| About a year ago, I was speculating on what best-in-class NDR (net dollar retention) would look like in the years ahead. The implication was that best-in-class NDR would bottom out at 115-120% post-ZIRP. The tried-and-true rule for a few years was that best-in-class NDR for the top companies was >130% and often >140%. Since the pendulum has swung so far so fast into the opposite direction, it’s super important for all of us to have the most up-to-date numbers when benchmarking company performance. This past week provided a much better view into this with Datadog and Monday.com releasing earnings. Let’s dive into the data which happens to be almost 1 year after What’s 🔥 #329 (Where will best in class Net $ Retention land in 2023?) The two big questions are whether we are at bottom yet in the cycle, and if we are at bottom, how much will these numbers bounce back? As readers know, during the ZIRP era many companies bought seats/licenses/infrastructure well ahead of growth, buying more than needed. The theory is that with annual renewals mostly done, we are close to bottoming out on downsells and churn and that any new customers who bought recently bought at the right levels and that eventually these numbers will start moving 📈 again. Tom Loverro from IVP thinks we are almost there. If you’re looking on an LTM basis, maybe it does dip for a little bit more here but my guess is the actual nadir on a shorter measurement period is behind us.

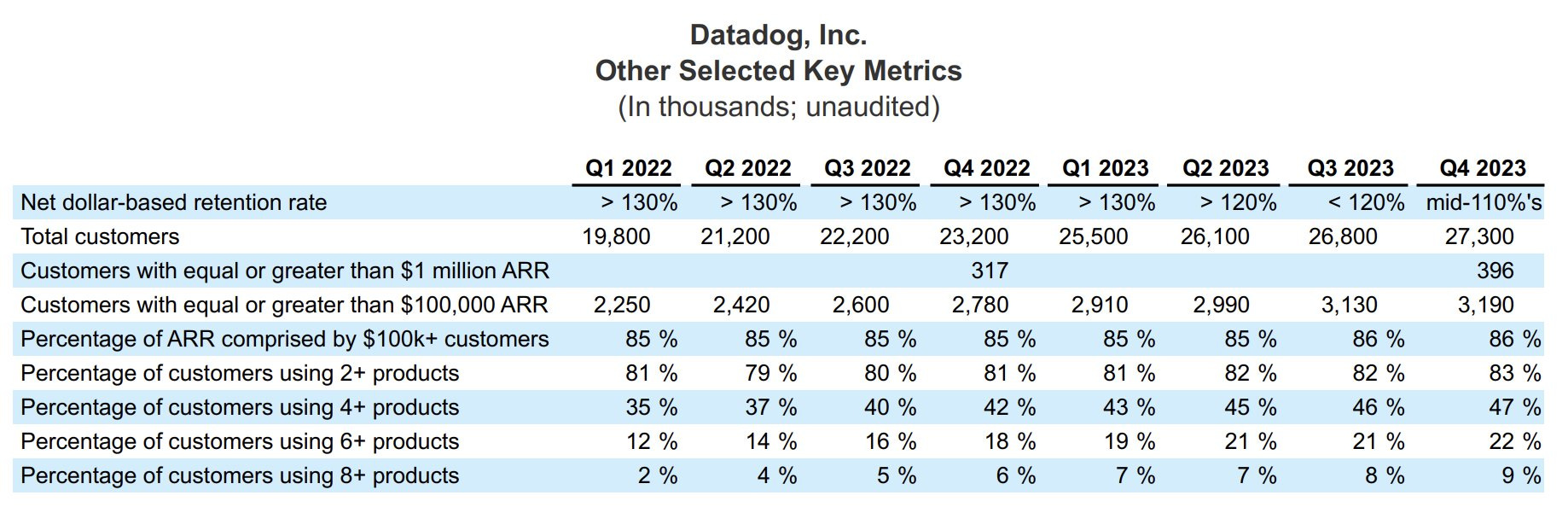

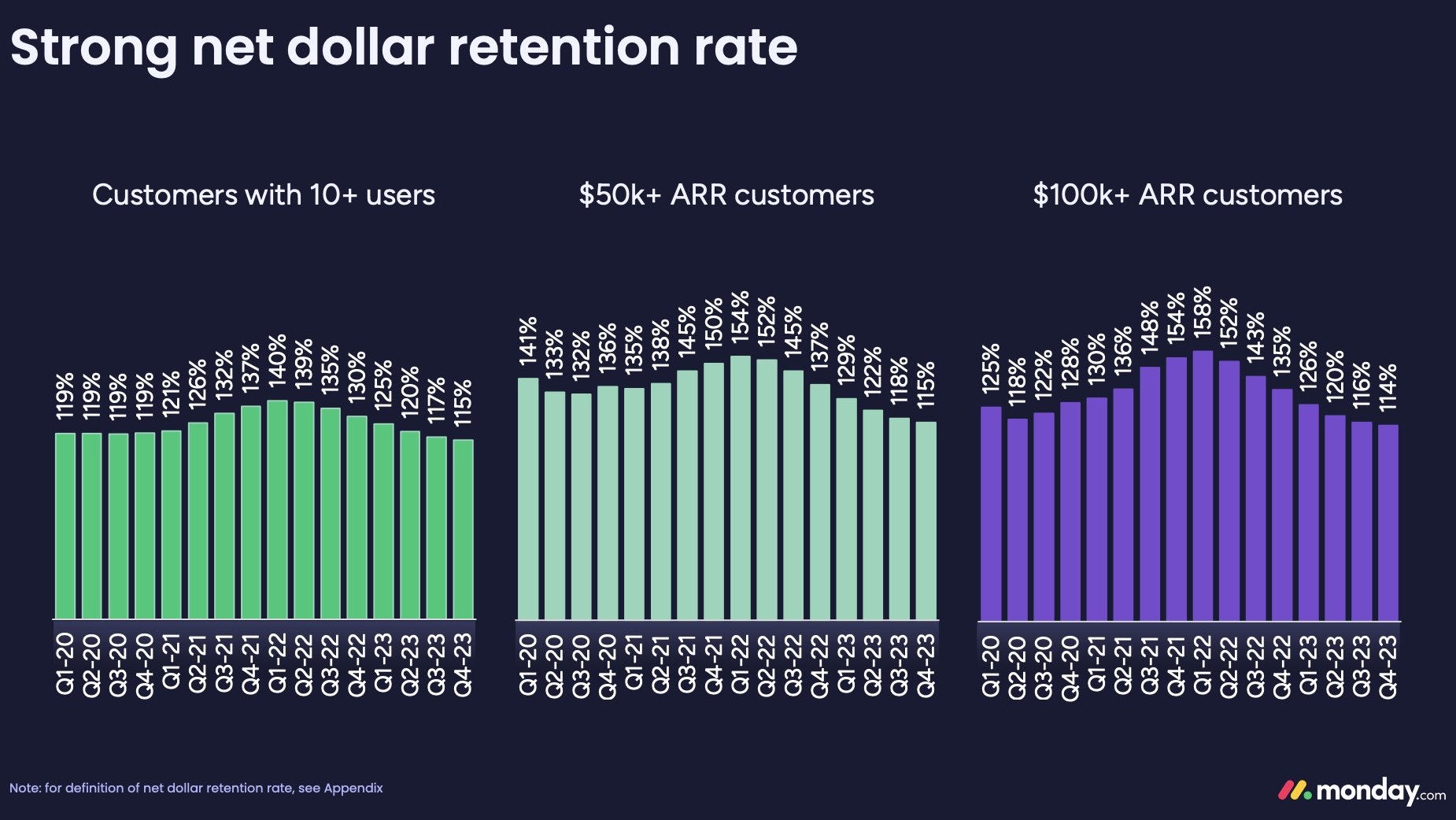

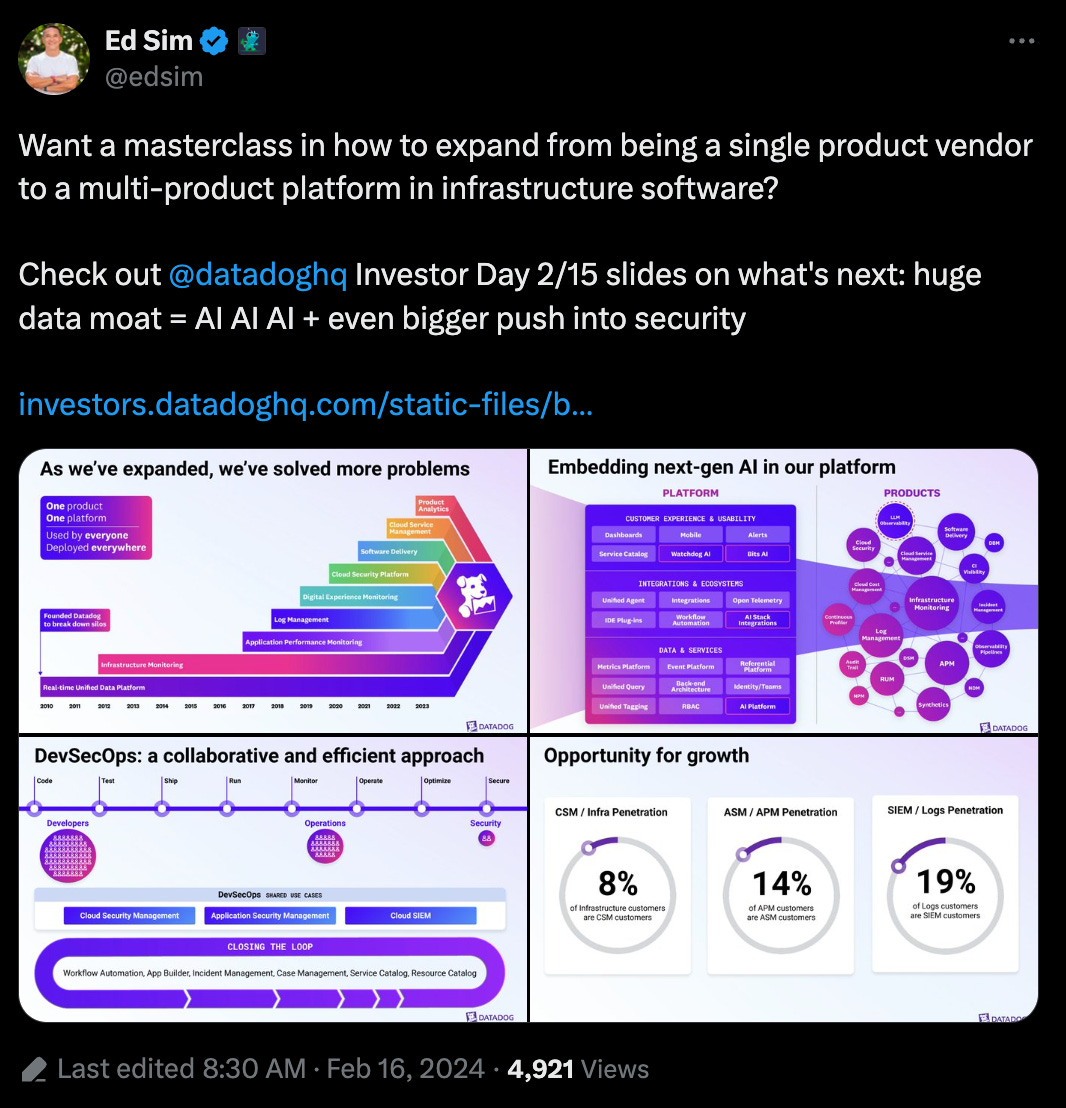

Let’s take a closer look at Datadog - you can see the steady 📉 from >130% to mid-110% this past quarter. You can find the financial appendix here. Next up is Monday.com. Once upon a time NDR was >150% for customers >$50k and during the last year it has trended back down to 114-115%. Overall NDR for all customer segments is at 110% (presentation here). As far as NDR bottoming out, here’s what Monday.com’s CFO had to say: Revenue for fiscal year '23 was 729.7 million, up 41% from the prior year. Our overall net dollar retention rate declined slightly in Q4 '23 to 110%, reflecting continued macroeconomic headwinds. We currently anticipate reported NDR to begin to recover in the second half of fiscal year '24. As a reminder, our net dollar retention rate is a trailing four-quarter weighted average calculation.

I tend to agree with Monday’s outlook - feeling like we are almost at the bottom and ready to see where normal is. Reminds me of that Drake song from a decade ago…  As always, 🙏🏼 for reading and please share with your friends and colleagues.

Startup comms 101 🧵 from Lulu Cheng Meservey (ex-Activision & substack) - going direct is 100% way to go The best time to pivot your comms strategy from media to social media was three years ago. The second best time is now.

It’s crazy in 2024 to see companies still prioritizing press ahead of social. Do they use LotusNotes too?

Every company and CEO should be going direct to their audience instead of relying on the media to do it for them — here’s why.

The world has changed. People now get most of their information from social platforms. Trust in social is rising while trust in media is falling. And that’s most pronounced among young people, ie the top audience for tech companies…

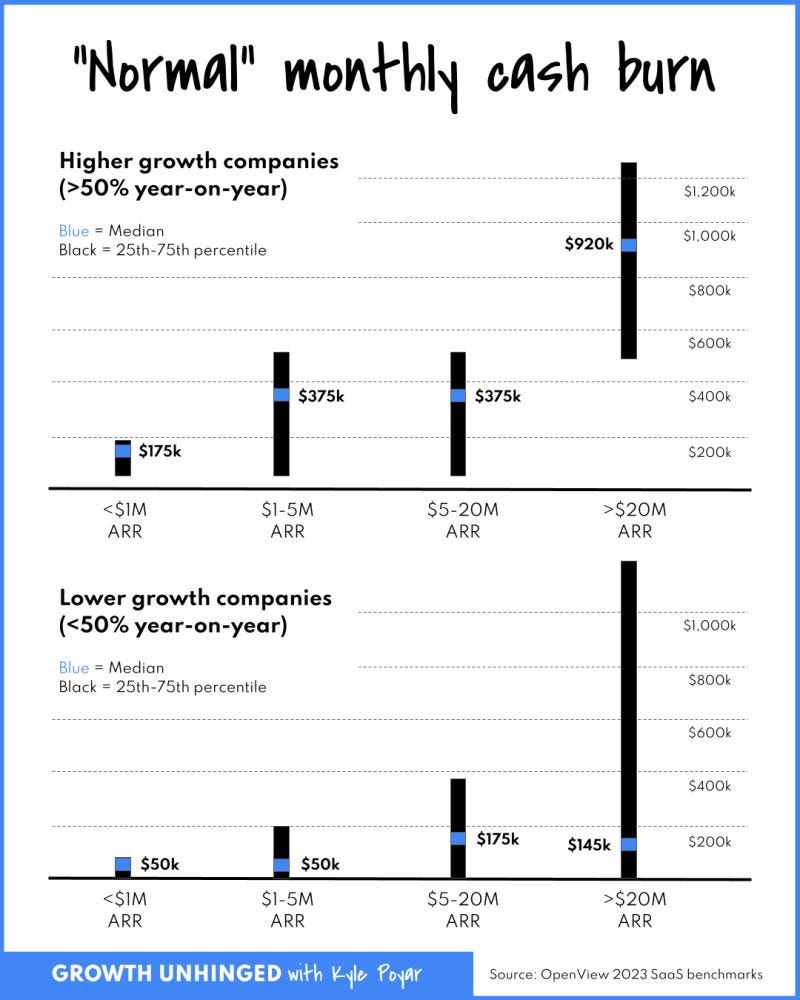

On Series A rounds and what to expect when raising from Nakul Mandan of Audacious Ventures…must read 👇🏼 💎 from Kyle Poyar of Growth Unhinged - while there is no one way to do things, seeing data from 700 SaaS startups is helpful What's a "normal" burn rate for a startup? ⤵

Here are benchmarks from 700+ SaaS companies.

A few observations:

1. There is no optimal burn rate.

- What's healthy for one business might lead another startup to run out of cash.

- Consider the level of cash on hand & confidence that any investments will leave the business better off.

2. What's "normal" today looks wildly different from 2021/2022.

- Median burn rates are down materially year-over-year.

- The biggest decreases are among SaaS companies with $5M+ ARR & especially those with $20M+ ARR.

- The median monthly burn rate for a $20-$50M ARR biz fell from $1.5M (2022) to only ~$100-150k (2023).

3. "Normal" depends on your size and growth rate.

🙏🏼 Mehdi for sharing my framework for being the right board member for founders There's a powerful framework I learned from our board member Ed Sim. He calls it the "3 Chs" and uses to manage the emotional aspects of the founder/investor relationship.

Having been on the receiving end of the "3 Chs" for the past 4 years, I can confirm that it works. Not only it helped build founder/investor trust but it also had a huge impact on my resilience as an entrepreneur.

More than that, I've found that the "3 Chs" proved to be a surprisingly good way to lead a team. With this framework, I was able to push my teammates to surpass themselves while showing them that I was supportive and engaged.

So... here's how it works. The "3 Chs" is basically knowing when to:

cheer 👏🏼 challenge 🧑🏫 chill 😎

More here…

Power Law rule in venture based on data from Correlation Ventures - it’s not the 80/20 rule but even more concentrated at 80/12 rule or 90/20 rule where 80-90% of all profits in a given year driven by 12-20% of invested dollars - chart here

👇🏼 masterful - read 🧵 YC call for enterprise startups in its new class ranging from: Fast follow A for LangChain (framework to build LLM apps) after $10M seed - $20M A led by Sequoia at $200M Post (Forbes) Investor interest developed quickly. In February, he raised a $10 million seed round led by Benchmark. By the time LangChain announced that raise in April, Chase had already closed another one: $20 million from Sequoia, valuing the company at $200 million, as first reported by Business Insider just a week later and now confirmed by Chase and the firm to Forbes. Amplify Partners, Conviction and Lux Capital also joined the round.

Today, LangChain (the open source project) has 2,000 contributors on GitHub, a popular code repository; more than 50,000 companies make use of its code. For now, they connect it mostly to OpenAI’s standard developer kit; at Sequoia, Huang noted that at least early on, monthly downloads of its tools (a combined 7 million) mapped almost one to one with OpenAI’s SDK.

Readers know how excited I am about AI on the edge - “AI drives explosion in edge computing” (Axios) Driving the news: Intel, AWS, Nokia and Ericsson announced collaborations Feb. 12 to deliver edge AI services for manufacturing plants, transportation hubs such as ports, and other complicated sites — such as the ancient Chichen Itza temple in Mexico…

On the heels of What’s 🔥 #380 from last week on what the cybersecurity market will look like in 2024, here’s another Israeli exit - company raised a $16M seed round and while acquired by F5 and not one of the big 4, this is the trend that will only accelerate! (CTech). I don’t know how many API security companies there are but I can recall at least seeing 10 of these in the last few years with NoName and Salt being the leaders. API security startup Wib acquired by F5 for tens of millions of dollars The Israeli startup’s platform provides complete visibility across the entire API landscape, from code to production, and will become part of F5’s Distributed Cloud Services

Architectural patterns for AI-related products - Multiple LLMs in enterprise workflows - not one model to rule them all - definitely the future as folks migrate from experimenting with OpenAI and moving to production - this is from @ZoomInfo earnings call with respect to its CoPilot - OpenAI, Anthropic, + roll your own Sierra raised $110M Series A from Sequoia and Benchmark - Brett Taylor, former Co-CEO of Salesforce, unveils what they are doing - enterprise bots…and yes, the architectural pattern they describe is similar to ZoomInfo…(Fortune) Sierra uses a mix of customized AI models In a departure from the conventional Silicon Valley playbook, Sierra is actually building the AI agents for customers, rather than just selling the tools for customers to do it themselves. It’s a business model that may not scale as rapidly, but the idea is that many companies, even very large ones, don’t have the in-house resources, expertise, or desire to take on this kind of complex project.

“It's possible to build a couch by going to Home Depot and buying lumber and cushions and fabric and putting it together yourself,” Bavor said. “Most people just want to buy a couch.”

And given the risks to a company’s brand if an AI agent goes rogue, Sierra is betting that its expertise and experience will carry a lot of weight.

A typical agent based on Sierra’s technology uses four or five different AI models when it receives a message from a user – one of the models might generate a response, for example, while another model might be tapped to prevent hallucinations. Sierra uses a mix of proprietary and open source large language models, including frontier models from OpenAI and Microsoft that are tweaked by their team of researchers to fit a customer’s use case.

The company trains its AI models to reason and make decisions by giving them specific goals and guidelines, similar to how a person might follow rules for their job. This approach allows them to onboard new customers quickly without needing a lot of their data, Taylor said, and he believes this sets them apart because they can adapt to new policies or changes in a customer's needs much faster than traditional AI models, which might take weeks or months to update.

Steak 🥩 dinnahs close deals! Ali Ghodsi, co-founder and CEO of Databricks in interview (The Information) when asked if we will have same number of salespeople in coming years with AI productivity But in enterprise sales, I don't think there's a big change. Why? Because ultimately, how do you get the big bank to buy software for $20, $30 million dollars from you? It's a relationship thing. You have to go meet the CEO, you have to convince the [chief information officer] that it is good tech. You have to convince the security team that it's secure. It's a lot about human relationships. So that job actually doesn't change. If anything, it becomes more valuable.

Who wins the AI agent wars? Going deeper into stack at operating system is one way, and IMO there’s no better way to get cross functionality than to build them with deep hooks at OS layer - this from Microsoft Open Source is pure 🔥. BTW the idea that Microsoft is open sourcing this is even cooler. 🕌 FrameworkUFO operates as a dual-agent framework, encompassing: AppAgent 🤖, tasked with choosing an application for fulfilling user requests. This agent may also switch to a different application when a request spans multiple applications, and the task is partially completed in the preceding application. ActAgent 👾, responsible for iteratively executing actions on the selected applications until the task is successfully concluded within a specific application. Control Interaction 🎮, is tasked with translating actions from AppAgent and ActAgent into interactions with the application and its UI controls. It's essential that the targeted controls are compatible with the Windows UI Automation API.

Both agents leverage the multi-modal capabilities of GPT-Vision to comprehend the application UI and fulfill the user's request. For more details, please consult our technical report.

Consolidation in sales + conversational intelligence stack and how to think about for other competitive markets - this post from Santosh Saran, COO of Retention.com, went viral on LinkedIn with lots of interesting comments Why Salesloft’s acquisition of Drift signals the beginning of a nightmare-era for SaaS startups. Here's my analysis:

I see a lot of comments congratulating Salesloft and Drift on this brilliant merger. I have friends in both these companies and I have resisted congratulating them. To me, this is a merger that marks the beginning of many such mergers across all VC and PE portfolios that will play out in the next 1-2 years.

Let’s look at the two companies:

During the good times, Vista paid a high multiple for both these businesses.

Revenue multiple Vista paid for Salesloft (2022): 23x

Revenue multiple Vista paid for Drift (2021) : 17x [estimated]

Now, when the hard times hit - we know the company valuations have dramatically decreased, churn and downgrades have increased and the market has changed in a way that there’s no coming back from.

It’s no surprise that both Salesloft and Drift had layoffs in 2023.

The competitive landscape for both these companies don’t look great either.

Salesloft is in the Sales Engagement segment and Drift in Conversational Intelligence segment. While both the companies are market leaders in their category, they face stiff competition as product differentiation rapidly wanes.

On G2, there are 163 companies listed in sales engagement category and 169 companies listed in conversational intelligence. Both these categories are heavily commoditized.

I don’t think Salesloft or Drift are particularly faring well as competition continues to chew up their bottom end. It made sense for Vista to combine the two businesses and cut their losses, this will decrease some costs and potentially leverage new synergies, particularly around buyer-led growth. Individually, both of these businesses would have a hard time maintaining their leadership, however they have a better chance to justify the high multiples together. This also signal’s Vista’s lack of confidence in the businesses to fare well on their own.

Here’s why I worry:

There were a large number of PE deals done at astronomical valuations in the last few years. A lot of them are likely under water now. We will see several mergers like what Vista just orchestrated. This is a sign that the powers to be have given up on their ability to run these companies independently to justify the high multiples. Things can get much worse from here.

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. Pledge your support | |