Earnings+More - Divide and rule

Divide and ruleIllinois’ tax hike hurts FanDuel and DraftKings the most, Las Vegas room supply, startup focus – Fluid +more

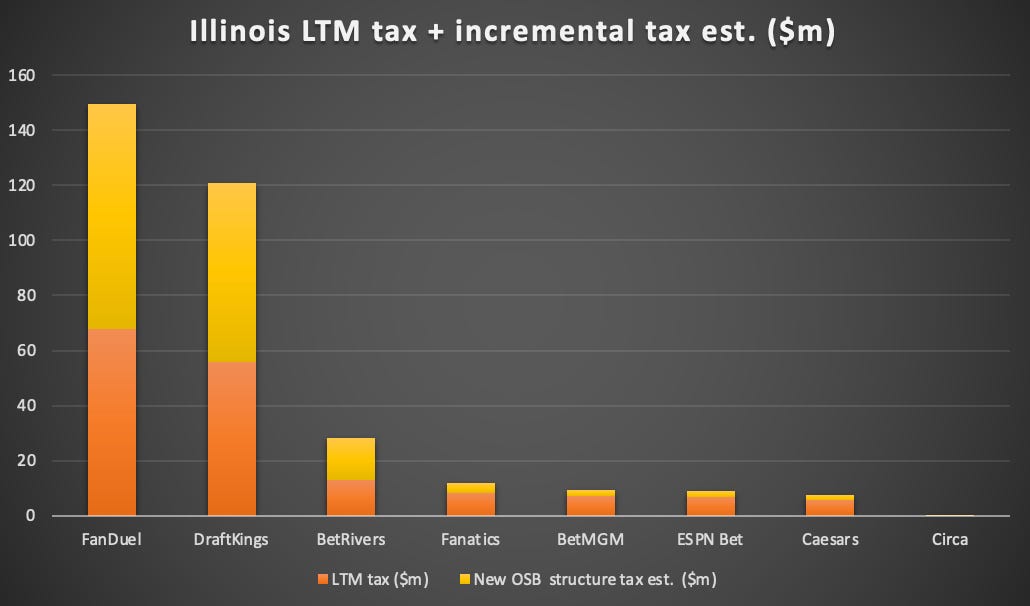

You come on with it, come on, you don't fight fair. Top two targetedHit ’em where it hurts: The new graduated sports-betting tax proposals passed over the weekend by the Illinois Senate featuring a 40% top rate will hurt FanDuel and DraftKings the most while leaving the rest of the market relatively unscathed.

Call that fair? Analysts at Deutsche Bank have estimated the top two would pay an extra $146m between them based on the GGR from the LTM. In comparison, the rest of the market would end up paying less than $25m in extra tax between them.

🤮 Sweating the rich: FanDuel and DraftKings pay the price in Illinois What are you going to do about it? Deutsche Bank suggested the talk post-legislation would be about what mitigation would be sought, with promotions being the area most likely to be focused on.

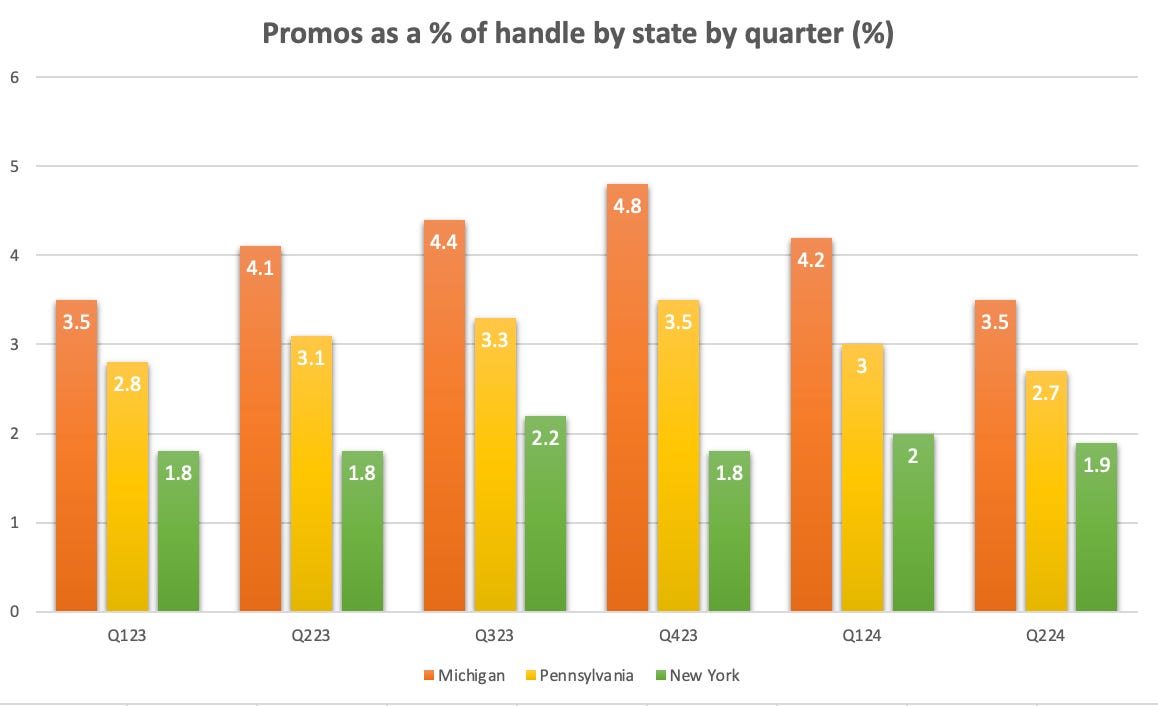

Point proven: New York has the nation’s highest rate of tax on sports-betting operators at 51% of GGR and, after requesting promo data from the state, the DB team argued that a key plank of the argument against higher tax rates – namely that consumers receive lower proportional offers – appears to be true in the Empire State.

👀 Promo levels as a % of handle in MI, PA and NY Now you’ll see, just you wait: Suggesting that much of the current GGR growth in mature markets is generated by promos, the team at DB argued that any significant reduction in promotional activity “could provide a peek into organic demand in Illinois.”

Empty threat: The team also poured cold water on the argument from the lobbyists that increased tax rates would lead to worse odds for consumers, suggesting it is “nothing more than a threat by operators to politicians.”

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless. For more info, go to www.kambi.com +MoreBetMGM has replaced FanDuel as the official odds provider for AP’s global sport report. Under the new agreement, BetMGM’s odds will appear in AP’s daily sports odds fixtures, game previews and other sports stories where odds are mentioned. Spanish news reports suggest that Blackstone, the owner of CIRSA, is looking to seek an IPO for the gambling group, with the PE house rumored to have engaged Morgan Stanley, Deutsche Bank and Barclays. By the numbersNorth Carolina: April revenue rose 58% MoM to $105m on handle that was up 25% to $569m. What we’re readingSharp words: Civil rights campaigner Al Sharpton has penned a letter to USA Today complaining that FanDuel and DraftKings’ dominance of the OSB market raises “serious concerns about competition, fairness and consumer protection.” Las Vegas supplyOne door closes: The upcoming closure of the Mirage added to the recent shuttering of the Tropicana will see room inventory across the Las Vegas Strip market decline by about 3% from July, according to analysis from JMP.

That Riviera touch: The example from the most recent period of room supply decreases came with the closure of the Riviera in 2015 when total supply fell by ~1%. JMP noted that occupancy hit an all-time high for the Strip of 91% in the following year while average room rates also experienced an above-average growth rate.

Recall, the Mirage has been bought by Hard Rock and will be closed for extensive remodeling for the next three years. Meanwhile, the Tropicana closed as part of the MLB stadium plans for the site.

Analyst takes – Q1 reviewStormy weather: The team at Macquarie have noted that only 30% of companies within the sector beat estimates, as the US regional B&M operators struggled to overcome the bad weather-related issues at the start of the quarter.

Tiring: In Vegas, the market is somewhat bifurcated with the high-end continuing to outperform but with evident “fatigue” on the lower-end customer. The team noted optimism at MGM Resorts that it will continue to grow EBITDA this year, while Caesars was “clear that volumes are healthy.” More takesFlutter: The team at Jefferies suggested FanDuel’s iCasino momentum has continued into April, with GGR up 54% YoY vs. the 13% increase for DraftKings and BetMGM’s mere 2% of growth.

Now live on the OpticOdds screen: player market alternate lines, vig, line history & more… Built for operators with an emphasis on speed and coverage, OpticOdds offers:

Join top operators at opticodds.com/contact. Startup focus – FluidBright spark: Fluid's journey began with “a spark of frustration” a couple of years ago, when the founding team were all working for a medium-sized iGaming operator, says Roberto Rubio, CEO of the payments provider.

Funding backgrounder: Fluid was more or less bootstrapped by Rubio during the first months of 2023, before securing €500k in July from HappyHour. The company is currently completing a seed round of ~€1m. Liquid engineering: Fluid uses advanced machine learning algorithms designed to improve conversion and reduce fraud. “We believe in merging great user experience with technology in order to create the best possible ‘money-in and money-out’ experience,” says Rubio. The response has been “overwhelmingly positive.” But the company’s main challenge, he adds, lies in “convincing” potential clients that the technical installation is “not that complex” and that it can be completed within two days.

Growth company newsNo swap shop: The Nevada Gaming Control Board has nixed the idea of a sports-bet resale exchange more than two years after regulators forced PropSwap to cease operating in the state.

Sports-betting provider CopyBet has entered a new partnership with TrueLayer that will see instant deposits and withdrawal payments being introduced for UK customers. Games studio and supplier 4theplayer has secured regulator approval to offer its games in Pennsylvania. Calendar

100 Days To Comply Frictionless affordability checks are required from 30 August 2024. No time to waste – email michael@dotrust.co.uk and join other leading operators including Rank and Lottoland on the leading dedicated platform for financial assessment. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Still got that swing

Monday, June 3, 2024

The future of Las Vegas looks bright, Flutter completes NY switch, CFO doesn't, Product Panel – Sky Bet's AccaFreeze +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Up for grabs

Monday, June 3, 2024

Caesars and Penn in play after activists interventions, Flutter's CFO departs, startup focus – Third Planet +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How d’ya spell egregious?

Tuesday, May 21, 2024

Penn under scrutiny, Entain concludes strategic review, Hard Rock denies Star link +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Wheels up! Penn’s private jet use

Monday, May 20, 2024

Penn's private jet flights, Rank's machine bump, Sportradar reaction, startup focus – Sharp Alpha +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

‘Hands off AGS’ plea

Friday, May 17, 2024

Investor goes public on take-private fears, Flutter reaction, Sportradar, Aristocrat, Gambling.com earnings +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The

End 2024 with a BANG💥 (Huge GIVEAWAY!)

Tuesday, December 24, 2024

Over $12K in gizmos & gadgets up for grabs View in browser ClickBank Hi there, We've got something totally different for you today, some good value fun (with no-strings-attached) to wrap up

Survey: Tech VCs ride wave of optimism

Tuesday, December 24, 2024

Crypto headhunter turns VC; unicorn valuations are stampeding; Nordstrom family inks $6.25B take-private for chain Read online | Don't want to receive these emails? Manage your subscription. Log in

The Daily Coach's Picks: 10 Recommended Books of 2024

Tuesday, December 24, 2024

These books promise to help empower your journey of growth and transformation.

Here's everything retail media network experts are asking for this holiday season

Tuesday, December 24, 2024

If retail media network experts could write a letter to the North Pole, here's what they'd ask for. December 24, 2024 Here's everything retail media network experts are asking for this

Hack offline word of mouth

Tuesday, December 24, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

🎯 Stop Planning Your Goals Like An Amateur

Monday, December 23, 2024

Here's how to actually crush 2025 while everyone else is nursing their hangover... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌁#81: Key AI Concepts to Follow in 2025

Monday, December 23, 2024

Plus – we become Hugging Face's residents 🤗

The best countries to manufacture your product [Roundup]

Monday, December 23, 2024

Here's your chance to win our best-selling "How to Find a Product to Sell on Amazon" course for FREE by answering our Amazon Software Poll. Hey Reader, Want to start sourcing from places