Making things happen: activist investors flex their muscles

Making things happen: activist investors flex their musclesChange makers, FDJ/Kindred reaction, New Jersey’s surprising November +More

Change, like the sky, like the leaves, like a butterfly. Change makersHigh-profile activist investor efforts are reshaping the sector. Chalk ’em up: There is no denying the impact of activist investors in the betting and gaming space after two high-profile ‘wins’ for those hoping to reshape and reposition key players in the space, setting the scene for more actions in 2024.

Can you feel it now? Penn Entertainment, 888, PointsBet and Bragg Gaming are four further recent examples where activist investors have gone public with complaints about strategic directions – highlighting how investors feel emboldened in thinking they can effectively agitate for change.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Activists on the marchChange is gonna come: The success of Eminence and Corvex in their campaigns at Entain and Kindred respectively comes against a backdrop of a wider increase in shareholder activism in the past year. This is backed up by two recent surveys.

Notably, the report found that in Europe two-thirds of first-timer campaigns focused on challenging announced M&A transactions or advocating for sale/divestitures as a path to unlock value; while the number of board seats won globally rose 13% YoY to 122.

Laying the foundations: A second report from experts at consulting firm Alvarez & Marsal put some flesh on the numbers, suggesting the foundation has been laid for further activist campaigns in the year ahead. Fix you: Its Activist Alert Outlook for 2024, published earlier this month, suggested that among the six major themes that would drive an increase in activist campaigns this year was a strategy of pushing for M&A actions and, while the deal market remains subdued, the campaigns often have a mindset of “if you can’t sell, fix.” This plays into the other themes identified by A&M, including:

A seat at the tableBoard games: Until yesterday’s news from Kindred, the most outwardly successful activist campaign concerns the troubled Entain after it recently gave shareholder Eminence Capital’s CIO Ricky Sandler a seat on the board and apparently a substantial say on who will be the next CEO.

Similarly, hoping to influence events from the top table is HG Vora, which is seeking at least a couple of board posts at Penn Entertainment – and has said it is willing to go the proxy battle route should it not get its way.

Check the guy’s track record: Sources close to HG Vora’s thinking suggested the company is worried about the board’s track record on capital allocations, given what it sees as the value-destructive acquisitions of Barstool Sports and theScore. It is now worried Penn will “fumble the ball” from a promising start with ESPN Bet. Disruption aheadRumble fish: As noted earlier, the suspicion is that 2024 will see more activist investor actions. According to one fund source, the economic backdrop has changed to such an extent that boards and management are now more constrained and unable to buy their way out of trouble.

Gloss paint: Under the circumstances that occurred at the time of the pandemic, some “very, very bad decisions were glossed over when times were good. “And when all of that is laid bare suddenly, there’s a bigger demand for accountability,” said an advisor source.

The hindsight fund: This is where the activists step in. With the era of cheap money in the rear-view mirror, 20/20 hindsight is a powerful force and investors – particularly activist investors – have it in abundance.

FDJ/Kindred reactionThe state we’re in: Titling their reaction to the news of FDJ’s $2.8bn all-cash offer for Kindred ‘L’etat c’est moi’, the team at Regulus highlighted the importance of FDJ’s position as a lottery monopoly as the company moves to try and cement a stronger position in its home market. Bolster: FDJ, the analysts contended, has a “desultory” ~11% share of the competitive online French market “despite being able to leverage a strong brand, ubiquitous distribution, lottery cash flow,and a land-based betting monopoly.”

Prêt à porter: Adding Kindred’s ~12% share of the market – while not enough to raise competition concerns – would give FDJ a “compelling” 23% of the market. “Kindred is therefore a perfect fit for FDJ in France,” the team added.

Française des-truction: Despite the $2.8bn price tag, Regulus suggested adding Kindred to FDJ produces only a 17% revenue increment – FDJ delivers ~€6.6bn in annual revenues and €600m in EBITDA. “The acquisition is therefore relatively low risk and easy to digest financially for FDJ,” they ssaid.

Sportsbook operators & providers - Are you looking to up your risk management & trading game in 2024? Set a meeting with Matchbook at ICE 2024 February 6th-8th to discuss any of the following:

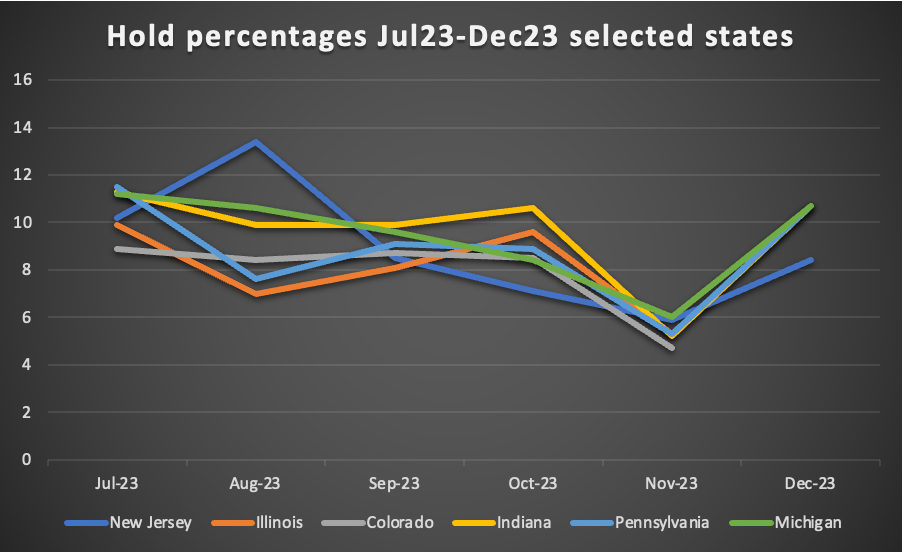

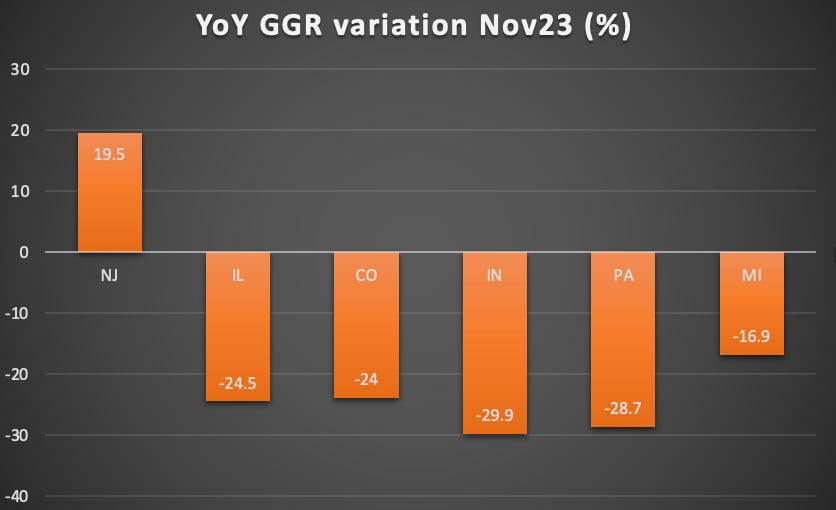

Matchbook B2B - Because the best price is for everyone. Visit http://www.matchbook.com/promo/b2b or get in touch at b2b@matchbook.com New Jersey’s surprising NovemberThe hold steady: Hold in November in New Jersey tracked the weakness seen across the market. No surprises there. After all, sporting results are results across the board. 🏈 New Jersey hold tracks the rest of the market Against the odds: Yet, as the team at Deutsche Bank noted, New Jersey’s monthly handle notably outperformed the peer group and was the cause of a “material outperformance” in GGR.

🔥 New Jersey outperforms on GGR growth in November +More analyst takesMacro: “Net-net, the macroeconomic outlook for gaming doesn’t look particularly great, but we don’t think it looks particularly grim either,” said the team at Truist in a recent analysis of trends in REIT investment.

Rate my goal: Given the rate environment, the team said they expected most companies in the gaming space to continue deleveraging. “Most economic forecasts show rates continuing to decline, though we think much will depend on how economic data presents over the next quarter,” they suggested.

Calendar

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs. EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Kindred accepts $2.8bn cash offer from FDJ

Monday, January 22, 2024

FDJ Kindred offer, Flutter's dual-listing boost, New Jersey data dive, startup focus – Testa +More

Caesars opens up the toga

Friday, January 19, 2024

Caesars' preliminary earnings, By the numbers – PA and MI, Flutter analysts reaction, Product+More – Sportradar's Alpha Odds +More

FanDuel shrugs off football hit

Thursday, January 18, 2024

Flutter trading statement, 888 reaction, analyst 2024 outlooks +More

888 promises bright new dawn

Wednesday, January 17, 2024

888 trading update, DraftKings downgrades, Flutter and Caesars takes +More

No pressure: Entain awaits its new boss

Tuesday, January 16, 2024

What next for Entain? M&A in 2023 +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these