Bitcoin ETFs Continue To See Material Inflows

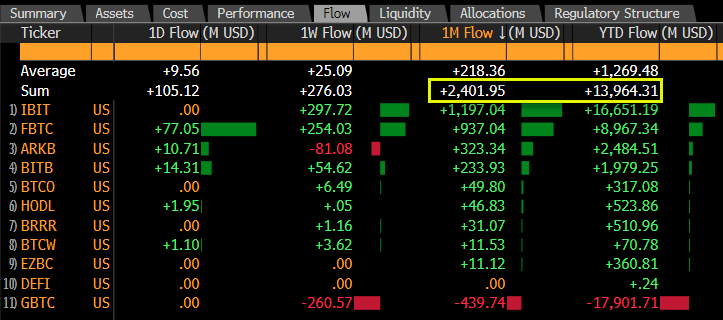

To investors, Bitcoin has been lulling the market to sleep in recent weeks. However, as the digital currency continues to trade sideways, the ETFs are quietly accumulating more assets. Bloomberg’s Eric Balchunas pointed out this morning:

It is hard to decipher a difference between retail and institutional flows in these ETFs, but capital is flowing regardless of who is putting money to work. This capital doesn’t care about the price of the asset. It continues to flow in an attempt to gain price exposure to one of the best performing assets in history. Last week I attended the Consensus Conference in Austin, Texas. One of the big takeaways was how certain the institutional world has become when thinking about bitcoin. This certainty has nuance to it. Institutions have not reached consensus on what bitcoin will become — there is wide disagreement on how to value bitcoin, along with various price targets that people have thrown out to the public. Instead, institutions are building certainty around bitcoin’s survival. They have developed confidence in the downside protection of allocating to bitcoin. This confidence changes market behavior. Long-term thinking is derived from confidence and conviction. Without those, insecurity drives impatience. Bitcoin is antithetical to impatience. You can see this quantitatively in the fact that majority of the bitcoin in circulation has not moved in over two years. It didn’t matter that the price dropped 80% or that the asset rebounded back to all-time highs. Most bitcoin holders aren’t selling. Combine this newfound certainty and conviction from institutions with their existing trend of passive investing and you can see how persistent capital in-flows are likely the name of the game for years to come. At the same time that the existing institutional leadership is building their certainty and conviction, there is a rising demographic of young people in these institutions who are poised to take up the cause as they ascend into leadership positions. An interesting way to think about this is how Bitcoin Magazine’s David Bailey explains it:

That view of the current bitcoin holder base almost sounds too good to be true. But I am constantly surprised at how many people I meet who hold bitcoin and don’t work in the industry. This weekend I was at a dance recital for my daughter and a guy came up to me. He works at Apollo, but is a big bitcoin believer. Last week at the conference I met people from almost every continent, and from many different industries, who were all interested in seeing the Bitcoin vision come to fruition. Some of the individuals will eventually sit in positions of influence and power. They will run the large financial firms. They will become our political leaders. They will create the next generation of world-changing companies. A true decentralized network of people all working towards a common cause. This is what capitalism looks like. This is how economic incentives work. What a beautiful thing to see. And this is why the ETFs will continue to see persistent in-flows over the long-term. Bitcoin is an idea whose time has come. Have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Peter McCormack is the Chairman of Real Bedford, and the host of “What Bitcoin Did” podcast. In this conversation, we talk Peter buying Real Bedford men’s team and plugging it into the bitcoin network, his plan to make the Premier League, raising capital, sponsors, merchandise, treasury management, bitcoin market cycles, women’s team, opening a bar, building a stadium, investing in the community of Bedford, and potential risks. Listen on iTunes: Click here Listen on Spotify: Click here Peter McCormack’s Football Plans & How Bitcoin Saved Them Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Ether ETFs Are Causing Controversy

Monday, June 3, 2024

Listen now (4 mins) | To investors, The SEC approved important rule changes for various traditional exchanges yesterday which will allow them to list spot Ether ETFs in the near future. This is another

Is Bitcoin Ready To Break Out?

Monday, June 3, 2024

Listen now (3 mins) | To investors, Bitcoin has been trading sideways for a number of weeks. This follows the euphoria from the bitcoin spot ETF approvals, along with the market-wide exhale post-

Podcast app setup

Monday, June 3, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Monday, June 3, 2024

Open this on your phone and click the button below: Add to podcast app

Corporations Want A Lot More Bitcoin

Monday, June 3, 2024

Listen now (3 mins) | Today's letter is brought to you by Consensus 2024! Consensus 2024 is happening May 29-31 in Austin, Texas. This year marks the tenth annual Consensus, making it the largest

You Might Also Like

The best countries to manufacture your product [Roundup]

Monday, December 23, 2024

Here's your chance to win our best-selling "How to Find a Product to Sell on Amazon" course for FREE by answering our Amazon Software Poll. Hey Reader, Want to start sourcing from places

This "Boring" Website Makes $35k/month + A Special Deal

Monday, December 23, 2024

I'm always fascinated by different types of websites and how they make money. I recently ran across a website on such a boring subject, it got me thinking...maybe boring is a great way to make

How brands leverage commerce media for seasonal success in 2025

Monday, December 23, 2024

How diversifying ad placements reveals untapped revenue opportunities

Holiday Special: Lifetime Access for Less Than $1/Day

Monday, December 23, 2024

Make 2024 Your Year – Special Holiday Deal ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Create a LinkedIn funnel from personal posts

Monday, December 23, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Pfeffernuesse Day, Reader! Who wants a delicious and spicy

New SEO strategies for 2025

Monday, December 23, 2024

60% of Google searches result in no clicks. Zero. With AI integration, that number could become even higher. I'll show you how to adjust your strategy so you can capitalize on these shifts in our

Can We Mine Bitcoin In Space With Solar Panels?

Monday, December 23, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI keeps its grip on early-stage deals

Monday, December 23, 2024

Playground Ventures pares flagship fund size again; ecommerce startups ring up a funding surge; is 2025 the year of the industrials revival? Read online | Don't want to receive these emails? Manage

Found Ya 📍

Monday, December 23, 2024

Biz directories are still big.

The Pareto Principle in Practice: Why Two Is Better Than Three

Monday, December 23, 2024

By leveraging the Pareto Principle and following these five steps, we can avoid analysis paralysis and concentrate on decisions that truly move the needle.