Investors not buoyed by weather-beaten Boyd

Investors not buoyed by weather-beaten BoydBelow-estimate Boyd, Betsson earnings recap, Churchill Downs’ derby date, Gambling.com shares watch +More

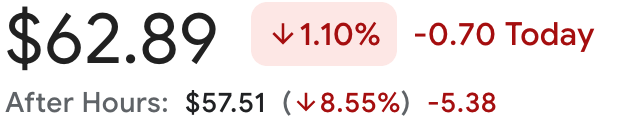

Get up and shake the glitter off your clothes. Weather-beaten BoydA passing storm: Boyd Gaming’s shares fell almost 9% in after-hours trading after the company reported below-estimate earnings, with the regionals business hit by poor weather in January and new competition in its Las Vegas Locals business.

🤒 Investors get queasy with Boyd after-hours Las Vegas by the numbers: Yesterday also saw the release of the March data showing Strip revenues down 1% YoY to $716m, while the Locals market was static at $271m and Downtown fell 13% to $76m. Boyd by the numbers: Revenue was down less than half a percent to $961m but adj. EBITDA fell by 10% to $331m. The Locals segment EBITDA fell 12.5% to $110m, while Downtown was off by 20% to $18m and the Midwest & South was down 9% to $181m.

Throwing rocks: The team at JMP said they believed “trends shifted negatively across several areas of the Las Vegas market” including tough comps and competitive pressure, notably from Red Rock’s Durango opening, with the negatives persisting for the rest of this year. The team added that M&A seemed “unlikely.”

We were so much older then: Regionally, DB noted the “surprising” sequential weakness in the Midwest & South segment, adding that while comps might get easier “we struggle to see how the gaming consumer of tomorrow is better than the gaming consumer of yesterday.” Is your goal covered? We oversee and safeguard more than $1 billion in sports betting ad expenditure, safeguarding the interests of industry titans such as William Hill, Entain, and Tabcorp. Here's our insight gleaned from these expansive global campaigns:

So, how much are you losing? As part of our discovery phase, we run a free 14-day traffic quality audit which takes a forensic look at your PPC traffic quality. Think of it as due diligence. Based on this, we’ll be able to identify how much of your traffic is invalid and, as a result, how much of your budget is being wasted. Then we can set about fixing it. Book a trail with TrafficGuard here: https://www.trafficguard.ai/protect/industry/sports-betting +MoreSigned, sealed, delivered, I’m yours: Aristocrat has completed the $1.2bn acquisition of NeoGames. The all-cash deal was originally announced in May 2023. Give me all your money: MGM Osaka – the JV between MGM Resorts and Orix Corp in Japan – has secured $3.42bn of funding from a consortium of Japanese banks in order to fund the building of the planned IR. Total funding is expected to come in at over $8bn for a project that is slated to open in 2030. Genting Malaysia is reported to be in early discussions to build a casino in Forest City, a new city-sized development that will lie between Singapore and Malaysia. OpenBet is to supply its scalable betting engine and advanced trading system to Australian wagering giant Tabcorp. Lottery.com has restarted its sweepstakes operations in conjunction with the WinTogether Trust. Demolition time: Bally’s has secured permission to implode the Tropicana in September or October to make way for the planned MLB ballpark. Coming soon – The Token WordAnd More Media is pleased to announce the launch of its latest newsletter The Token Word, which will cover key aspects of the crypto world including the rise of token ETFs, the crypto exchanges, the emerging regulatory structures, fan tokens and crypto-based betting and gaming. Brought to you in association with LearnCrypto.com.

Betsson’s upliftMy oh Milei: Betsson overcame its lowest sportsbook margin for two years and the devaluation of the Argentine peso to record a 32% EBITDA uplift to €71.6m for Q1 2024. Betsson’s Q1 launch in the province of Córdoba means it now services over half of Argentina’s population. However, the new Argentine president’s 50% devaluation in December turned a 25% growth rate in the country to a revenue decline.

By the numbers: Overall group revenue was up 12% YoY to €248m, with casino revenue up 19% and sportsbook down 3% due to unfavorable football results hammering its margin. Revenue from Western Europe increased by 60% due to last June’s €120m acquisition of Belgium’s Betfirst reporting for the first time.

Churchill Downs recapMay the fourth be with you: Ahead of the Kentucky Derby on May 4, management was in buoyant mood on the call, with analysts speaking about the $200m it has spent on its new “transformative” paddock project. History boys: Meanwhile, its HRM expansions continue in the key markets of Kentucky, where its seventh facility is under construction in Queensboro, and in Virginia where it is working on a $465m greenfield project in Washington D.C.

By the numbers: Revenue rose 6% to $591m, with adj. EBITDA coming in up 9% to $243m. The live and HRM segment saw a 23% adj. EBITDA uplift to $101m, while TwinSpires was up 35% to $39.6m and gaming was down 5% to $123m. Combination: Carstanjen said Churchill Downs was “rolling with the punches” when it came to the regulatory backdrop in various states with regard to the status/non-status of skill gaming.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs. EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets. Capital Markets Forum New YorkHot cakes: Tickets are still – just – available to subscribers. Use the code EARNINGS100. The shares weekGambling.com: The analysts at B Riley resumed their coverage of the gaming affiliate with a Buy, suggesting it will “outpace” the online gambling sector. Noting the 30%+ fall in the share price since November, the analysts believed the primary reason for investors’ lack of faith was the worry over the impact of Google’s algo updates on Gambling.com’s SEO efforts.

⛷️ Google it: Gambling.com investors take fright on SEO algo fears Earnings in briefGaming & LeisureProperties: The gaming REIT said adj. funds from operations (AFFO) was static at 92¢. Adj. EBITDA rose 3% to $333m. GLP will hold its call with analysts later today, Friday. BlueBet, which just the other week announced the merger with the Australian Betr, saw its first-ever cash flow positive quarter in FYQ3, with gross win up 23% to A$19.5m ($12.8m) and net win soaring 37% to A$16.4m.

Calendar

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless. For more info, go to www.kambi.com An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

ESPN Bet ‘can lay claim to No. 3’ in OSB

Wednesday, April 24, 2024

ESPN Bet's Tier 2 opportunity, Evolution's Asian success, Kindred's holding pattern, Kambi earnings review +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Room at the top: price holds key to Tier 2 competitors

Tuesday, April 23, 2024

HoldCrunch price data analysis, Games Global IPO prospectus, Vegas visitation +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NJ iCasino will ‘soon be bigger than Atlantic City’

Monday, April 22, 2024

New Jersey analysis, analyst takes – Bally's, Penn, 888, shares watch – Melco Resorts, startup focus – the Tenth Man +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Sands sheds $3bn on investor Macau fears

Friday, April 19, 2024

LVS earnings reaction, 888 progress, sector watch – retail financial trading +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Capital Markets Forum, New York

Thursday, April 18, 2024

Our debut event on May 6 at the New York Stock Exchange ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

How to Write a Job Description

Wednesday, December 25, 2024

A deep dive into a job description that speaks to the deepest longings of the human spirit.

🎄 Recap: 21 Episodes of AI 101 Guide

Wednesday, December 25, 2024

Take some time to learn or refresh the key concepts, techniques, and models that matter most

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?