or not, my best guess is that we will see looser monetary policy to end the year than we have today. How severe the loosening will be, along with the exact timing, is up for debate. But economies around the world are addicted to cheap money and central banks are more than happy to deliver the drug of choice. We can fight the trend in the short-term, but the long-term trend may as well be written in stone. Cheap money. Higher asset prices. And a lot of investors who will have to figure it out along the way. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Darius Dale is the Founder & CEO of 42Macro. In this conversation, we talk about global liquidity, Macro Weather Model, bitcoin & other risk assets, and impact of fiscal stimulus. Listen on iTunes: Click here Listen on Spotify: Click here My Appearance on Fox Business Friday with Charles Payne Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Podcast app setup

Sunday, January 21, 2024

Open this on your phone and click the button below: Add to podcast app

Bitcoin ETFs Receive Billions, But Price Goes Down?

Friday, January 19, 2024

Listen now (4 mins) | Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative

World Leaders Share Their Perspective On Markets

Thursday, January 18, 2024

Listen now (4 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

Global Liquidity Is Ready To Push Assets Higher

Wednesday, January 17, 2024

Listen now (4 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

The Central Banks Work For Us Now

Tuesday, January 16, 2024

Listen now (3 mins) | Today's letter is brought to you by Frec! The wealthy have used a secret strategy to make money and save on taxes for decades — direct indexing and tax-loss harvesting. The

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these