The Chinese Are About To Give A Gift To The World

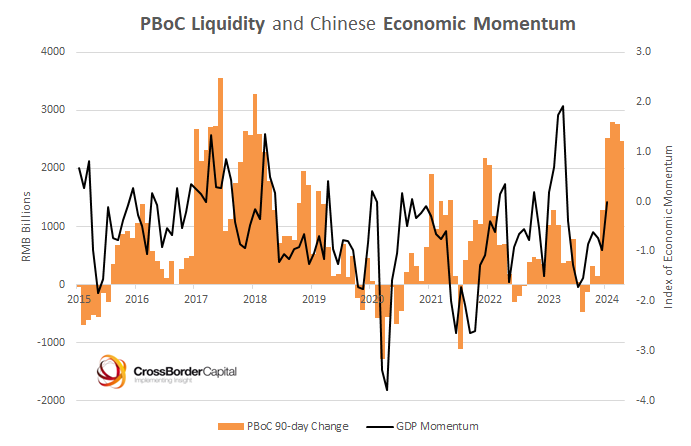

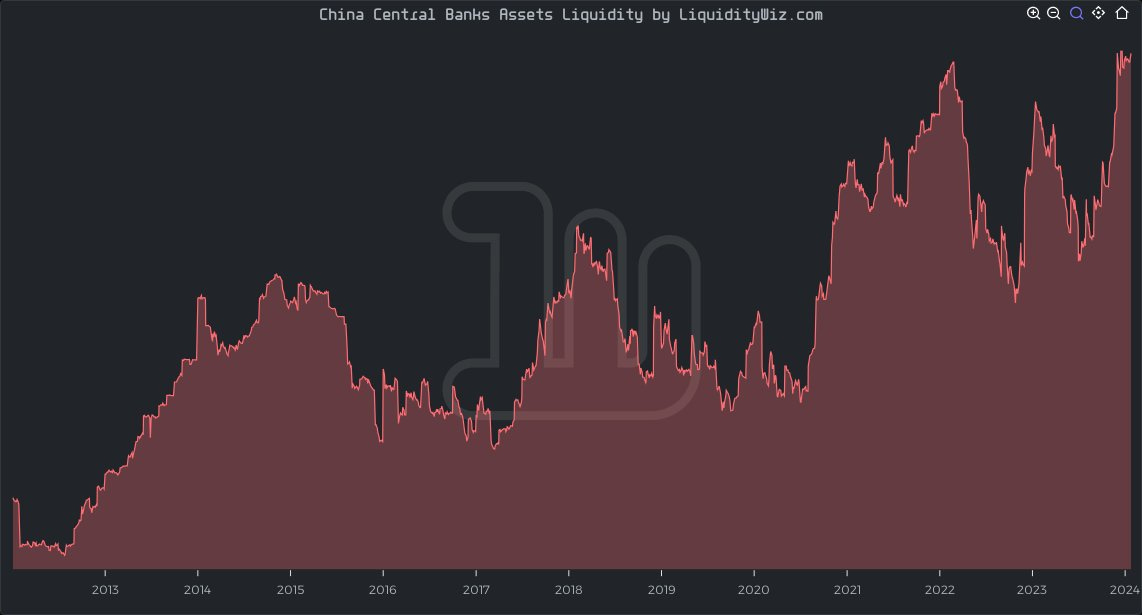

READER NOTE: I am hosting a webinar tomorrow morning at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a massive amount of data, charts, and graphs to explain the US economy, inflation, the global liquidity situation, and where I think various asset prices are going in the next 24 months. You can join us by becoming a paying subscriber here. I will send out the Zoom link to all members in the morning. Thank you. To investors, Kyle Bass shot to national fame when he correctly predicted the US housing crisis that kicked off the Global Financial Crisis. He was on CNBC yesterday claiming that recent problems out of China are “like the US financial crisis on steroids.” Bass has been critical of China’s economy for years. His point recently is that the two largest property developers in the country, Evergrande and Country Garden, have more than $500 billion in debt combined. That is a very big number, especially when you consider that these two companies have been large drivers of the Chinese economy in recent years. In fact, Bass argues that “when the Chinese ‘miracle,’ and I put the ‘miracle’ in quotes, when the Chinese ‘miracle’ was running its course…the substantial majority of Chinese GDP growth was real estate and the concentric circles that surround real estate. And now you’re having a reversal after an unregulated and unabated climb in real estate, and now you’re seeing a real estate collapse…they have three and a half more times banking leverage than we did going into the crisis.” If the American investor’s analysis is right, China is headed towards a gnarly situation. China disagrees though. For the last few months, the country has been manipulating the liquidity in their economy to prevent a collapse in financial markets. They cut banking reserves back in January and added more liquidity via reverse repos last night. There was even multiple inflection points in the last 24 hours based on various comments or actions from different Chinese officials and organizations. Why are they working so hard to keep liquidity high? As the folks at Crossborder Capital pointed out, China’s increasing liquidity creates positive GDP momentum. This development in China is worth paying attention to because it is the exact opposite of what is happening with America’s Federal Reserve. China is easing and pumping liquidity into the market, while America is tightening and trying to drain liquidity. The battle of liquidity on a global scale will ultimately determine what happens to your investment assets. Too many investors in the western world get overly focused on the Federal Reserve, while ignoring the liquidity decisions of foreign central banks. The US is still the top dog, but countries like China have a significant impact that can overwhelm the US in certain situations. These two countries are not always at odds with each other. As you can see here, China has been growing their central bank balance sheet at a rapid rate similar to the US over the last 15 years. The short-term trend is to expect higher volatility (China’s small and mid-cap stock index is down 25% year-to-date), but the long-term trend is obvious: asset prices are going to go up for the next few decades as central banks monetize their debts around the world. Don’t get distracted by only watching the United States and western central banks. They may be still tightening at the moment, but there is trouble brewing in the eastern world. This is going to bring an estimated $2 trillion of liquidity into the market. If that happens, investment assets globally will likely benefit. We live in a digital, hyper-connected world today. Your local geography can have an impact on you, but the global liquidity situation is the final boss. And it appears the Chinese are about to give a gift to the world. Hope you all have a great day. I’ll talk to you tomorrow. -Anthony Pompliano READER NOTE: I am hosting a webinar tomorrow morning at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a massive amount of data, charts, and graphs to explain the US economy, inflation, the global liquidity situation, and where I think various asset prices are going in the next 24 months. You can join us by becoming a paying subscriber here. I will send out the Zoom link to all members in the morning. Thank you. Peter Diamandis is the Founder & Executive Chairman of the XPRIZE Foundation, which leads the world in designing and operating large-scale incentive competitions. He is also the Executive Founder of Singularity University, a graduate-level Silicon Valley institution that counsels the world’s leaders on exponentially growing technologies. In this conversation, we talk about XPRIZE, longevity, importance of health span & life span, artificial intelligence, bitcoin, and more. Listen on iTunes: Click here Listen on Spotify: Click here My Conversation with Peter Diamandis on Longevity, AI, Bitcoin, and XPRIZE Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Fed Chairman Admits Mistakes & Predicts Economy Strength Moving Forward

Monday, February 5, 2024

Listen now (5 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

Tether May Be The Best Business In The World

Thursday, February 1, 2024

Listen now (4 mins) | Today's letter is brought to you by ResiClub! ResiClub is the leading publication for the residential real estate market. Housing affordability is the worst that it has been

Pomp Letter Webinar — Next Wednesday

Wednesday, January 31, 2024

To investors, Understanding the economy and financial markets is essential to allocating capital effectively. I spend hours per day researching what is going on, while trying to decipher where the

The Fed Should Cut Interest Rates Today But They Won't

Wednesday, January 31, 2024

Listen now (3 mins) | To investors, The Federal Reserve is conducting their first meeting of the year today. The market expectation is that the Federal Open Market Committee will keep interest rates

Politicians & Central Bankers Need To Get On The Same Page

Tuesday, January 30, 2024

Listen now (4 mins) | Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these