Headlines Saying FTX Is Paying Everyone 100% Are Inaccurate

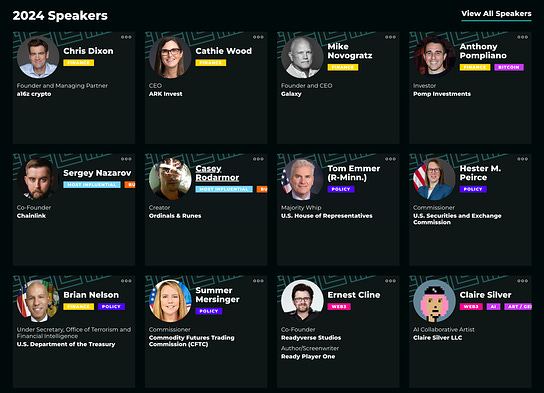

Today’s letter is brought to you by Consensus 2024!Consensus 2024 is happening May 29-31 in Austin, Texas. This year marks the tenth annual Consensus, making it the largest and longest-running event dedicated to all sides of crypto, blockchain and Web3. Don’t miss Bitcoin: We Are So Back, where Anthony Pompliano will discuss what the next bull market will look like, how it will differ from previous run-ups and the broad macro investment thesis for bitcoin and crypto more broadly. Consensus has tailored programming for Bitcoin maxis and multi-chain mavericks alike, covering everything from post-halving strategies to mining and more. Plus, you absolutely won’t want to miss the epic BTC (Nic Carter) vs ETH (David Hoffman) battle at Karate Combat. That’s just a taste of what's to come at crypto’s only big-tent event. Join Consensus in Austin alongside 15,000+ investors, founders, brands and more to take in all that blockchain has to offer. Get your pass today and use code POMP to save 20%. To investors, Mainstream media headlines this morning read “FTX Has Billions More Than Needed to Pay Bankruptcy Victims” and “FTX says most customers of the bankrupt crypto exchange will get all their money back.” This is inaccurate. Let me explain. FTX’s advisors filed a disclosure statement yesterday that revealed a plan to end the Chapter 11 bankruptcy. In the document, the advisors claim they have between $14 billion to $16 billion to pay out to creditors in the coming months. These are big numbers considering that FTX only owes approximately $11 billion to various people and entities. So how did FTX get so much money? First, they had cash on their balance sheet before they went bankrupt. Second, they were able to sell a number of investments they had, such as an investment in hot AI startup Anthropic, to generate more cash. And lastly, the various crypto assets FTX held have appreciated hundreds of percent over the last year. So if the company has more money than what they owe, everyone should get paid back 100%, right? Not quite — it is not that easy. There is some funny math going on here. FTX users who had crypto on the platform are owed money based on crypto prices back in November 2022. So if you had 1 bitcoin on the platform, you would be owed approximately $18,000. Although FTX is claiming they will pay you 100% of the $18,000, this means that you are actually only getting ~ 0.28 bitcoin back from the exchange. That is only 28%. If you price the claim in dollars at the time of the bankruptcy, then FTX can take a victory lap and claim they are paying everyone back 100% of their funds. But if you denominate the claims in the native asset that a user put on the platform, then FTX is not even paying back 30% of the users’ funds. Unfortunately, this is how bankruptcy works. The courts need to pick a date to use for the value of claims. The court also historically has used a single currency, US dollars, to denominate all claims. The same phenomenon at play in the FTX case is also present in other crypto bankruptcy cases (Celsius, Blockfi, etc). The fact that crypto assets are involved here has thrown a curveball to the courts. They have never seen financial assets appreciate hundreds of percent in a year, which drastically changes the calculation of the true value of a creditors’ claim. I don’t know what the right answer is for future bankruptcy cases. That is for people much smarter than me to figure out. But I do know that the headlines boasting that FTX users are going to be paid back 100% of their money are misleading. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Marko Papic is a macro strategist who incorporates geopolitics into his investment analysis. He is also the author of "Geopolitical Alpha: An Investment Framework for Predicting the Future." In this conversation, we talk about geopolitical alpha, how to apply it to your investment process, China, Ukraine, Russia, Isreal, El Salvador, United States, rest of the world, commodity prices, public media narrative, inflation, proxy wars, bitcoin, and more. Listen on iTunes: Click here Listen on Spotify: Click here Geopolitical Investor Marko Papic Breaks Down The Global Situation Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Bitcoin's 200 Day Moving Average Hits All-Time High

Monday, May 6, 2024

Listen now (2 mins) | To investors, The bitcoin network launched on January 3, 2009. In just over 15 years, the network has become the strongest computer network in the world. There are hundreds of

Prediction Markets Don't Believe The Fed

Friday, May 3, 2024

Listen now (2 mins) | Today's letter is brought to you by Consensus 2024! Consensus 2024 is happening May 29-31 in Austin, Texas. This year marks the tenth annual Consensus, making it the largest

Bitcoin Is Beaten Down By The Macro Environment

Wednesday, May 1, 2024

Listen now (3 mins) | To investors, Bitcoin's price has been falling in recent weeks. This may be surprising to market participants that expected the digital currency to rise aggressively after the

Hong Kong Launches Crypto ETFs To Lackluster Trading Volumes

Tuesday, April 30, 2024

Listen now (3 mins) | To investors, There were six new crypto ETFs that started trading in Hong Kong on Tuesday. These were the first spot bitcoin and spot ether ETFs to launch in the region, but the

There Is So Much Money Sloshing Around The System

Monday, April 29, 2024

Listen now (2 mins) | READER NOTE: This Thursday I am hosting a free webinar for anyone who is trying to transition into a new job in the bitcoin and crypto industry. Previously, my team and I have

You Might Also Like

Fixing conversions and killing the business

Thursday, December 26, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

How to Write a Job Description

Wednesday, December 25, 2024

A deep dive into a job description that speaks to the deepest longings of the human spirit.

🎄 Recap: 21 Episodes of AI 101 Guide

Wednesday, December 25, 2024

Take some time to learn or refresh the key concepts, techniques, and models that matter most

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack