The Fed Should Cut Interest Rates Today But They Won't

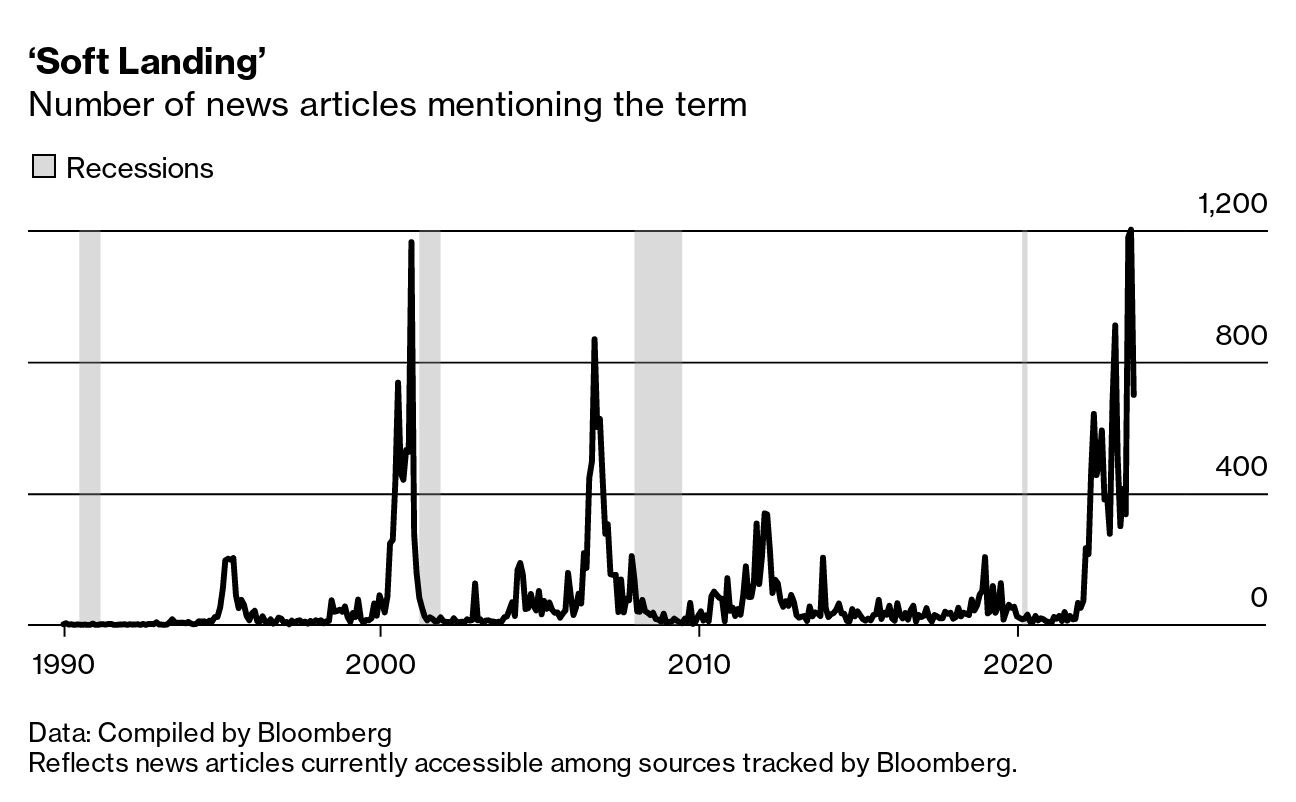

To investors, The Federal Reserve is conducting their first meeting of the year today. The market expectation is that the Federal Open Market Committee will keep interest rates unchanged. I believe this could be a mistake. The current CPI reading shows 3.4%, which is more than 50% higher than the Fed’s stated target of 2%. From this perspective, the Fed has a 0% chance of cutting interest rates. They want to win the war on inflation and get back to the target. The CPI data could be wrong though. Truflation, the leading alternative economic data provider, shows inflation at just under 2% already. From this perspective, the Fed would have already achieved their target, could claim victory, and should be cutting interest rates now. But the Fed doesn’t use Truflation data. The argument to the Federal Reserve has to be rooted in a different angle. You could argue that the real interest rate of the economy is increasing as CPI falls. You could argue that private payroll growth has slowed worse than expected. You could argue that the explosion of articles arguing for a “soft landing” is actually an indicator of a looming recession. Regardless of which angle you take, the Federal Reserve is unlikely to listen. The data they look at is telling them a different story. Jeanna Smialek from the New York Times explains:

Those numbers look strong. But remember, that data is backwards looking. It tells us what already happened, not what is about to happen. This highlights the problem with most human-led monetary policy decisions. No one knows what is going to happen in the future. We saw the negative side-effect of this during the pandemic. The Fed continued to tell us that inflation was transitory. They took too long to act and inflation eventually went over 9% in the economy. This overshoot of inflation was a direct cause of a misunderstanding of how sticky inflation would be, along with a slow response to the data that showed inflation was growing aggressively. My concern is that the Fed is going to make the same mistake again. If they don’t cut interest rates soon enough, they risk overshooting to the downside and causing a recession. No one should want a recession to occur. So the Fed could wait a few more months before cutting interest rates, but they risk having to make extreme cuts very quickly if they are wrong. Instead, they should do a 0.25% interest rate cut today to start slowly pushing us back towards a lower interest rate. Extreme reactions should be avoided. Looking forward, not backwards, should be the name of the game. The Fed got inflation down and we should give them their victory so they don’t repeat their mistakes of the past simply to pursue a reputation achievement. I don’t think we get the rate cut, but at least I am on record now saying that we should. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Leif Abraham is the Co-Founder & CEO of Public.com. They are creating technology that makes building a multi-asset portfolio fast, secure, and frictionless. In this conversation, we talk about the shift in investing trends, bitcoin ETF, technology vs financial advisors, giving revenue back to users, and operating the business. Listen on iTunes: Click here Listen on Spotify: Click here My Conversation with Public CEO Leif Abraham Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Politicians & Central Bankers Need To Get On The Same Page

Tuesday, January 30, 2024

Listen now (4 mins) | Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative

The National Debt Promises You Lots Of Investment Opportunities

Monday, January 29, 2024

Listen now (3 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

On-Chain Audits & Rules Are Going To Dominate Future

Thursday, January 25, 2024

Listen now (4 mins) | Today's letter is brought to you by Frec! The wealthy have used a secret strategy to make money and save on taxes for decades — direct indexing and tax-loss harvesting. The

The New Players Won't Act Like The Old Players

Wednesday, January 24, 2024

Listen now (2 mins) | To investors, The new capital flowing in the crypto industry from Wall Street and traditional investors will not behave like the capital that has been here for years. Let me

Price Is Trying To Distract Everyone

Tuesday, January 23, 2024

Listen now (3 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these