Global Liquidity Is Ready To Push Assets Higher

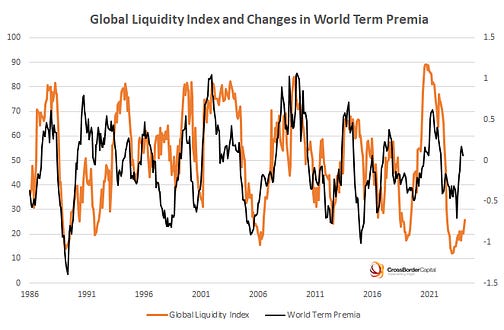

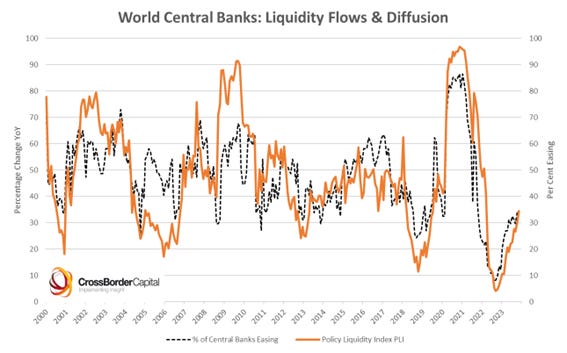

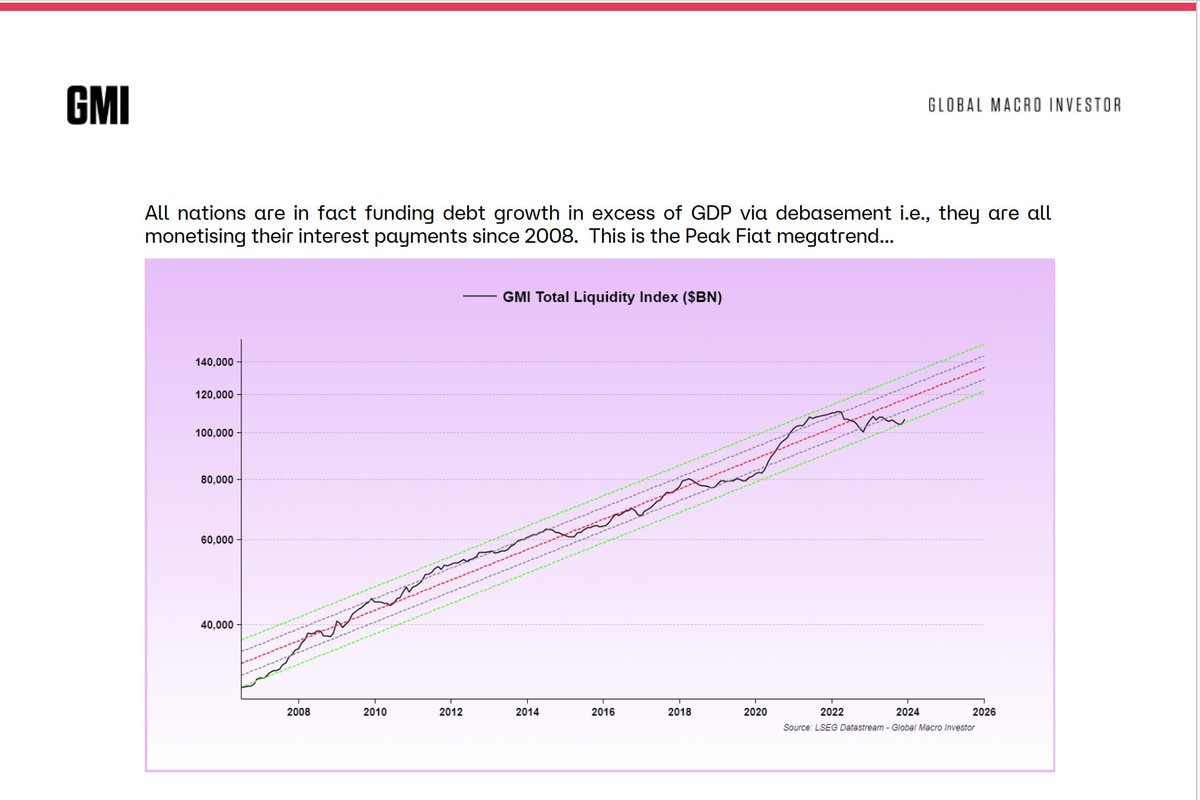

Today’s letter is brought to you by Espresso Displays!I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity on a laptop. So I started to use a second screen and it seems to have fixed the issue. It took awhile but I evaluated tons of different screens — Espresso Displays was by far the best one. I use it every day. I can’t imagine working from my laptop without it now. They are lightweight, thin, and look like Steve Jobs designed them himself. Any reader of The Pomp Letter who orders one this week will get a great deal. Highly recommend! To investors, Central bankers learned the QE playbook during the Global Financial Crisis. They practiced it during the 2020 pandemic. And now they are about to perfect it. Multiple people are pointing out that the global liquidity drawdown has bottomed and it appears we are headed up for the foreseeable future. There is Michael Howell at Crossborder Capital with this chart: You can see the Global Liquidity Index (in orange) turning up on the bottom right of the chart. Crossborder goes on to point out that more than 1/3 of global central banks were easing at the end of 2023. That is a very different story than the mainstream narrative inside the United States where majority of the focus has been on when the Federal Reserve is going to cut interest rates. As I mentioned yesterday, GMI’s Raoul Pal recently pointed out that global liquidity is bouncing off the bottom of a well established trend line, which he believes signals a significant increase from here over the coming years. Onchain analyst Cole Garner recently pointed out that the stablecoin market cap ratio is a leading indicator of crypto market performance. But PBoC’s liquidity index is a leading index of the stablecoin ratio by approximately one week. Given that PBoC has flipped bullish, we should expect stablecoins to follow and then the rest of the crypto market. These three individuals, along with many others, are pointing out that asset prices are rising because total global liquidity is rising. The US and Federal Reserve may get all the attention, but they aren’t driving the asset price ship at the moment. This is important because when the Fed joins the party sometime in Q1/Q2 of this year, we should expect an even larger move in investment assets. So lets go back to the situation I posed at the start of the letter — are central banks about to perfect the QE playbook? Bryan Hardy and Goetz von Peter from the Bank of International Settlements published a paper in December titled “Global liquidity: a new phase?” In the paper, they state the following:

Regardless of whether you call this developing situation a new phase or a perfected playbook, the data points are lining up to tell the same story—central banks are addicted to loose monetary policy and asset prices are ready to rip higher at the first sign of the central banks giving up on their tight monetary policy dreams. And it should go without saying, but just to make sure everyone understands my current view, if asset prices go higher then I believe crypto assets will outperform all other assets. There is something unique about asymmetric assets that are globally available during an injection of global liquidity. But don’t take my word for it. JP Morgan’s Jamie Dimon was at Davos this morning talking to CNBC and said that he believes the government should be very cautious right now. His point is that we may not understand quantitiative tightening nor quantitiative easing nearly as much as we think. So caution is warranted as we enter this new phase. Hope you all have a great day. I’ll talk to you tomorrow. -Anthony Pompliano Raoul Pal is the Co-Founder & CEO of Real Vision. He also writes ‘Global Macro Investor” and he has a brand new asset management firm (EXPAAM), with a mission to deliver leading returns on invested capital and serve as catalysts of crypto adoption. In this conversation, we talk about the bitcoin ETF, who is going to win the Cointucky Derby, Ethereum, Solana, his “Everything Code” thesis, macro environment, and more. Listen on iTunes: Click here Listen on Spotify: Click here Raoul Pal on Bitcoin, Ethereum, Solana, and Macro Environment Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Central Banks Work For Us Now

Tuesday, January 16, 2024

Listen now (3 mins) | Today's letter is brought to you by Frec! The wealthy have used a secret strategy to make money and save on taxes for decades — direct indexing and tax-loss harvesting. The

Bitcoin ETFs Saw Significant Inflows Yesterday

Friday, January 12, 2024

Listen now (4 mins) | Today's letter is brought to you by Trust & Will! Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of

The Bitcoin ETF Dress Rehearsal Yesterday

Friday, January 12, 2024

Listen now (5 mins) | To investors, Yesterday can only be described with one word — madness. The SEC's account on Twitter/X posted the following message just after 4pm EST: The market immediately

What Will a Bitcoin ETF Mean for Bitcoin? Lessons From ETF History

Friday, January 12, 2024

To investors, The bitcoin spot ETF was approved yesterday afternoon. All eleven issuer applications got the green light from regulators and they will begin trading this morning. I asked Matt Hougan,

Our Company Reflexivity Research Has Been Acquired

Tuesday, January 9, 2024

Listen now (5 mins) | To investors, We are announcing this morning that Reflexivity Research, a company that I co-founded with Will Clemente, has entered into a binding LOI to be acquired by DeFi

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these