The New Players Won't Act Like The Old Players

To investors, The new capital flowing in the crypto industry from Wall Street and traditional investors will not behave like the capital that has been here for years. Let me explain. These new investors have different goals. They are not luddites. While the memes and narratives may be fun, these investors are more likely to manage their portfolio based on spreadsheets and academic theories. One good example is portfolio rebalancing. If a financial advisor allocates 1% of their client’s assets to bitcoin, and then bitcoin triples in price, many times the advisor will sell some of the client’s bitcoin to bring the portfolio allocation back to 1%. This activity would be blasphemous to hardcore bitcoin holders. They believe you should never sell your bitcoin. It doesn’t matter how large of a percentage the bitcoin position becomes. Hold what you have and then buy more. That is not how professional money managers operate though. Rebalancing is a core strategy that they use, regardless of whether you agree with it or not. This is important to understand because the new segment of investors will introduce net new selling pressure to the market as bitcoin’s price rises. There will also be cyclical times of year where rebalancing is more popular than others. Rebalancing is not the only behavioral difference either. Many of the sophisticated investors who will begin allocating to bitcoin or cryptocurrencies will choose to use derivatives instead of spot bitcoin. This introduces a new avenue for capital to enter the market without actually purchasing real bitcoin on a dollar-for-dollar basis. It also introduces new ways for large pools of capital to short the market as well. Lastly, many of the investors from the traditional world have morphed into passive indexers. They want to make market selection decisions, not asset selection decisions. This rise of passive investing is highly debated, but the numbers show that it is becoming a dominant approach to capital allocation. As those investors begin allocating to the new world, many of them will want a carbon copy of their traditional strategy. They want an index of the market, which will put some capital into bitcoin — just not all of it. The arrival of Wall Street and traditional investors should be celebrated. Tens of billions of dollars will flow into the industry that was previously on the sidelines. Just don’t buy the story that 100% of that capital is going to plow into bitcoin, nor will it all be investors going long. When the ground shifts beneath an industry, you have to pay attention. The more you understand the new players, the better you will be positioned to understand the future. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Juan Meisel is the Founder & CEO of Grip Shipping. In this conversation, we talk about how he took his business from 0 to 8 figures in revenue, attacking an incumbent industry using innovation & technology, hiring, processes, and how the world is changing. Listen on iTunes: Click here Listen on Spotify: Click here My Appearance on Bloomberg Television Yesterday Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Price Is Trying To Distract Everyone

Tuesday, January 23, 2024

Listen now (3 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

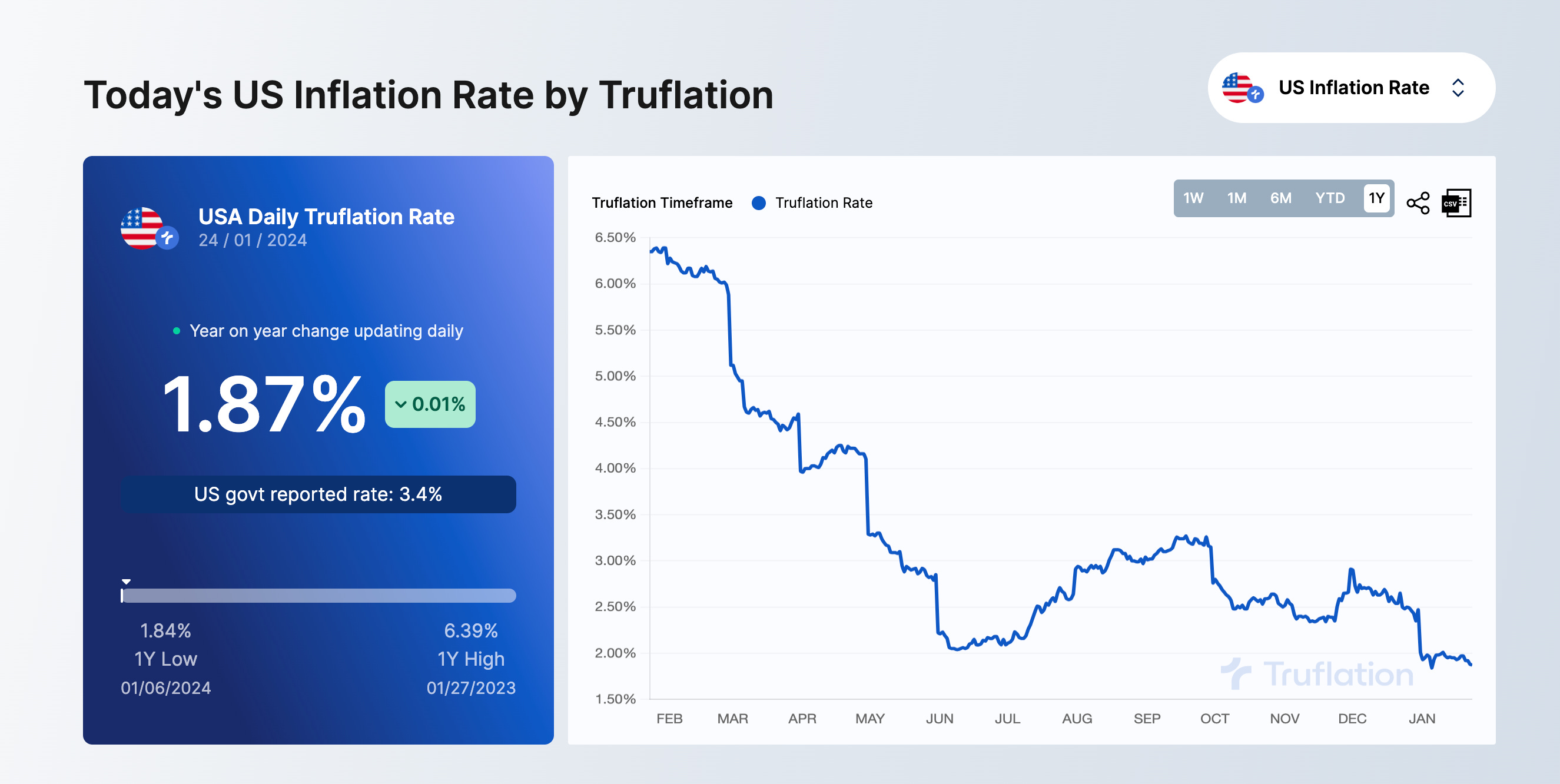

What If The Fed Already Won The Fight Against Inflation?

Monday, January 22, 2024

Listen now (5 mins) | Today's letter is brought to you by ResiClub! ResiClub is the leading publication for the residential real estate market. Housing affordability is the worst that it has been

Podcast app setup

Sunday, January 21, 2024

Open this on your phone and click the button below: Add to podcast app

Bitcoin ETFs Receive Billions, But Price Goes Down?

Friday, January 19, 2024

Listen now (4 mins) | Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative

World Leaders Share Their Perspective On Markets

Thursday, January 18, 2024

Listen now (4 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these