The Usage & Evolution of Decentralized Exchanges (DEX’s)

The Usage & Evolution of Decentralized Exchanges (DEX’s)Checking in on pool liquidity, trading volumes and adoption across Ethereum DEX'sGet the best data-driven crypto insights and analysis every week: The Usage & Evolution of Decentralized Exchanges (DEX’s)By: Tanay Ved & Matías Andrade Key Takeaways:

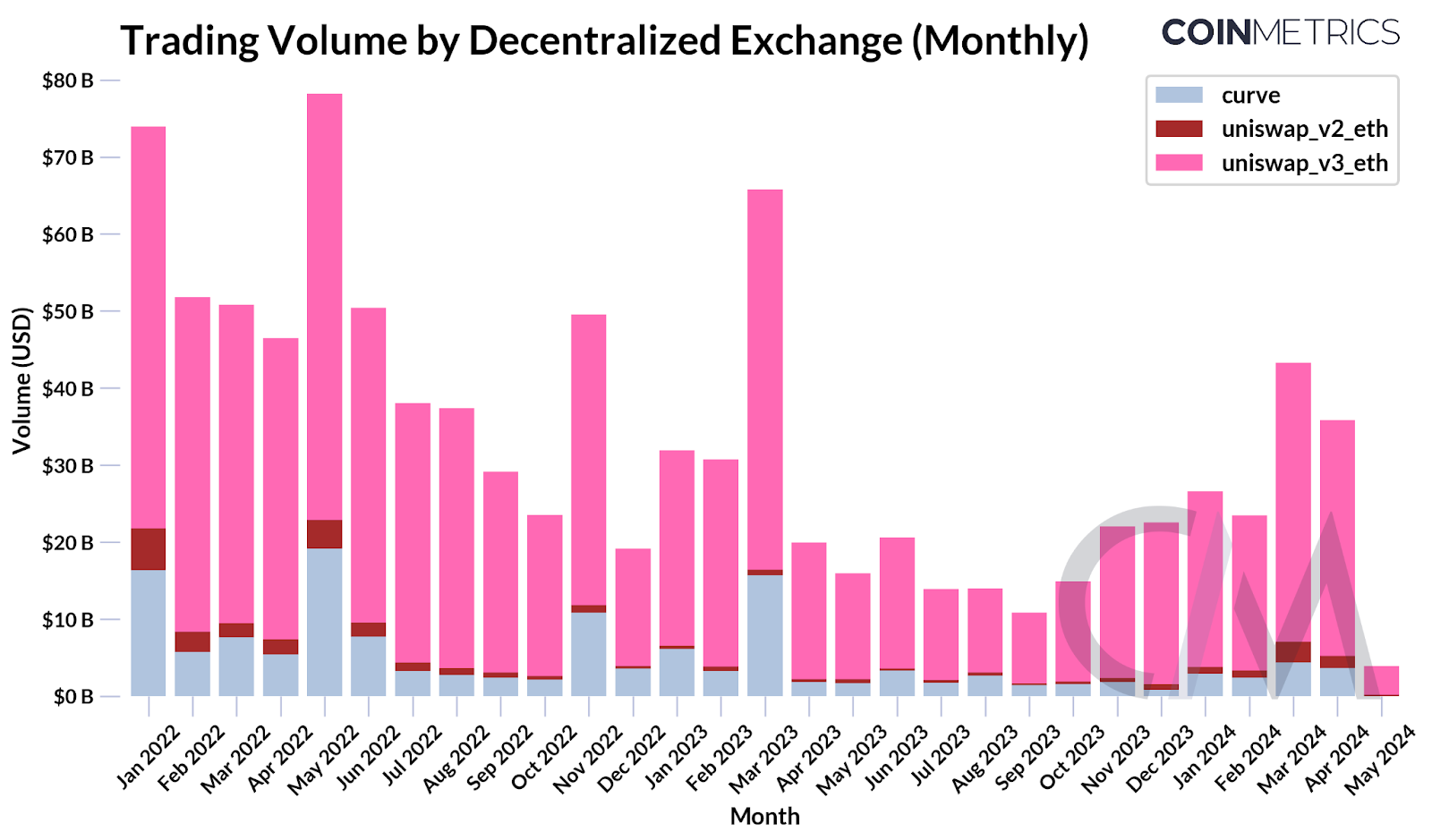

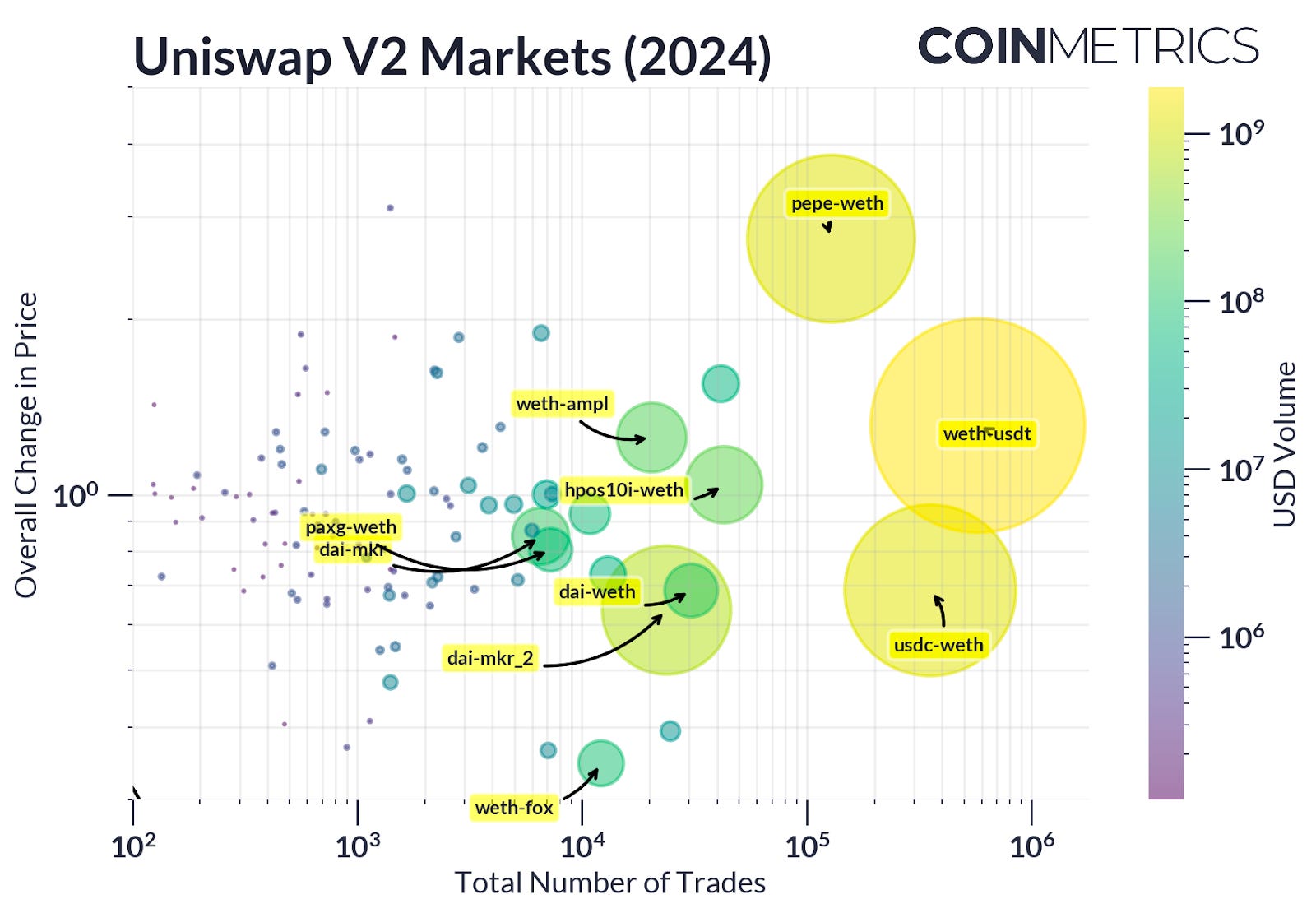

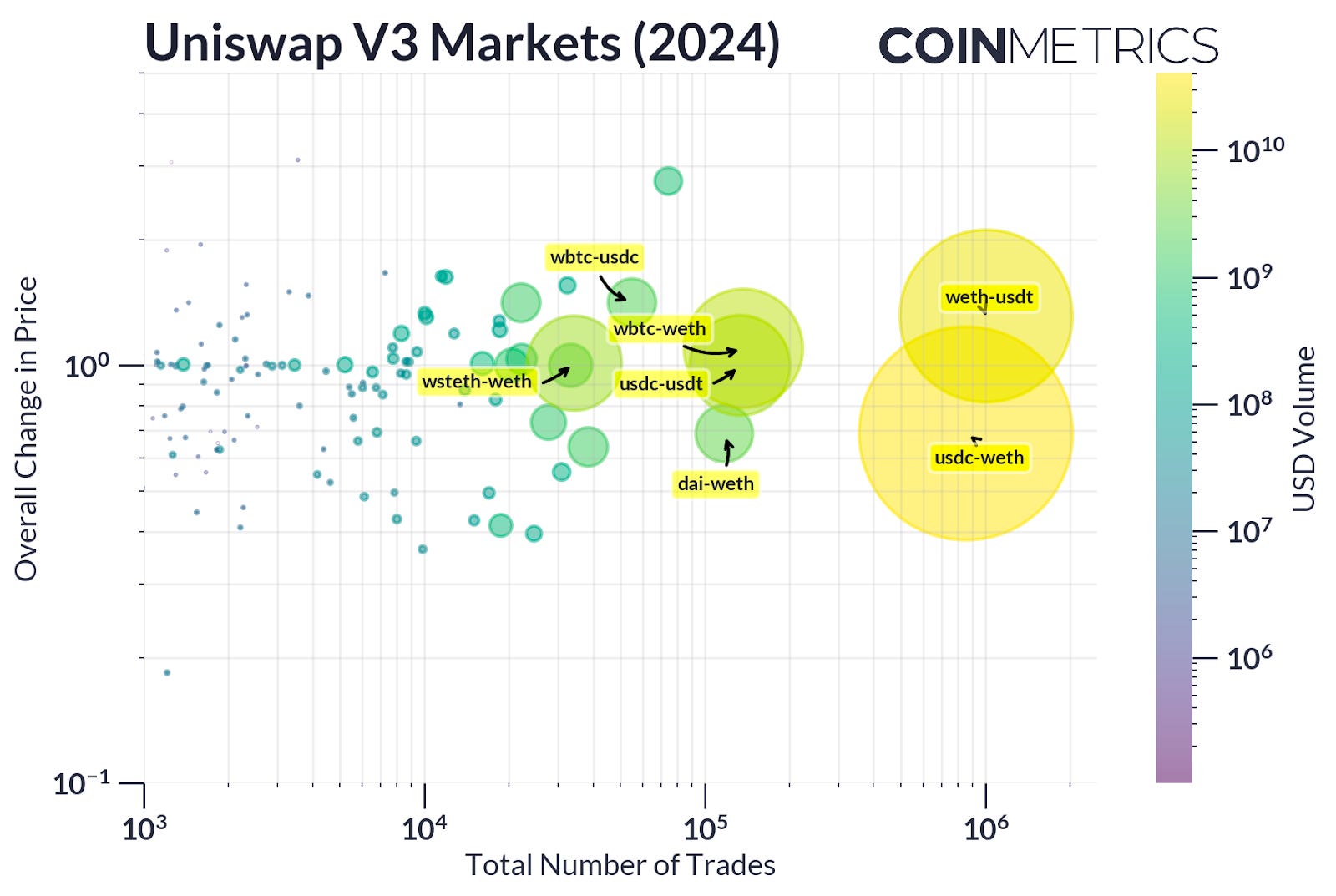

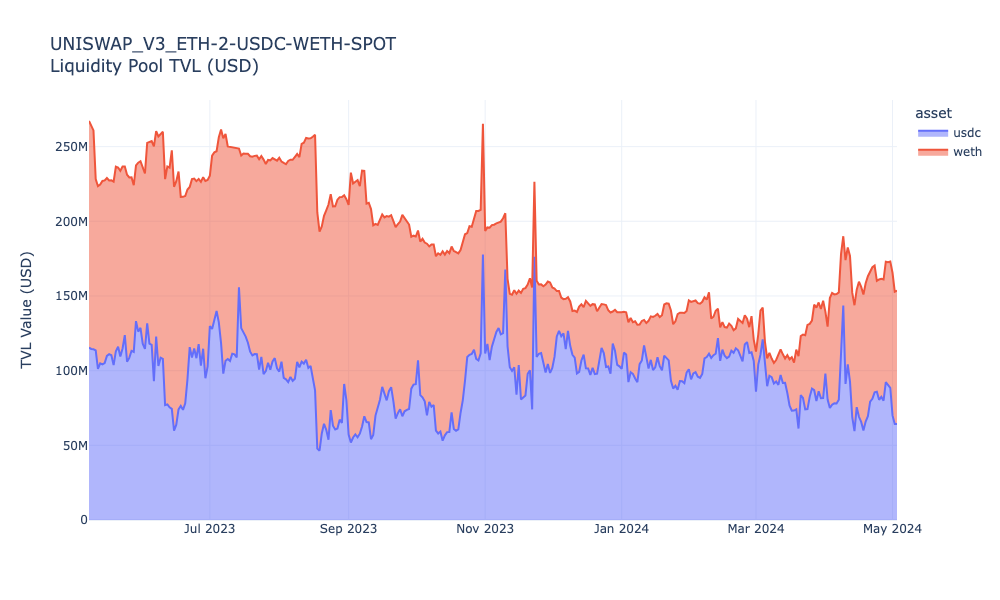

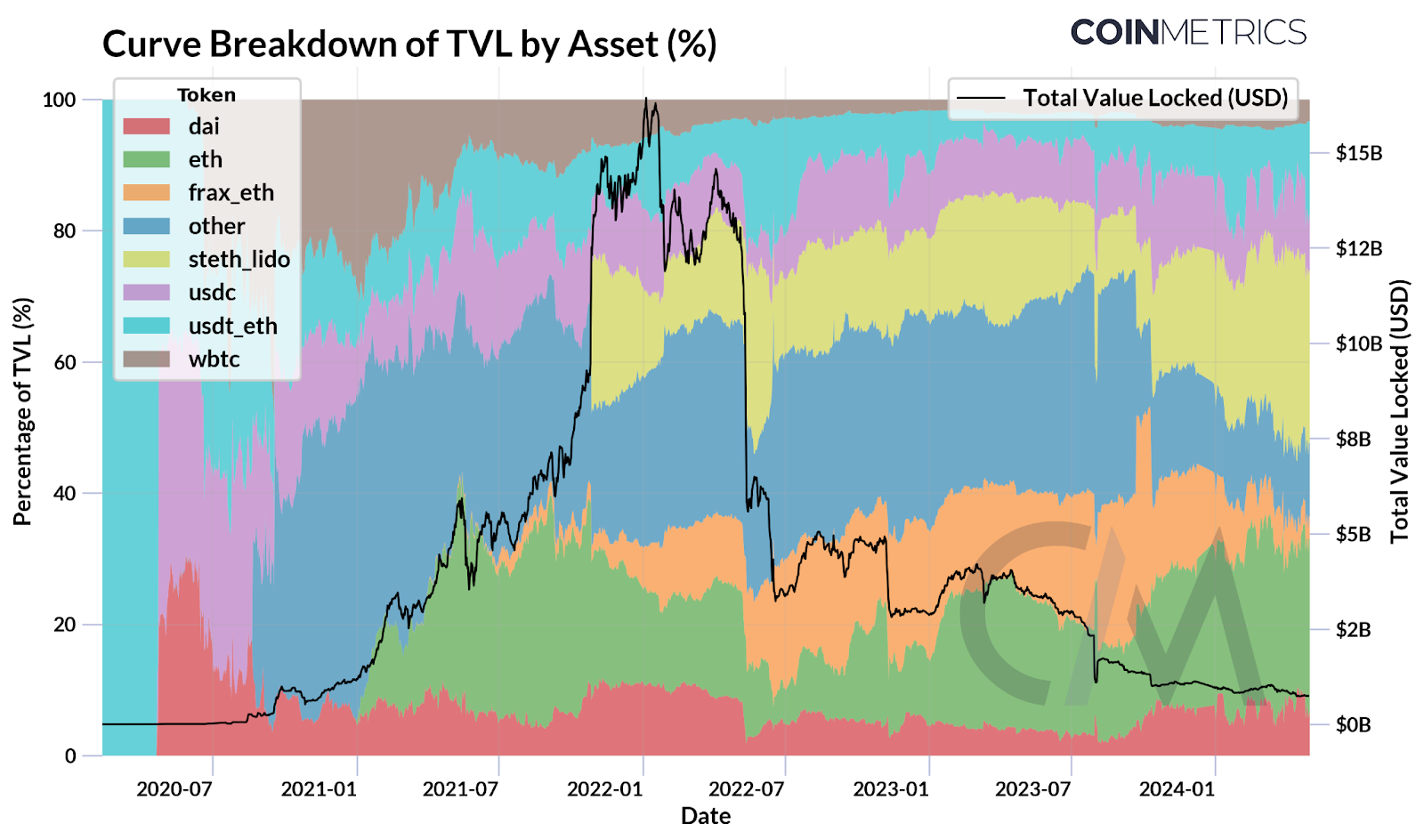

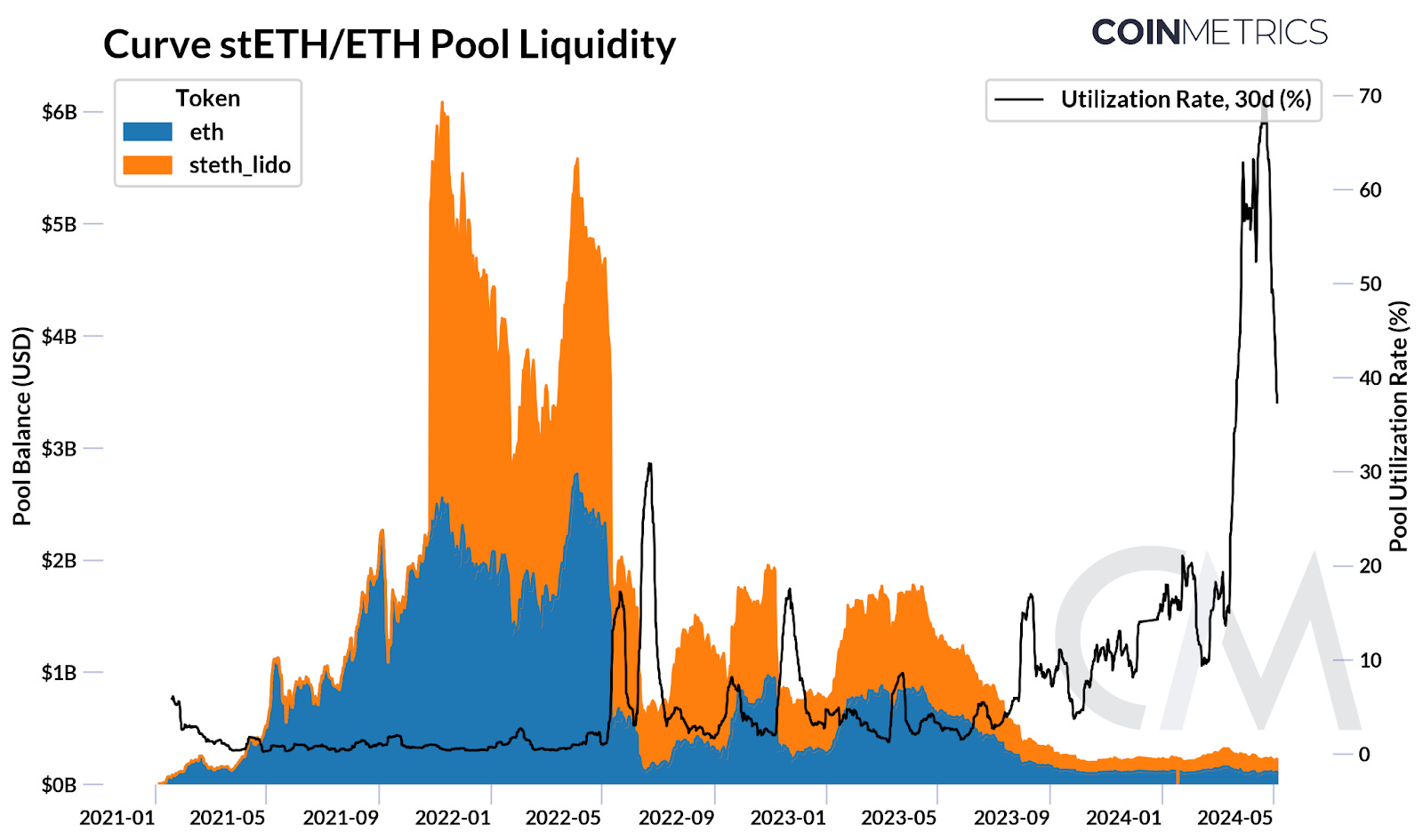

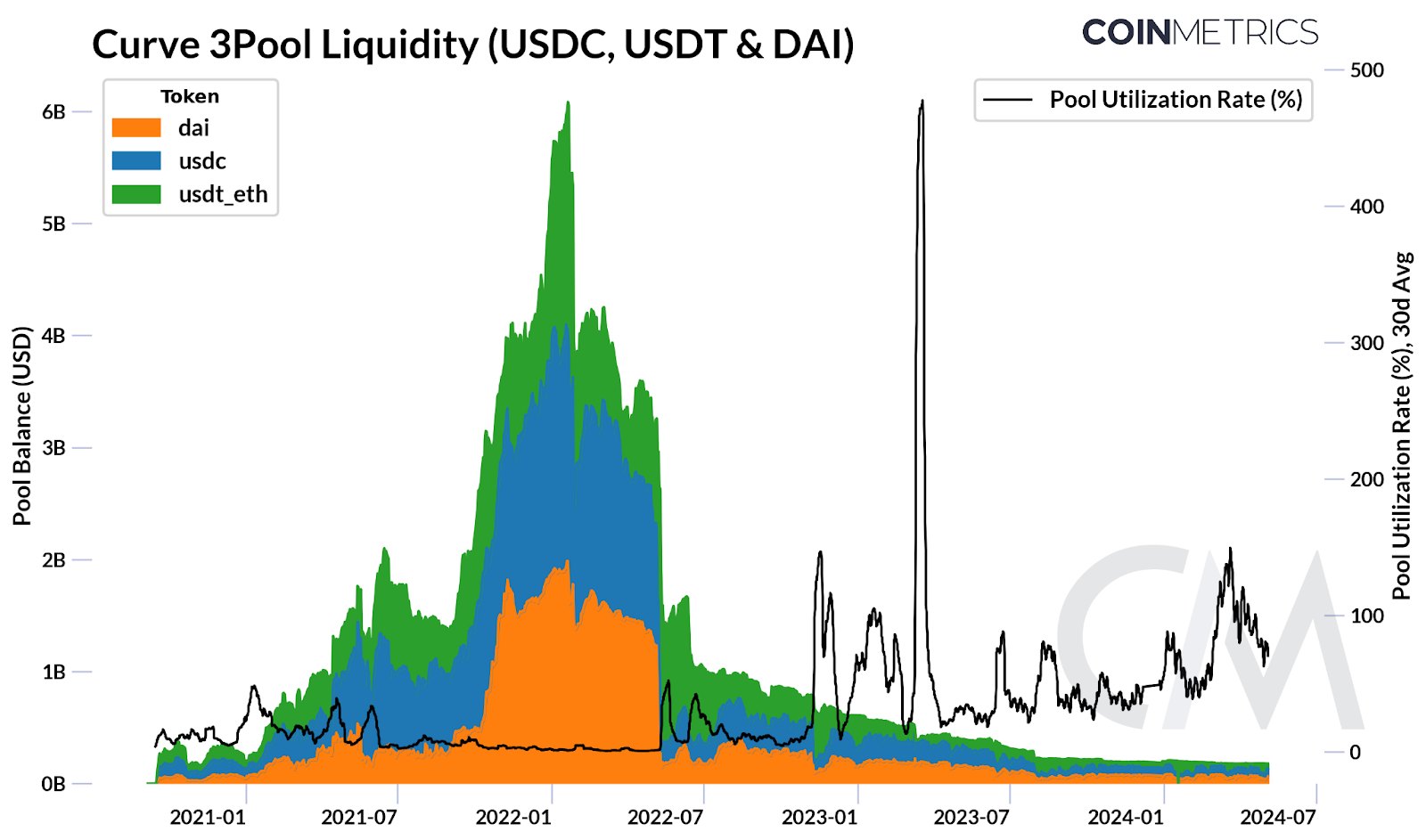

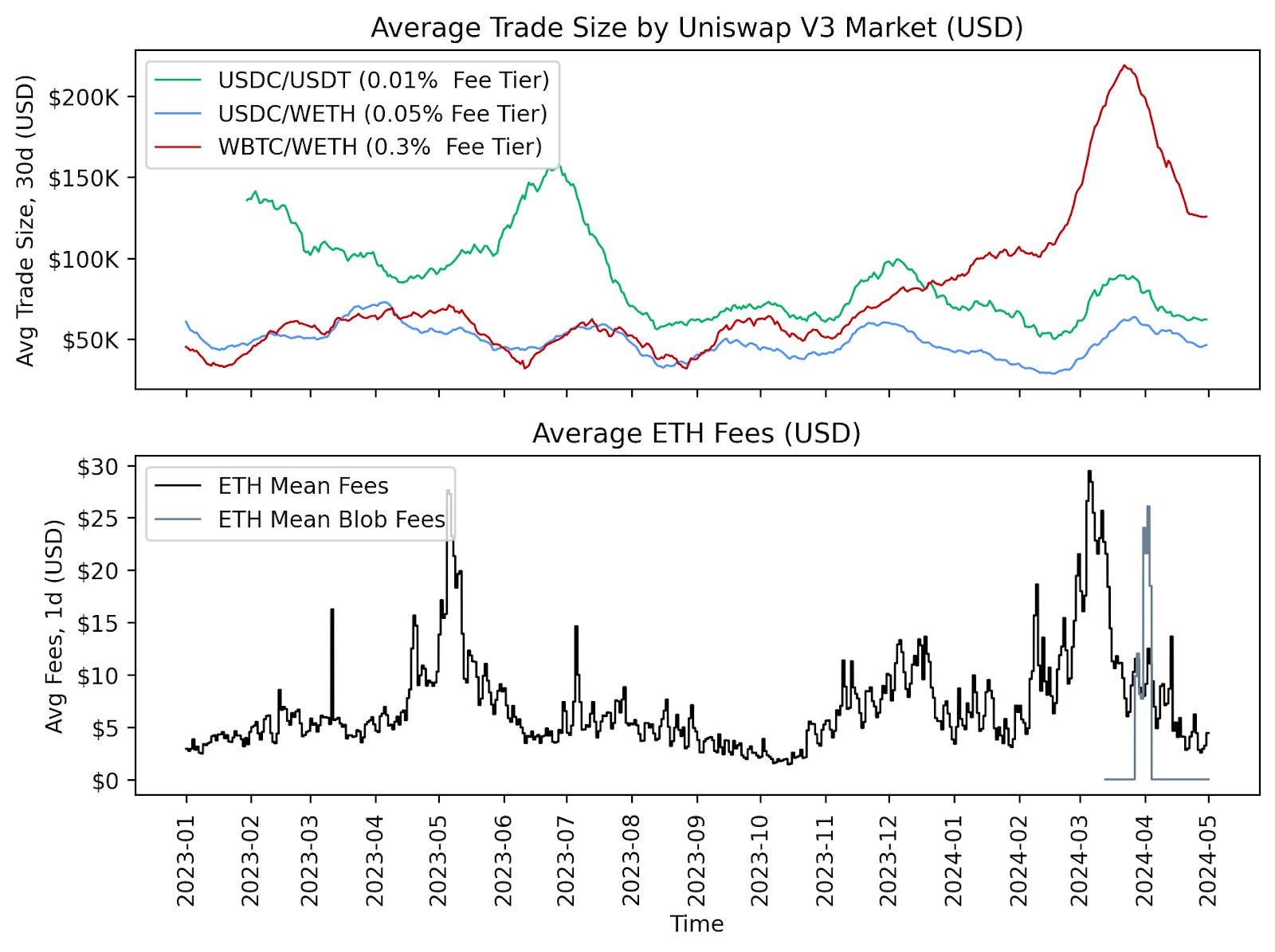

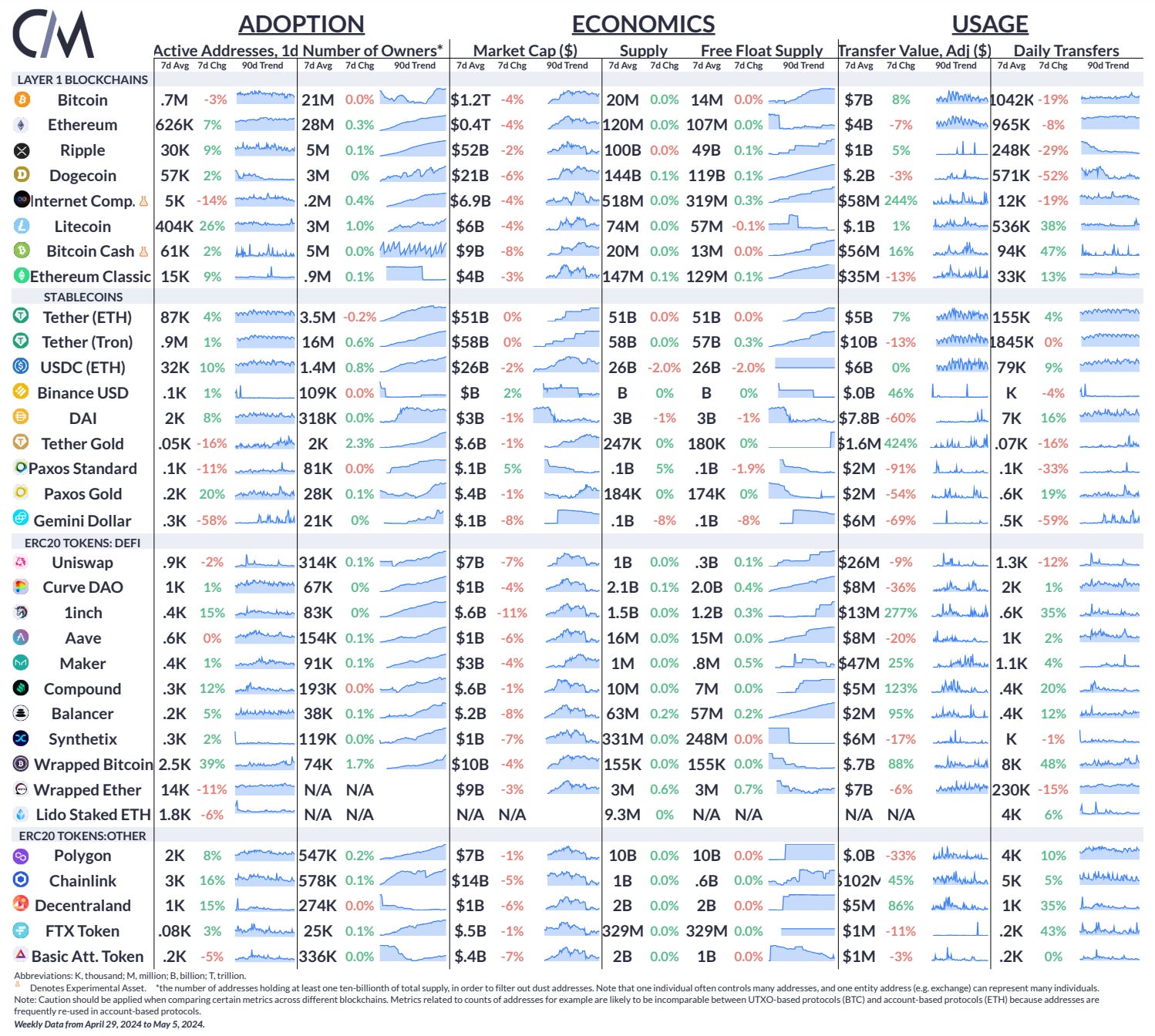

IntroductionDecentralized exchanges (DEX’s) form a core piece of infrastructure in the digital asset ecosystem. They serve as the gateway to the on-chain economy and facilitate the listing, trading, and provision of liquidity across markets without the need for intermediaries. The debut of Uniswap in 2018 marked a pioneering development in the use of liquidity pools and automated market makers (AMMs), a model that has since been widely adopted by numerous DEXs. As the number and maturity of DEXs have evolved, assessing their adoption provides insight into a critical component of the cryptocurrency infrastructure. The Properties of Decentralized Exchanges & AMM’sIn light of the recent Wells Notice issued by the Securities and Exchange Commission (SEC) to Uniswap Labs, it is crucial to underscore the distinctive features of DEXs. Although the specific concerns have not been fully disclosed, the SEC's intent to potentially subject DEXs to regulatory oversight mirrors actions taken against major centralized exchanges like Coinbase and Binance, particularly regarding the securities classification of traded assets. However, DEXs differ fundamentally from their centralized counterparts. Trading Volume RisesTrading volumes across major decentralized exchanges (DEXs) are currently on an uptrend. While market volatility has occasionally spurred spikes in activity, trading volumes remained subdued for most of last year, averaging around $15B in monthly trading volume. However, since October, Uniswap has recorded a quarterly trading volume of $54B in Q4 2023 and $84B in Q1 2024. Trading volume on Curve Finance is also on the rise, though not yet reaching the levels seen before the USDC de-peg in March 2023. Source: Coin Metrics DEX Market Data & Labs Uniswap — Largest Markets & Liquidity PoolsToday, Uniswap stands as the largest decentralized exchange by volume, having facilitated over $2T in cumulative transaction volume. It is regarded as a cornerstone of the entire decentralized finance (DeFi) sector's expansion. With each protocol iteration, Uniswap’s liquidity provision model has seen several advancements. Introduced in 2020, Uniswap v2 offered a foundational AMM platform, utilizing a constant product invariant (x * y = k). This version facilitated token swaps by ensuring liquidity even in less active markets and its permissionless process to create markets (also referred to as pools) has made it a nurturing ground for a diverse set of pairs—ranging from blue-chips to memecoins. While trading volumes don’t match that of Uniswap v3, several pools on Uniswap v2 boast a greater quantity of trades, favoring newly-listed tokens and passive liquidity providers. However this also came with its challenges, such as vulnerability to forms of maximal extractable value (MEV), reduced capital efficiency due to having to allocate capital across the entire price range, and the potential for impermanent loss, reducing earnings for liquidity providers. Source: Coin Metrics DEX Market Data Uniswap v3 addressed some these challenges with its concentrated liquidity model, allowing LP’s to allocate capital within spcific price ranges. This enhancement greatly improved capital efficiency and LP returns, as token reserves only needed to be maintained across a defined price range where liquidity was most required. As illustrated in the chart below, this mechanism has significantly increased liquidity in stablecoin markets. Source: Coin Metrics DEX Market Data The pairing of Circle’s USDC with wrapped ETH (USDC-WETH pool), featuring a 0.05% fee, is one of the most liquid and actively traded markets on Uniswap v3. This pair draws a higher number of trades due to its low transaction cost, reduced price volatility, and the popularity of both assets. These factors make it an attractive option for both traders and liquidity providers. Source: Coin Metrics DEX Market Data & ATLAS Curve — Liquidity Drier, Utilization HigherSimilar to Uniswap, Curve Finance is an automated market maker (AMM)-based DEX that has established itself as a central hub for assets of similar value. Before the introduction of Uniswap v3’s concentrated liquidity mechanism, stablecoins often faced liquidity challenges, and liquidity providers (LPs) earned relatively low fees. Launched in 2020, Curve aimed to address these issues by enabling low slippage swaps between stablecoins through its StableSwap AMM. This system uniquely combines the constant sum invariant (x + y = k) with the constant product invariant (x * y = k) used by Uniswap. As a result, Curve has facilitated a diverse set of markets for stablecoins, wrapped assets, and liquid staking tokens (LSTs), focusing on deep liquidity within narrower price ranges. Source: Coin Metrics DeFi Balance Sheets & Labs As seen in the chart above, the total value of locked (TVL) of assets in Curve smart contracts rose rapidly to over $15B in 2021, before an exodus of liquidity due to a loss of user confidence to de-peggings and an exploit in 2023. The composition of liquidity in Curve has changed over time, with ETH (26%), stETH (26%) and stablecoins (32%) making up a majority of liquidity, while other assets have reduced in dominance. Currently, the stETH/ETH pool is the largest liquidity pool on Curve. Curve was a primary hub for stETH, where a majority of liquidity was concentrated prior to the Shapella upgrade. However, conditions have changed since the stETH de-pegging in May 2022 (when price of stETH deviated from the underlying ETH by ~6.5%) and since withdrawals were introduced. Liquidity has expanded to other AMM’s and CEX’s and there is also a primary market for stETH liquidity. Currently, there is ~$220M of liquidity in this pool, significantly lower than its $6B peak in early 2022. Source: Coin Metrics Labs However, liquidity or total value locked (TVL) alone doesn’t capture the full picture. The utilization rate of the pool, representing how much of the deposited liquidity is being actively used/traded, is on the rise. This metric, available through our DeFi Balance Sheets endpoint is applicable to liquidity pools in money markets like Aave and DEX’s like Curve, capturing the financial health of these protocols more effectively. Source: Coin Metrics Labs With its focus on pegged assets, stablecoins like USDC, USDT and DAI gained traction on the platform, resulting in the largest stablecoin pool called the 3Pool. Loss of investor confidence with the de-pegging of Terra’s UST and Circle’s USDC has caused liquidity to dry up. However, several stablecoins that have recently entered the fray, such as PayPal’s PYUSD, FRAX and yield-bearing products like MakerDAO’s sDai and Ethena’s USDe, have gained ground on the exchange. Impact of Protocol & Network FeesTrading fees at the protocol level (i.e. Uniswap v3) and transaction fees at the network level (i.e. Ethereum mainnet or Layer-2’s) can shape the behavior of traders and liquidity providers on DEX’s. In the chart below, we can observe that higher fee tiers, such as the 0.3% fee tier for WBTC/WETH pair on Uniswap v3, tend to have larger average trade sizes compared to lower fee tiers like the 0.01% tier for USDC/USDT pair. In addition to external market conditions and transaction costs, these fee tiers also directly impact the trade-off between risk and return for swappers and liquidity providers (LP’s). Source: Coin Metrics DEX Swaps Data & Network Data Network transaction fees represent an additional expense for users on DEX’s. High transaction fees on Ethereum mainnet are better suited to larger and less frequent trades, as fixed costs can be spread over larger trade sizes. On the other hand, the implementation of the Dencun upgrade and the explosion of Layer-2 solutions means that users who prioritize speed and low costs can transact without being priced out, while those that require the security of the base-layer can utilize Ethereum’s L1. Trends Shaping the DEX LandscapeWith a number of rollups on Ethereum and layer-1 blockchains like Solana bringing transaction fees magnitudes lower, DEX’s are expanding across multiple networks. Uniswap v3 is already deployed on 16 different chains. Several layer-2’s host native DEX’s such as Aerodrome, the largest exchange on Coinbase’s Base network, allowing users to traverse across the ecosystem, while others feature hybrid AMM or order-book based DEX’s like Raydium and Hyperliquid, leveraging its high throughput and low fees. This diversity caters to users with different risk profiles and preferences in the DeFi landscape and will continue to evolve as rollups and L1’s mature. Uniswap is also set to release its 4th iteration, introducing a “singleton” architecture, where all pools live within a single smart contract. This will bring major reductions in gas costs as tokens won’t need to move between separate pool contracts when a swap is made. Uniswap v4 also introduces “hooks”, which enables developers to customize pool functionality and execution, extending the flexibility of the protocol to build on-chain limit orders, tools to protect against MEV or custom logic for the trading of tokenized real-word assets (RWA’s). In general, the trends point towards DEX’s becoming more universal, expanding their presence across networks while catering to a wider range of traders and liquidity providers. ConclusionThe evolution of decentralized exchanges such as Uniswap and Curve Finance highlights significant strides in the DeFi sector, particularly in enhancing liquidity management and trading efficiency. These developments not only cater to a broad spectrum of trader preferences and risk profiles but also signal a robust future for decentralized trading environments, where accessibility and efficiency continue to drive widespread adoption in the crypto ecosystem. As the DeFi ecosystem matures, the regulatory environment around DEXs and their adoption trends are poised to continue evolving. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro The market capitalization of Bitcoin and Ethereum declined by 4%, while active addresses for Wrapped Bitcoin (WBTC) rose by 39% over the week. Aave Labs released a deployment proposal for Aave V4, aiming for a mid-2025 release Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Measuring Exchange Quality And ‘Fake Volume’

Tuesday, April 30, 2024

Crypto data for the decentralized economy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Layer-1 Landscape

Tuesday, April 23, 2024

A data-driven look across Layer-1 ecosystems ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s 4th Halving

Tuesday, April 16, 2024

Understanding the significance of halvings, impact on miners and bitcoin's price ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Solana Uncovered: An Introduction to the Solana Network

Tuesday, April 9, 2024

A data-driven overview of the Solana Blockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q1 2024 Wrap-Up

Tuesday, April 2, 2024

A data-driven overview of events shaping digital asset markets in Q1–2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏