Earnings+More - Up for grabs

Up for grabsCaesars and Penn in play after activists interventions, Flutter’s CFO departs, startup focus – Third Planet +More

This game is all just snakes and ladders. Troop maneuversIcahn opener: In something of an activist double whammy last Friday, Penn Entertainment investor Donerail issued a letter severely criticizing Penn’s management while a news report from Bloomberg disclosed famed activist Carl Icahn, who has previous with the gaming sector, has “amassed a sizable position” in Caesars Entertainment.

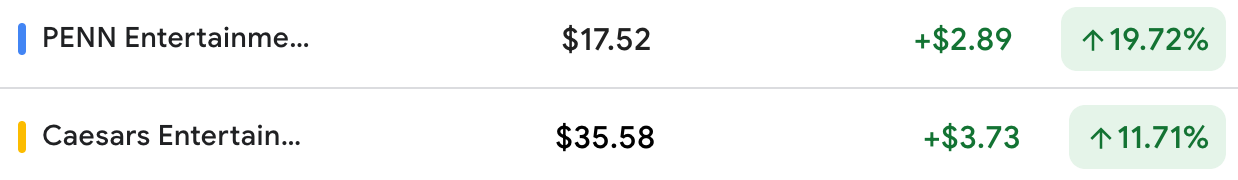

🔥 Penn and Caesars’ shares up on activist news Donerail party: Icahn, who owned a chunk of the Caesars’ pre-Eldorado merger entity, offered no comment. But the latest salvo from indignant Penn shareholders was much more public and piled on the pressure after similar public outbursts from shareholders HG Vora, which controls 9% of the shares of the company, and Greenlight Capital.

Piling in: In an open letter, Will Wyatt, managing partner of Donerail, said it was the investment group’s belief that the share price was “significantly below” the intrinsic value of Penn.

Good knight and good luck: Analysts at Jefferies said on Friday that the Donerail letter “highlights not only key drivers of the shares’ (under)performance but also prospective alternatives for driving higher value.”

While Donerail bemoaned the “destruction of value” represented by Penn’s “inability to execute” in interactive, the company’s “newest bright and shiny object” ESPN Bet could yet find a home with another buyer.

Read the room: The content of the Donerail letter and the share price reaction mean events now “have their own momentum,” said one source. "If your shareholders are calling for a review and the share price is telling you that it could be worth more, then maybe the board might feel it can save face,” the source added. Proxy music: What the Penn board will want to avoid is a looming proxy battle over board appointments. While there won’t be a challenge in the upcoming AGM vote in June, it is believed activists HG Vora are primed to present a slate of alternative board directors at next year’s AGM.

See tomorrow's special Due Diligence edition for more on the content of the Donerail letter and what might happen next at Penn. Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. +MoreGiG Media has announced the acquisition of iCasino advocacy and review platform Casinomeister for €3m. GiG said the acquired business will continue to operate under its brand within the portfolio, “preserving its unique voice.” The deal is expected to close in June. Earnings in briefPlaygon: The live casino provider saw a sequential decline in revenues in Q1, down 20% to C$230k ($169k) after the loss of a customer. Net losses rose 12% YoY to C$4.5m. By the numbersMacau: GGR was up 30% YoY in May to $2.51bn, a sequential improvement of 9% and representing the highest post-pandemic total to date though still nearly 20% below 2019 levels. The analysts at Seaport suggested the total was “better than expected.”

Arizona: Belated March numbers showed sports-betting GGR up over 10% to $37.9m on handle that rose 42% to $758m. FanDuel remains the market leader with 46% of GGR share, followed by DraftKings on 29%. Career pathsFinger lickin’ good: Churchill Downs has appointed Sam Ullrich as VP of investor relations. Ullrich was previously director of commercial and financial planning for KFC. Evoke has appointed Anne Sewell as chief people officer. Star Entertainment has installed Jeannie Mok as group COO. Catena Media has named Jasleen Kals as VP of product. Carl Hallam, the former head of marketing at BetVictor, is to lead the new Gibraltar hub of Manchester-based marketing business Vega. Flutter departuresGoodbye and good riddance: As if to wave a dismissive goodbye to Flutter, its share price in London suffered a volatile day on Friday when the confirmation of the company moving its primary listing to New York coincided with the news of the departure of CFO Paul Edgecliffe-Johnson.

👻 Spooked: UK shareholders react badly to news of Flutter’s CFO departure Nothing to see here: The team at Jefferies said the share price reaction was understandable given the “immediate effect” nature of the departure, but insisted it did not reflect any change in guidance.

With great power comes great responsibility: Recall, Flutter said on Friday Edgecliffe-Johnson was leaving due to personal reasons and an inability to commit to spending time in the company’s new US HQ in New York.

The team at JMP also noted the “next goal” for Flutter would be inclusion in the S&P 500, which as they pointed out, currently has no online gaming company. “Given Flutter’s profitability and global scale, it meets nearly all criteria as a candidate for inclusion,” the team argued. The pips squeakTo the hilt: Flutter’s share price action on Friday came after a volatile week for the bellwether’s of the online betting and gaming sector. Flutter ended the week down over 5% while rival DraftKings shipped almost 15% of its market cap on the news of the tax hike in Illinois.

😱 The shareholders are revolting Contagion risk: The analysts at Truist said the share price moves reflected concerns that other states “could potentially follow suit.” But as the team at Jefferies said last week, the moves in Illinois were very much about protecting local casino operators.

Mitigate, mitigate: Still, Jefferies added that rising taxes were a “likely narrative” as the market matures. “Where taxes have risen elsewhere, operators recapture lost margin with lower promotional activity, less favorable odds to customers and market share shifts to the larger operators,” they added. Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless. For more info, go to www.kambi.com Growth company newsThe decentralized betting exchange BetDex founded by ex-FanDuel co-founder Nigel Eccles, has officially launched operations in Ireland. See Wednesday’s The Token Word for more. The AI-generated slots provider Xgenia has launched a platform that it said would allow operators to create unique slots games using AI technology in under 20 minutes. Startup focus – Third Planet AffiliatesWho, what, where and when: Founded by Cal Spears and Adam Small, Third Planet is a remotely operated entity that, says Small, brings “top-quality casino and lottery news to the US-facing industry without putting anything behind a paywall.”

Funding backgrounder: So far, there has not been any outside funding. The Third degree: “Right now, resources are lacking for those who want to follow and educate themselves about the online casino and lottery spaces,” suggests Small. “Particularly in lottery.”

No messing: For now, Third Planet is solely US-focused, covering regulated online casinos, the sweepstakes and social casino sector, and the lottery. “We’ll also be hanging around the rim looking for good sports-betting opportunities if they come up. But as of now we’re not messing around in that space,” says Small.

What will success look like? Medium term, Third Planet’s goal is to be known as the top source for high-quality journalism on online casino and lottery. It also expects “consistent” positive revenue by “sometime in 2025.”

Calendar

Now live on the OpticOdds screen: player market alternate lines, vig, line history & more… Built for operators with an emphasis on speed and coverage, OpticOdds offers:

Join top operators at opticodds.com/contact. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

How d’ya spell egregious?

Tuesday, May 21, 2024

Penn under scrutiny, Entain concludes strategic review, Hard Rock denies Star link +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Wheels up! Penn’s private jet use

Monday, May 20, 2024

Penn's private jet flights, Rank's machine bump, Sportradar reaction, startup focus – Sharp Alpha +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

‘Hands off AGS’ plea

Friday, May 17, 2024

Investor goes public on take-private fears, Flutter reaction, Sportradar, Aristocrat, Gambling.com earnings +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Sunk! Games Global abandons float

Tuesday, May 14, 2024

Games Global IPO cancellation, Flutter momentum continues, Penn's ESPN Bet downgrade, Deal Talk – Tipico +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

FSB for sale… but who’s buying?

Monday, May 13, 2024

FSB sale rumors, Flutter reports Tuesday, Inspired's earnings recap, startup focus – Sports IQ sale +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The

End 2024 with a BANG💥 (Huge GIVEAWAY!)

Tuesday, December 24, 2024

Over $12K in gizmos & gadgets up for grabs View in browser ClickBank Hi there, We've got something totally different for you today, some good value fun (with no-strings-attached) to wrap up

Survey: Tech VCs ride wave of optimism

Tuesday, December 24, 2024

Crypto headhunter turns VC; unicorn valuations are stampeding; Nordstrom family inks $6.25B take-private for chain Read online | Don't want to receive these emails? Manage your subscription. Log in

The Daily Coach's Picks: 10 Recommended Books of 2024

Tuesday, December 24, 2024

These books promise to help empower your journey of growth and transformation.

Here's everything retail media network experts are asking for this holiday season

Tuesday, December 24, 2024

If retail media network experts could write a letter to the North Pole, here's what they'd ask for. December 24, 2024 Here's everything retail media network experts are asking for this

Hack offline word of mouth

Tuesday, December 24, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

🎯 Stop Planning Your Goals Like An Amateur

Monday, December 23, 2024

Here's how to actually crush 2025 while everyone else is nursing their hangover... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌁#81: Key AI Concepts to Follow in 2025

Monday, December 23, 2024

Plus – we become Hugging Face's residents 🤗

The best countries to manufacture your product [Roundup]

Monday, December 23, 2024

Here's your chance to win our best-selling "How to Find a Product to Sell on Amazon" course for FREE by answering our Amazon Software Poll. Hey Reader, Want to start sourcing from places