ESPN Bet ‘can lay claim to No. 3’ in OSB

ESPN Bet ‘can lay claim to No. 3’ in OSBESPN Bet’s Tier 2 opportunity, Evolution’s Asian success, Kindred’s holding pattern, Kambi earnings review +More

Just because you don't believe that I wanna dance. Penn’s ESPN Bet upsideA new career in a new town: ESPN Bet has a shot at establishing itself as the number three operator in US OSB, according to new analysis, which comes with the news that Penn Entertainment has appointed a new tech chief to oversee its online efforts.

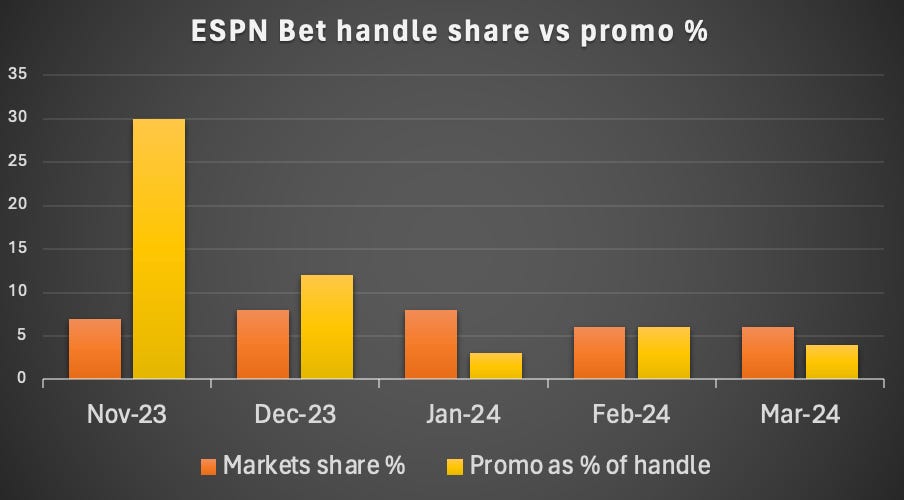

No pressure: LaBerge joins at a “pivotal moment” for Penn’s online ambitions as it prepares for ESPN Bet’s first football season in September, and his appointment could be the “catalyst to determine if the venture will work.” Your task should you accept: A note from the analysts at Truist this week laid out what the team suggested is the “upside case” for Penn’s online ambitions, saying that although it remains early days ESPN Bet is “already making a splash.”

💰and 👛 ESPN Bet handle market share vs. promos as % of handle We’re not alone: The Truist team suggested that, after the top two in the market, they see “plenty of white space” for a third-place competitor to emerge. ESPN Bet has “already achieved its standing with relatively nascent tech compared to Penn’s ultimate vision for the product,” they added.

The price is right: Recall, yesterday E+M published findings from HoldCrunch that suggested there was room for a Tier 2 operator to grab profitable market share behind FanDuel and DraftKings in US OSB. That research suggested the winner would be determined by price. Maximize your trading success in 2024 with OpticOdds’ real-time Odds Screen. Built for operators with an emphasis on speed and coverage, OpticOdds offers:

Get in touch at opticodds.com/contact. +MoreCrown heights: As noted yesterday in Compliance+More, Crown Resorts will keep its license to operate in New South Wales following an investigation by the authorities into AML violations. The NSW Independent Casino Commission said the company had turned around its business culture. The UK Tote Group and Singapore Pools have agreed a commingling deal that will see both organizations combine liquidity, with customers of Singapore Pools betting into the UK Tote’s pools on British racing meetings. By the numbersFrance: GGR in 2023 rose 3.5% YoY to €13.4bn, according to the regulator L'Autorité Nationale des Jeux, which said online players rose to a record 3.6m uniques. Evo’s Asian dominationThe Asian (double) century: Asia continues to dominate Evolution’s growth story, with revenue from the region up 28% YoY to €198m in Q1 compared to growth rates of less than 10% elsewhere. “The pace of growth is coming down as our size is increasing. But it's still a market with vast potential,” commented CEO Martin Carlesund. A plea for patience: The company’s North America business has been more sluggish, with revenue up just 8% to €62.1m. Carlesund hailed the addition of Fanatics to its client portfolio, a launch in Delaware and a new studio in New Jersey, and claimed the live business is “growing in line with the market.”

By the numbers: The slow growth of RNG is a factor across the business, with revenue from slots and other RNG games up just 0.8% to €70.1m, while live casino revenue increased 20% to €431m during Q1.

Playing the waiting game: Latin America was similarly disappointing to North America, with revenue up 10% to just €33m. Carlesund believed operators in Brazil are quiet as they wait for the launch of the regulated market.

People power: “One of the biggest challenges is to keep up with demand. Few companies are privileged enough to exist in this reality but it also raises the bar on us as an employer, an innovator, game creator and a market leader. We need to work even harder to step up to this challenge,” noted Carlesund.

Kindred earnings reviewNo drama: Compared to previous updates, when profit warnings, market exits and M&A news was to the fore, Kindred managed to produce a ‘steady as she goes’ quarterly update ahead of any further news on the FDJ takeout.

Bovvered: Andén played down fears over moves in the Dutch parliament that could see online slot games banned, suggesting the party that will most likely form the next government voted against the measure. See Compliance+More tomorrow for more. By the numbers: Revenue was flat at £308m while adj. EBITDA was up 20% to £59.3m, helped by the company’s cost-cutting and reduction efforts. Excluding the US, revenues rose 4% in constant currency terms.

Leaving Dodge: Talking of the US, Kindred has to date closed three states, and Andén said the business was on track to complete its exit by the end of Q2. He added the company had been able to “drastically reduce” its spending in the market. A new hope: Andén said Kindred had now taken its first bet on the new proprietary platform, adding that the project remained “firmly on track.” Let’s Get Results. InclineBet’s specialist digital marketing services, including high-performance UA, CRM, Creative and Branding for clients in global regulated markets, are backed by data analytics and measurable results. With our deep market focus and unrivaled expertise, we build brands and help you acquire high-value customers and maximize lifetime value. We give you a competitive advantage. Learn more. incline.bet Kambi earnings reviewPuts and takes: The company saw the addition of new customers during the quarter, including Bally’s and LiveScore, but it also saw the exit of the Napoleon sportsbook, which was bought by Superbet in 2021.

Modular living: Nylén added that it would not stop Kambi from seeking Tier 1 customers as much as Tier 2 and 3. “It’s always a risk and that is one of the reasons why we launched modular services,” he added.

By the numbers: Revenue was down slightly at €43.2m while EBITDA rose 10% to €14.1m. Earnings in briefPointsBet: The company said it has received its final installment of US$50m from the sale of the US operations to Fanatics as the rump Australian and Canadian operations delivered a 24% YoY revenue increase to A$70.6m (US$45.9m).

Svenska Spel: Online provided the bright spot with a 5.8% YoY revenue rise to SEK1.09bn ($100.3m) as the state-owned operator suffered an overall 1% YoY decline in revenues in Q1 to SEK1.96bn, while net profits slumped by nearly a quarter to SEK294m.

Calendar

White Paper worries? Join Rank Group plc and other leading operators in getting a head start on the coming era of additional checks from the sector experts. Book your demo today at https://dotrust.co.uk Offices in London and Gibraltar. FCA, ICO registered. ISO27001 certified. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Room at the top: price holds key to Tier 2 competitors

Tuesday, April 23, 2024

HoldCrunch price data analysis, Games Global IPO prospectus, Vegas visitation +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NJ iCasino will ‘soon be bigger than Atlantic City’

Monday, April 22, 2024

New Jersey analysis, analyst takes – Bally's, Penn, 888, shares watch – Melco Resorts, startup focus – the Tenth Man +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Sands sheds $3bn on investor Macau fears

Friday, April 19, 2024

LVS earnings reaction, 888 progress, sector watch – retail financial trading +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Capital Markets Forum, New York

Thursday, April 18, 2024

Our debut event on May 6 at the New York Stock Exchange ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Games Global files for IPO in New York

Wednesday, April 17, 2024

Games Global float, Entain's first quarter, Inspired earnings review +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Fixing conversions and killing the business

Thursday, December 26, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

How to Write a Job Description

Wednesday, December 25, 2024

A deep dive into a job description that speaks to the deepest longings of the human spirit.

🎄 Recap: 21 Episodes of AI 101 Guide

Wednesday, December 25, 2024

Take some time to learn or refresh the key concepts, techniques, and models that matter most

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack