| I can’t just seem to get cybersecurity out of my mind! On the heels of What’s 🔥 #380 laying out the dynamics of the cybersecurity industry where 5 companies generate over 1/2 the revenue, here’s another post in light of the Palo Alto Networks earnings release this past week. This chart below is all you need to know - $26 Billion of market value was vaporized in one day with a 29% drop in the stock price post-call. I’m not crying for the industry or PANW as cybersecurity spend continues to go 📈 and PANW is still worth $91B. That being said, PANW is about to share its pain by raining pain on the market with an aggressive Microsoft-like platform and bundling approach. So how will this affect cybersecurity startups, and who wins in the age-old debate of best-of-breed vendors or single platform players? Platformization is the standard Microsoft playbook but now Palo Alto Networks is amping up the game. Five years ago when we began our strategy, the industry believed building leadership across multiple categories wasn't possible. No one was talking about security platform. Instead, the word was best-of-breed. Our success over the last five years has been driven by the shift to platformization.

Startups and single product vendors get ready, PANW is coming for you. When they're not able to convince the customers that their strategy is competitive, they're many times resorting to un-economic pricing and putting pressure on transactions in this manner. We're beginning to see rogue behavior by some vendors in the space who are keen to retain their customers, primarily in the legacy vendor space and the start-up space. We intend to combat that with investing in this space and trying to accelerate platformization and consolidation for our customers.

As mentioned in What’s 🔥 #380, we do have way too many cybersecurity companies in too many categories as there are a dozen or more in areas like API security, CSPM (cloud security posture management), DSPM, and you get the picture. There will be no one dominant player in cybersecurity, but we do have to acknowledge that over 51% of the revenue for the industry just comes from 5 vendors 🤯 - Microsoft, Palo Alto Networks, Crowdstrike, ZScaler and Fortinet. The other 49% is covered by hundreds upon hundreds of companies, and I frankly don’t see either changing. PANW will get more market share but the market will also continue to grow, and there will always be new attack vectors and markets. In the short-term however, companies like the Wiz who have a killer CSPM product and others will I’m sure see elongated sales cycles as we enter this aggressive phase from PANW. Free for 6 months until existing contracts expire from competitive vendors is going to wreak havoc near-term without a doubt. We intend to answer this challenge. With all the problems that platformization holds, adoption is not always easy for many of our customers. Until now, we have primarily assumed that our customers adopt our platforms at their own pace. The crux of the challenge is around execution. Customers face risk in executing or making significant changes to the environments as well as economic exposure from these changes. Key friction points you've noticed include the challenge of replacing multiple products simultaneously as well as the issues around double playing while working through complex contract terms. Over the last six months, we have been quietly working to develop programs that enable us to help minimize and even share in the risk of our customers' face. You will see us tomorrow launching a significant number of platform offers to our customers to help drive the consolidation and platformization strategy. We believe we can build customer confidence in our platforms by approaching them well before their point product contracts expire. After we gain their contractual commitment, we have offered an extended rollout period where we can demonstrate our ability to deliver these platform benefits. Customers can then start paying us after the obligation of legacy vendors ends. With the experience we've gained over the last six months, we believe now is the right time to accelerate programs across our portfolio to drive this platformization. All these programs will have mechanisms to reduce customer friction, accelerate product deployment, help customer realize the value of our platforms, and consume new innovation sooner. While this is not an exhaustive list, I wanted to give you some examples. We have begun to launch programs already that include legacy trade-ins, no-cost introductory offers and product add-ons and incentives to accelerate estate standardization. Each of these programs is elements of reducing execution risk and dealing with economic exposure that concern our customers.

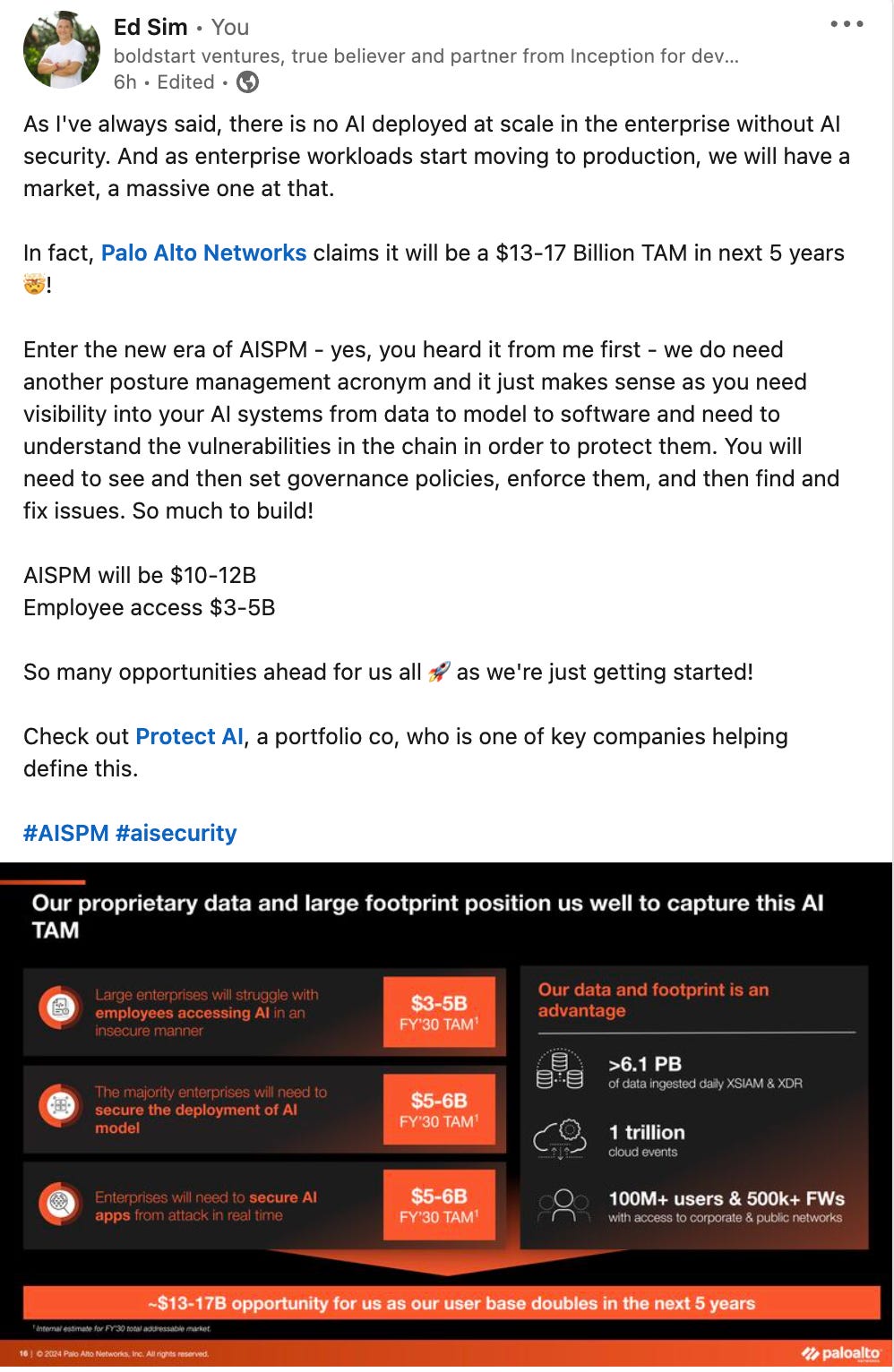

Nikesh Arora, CEO of Palo Alto Networks, also went directly on LinkedIn to share the platform approach, and I highly encourage you to read the comments as there are a number of bangers (click post to read more). Speaking of new attack vectors in cybersecurity, one interesting comment that caught my eye is PANW’s view on the size of the AI Security market. Readers know my mantra - there is no AI at scale in the enterprise without AI security. It’s awesome to see PANW be the first large scale vendor to plant a flag in the ground. There is no doubt that PANW is ready to define the market here, and I suspect they will make some moves. And brace for it, it’s time for AISPM! Yes, I know, does the world need another security posture management acronym like CSPM, DSPM, and ASPM and the answer is yes, and I’m coining it 💪🏼! We're also seeing increased demand for AI, along with deploying AI in our products or big needs to our customers asking us to help them protect for a successful and responsible deployment of AI in their infrastructure. Putting this all together, these trends of the market bolster our conviction that adopting platforms is the only viable strategy for customers and leveraging AI is imperative. We want to march faster to our aspiration to become the sales force, to become the service now, or the workday of cybersecurity. Customers have adopted platforms in other markets across technology, and this will inevitably happen in cybersecurity. These industry trends set up conditions that favor leaders that can drive consolidation.

I agree with Nikesh - the AI security market is going to be super important and huge. Here’s portfolio co Protect AI’s blog post owning AISPM, defining why it’s needed, and how it fits into a broader MLSecOps approach. Protect AI: Elevating Enterprise AI Security with MLSecOps and AISPM Integration Protect AI unleashes AISPM within the broader practice of enabling MLSecOps, offering enterprises a pathway to See, Know, and Manage their AI landscapes with unparalleled insights. Our comprehensive suite, includes Radar, the industry's first AISPM product and offers unprecedented visibility into the interconnected web of AI assets. This visibility, coupled with advanced risk management policies and security capabilities, empowers enterprises to proactively identify and mitigate potential threats before they escal ate. In addition to Radar's insights, Protect AI's Guardian ensures robust model security, while LLM Guard fortifies large language models against vulnerabilities. Together, these tools exemplify Protect AI's commitment to a holistic AISPM approach, enabling organizations to navigate the complexities of AI security with confidence and precision. By leveraging Protect AI's capabilities, enterprises can ensure their AI deployments are not only secure by design but also aligned with the evolving demands of the digital landscape, positioning them to capitalize on AI innovations securely, safely and meet compliance requirements.

As always, 🙏for reading and please share with your friends and colleagues.

How much dilution are founders giving up per round? (Pete Walker, Carta) Real dilution by venture round - data from 17,000 primary rounds since 2020.

The primary round note is important, as there are lots of bridge rounds, extensions, and all sorts of creative financing going on.

But in the standard venture alphabet round, here's how much founders are selling to investors:

𝗣𝗿𝗶𝗰𝗲𝗱 𝗦𝗲𝗲𝗱

• 20.6% median in 2023

• Nudging down from 2020, but flat from 2022

𝗦𝗲𝗿𝗶𝗲𝘀 𝗔

• 20.1% median in 2023

• Consistently notched downward over the past 4 years

𝗦𝗲𝗿𝗶𝗲𝘀 𝗕

• 17.6% median in 2023

• Bumped up from 17.1% in 2022

𝗦𝗲𝗿𝗶𝗲𝘀 𝗖

• 13.4% median in 2023

• Essentially flat from 2022

𝗦𝗲𝗿𝗶𝗲𝘀 𝗗

• 11.5% median in 2023

• Sizable rise from the 10.4% median in 2022

If you're looking for how much founders are selling through SAFEs and Convertible Notes, we covered that yesterday in a separate graphic. You can add in ~18% for a major SAFE round (over $2M) and 8-10% for a more minor SAFE round.

Founders, if you don’t run out of energy, there is a chance…from Dani Grant founder of Jam.dev which just raised an $8.9M A round led by GGV to help engineers record bugs and fix problems faster.

🔑 thought especially for dev and infra founders is that patience is required and it does take time to bake and mature the product and build a community for a developer first startup. Figma started as a drone company.

Twitter started as a podcast app.

Instagram was a location-based social network.

We went through 7 failures until we hit PMF.

And just crossed 80K users!

Sometimes a change of direction is exactly what you need to get to your destination.

Speed wins, esp. when it comes to product velocity - never forget no matter how big your company gets. Just added to my “Back to Basics Building Lean Startups from Inception” Google Doc with tips and thoughts on what that means to build lean and mean always How to write like investment legend Howard Marks (David Perell -text and video here) Howard Marks manages ~$190 billion and has penned some of the world's best investment writing.

Warren Buffett loves his writing too: "When I see memos from Howard in my mail, they're the first thing I open."

Here’s our conversation—with its top 13 insights:

1) For Howard Marks, heaven is seven little words: “I never thought of it that way.” Get the reader to say them and you win.

2) Einstein supposedly said there are four levels of intelligence: bright, brilliant, genius, and simple. Insecure writers try to flaunt their expertise with jargon; secure writers share what they know in surprising yet simple ways.

3) Something about putting words to paper freezes people up. Hence, Howard Marks tries to write as he speaks. Lesson: Take your written voice closer to your conversational voice. You’ll discover a new freshness and speed in your work.

4) Most writing rings hollow. No stories or thought-out principles inside. Howard Marks’ challenge to writers: Have experiences, cultivate convictions, and then your writing will come alive like never before. Thoreau said it best: “How vain it is to sit down to write when you have not stood up to live.”…

The Shift from Models to Compound AI Systems - post from CTO of Databricks Matei Zaharia - and yes, this is what I’m seeing from many a startup. Also a number of startups, OSS projects, frameworks, etc. are referenced. AI caught everyone’s attention in 2023 with Large Language Models (LLMs) that can be instructed to perform general tasks, such as translation or coding, just by prompting. This naturally led to an intense focus on models as the primary ingredient in AI application development, with everyone wondering what capabilities new LLMs will bring. As more developers begin to build using LLMs, however, we believe that this focus is rapidly changing: state-of-the-art AI results are increasingly obtained by compound systems with multiple components, not just monolithic models.

For example, Google’s AlphaCode 2 set state-of-the-art results in programming through a carefully engineered system that uses LLMs to generate up to 1 million possible solutions for a task and then filter down the set. AlphaGeometry, likewise, combines an LLM with a traditional symbolic solver to tackle olympiad problems. In enterprises, our colleagues at Databricks found that 60% of LLM applications use some form of retrieval-augmented generation (RAG), and 30% use multi-step chains…

Even more importantly, iterating on a system design is often much faster than waiting for training runs. We believe that in any high-value application, developers will want to use every tool available to maximize AI quality, so they will use system ideas in addition to scaling. We frequently see this with LLM users, where a good LLM creates a compelling but frustratingly unreliable first demo, and engineering teams then go on to systematically raise quality.

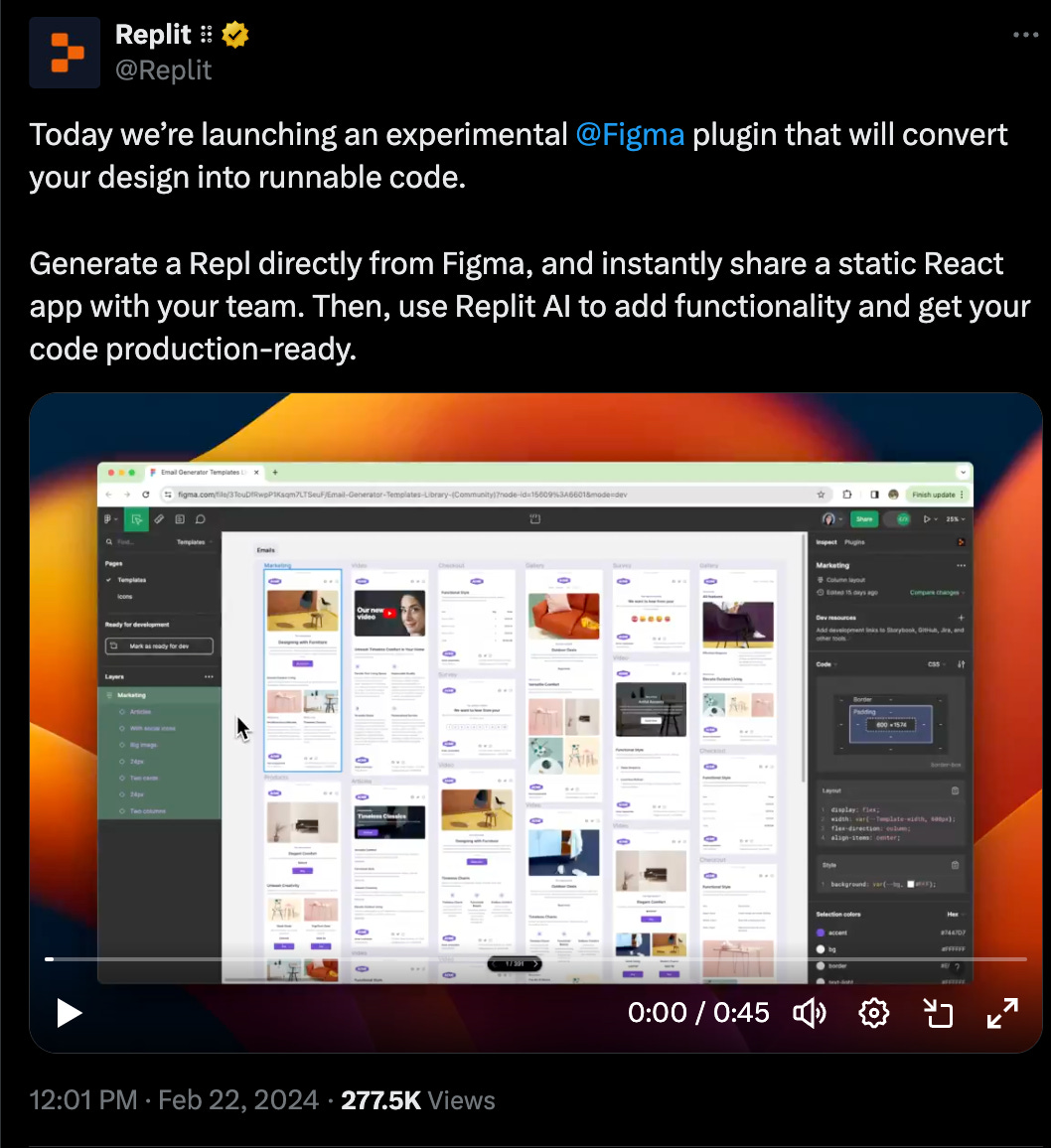

🤯 I’ve always suggested to founders that they should show first and then tell next as a picture is worth a 1000 words. The original Superhuman mockup that we funded at Inception was certainly quite pedstrian given what founders can now do with Figma. And we can now go one step further as Replit can now turn that Figma mockup into usable code! AI coding copilots are an awesome productivity enhancer for developers but it can also replicate insecure code at scale. Read this insightful post from Snyk on how to prevent this and why security guardrails are always needed when using AI coding copilots...

It also helps to not have the fox guarding the henhouse and have a separate security watchdog to keep up with AI code at scale - yes, it's called Snyk Deepcode and utilizes multiple AI models, is trained on security-specific data, and is all curated by top security researchers to give you all the power of AI without any of the drawbacks. Speaking of security platforms and Snyk - great interview with Peter McKay, CEO of Snyk from Runtime For years, [CISOs] used these kind of legacy solutions that were always after the fact and more runtime. We came up with this developer security category, embedding security earlier in that software development lifecycle, and it was a very new concept. And so [they were] like, "OK, I'll try that, and I'll keep the old [products]."

Then the market goes through this correction. And so where everybody kind of bought two of everything, [now they were] like, "OK, let's take the better of the two."

Security has always been so fragmented, all these little point products that do all these pieces. And what's happened is companies are gravitating to more platform-based [products], where I can get more from one company that can pull some of these pieces together. We've had a fully integrated process, but we've also made eight acquisitions to bring all these pieces together that make it easier for customers.

Absolute 💎 of a post - "Every infrastructure decision I endorse or regret after 4 years at a startup" - covers AWS, GCP, PagerDuty, Datadog, Gitops, Infra as code… 👇🏼 time to sign up for this… 🤯 multimodal inputs to generate code from Paige Bailey (Google Deepmind)- must watch video Mind officially blown:

I recorded a screen capture of a task (looking for an apartment on Zillow). Gemini was able to generate Selenium code to replicate that task, and described everything I did step-by-step.

It even caught that my threshold was set to $3K, even though I didn't explicitly select it. 🤯 🔥

"This code will open a Chrome browser, navigate to Zillow, enter "Cupertino, CA" in the search bar, click on the "For Rent" tab, set the price range to "Up to $3K", set the number of bedrooms to "2+", select the "Apartments/Condos/Co-ops" checkbox, click on the "Apply" button, wait for the results to load, print the results, and close the browser."

While consumer, this AI x productivity tool market map from a16z is definitely littered with prosumer or team-based SaaS cos Must watch - never gets old! Steve Ballmer, pitchman and salesman extraordinaire! We have certainly all evolved as human beings!

🙏🏼 nvidia crushed earnings thankfully, but wow on inference which is 40% of revenue and 100% new! (earnings transcript) One, the amount of inference that we do is just off the charts now. Almost every single time you interact with ChatGPT, that we're inferencing. Every time you use Midjourney, we're inferencing. Every time you see amazing -- these Sora videos that are being generated or Runway, the videos that they're editing, Firefly, NVIDIA is doing inferencing. The inference part of our business has grown tremendously. We estimate about 40%. The amount of training is continuing, because these models are getting larger and larger, the amount of inference is increasing.

What happens when you go public via SPAC and miss your numbers - from value of $672M to $10M and now offers to buy out and take private at $37M valuation (TechCrunch) MariaDB emerged as a fork of MySQL 15 years ago, after MySQL’s project creators became concerned about its independence in the wake of a series of billion-dollar acquisitions that led Oracle to effectively own MySQL in 2009. MariaDB was considered a “drop-in” replacement for those seeking a fully open source MySQL alternative and has been used by big-name companies for storing and manipulating data across their applications. The commercial entity behind MariaDB raised roughly $230 million in venture funding through the years to develop premium features and services on top of the core project, eventually going public in December 2022 via a special purpose acquisition company (SPAC). As with just about most SPAC-based IPOs, MariaDB’s flotation has been far from a resounding success, falling from an opening day market cap of $445 million in late 2022 (which itself was down considerably on its previous private enterprise value of $672 million at its Series D round) into a perennial nosedive that has seen it hover at just over the $10 million mark since the turn of the year.

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. Pledge your support | |