Earnings+More - Acquire, signal, maneuvre

’Cause I've been waiting on you. MGM’s signal, noiseNeedle point: The deal announced yesterday that will see MGM Resorts’ wholly owned subsidiary LeoVegas acquire Tipico US for an undisclosed sum is “more symbolic than needle moving,” according to the team at Deutsche Bank. Putting their money where their mouth is: The buyout, which is expected to close in Q3 this year and was predicted by E+M in late April, “shows a continued commitment to MGM's International digital strategy,” DB’s analysts said.

From the ground up: Over at JMP, the team suggested it was “notable” that MGM was going down the route of buying its way to a full complement of online provision rather than build its own capability, while at the same time avoiding having to commit to a large-scale platform acquisition.

See you ’round the clubs: JMP said MGM has been “steadfast” in stating its commitment to the JV with Entain for BetMGM but “at some point” the two will go their separate ways. Crucially, this will leave MGM with the BetMGM brand and now, potentially, a platform to go with it..

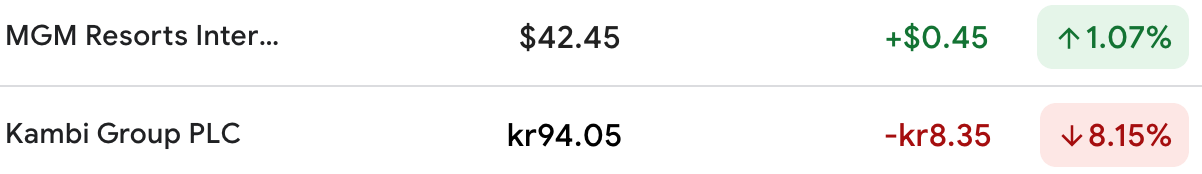

Foreign adventures: A first test for the new platform could come in Brazil, according to the team at CBRE, who suggested MGM/LeoVegas’ plans for the new regulated market were “of interest.” MGM has previously been rumored to be close to a partnership with media group Globo about a market entrance for BetMGM. Repercussions: MGM’s shares nudged up 1% on the news yesterday while LeoVegas’ current sportsbook backend provider Kambi saw its shares take an 8% hit on the news. Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless. For more info, go to www.kambi.com +MoreBuying spree: The Juroszek family, the former owner of Polish sportsbook STS, is now the largest shareholder in GiG after further buying from various family controlled entities, including the purchase of SkyCity’s stake in the business. Following a 7m+ share transaction yesterday, the various entities now control just over 25% of the company.

Radio gaga: The announcement yesterday that BBC Radio’s leading morning news program would no longer carry horseracing betting tips caused the head of the Betting and Gaming Council to accuse the broadcaster of middle-class “snobbery.”

Simplebet: The micro-betting provider has reported taking nearly $325m across all its operator client base and logging nearly 13m bets on the games across the NBA season, up 75% YoY. At the post: Racecourse operator Arena Racing is teaming up with Racecourse Media Group, 1S/T Content and Tabcorp to provide a joint distribution network for international racing. Earnings in briefStar Entertainment: The troubled Australian casino operator said trading conditions remained challenging, with Q424 revenues expected to show a 4.3% decline QoQ and a 3.3% drop off YoY. The damage has been caused by a fall in revenue from premium gaming rooms, which were down 16% YoY.

More Boyd/Penn skepticismFirestarter: Boyd Gaming’s potential bid for Penn Entertainment has been the subject of further analyst skepticism, with the team from Wells Fargo suggesting that while they “generally believe where there’s smoke, there’s fire, this tie up seems unlikely." As with the note from Deutsche Bank late last week, the team at Wells Fargo also noted what could be a “complex and lengthy” deal process including various state approvals and divestiture negotiations.

Now live on the OpticOdds screen: player market alternate lines, vig, line history & more… Built for operators with an emphasis on speed and coverage, OpticOdds offers:

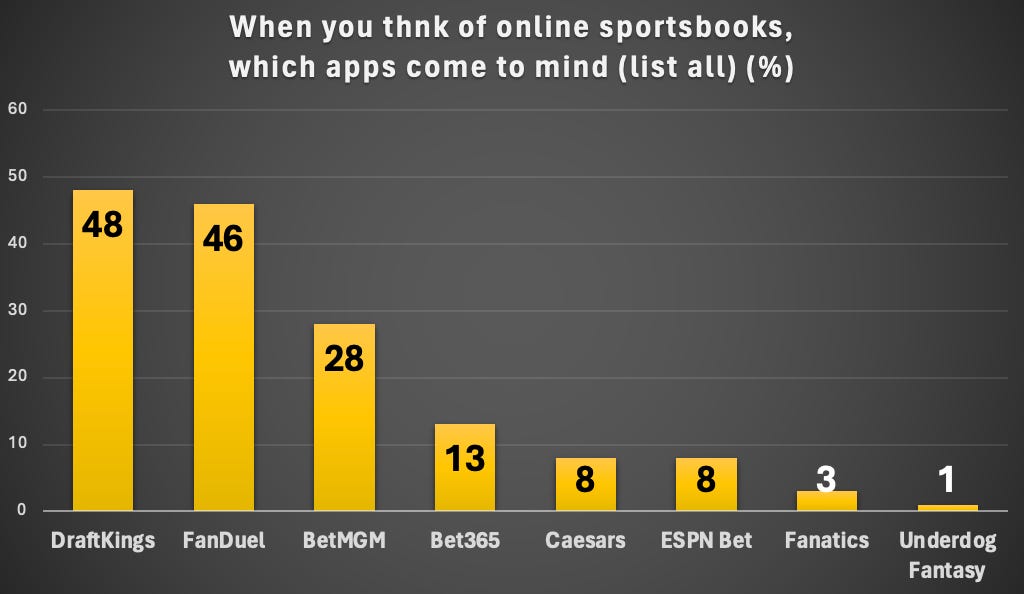

Join top operators at opticodds.com/contact By the numbers – North CarolinaRaleigh to the cause: As the biggest and likely last new OSB state to launch this year, there is understandably a deal of interest in how the regulated market has landed in North Carolina. But according to market research undertaken by the team at bettor activation affiliate Betting Hero, the shape of the market is very little different to the 29 regulated markets that went before. Top two: In terms of brand awareness, when asked which apps came to mind when thinking about online sportsbooks, DraftKings was just ahead of FanDuel with 48% vs. 46%. There is then a gap to BetMGM, which received 28% of mentions, and bet365 with 13%.

🤔 When you think of a sportsbook brand, who comes to mind? The research was undertaken within the first month of the market opening and the data on the first app used shows a similar result, with DraftKings leading FanDuel by 33% to 32%, BetMGM back in third place with 14% and the rest trailing in behind.

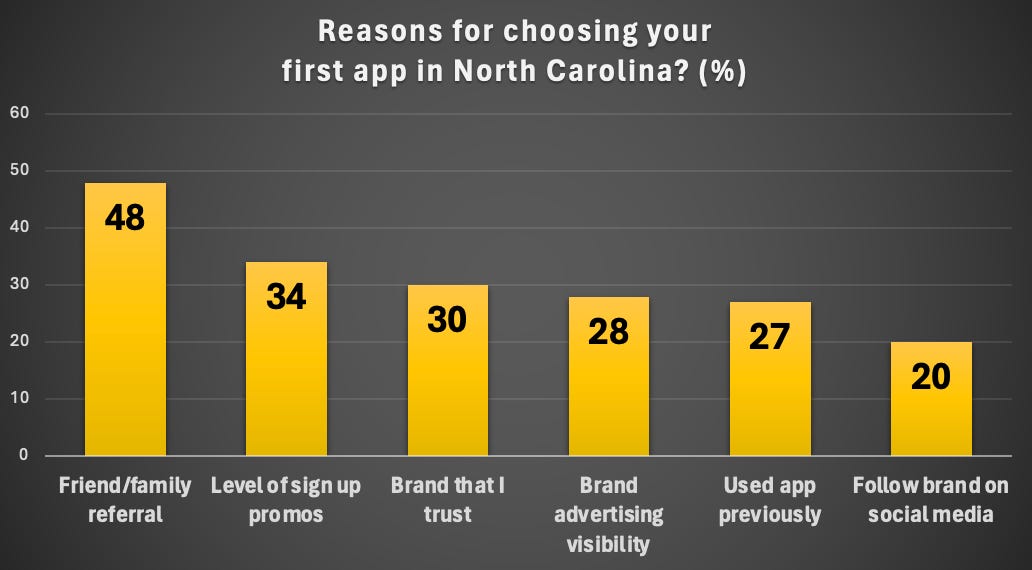

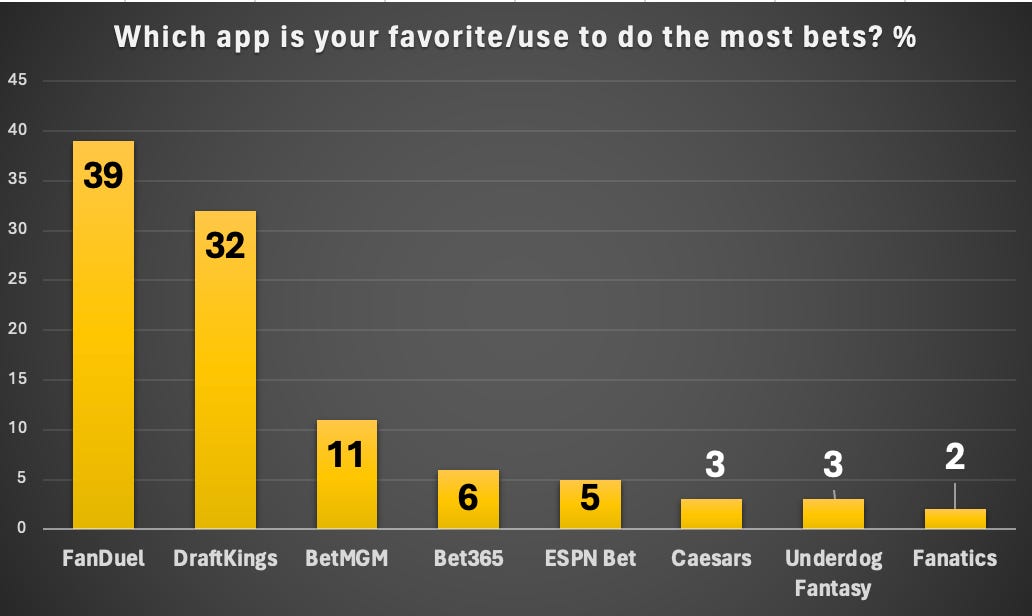

🕺 Do you remember the first time? Come back to what you know: So much for first-time users, but what about sustained usage post-the initial app sign up? Here it can be seen that FanDuel surges into a strong lead with 39%, while DraftKings remains on 32%; then there is a drop off to BetMGM on 11%, bet365 on 6% and ESPN Bet on 5%. 🥰 Whenever you need me, I’ll be there Getting the basics right: Ease of practical use was the clear reason for consumers choosing their most regularly used app, with 63% saying easy deposits and payouts were the prime reason, making it the top answer.

Calendar

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Hot Tipico

Monday, June 24, 2024

MGM Resorts confirms LeoVegas Tipico US buyout, Boyd/Penn skepticism, Entain review is ongoing, startup focus – 7Qz +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Boyd makes a bid

Friday, June 21, 2024

Penn shares soar on bid report, Florida decision analysis, Catena Media profit warning, shares week +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Learning to fly

Tuesday, June 18, 2024

Where next once proof of concept has been achieved? Plus, Sharp Alpha raises cash, Prime on a zero marketing regime +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Canadian stakes

Monday, June 17, 2024

Crypto-friendly operator claims gray Canadian supremacy, Fanatics in New Jersey, startup focus – XGENIA +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Penn put

Friday, June 14, 2024

Shares bounce on M&A talk, Bally's permanent casino doubts, sector watch – esports +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

How brands leverage commerce media for seasonal success in 2025

Monday, December 23, 2024

How diversifying ad placements reveals untapped revenue opportunities

Holiday Special: Lifetime Access for Less Than $1/Day

Monday, December 23, 2024

Make 2024 Your Year – Special Holiday Deal ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Create a LinkedIn funnel from personal posts

Monday, December 23, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Pfeffernuesse Day, Reader! Who wants a delicious and spicy

New SEO strategies for 2025

Monday, December 23, 2024

60% of Google searches result in no clicks. Zero. With AI integration, that number could become even higher. I'll show you how to adjust your strategy so you can capitalize on these shifts in our

Can We Mine Bitcoin In Space With Solar Panels?

Monday, December 23, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI keeps its grip on early-stage deals

Monday, December 23, 2024

Playground Ventures pares flagship fund size again; ecommerce startups ring up a funding surge; is 2025 the year of the industrials revival? Read online | Don't want to receive these emails? Manage

Found Ya 📍

Monday, December 23, 2024

Biz directories are still big.

The Pareto Principle in Practice: Why Two Is Better Than Three

Monday, December 23, 2024

By leveraging the Pareto Principle and following these five steps, we can avoid analysis paralysis and concentrate on decisions that truly move the needle.

Marketers may become part of the culture war — even if they didn't intend to be

Monday, December 23, 2024

As consumers put brands' advertising and marketing messages under a microscope, marketers have to be keenly aware of how anything they put out in the world could be interpreted — or misinterpreted.

The Vend-pire Strikes Back

Monday, December 23, 2024

What could be more enticing than a 24-hour business with no payroll or monthly lease? This business could mean “the vend” of your financial struggles.