Solana Uncovered: An Introduction to the Solana Network

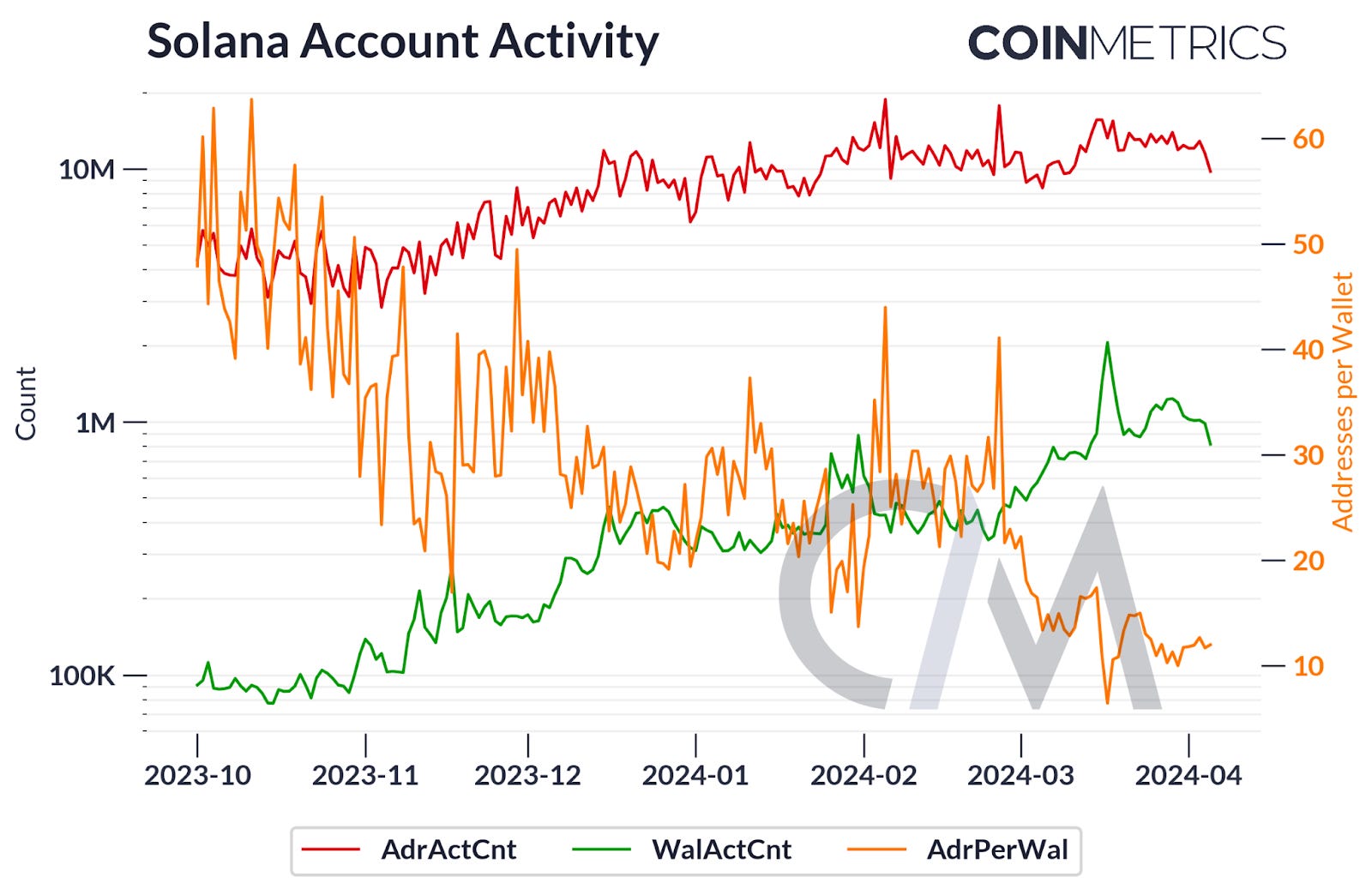

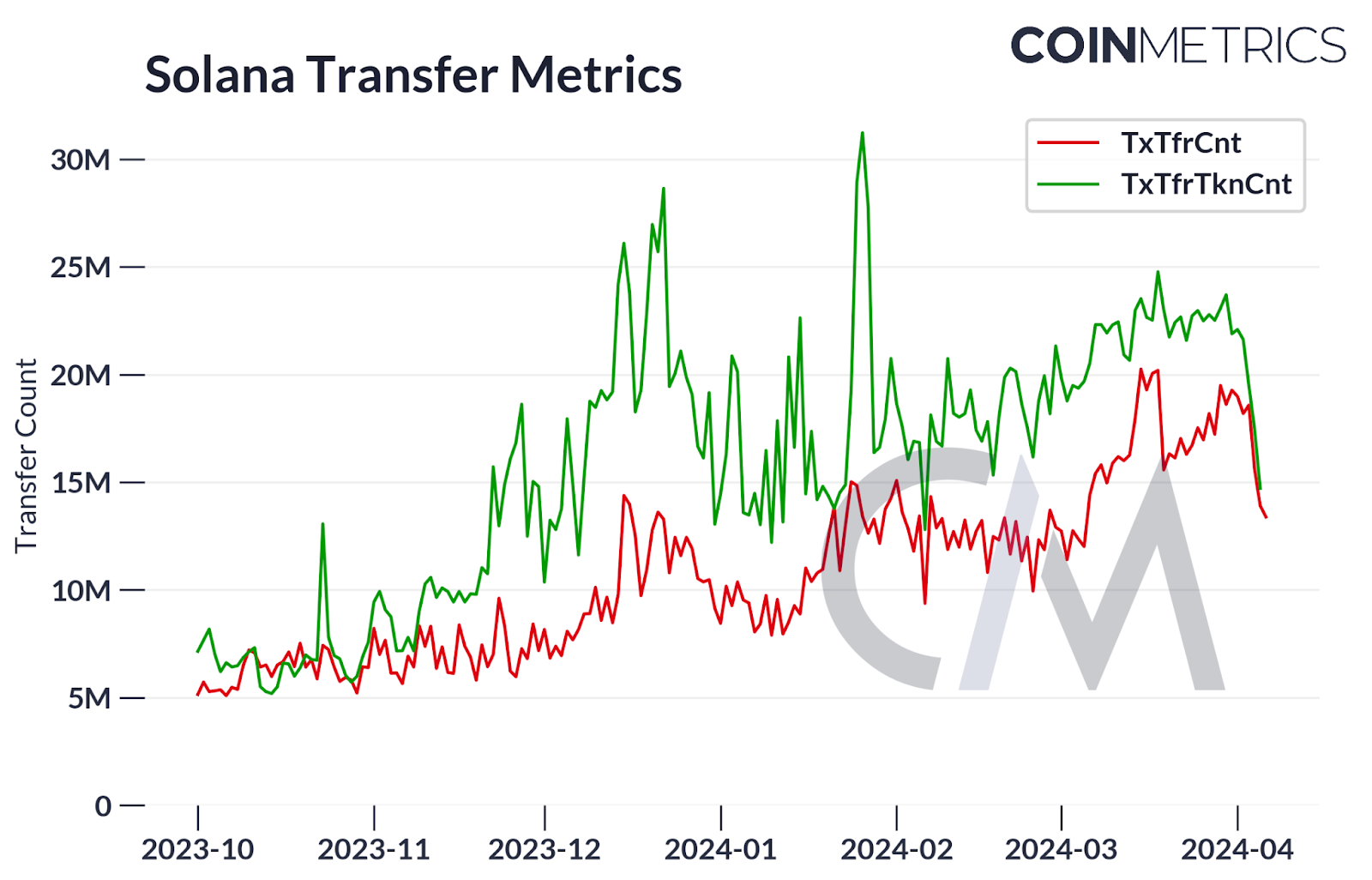

Solana Uncovered: An Introduction to the Solana NetworkA data-driven overview of the Solana BlockchainSolana Uncovered: An Introduction to the Solana NetworkBy: Caron Schaller IntroductionIn the dynamic realm of digital assets, layer-1 blockchains provide both the execution environments to move and manage massive value and the consensus mechanisms to secure that value. As the blockchain landscape continues to expand and evolve, we have seen fewer layer-1 developments and more vertical expansion into layer-2 and modular solutions. However, some foundational monolithic blockchains still play a vital role in the Web3 ecosystem. Our exploration of layer-1 blockchains continues with with Solana and its network metrics, our latest experimental installment to Network Data Pro. This highly performant chain has been a staple of the blockchain space since its mainnet launch in March 2020. For its first year, it kept a relatively low profile, kicking off support for ERC-20-like tokens through its Solana Program Library (SPL) in the following July. It rapidly gained traction as retail traders felt priced out by Ethereum’s high transaction fees, finding a place among the top 5 coins by market cap in August 2021 at $77B, at the time a 2.7% share of the total crypto market. Source: Coin Metrics Network Data Pro Solana fell almost as quickly as it rose, finding its most woeful moments in 2022, shortly after the bankruptcy of FTX and Alameda, which were intricately involved with Solana—FTX developed Project Serum, an on-chain central limit order book—and held a large number of locked SOL coins. Since then, Solana has reemerged from its ashes and is once again competing for the rank of third largest digital asset, with a market capitalization currently near $80B. In its early days, Solana quickly became a home for high-frequency and retail traders. It boasted previously unimaginable transaction throughput and finalization times and has attracted a formidable force of developers. In this week’s issue of Coin Metrics’ State of the Network, we explore Solana and its architecture, the projects it has attracted, and what we find if we but scratch the surface of the data stored in this immense chain. What is Solana & the SOL Coin?Solana represents a groundbreaking blockchain platform specifically engineered to accommodate decentralized applications (dApps) and cryptocurrencies, with a sharp focus on optimizing for high transaction throughput while keeping costs minimal. This is achieved through a unique mechanism developed by Solana Labs known as Proof of History (PoH) alongside the traditional Delegated Proof of Stake (DPoS). This blend not only strives for scalability but also attempts to prevent decentralization and security from being compromised. The Solana team’s expertise in compression algorithms led to the conceptualization of PoH, which serves as a chronological testament to event occurrences, significantly streamlining the consensus process and propelling Solana towards then unprecedented efficiencies in decentralized transaction speeds. The architectural prowess of Solana allows it to support a theoretical 710,000 transactions per second (TPS) with a blocktime of 0.4 seconds. In practice, TPS rarely approaches 10,000 and blocktime usually hovers around 0.5 seconds. Nevertheless, this feat starkly contrasts with the throughput of other blockchains, all while maintaining negligible transaction fees and without sacrificing security. The SOL coin underscores the synergy by facilitating transaction and staking mechanisms and is also the dominant countercurrency for DeFi transactions on the network. Source: Coin Metrics Network Data Pro, CM Labs Daily SOL transfers on Solana approximately match those of Ethereum in US Dollars. A noticeable peculiarity caused by Solana’s low transaction fees and fast execution is the seemingly high number of “minnow” transfers—those worth less than $1M—when compared with “whale” transfers. Over 80% of the total value transferred on Solana stems from such minnow transfers. On the other hand, Ethereum currently sports a minnow ratio of only 40% as users shy away from sending funds from which fees would take a significant chunk. Consensus and StakingUnder the delegated proof of stake consensus mechanism, SOL can be staked by both validators and delegators, with the former running high performance physical infrastructure and the latter delegating their stakes to validators. Validator infrastructure generally consists of a machine with 512 GB of memory and a 16 core CPU, the general recommendations for being able to execute the high flow of transactions. Following a leader schedule, a single validator processes each block, which is then voted on by the remaining validators. The leader is responsible for sequencing messages and computing the chain’s new state. By rotating leadership, the network ensures decentralization and security. Votes are weighted based on the validators' stakes and a supermajority is required for a block to be confirmed, ensuring finality and preventing forks within the network. Validators and their delegators are rewarded with a steady and predictable flow of block rewards once per epoch (approximately every 2 to 3 days). Inflation currently hovers around 5% depending on the speed of the chain, but is scheduled to fall to 1.5% ten years after chain genesis. Source: Coin Metrics Labs The lead validator of each block receives half of that block’s transaction fees with the other half being burnt, creating a deflationary effect on SOL. Signing a transaction costs only 0.000005 SOL. Every transaction must pay this base fee, including vote transactions by validators. Unlike Ethereum blocks, Solana blocks are far from full and, for a long time, users were not even able to set priority fees, which has historically kept the SOL burn rate very low. However, recent demand for block inclusion and a recent ecosystem upgrade have made the transaction fee model quite a bit more complex. The compute budget program has given users the ability to manipulate the compute units of their transactions, which quantify the computational complexity of a transaction, similar to gas on EVM blockchains. Users can increase the price they are willing to pay per compute unit and also set higher compute unit limits for heavy-duty transactions. Transactions and Vote TransactionsThe high throughput and large block size of Solana comes at the expense of an immense chain size. Altogether, the Solana blockchain is over 150 TB. As a result, Solana nodes cannot provide full history back to chain genesis, but are pruned after two epochs (approximately 4 days). Deep history is stored in centralized BigTable instances hosted by the Solana Foundation or professional RPC providers. Another factor that increases the overall size of the Solana blockchain is the inclusion of vote transactions in the block. Validator vote transactions sit in the block alongside user transactions, which leads to a misleading transaction throughput as other blockchains generally do not include consensus operations in their block execution payloads. Ethereum, for example, isolates consensus in a completely separate consensus layer and other ecosystems also have dedicated chains specifically for consensus actions among validators. Source: Coin Metrics Network Data Pro, CM Labs As the number of non-vote transactions rises, we see a steady fall in vote transactions. Validators can choose to vote on multiple blocks in a single bundled transaction – a cost-saving strategy that may explain this fall. Some Solana validators have also explored other strategies to cut costs, some of which are detrimental to consensus and could lead to chain halts, such as purposely missing votes near the end of an epoch to submit those votes at the beginning of the next epoch, a practice which pumps up their APR values on paper and attracts more delegators. As with all chains, MEV is present on Solana. In the previous bull run of 2021, users spammed the chain to be included in a block first, causing several multi-hour chain outages as validators were unable to come to agreement on the chain tip at the time. With the compute budget program, users can now outbid each other in an effort to be the first to mint an NFT or backrun arbitrage a large DEX transaction. To avoid penalization, a block leader will prioritize creating a block over ensuring all transactions are included. With this new bidding system, during periods of high blockspace demand, non-prioritized transactions can thus still face a bottleneck and be priced out of being executed in that block. A high volume of sophisticated bot traders is currently eking out normal users that may not be familiar with offering a priority fee. And since Solana does not have a mempool, transactions time out and fail after a few seconds. Users have to manually resubmit them. This is visible on-chain as Solana is again facing a peak in failed transaction rates at 30% (or 75% for just non-vote transactions). Source: Coin Metrics Network Data Pro We can see clear spikes in transaction fees and the corresponding increase in burnt SOL on January 31st and for the whole of March. The first spike occurred as a result of the JUP airdrop. The memecoin frenzy set off the currently high fee levels which are depressing inflation by over 10%. Solana Accounts and UsersAccounts on Solana can be broken down into externally-owned accounts (EOAs) and program-derived accounts (PDAs). Unlike EVM-compatible chains where state is stored in individual smart contracts, Solana asks every user to store data on-chain themselves by way of PDAs. Executable code can be added to the chain by publishing a so-called program, which functions as a blueprint that allows users to generate a PDA that is co-owned by the user and the program. Both the owner and program can move funds to other accounts as the program’s code decrees. Each such PDA has its own unique address. In fact, even to interact with a new token, a PDA must first be created for that token. As a result, a unique addresses metric is misleading on Solana. Instead, we can estimate unique Solana users by identifying EOAs as wallets. Source: Coin Metrics Network Data Pro, CM Labs While the number of unique accounts have increased alongside unique wallets, the ratio of accounts per wallet has steadily decreased from 50 in October 2023 to 10 today, showing that active users in October interacted with a wide array of programs in the Solana ecosystem and today’s average user seems to be much more limited in their on-chain interactions, perhaps even partisan towards a favorite memecoin. If these users prove to be non-transitory, they may also eventually collect a much higher number of PDAs associated with their EOA, be it from holding more unique tokens or from slowly building up more interactions with diverse dApps. Solana EcosystemSolana's introduction has galvanized a diverse array of projects, encompassing decentralized finance (DeFi), non-fungible tokens (NFTs), and beyond, all drawn to its scalability and developer-centric environment. Despite encountering hurdles related to network stability and occasional outages, the resilience and continuous enhancements of the Solana network underscore its commitment to fostering a robust ecosystem, bolstered by regular month-long hackathons. Solana is currently the leading blockchain with regard to memecoin trading, mobile interoperability, and decentralized physical infrastructure networks (DePIN) such as Hivemapper or Helium. The Solana Program Library provides a standardized program for minting tokens, both fungible and non-fungible. Recent upgrades to this program have added extensions such as confidential transfers, transfer fees, and soulbound tokens – these are awarded to individual addresses as “badges” and cannot be transferred. SPL tokens have always been vital to the Solana ecosystem, though over the past few months they have taken on an outsized role when comparing transactions that transferred tokens with those that transferred SOL. This may again be explained by behavioral differences between seasoned Solana users and seasonal memecoin traders. The former is much more likely to choose SOL as the safe countercurrency in their trades while the latter relies more on chain-agnostic stablecoins such as USDC and USDT. Source: Coin Metrics Network Data Pro Since its launch on Solana in January 2021, USDC has always been the ecosystem’s most dominant stablecoin, with a current supply of 2.5B. Though USDT followed suit only four days later, it failed to gather the same traction. USDC tokens unofficially bridged from Ethereum through Wormhole had long been the go-to stablecoins in Solana’s early days. Even today, unique daily user counts for USDC and USDT have ranged from 14,000 and 3,500 in October 2023 to 260,000 and 112,000 on January 31st, 2024, respectively. UXD, the decentralized Solana-native stablecoin lags far behind at an average daily user count below 1000. Ethereum users are similarly active regarding USDT at 100,000 unique daily addresses, while USDC users are less active at only 30,000, with both values only seeing a modest growth of 20% since October 2023 Source: Coin Metrics Labs ConclusionWith its streamlined consensus mechanism, Solana manages to bridge security with throughput and continues to champion the monolithic blockchain narrative, albeit at the cost of greater centralization. Higher hardware requirements keep out amateur, staking-at-home validators and the couple of times chain tip consensus has broken down, prominent validators are forced to coordinate through backchannels to restart it. Nevertheless, with its ease of access, focus on exceptional UI/UX, and dedicated developer support, Solana attracts both developers and users alike. Its Proof of History mechanism ensures efficiency and speed, attracting projects that require fast execution. Solana's growing ecosystem offers tools and resources for a wide range of applications, from DeFi to NFTs, encouraging innovation. Users are drawn to Solana for its fast transaction times, making activities like trading and gaming seamless. The low fees enhance accessibility for a broader audience, democratizing access to blockchain technology, though it remains to be seen whether the participants in its memecoin frenzy are merely transitory. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro Going into its 4th halving, active addresses on Bitcoin rose by 10%, while Ethereum active addresses declined by 6% over the week. The transfer value of Tether (ETH) and Tether (Tron) increased by 25% to $6B, and 13% to $13B, respectively, while USDC transfer value reached $7B, growing 20% over the week. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

State of the Network’s Q1 2024 Wrap-Up

Tuesday, April 2, 2024

A data-driven overview of events shaping digital asset markets in Q1–2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q1 2024 Mining Data Special

Tuesday, March 26, 2024

Our quarterly update on Bitcoin mining, zeroing in on recovering revenues, public miner strategies, and increased energy usage ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Appraising Growth in Digital Asset Markets

Tuesday, March 19, 2024

Coin Metrics' State of the Network: Issue 251 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Market Dynamics and Risks of Liquid Staking Derivatives

Tuesday, March 12, 2024

Exploring the market dynamics and risks of liquid staking tokens (LST's) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Following Flows V: Pool Cross-Pollination

Tuesday, March 5, 2024

Examining on-chain flows to better assess Bitcoin mining pool decentralization ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏