Earnings+More - The $10bn goldmine

The $10bn goldmineAssessing the gaming opportunity in the UAE, hold rates could increase OSB TAM, FanDuel extends lead +More

But you won't need no harem, honey. Gaming oasisThe other Sahara: An operator-friendly casino market in the United Arab Emirates could be worth up to $10bn in gaming revenue and could tap into significant untapped demand, according to a report published this week by the equity and credit analysts at CBRE. Gulf resorts: With robust tourism, high spending levels and no gaming competition to speak of in the region, the analysts said the UAE presents “one of the best IR investment opportunities we have seen in a long time.”

Onto a Wynn-er: Wynn Resorts is furthest ahead with its plans for an IR situated on Marjan Island in Ras Al Khaimah. That project is slated to open in 2027 and the CBRE team said it has the potential to deliver strong returns and a greater non-gaming mix than Macau and even Singapore.

On the beach: Abu Dhabi will be the “likely” second mover with Yas Island, which CBRE said would be a “logical location” for an integrated resort. Lastly, MGM Resorts’ project at Jumeirah Beach in Dubai would also be a “contender” for an IR. MGM currently has a non-gaming management contract in place. Getting in on the ground: Other IRs are possible at a variety of locations across the UAE and CBRE suggested a line-up of global gaming operators would likely be interested, including Caesars Entertainment, Galaxy Entertainment, Genting, Hard Rock, Las Vegas Sands and others.

You’ll know when you know and not before: The analysts said the public commentary from the likes of Wynn and MGM Resorts suggested to them that the legislative changes to allow for gaming should be in place “within a couple of months.”

Now live on the OpticOdds screen: player market alternate lines, vig, line history & more… Built for operators with an emphasis on speed and coverage, OpticOdds offers:

Join top operators at opticodds.com/contact. +MoreGiG has completed an SEK100m ($9.6m) share issue with cash coming from existing investors, including Agerskov Kapital and the Juroszek family as well as the current joint CEOs Jonas Warrer and Richard Carter.

Gaming REIT Gaming & Leisure Properties has agreed to provide $111m to Queen Casino for the relocation of the operator’s Belle of Baton Rouge riverboat casino to land and for the property’s hotel renovation. Flutter’s Betfair has launched a new brand platform called Play Different in the UK. The brand will focus on in-play betting, cash out components and Acca Edge, and will debut at the start of the UEFA Euro 2024 tournament. Stats Perform has signed an exclusive agreement to collect and distribute data and live streams for International Cricket Council events. Now you see me: Golden Matrix will be added to the Russell 3000 Index, which it said will increase its visibility to investors. Jackpot.com has signed an agreement to become the official lottery courier and results provider for The Associated Press. Bally’s has launched a free-to-play social casino platform called Bally Play in association with Ruby Seven Studios. Earnings in briefSkyCity Entertainment: The New Zealand-based operator has lowered its FY24 EBITDA guidance to NZ$283m ($175.4m) at midpoint, blaming in part the increased casino expenses in Adelaide where the company faces an impending High Court judgment alongside a worsening economic outlook. Read acrossMaking plans for Nigel: In The Token Word, the Nigel Eccles-founded crypto-friendly betting exchange BetDEX has officially launched after being in beta for the past 12 months. Meanwhile, crypto-based prediction site Polymarket has recorded its best-ever month for bets transacted. Not a big college town: Compliance+More reported yesterday on how the NCAA’s proposals to ban college prop bets is gaining traction with apparently little push back from the operators. What we’re readingDestroy everything you touch: Sports agent Leigh Steinberg writes for The New York Times that “any suggestion” major league sport may be fixed or tainted will “destroy the industry.”

Allwyn’s UK boostJust the ticket: The global lottery operator enjoyed a 28% revenue boost from the first full quarter contribution from the UK National Lottery in Q1, as it formally took over under the new 10-year license. CEO Robert Chvátal said the launch was a “milestone” for the business.

Squeezebox: Over the period, Allwyn completed a new financing with the addition of a €500m accordion facility. While post-close it has managed to syndicate a debut $450m term loan, which Chvátal said offered further diversification in terms of access to capital. Hold analysisSomething to hold on to: Rising average hold rates will be an increasingly important factor in the growth story for US OSB, according to the analysts at Bank of America, noting that every 1% improvement increases TAM by ~10% or nearly $1.5bn.

This theory has legs: Much of the improvement in hold is related to the success of parlays and in particular the same-game variant, which the BofA team said has “transformed” OSB with hold rates at ~19% vs. just 5% for single bets.

The rest is noise: The analysts cautioned that improvement doesn’t happen in a straight line, pointing at the well-documented hold issues in both Q4 and Q1. But they said that “by their math,” hold swings of 1.4%-1.8% per month and per quarter are “natural” and are enough to swing industry GGR by 15%-20% in either direction. Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Heavyweight contestPulling ahead: The gap between the two market leaders in US online is widening once more with FanDuel sitting on 36% share versus DraftKings’ 30% in Q1, said the team at Wells Fargo. The analysts pointed out that this compares with Q423 when DraftKings edged very slightly ahead with 31%.

Team FanKings: Looking at the data in the YTD for OSB, the analysts at Truist said it is FanDuel and DraftKings world “until proven otherwise.” noting that FanDuel controlled 38% share of handle in YTD to April and DraftKings 36%.

More takesGaming sector: A slew of notes from Stifel this week included the reiteration of Buys on Caesars Entertainment, MGM Resorts, IGT and DraftKings, while it continued with Holds on Light & Wonder and Penn.

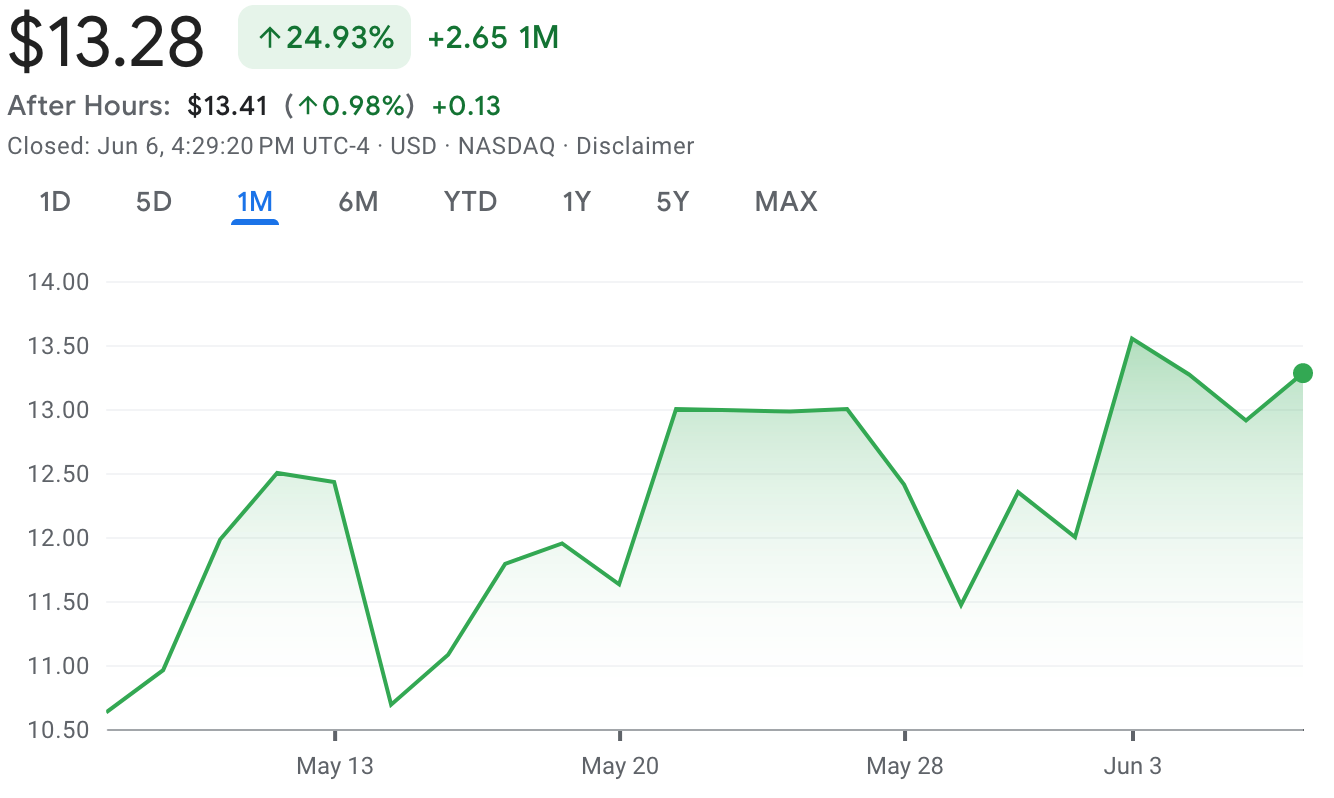

Sportradar: Analysts at Morgan Stanley have increased their FY24 and FY25 EBITDA estimates to €203m and €230m respectively, saying they are seeing improved industry and operating cost trends. The shares weekDoubleDown Interactive: Shares in the social casino to real-money iCasino operator have enjoyed a good month, up 25%, helped along in the past week by a Buy recommendation and a resumption of coverage from the analysts at B Riley.

🍒 DoubleDown on the up Calendar

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless. For more info, go to www.kambi.com An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Poisoned Penn

Tuesday, June 4, 2024

The potential for a sale of Penn assessed, online faces up to increased taxes, Raketech's earnout misery +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DraftKings keeps it Simple

Monday, June 3, 2024

Micro-betting provider the next M&A target, Star Entertainment's wild week, Better Collective's Google pros and cons +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Divide and rule

Monday, June 3, 2024

Illinois' tax hike hurts FanDuel and DraftKings the most, Las Vegas room supply, startup focus – Fluid +more ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Still got that swing

Monday, June 3, 2024

The future of Las Vegas looks bright, Flutter completes NY switch, CFO doesn't, Product Panel – Sky Bet's AccaFreeze +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Up for grabs

Monday, June 3, 2024

Caesars and Penn in play after activists interventions, Flutter's CFO departs, startup focus – Third Planet +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

🎯 Stop Planning Your Goals Like An Amateur

Monday, December 23, 2024

Here's how to actually crush 2025 while everyone else is nursing their hangover... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌁#81: Key AI Concepts to Follow in 2025

Monday, December 23, 2024

Plus – we become Hugging Face's residents 🤗

The best countries to manufacture your product [Roundup]

Monday, December 23, 2024

Here's your chance to win our best-selling "How to Find a Product to Sell on Amazon" course for FREE by answering our Amazon Software Poll. Hey Reader, Want to start sourcing from places

This "Boring" Website Makes $35k/month + A Special Deal

Monday, December 23, 2024

I'm always fascinated by different types of websites and how they make money. I recently ran across a website on such a boring subject, it got me thinking...maybe boring is a great way to make

How brands leverage commerce media for seasonal success in 2025

Monday, December 23, 2024

How diversifying ad placements reveals untapped revenue opportunities

Holiday Special: Lifetime Access for Less Than $1/Day

Monday, December 23, 2024

Make 2024 Your Year – Special Holiday Deal ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Create a LinkedIn funnel from personal posts

Monday, December 23, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Pfeffernuesse Day, Reader! Who wants a delicious and spicy

New SEO strategies for 2025

Monday, December 23, 2024

60% of Google searches result in no clicks. Zero. With AI integration, that number could become even higher. I'll show you how to adjust your strategy so you can capitalize on these shifts in our

Can We Mine Bitcoin In Space With Solar Panels?

Monday, December 23, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI keeps its grip on early-stage deals

Monday, December 23, 2024

Playground Ventures pares flagship fund size again; ecommerce startups ring up a funding surge; is 2025 the year of the industrials revival? Read online | Don't want to receive these emails? Manage