The Signal - India can’t afford a power nap

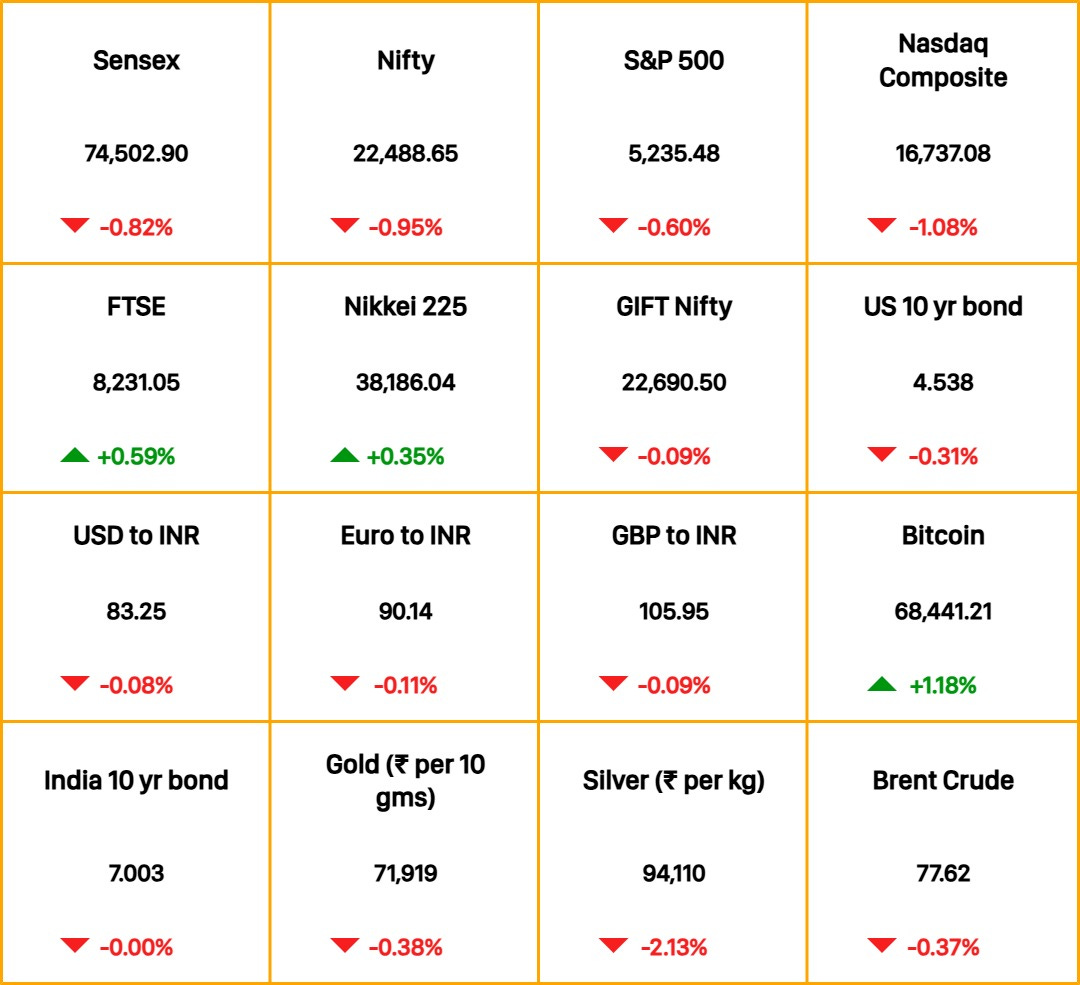

India can’t afford a power napAlso in today’s edition: Capital goods rut; Throuples therapy for OpenAI, Microsoft, and AppleGood morning! Netflix is cooking up brand new music competition shows. One of them is all about songwriters battling it out to pen tunes for pro artists. And the other? Musicians doing blind auditions to jam together in bands. According to The Wall Street Journal, the motive is to attract advertisers with such super-safe, family-friendly shows that have mass appeal. Also, now that Kapil Sharma is on Netflix, we're hyped for them to cook up some desi versions as well. Anup Semwal and Soumya Gupta also contributed to today’s edition. The Market Signal*Stocks & Economy: Asian stocks were up on Friday due to the probability of the Fed cutting interest rates after the US reported weaker than expected economic data. China’s PMI figures also missed estimates. Manufacturing activity fell from 50.4 in April to 49.5 in May, signalling weakening demand. Indian indices fell for the fifth day in a row on Thursday because of a selloff primarily in consumer durables, IT, and metals stocks amid a monthly expiry in derivatives contracts. Foreign direct investment inflows into the country declined 3% to $44.42 billion in the financial year-ended March 2024. The GIFT Nifty indicates a positive start for Indian markets. MANUFACTURINGNot Quite A Capital PositionThere’s money and demand, but no machines. India’s biggest manufacturers are struggling to add capacity because imports of capital goods and machinery for their factories are heavily delayed. Reliance Industries and Varun Beverages are struggling to expand bottling plants for their colas while electronic goods makers are waiting for key components such as heat exchangers for ACs. Losing fight: India is competing with bigger Asian manufacturing hubs. But it isn’t quite in the lead yet, meaning capital goods suppliers prioritise deliveries to clients in China, Vietnam and other rivals. Besides, the Red Sea crisis will likely continue for the rest of 2024, disrupting imports and spiking shipping rates. Too much demand: While they wait for the machines, manufacturers are losing business. This year’s heatwave has led to unprecedented demand for (and shortage of) ACs in India and for beverages, including bottled water and colas. PODCASTTune in every Monday to Friday as financial journalist and host Govindraj Ethiraj gives you the most important take on the latest in business and economy. In today’s episode, he speaks to veteran economic journalist and author Shankkar Aiyar and Deepti Saletore, principal economist at Crisil. ARTIFICIAL INTELLIGENCETricky ThroupleApple was in talks with both Google and OpenAI to license their AI models. The latter took home the trophy. This new deal now sandwiches OpenAI between new bae Apple and partner Microsoft. What's in it for these companies? 🍎: Siri may get a dose of AI magic, and iPhone and Mac may get a chatbot. As for Apple’s privacy USP, The Information reports that the company could process AI data in a virtual black box. 🤖🧠: If the deal works out, there’s a chance that OpenAI’s chatbot may eventually replace Google search on the Safari browser. Or so chief Sam Altman would hope. 💻: The Apple deal may hurt Microsoft’s bets on AI-puters, but it'd also be a windfall for Microsoft's cloud revenue. Tangent: Vox Media and The Atlantic are the latest to sign deals with OpenAI, but licensing content to AI firms is arguably counterintuitive in the long run. ENERGYWill To Power

India logged a record peak electricity demand of 250 GW on Thursday. That in itself isn’t surprising. In the latest edition of its World Energy Outlook report, the International Energy Agency had projected that India would have the highest energy demand of all countries by 2050, a significant driver being the surge in household ACs. Only a quarter of Indian households own cooling equipment, but this number will go up as heat spells become deadlier and more frequent. What does this bode for a country that may suffer its biggest power deficit in 14 years this June? Electricity supply has already been disrupted in the National Capital Region, Mumbai, Belagavi and Dehradun.

FYITwist: Donald Trump has been found guilty on all 34 counts in his hush money trial, becoming the first former US President convicted of felony crimes. His sentencing is set for July 11. Bill of health: The Emami Group is weighing strategic options, including a potential sale, of its pharmacy retail chain Frank Ross, Moneycontrol reports. The conglomerate has, however, denied plans for a sale. Tragedy: At least 22 people died and more than 50 suffered injuries after a bus ferrying pilgrims from Kurukshetra to Shiv Khori fell into a gorge in Akhnoor, Jammu. Going oil in: Saudi Arabia is poised for a major secondary share sale in oil giant Aramco to possibly raise around $10 billion, Reuters reports. Pay for the damage: Bloomberg reports that China may impose a record fine of at least 1 billion yuan or $138 million on PwC for its auditing work on developer Evergrande, which has been accused of financial fraud. THE DAILY DIGIT9%The rate at which India’s biggest retailers and quick service restaurant chains expanded their store network in FY24. This is the slowest growth rate in five years. (The Economic Times) FWIWSmart bandages?: Yep, they're in the pipeline. Picture this: bandages that chat with doctors. How cool is that? Researchers worldwide are hustling to whip up prototypes with tiny electronics that can monitor wound healing and shoot the data straight to the doc. Researchers at the University of Pennsylvania and Rutgers University are even experimenting with electrotherapy bandages. Shocking, right? But hey, it's believed that a jolt of electricity can turbocharge the healing process. While these high-tech bandages sound like the future, we'll have to stick with our trusty old-school ones for a while. Most prototypes are still in the animal testing phase, after all. The Signal is free today. But if you enjoyed this post, you can tell The Signal that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Red Bull is heading to England

Monday, June 3, 2024

Also in this edition: A collection of the best weekend long reads on the sports business ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The most important continent on Earth

Monday, June 3, 2024

What does the future of Antarctica look like in a changing world and geopolitical climate? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Exit stage right

Monday, June 3, 2024

Also in today's edition: Not enough liquidity for infra loans; China basks in the moonlight ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The dukes of hazard

Friday, May 24, 2024

Also in today's edition: Can marketing save De Beers (again)?; Home truths ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Can Google fix its mega Pixel flub?

Thursday, May 23, 2024

Also in today's edition: How climate change is making air travel riskier; China's tit-for-tat tariffs ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Where Are The 2021 Unicorns Today?

Tuesday, March 4, 2025

60% Are Stuck In Limbo To view this email as a web page, click here saastr daily newsletter Where Are The 2021 Unicorns Today? 60% Are Stuck In Limbo, Per Carta By Jason Lemkin Sunday, February 2, 2025

Ranking 2024's busiest investors

Tuesday, March 4, 2025

CoreWeave files for IPO; Anthropic banks $3.5B Series E; Ramp hits $13B valuation in secondary deal; one month in global markets Read online | Don't want to receive these emails? Manage your

Lead, Don’t Feed

Tuesday, March 4, 2025

Depth > Frequency.

"What You’re Made For": Lessons from a Life Well Lived

Tuesday, March 4, 2025

We are not merely here to exist, survive, or drift along—we are here to truly live.

WTF is attribution modeling?

Tuesday, March 4, 2025

Despite signal loss and last-touch bias limiting its usefulness, marketers are still turning to attribution modeling to measure the impact of their ad spend. March 04, 2025 PRESENTED BY WTF is

🔔Opening Bell Daily: Stocks believe Trump now

Tuesday, March 4, 2025

The S&P 500 just had its worst day of 2025 as the president confirmed tariffs.

From 0 to $5B (local non-US market)

Tuesday, March 4, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From 0 to $5B (local non-US market) Nadiem Makarim is a guy who managed to create