Hot in Enterprise IT/VC - What’s 🔥 in Enterprise IT/VC #390

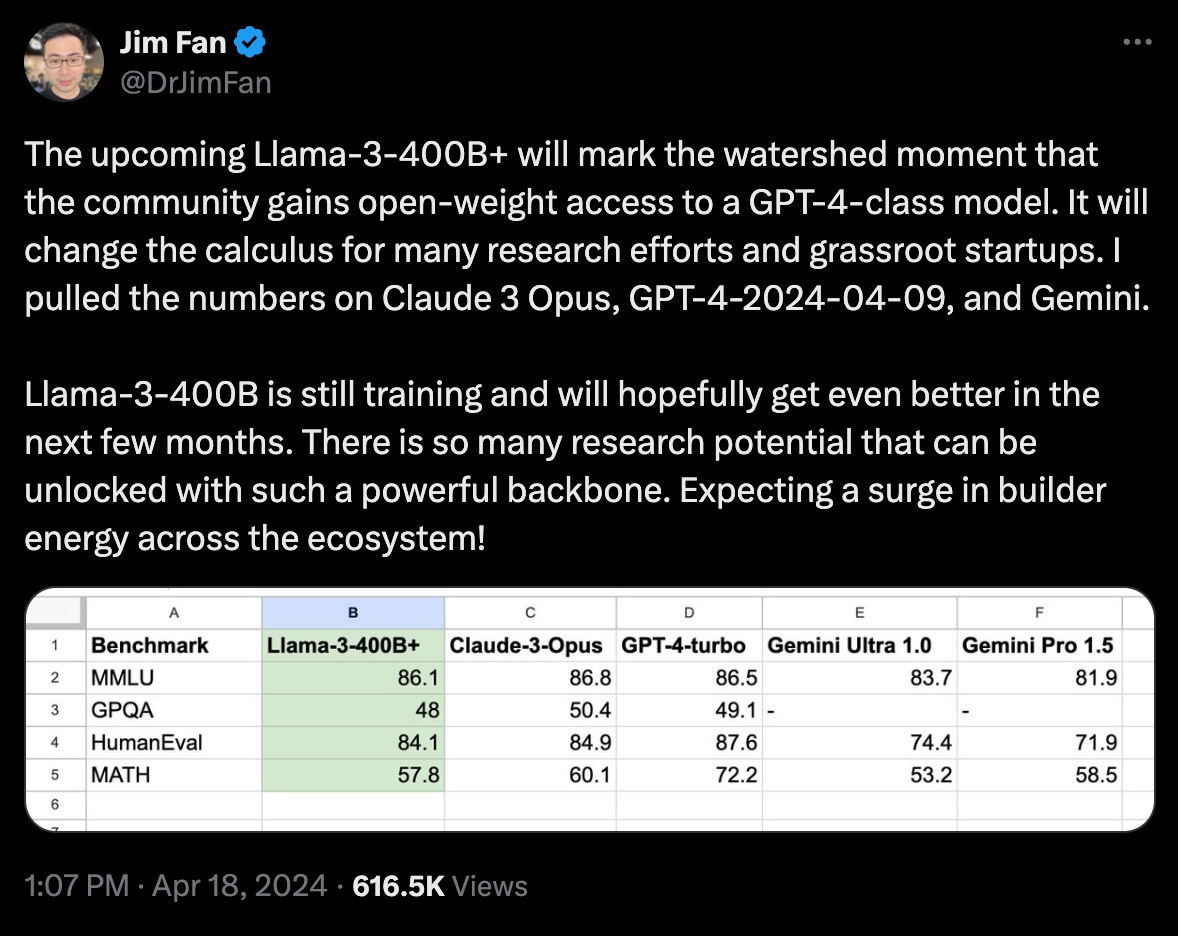

What’s 🔥 in Enterprise IT/VC #390Founders - focus on what you can control, and not on what you can't - too much noise in AI + still just 1st inningI was catching up with a few institutional LPs (those who invest big dollars into VC funds) last week and the sentiment at the moment from many investors is cautious optimism. Yes, this is one of the biggest platform shifts in history but yes, some of these prices are outrageous, and many companies who are early leaders now can just as easily be vaporized with the next update. Add to this the incredible pace of building, exaggerated claims of what products can offer, and one can easily get whiplash from all of this noise. To that end, here’s a reminder for all of us - Naveen, VP GenAI at Databricks, summarizes the week that was. More from Jim Fan at Nvidia… Isn’t it a wonderful time to be a founder? Just make sure your architecture easily allows you to swap out a model, and if you don’t like the models or the cost, just wait a minute, it will get better and cheaper. Speaking of hype, many a startup building AI into their developer offerings were certainly alarmed by the claims of Devin a few weeks ago, but it turns out that much of it is well…not exactly true. I applaud moonshots but seems like this company stretched a bit on its ability to deliver. Another reminder for founders and investors, AI is a technology and not a product. Solve a problem 10x better than what already exists for a user and buyer willing to pay and make sure that they love the product so much that you can’t pry it out of their cold, dead hands for real PMF. And one last thing as a founder or investor, especially at Inception, make sure you don’t over rotate to Total Addressable Market Size or TAM - you can miss lots of opportunities. Tomasz shares some similar lessons on TAM from Tobi, founder and CEO of Shopify… Now zoom in, build that product… A wise founder also told me, especially in new markets, can you take your first 10 customers, and double each of their revenues in next year or two? if so, you got a market It’s different, by the way, depending on new category creation or simply going 10x+ for incumbents. This from What’s 🔥 #277:

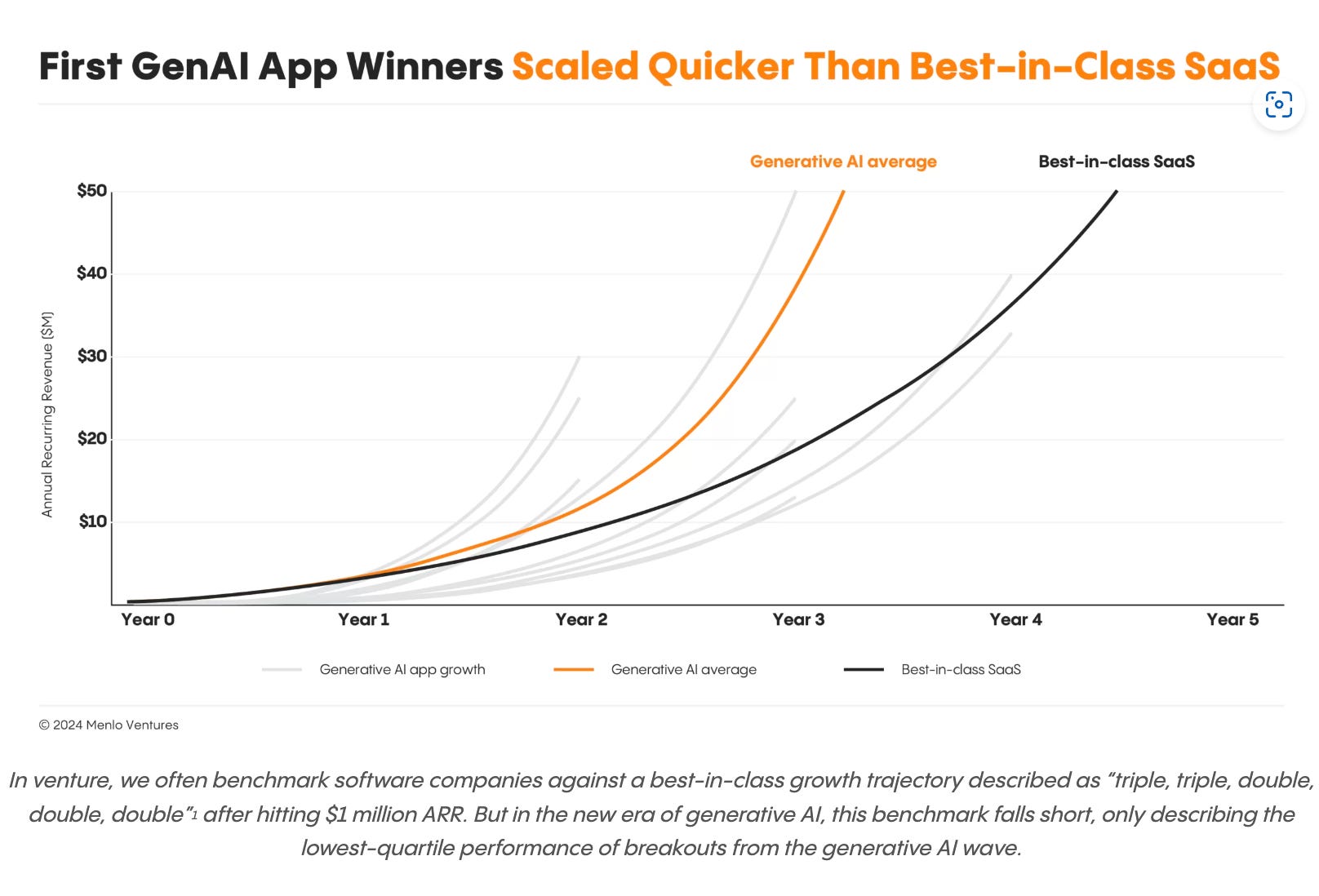

As always, 🙏🏼 for reading and please share with friends and colleagues. Scaling Startups#more killer advice from Jensen from 2003! Play long ball or as I like to say, sell the product (today), market the vision (the future) - must watch video #what Sundays are for - Jamie Dimon, CEO JPM Chase #lessons learned from the founder of AppDynamics and Harness (Jyoti Bansal) #ABL - Always Be Learning - today is your day to take the risk…Dr. Julie Gurner Enterprise Tech#cybersecurity consolidation continues (see my predictions from What’s 🔥 #380) - this time in cloud security - headline says $150-200M exit for Lacework which raised $2B but distributing $800M cash back to existing investors certainly helps. Last round was at $1.3B at $8.3B in 2021 so I’m sure in the heyday this was pari passu so everyone will get around 48 cents on dollar back. Still wild to think $1.2B was spent to get to $100M ARR. (CTech) #more VC playbooks - this one, which has some pretty good data, from Menlo Ventures on Enterprise AI Apps - the real question is what do these numbers look like in the next 12-24 months when it comes to retention? #Case in point - selling to prosumers and SMEs is brutal - Tome, a fast out of gates early winner in AI, cut 20% of its staff with a harder pivot to enterprise…question for many of these first to market AI native startups is how durable is the revenue as competition increases? What will churn look like? (The Information) #yes, this is a thing, especially because of AI and need for data privacy and security which means on-prem is often better for regulated industries. Also check out Replicated.com/AI which allows SaaS vendors to distribute commercial AI applications to secure enterprise environments. #🤯 the cost of cyberattacks is astounding - $872M charge in Q1 and up to $1.6B in potential damages to United Healthcare moving forward. Just to remind you, this was front and center in the earnings release - this is why cybersecurity revenue keeps going 📈 (Axios) #In case you don’t know what an agentic workflow is, this 90 sec primer from Andrew Ng nails it - here’s the kicker, if you use GPT3.5 in an agentic workflow it performs better than just using GPT4 (zero-shot) - also nice shoutout to CrewAI (a boldstart portfolio co) #more on AI and reasoning (FT) #building Glean, ChatGPT for enterprise and some of the problems building the product (Practical Intelligence: Tamar, former CPO Slack, Venture Partner IVP and now Glean, President, Product and Tech) #Gartner Says 75% of Enterprise Software Engineers Will Use AI Code Assistants by 2028 #The comprehensive AI Index Report for 2024 from Stanford Institute is out (summary from Luiza Jarovsky) Markets#What ARR and growth does one need for an IPO? Alex Clayton from Meritech breaks it down with data here 🧵 #Big ideas from the 🐐 Vinod Khosla 👇🏼 - definitely worth a read #🤔 - lots of investing in AI chip startups as of late but…Bojan Tunguz (ex-Nvidia) #Goldman Sachs on AI - here’s CEO David Solomon in the earnings call - tailwind in financing for GS…along with developer productivity #how to know if it’s you and not the macro environment (OnlyCFO) What's Hot 🔥 in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot 🔥 in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What’s 🔥 in Enterprise IT/VC #389

Saturday, April 13, 2024

Culture and resiliency at scale - JPM and Amazon ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #388

Saturday, April 6, 2024

Where we are in the funding cycle post Q1 - YoY 💰 deployed 📉 29% while Inception rounds (whatever you call it - seed...) pricing continue to be 🔥 📈 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #387

Saturday, March 30, 2024

Top 10 Takeaways from Enterprise Founder's Day - the AI sales wedge is now table stakes... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #386

Saturday, March 23, 2024

The barbelling of Inception rounds (pre-seed/seed) + the impact of AI on $$$ needed and fund sizing ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #385

Saturday, March 16, 2024

Jensen speech on pain + suffering is just what we needed - why we are all destined for greatness, inspiration from Superhuman + Snyk ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏