The Pomp Letter - The Bitcoin ETFs Are Sounding The Alarm

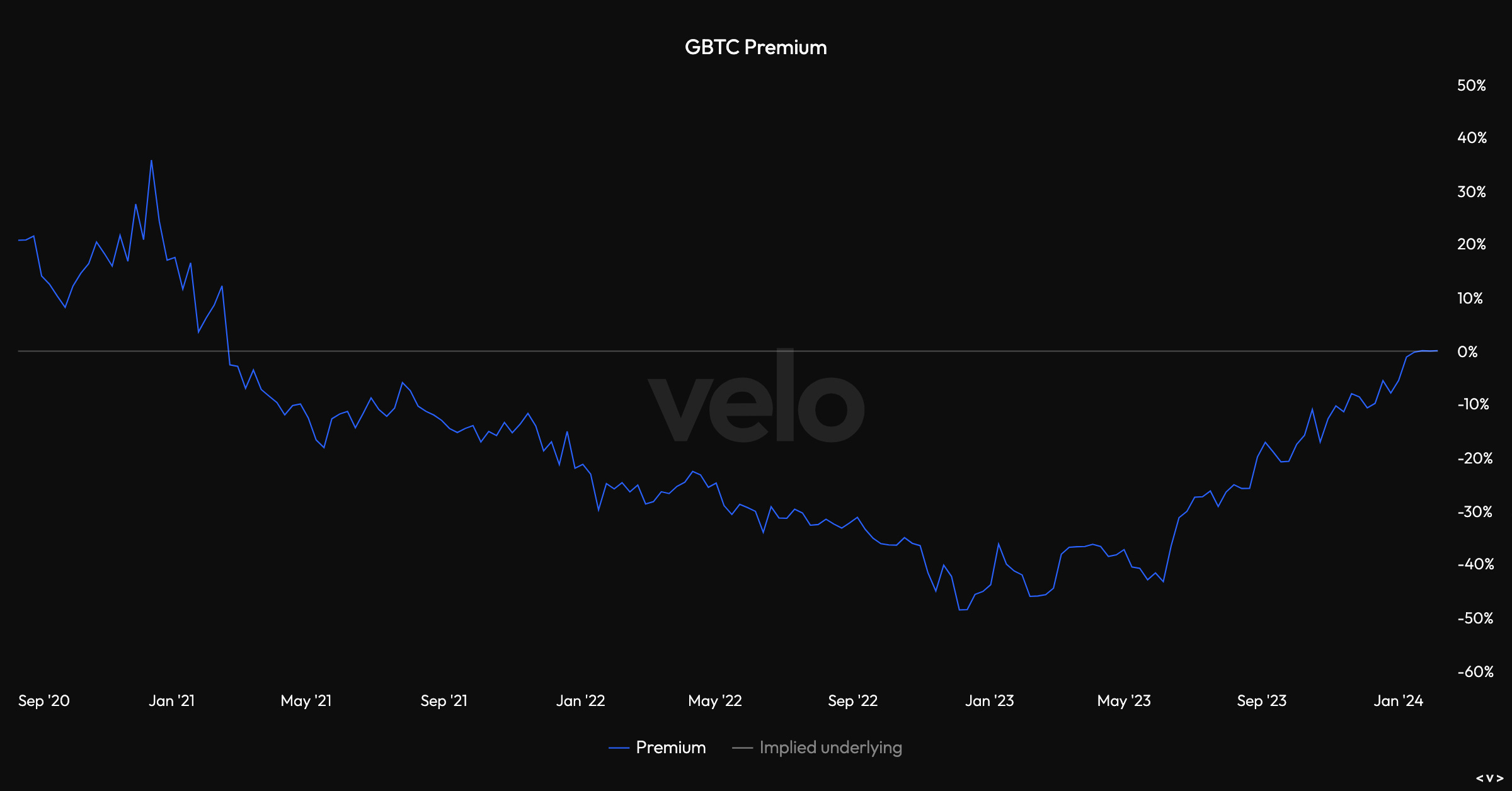

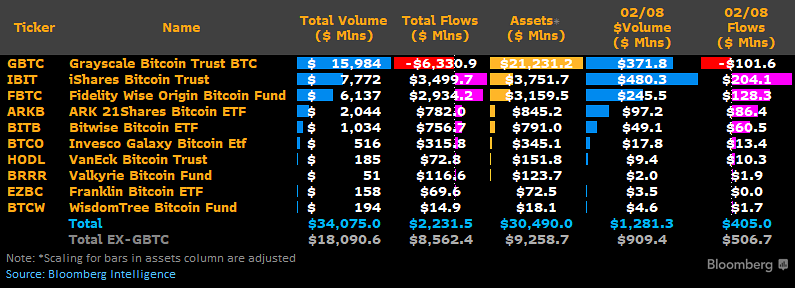

READER NOTE: Today’s letter is exclusive for paying subscribers of The Pomp Letter. I have unlocked the first half of the letter for everyone, but if you want to see the full analysis then please consider becoming a paying subscriber. To investors, The bitcoin spot ETFs were approved one month ago. The 90 days leading up to the approval had seen an approximately 80% increase in the price of the digital currency. Expectations were high. The luddites online were claiming a new all-time high was right around the corner. Once the SEC gave the green light, bitcoin would skyrocket — at least that was their argument. None of that happened though. The ETFs were approved and bitcoin’s price dropped quickly. We went from around $47,000 to under $40,000 in less than two weeks. All the excitement leading into the approval was actually just a classic “buy the rumor, sell the news” event. But what was driving that significant price drop? Investors were selling shares of GBTC in droves. Many of these investors had been holding on to GBTC for years. The fund historically traded at a premium to NAV. The premium was as high as 35% in Q4 of 2020. Once the premium flipped to a discount though, things got nasty. The GBTC discount to NAV reached almost 50% at one point. The SEC’s approval of a spot bitcoin ETF, including Grayscale’s conversion of their fund to a spot bitcoin ETF, closed the discount gap back to 0% essentially. Once that discount disappeared, investors sold more than $6 billion in GBTC shares. That is more than 20% of the fund. A big reason is that Grayscale refused to play the fee war game and left their management fee at 1.5% (down from 2%). There are still about $100 million per day leaving GBTC, but it appears the higher fee was a good financial decision if you are optimizing for short-term revenue. But don’t worry — there is a lot of good news in the market for bitcoin holders. There is a MASSIVE market structure setup that is likely going to send us to new all-time highs. The rest of today’s analysis on this market structure is exclusive for paying subscribers of The Pomp Letter…... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Shrinkflation Has Seeped Into The Housing Market - What You Need To Know

Thursday, February 8, 2024

Listen now (6 mins) | Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by

Is Ethereum Going To Be The AOL of Crypto?

Wednesday, February 7, 2024

Listen now (3 mins) | Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for

The Chinese Are About To Give A Gift To The World

Tuesday, February 6, 2024

Listen now (3 mins) | READER NOTE: I am hosting a webinar tomorrow morning at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a massive amount of data, charts, and

Fed Chairman Admits Mistakes & Predicts Economy Strength Moving Forward

Monday, February 5, 2024

Listen now (5 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

Tether May Be The Best Business In The World

Thursday, February 1, 2024

Listen now (4 mins) | Today's letter is brought to you by ResiClub! ResiClub is the leading publication for the residential real estate market. Housing affordability is the worst that it has been

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these