State of the Network’s Q2 2024 Mining Data Special

State of the Network’s Q2 2024 Mining Data SpecialOur quarterly update on Bitcoin mining, focusing in on transaction fee spikes, public miner M&A, and ASIC efficiency improvementsGet the best data-driven crypto insights and analysis every week: State of the Network’s Q2 2024 Mining Data SpecialKey Takeaways:

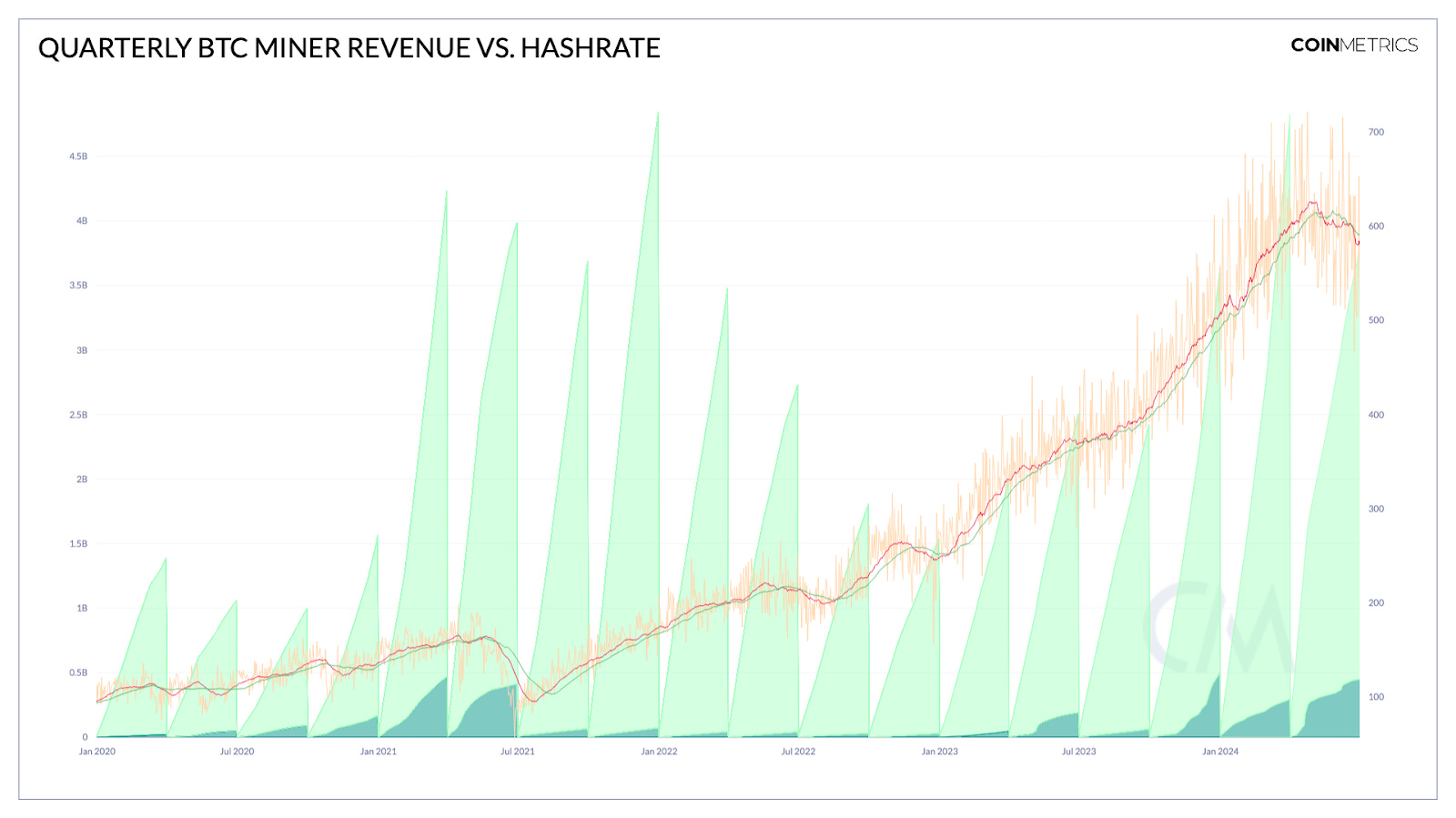

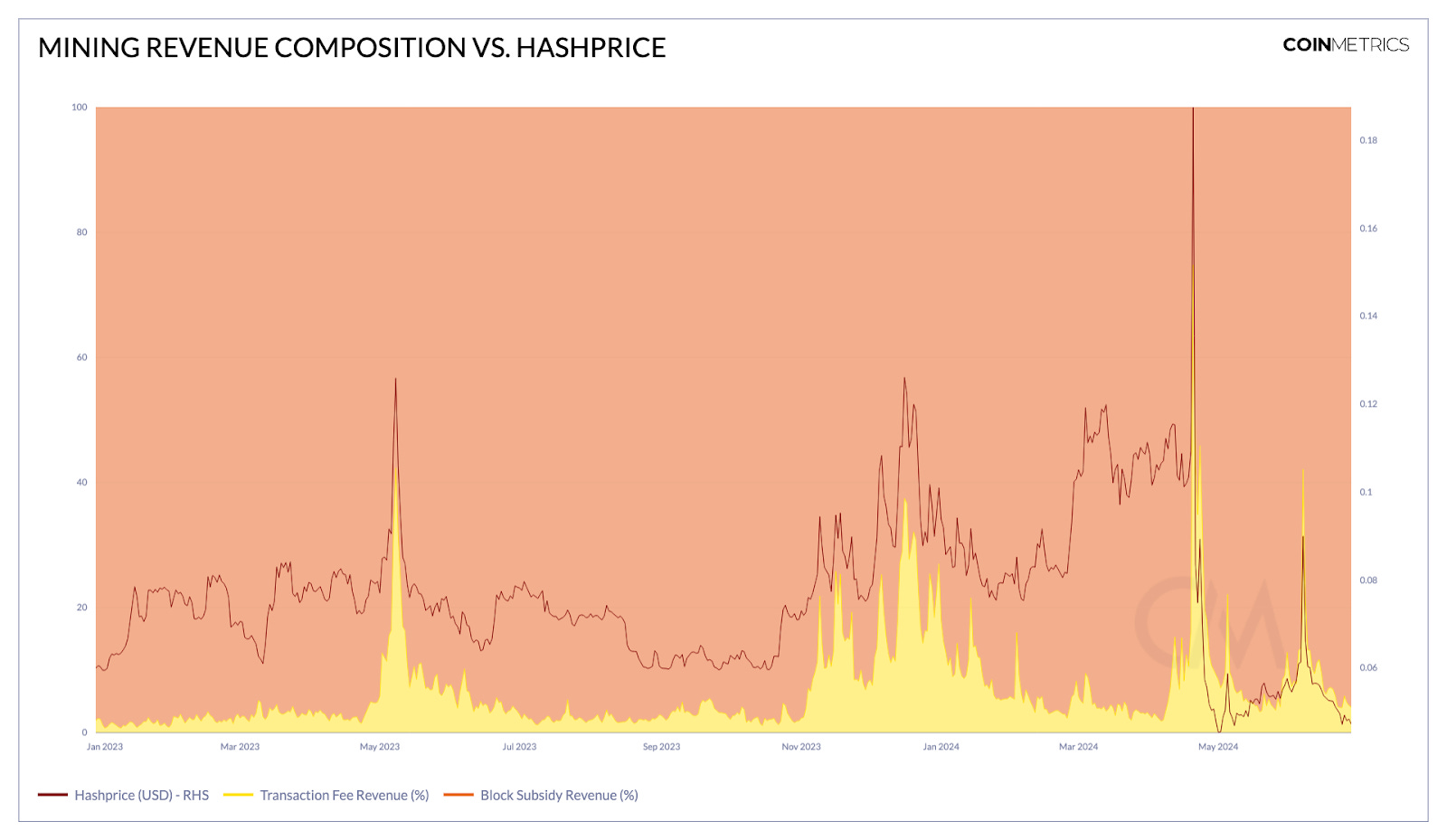

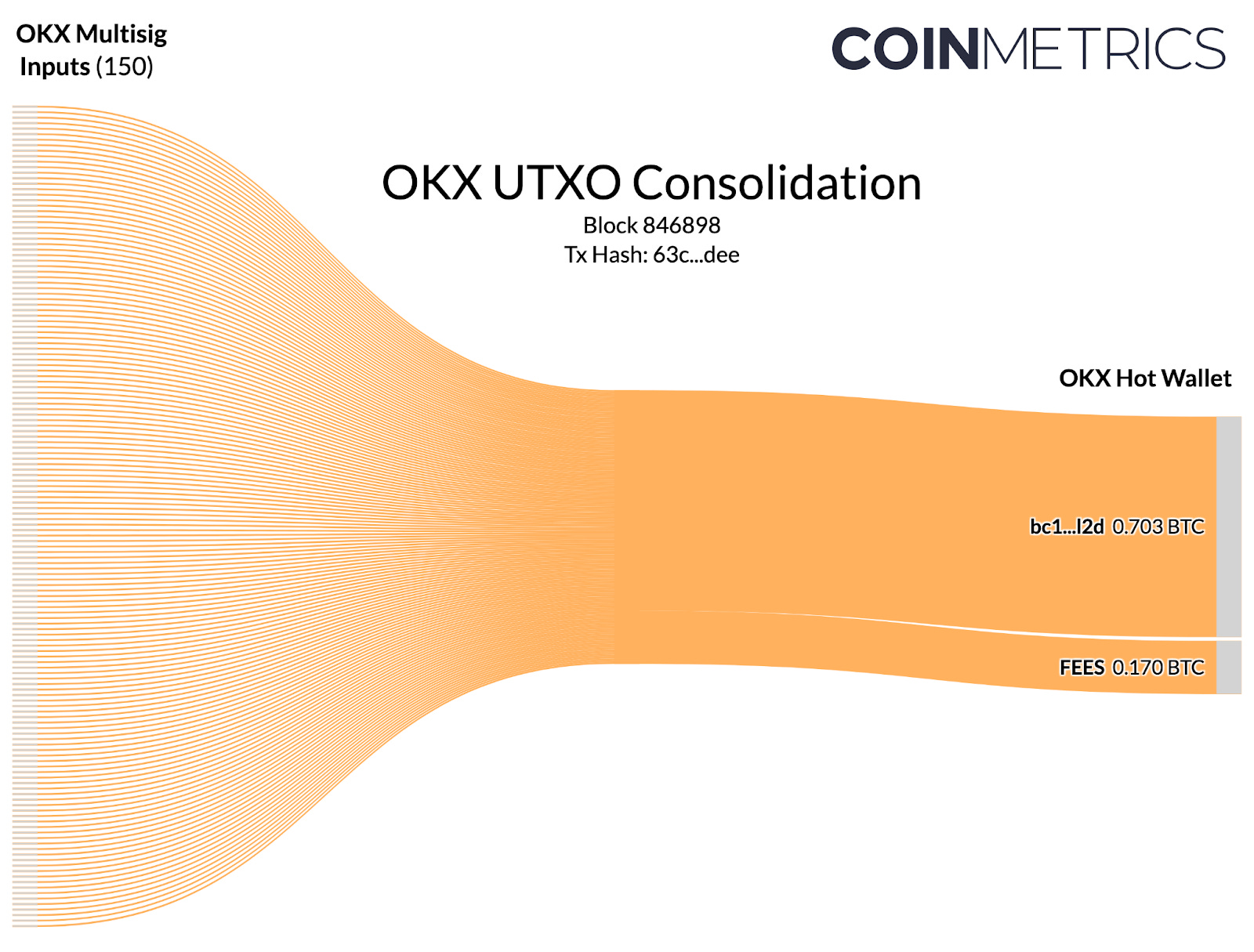

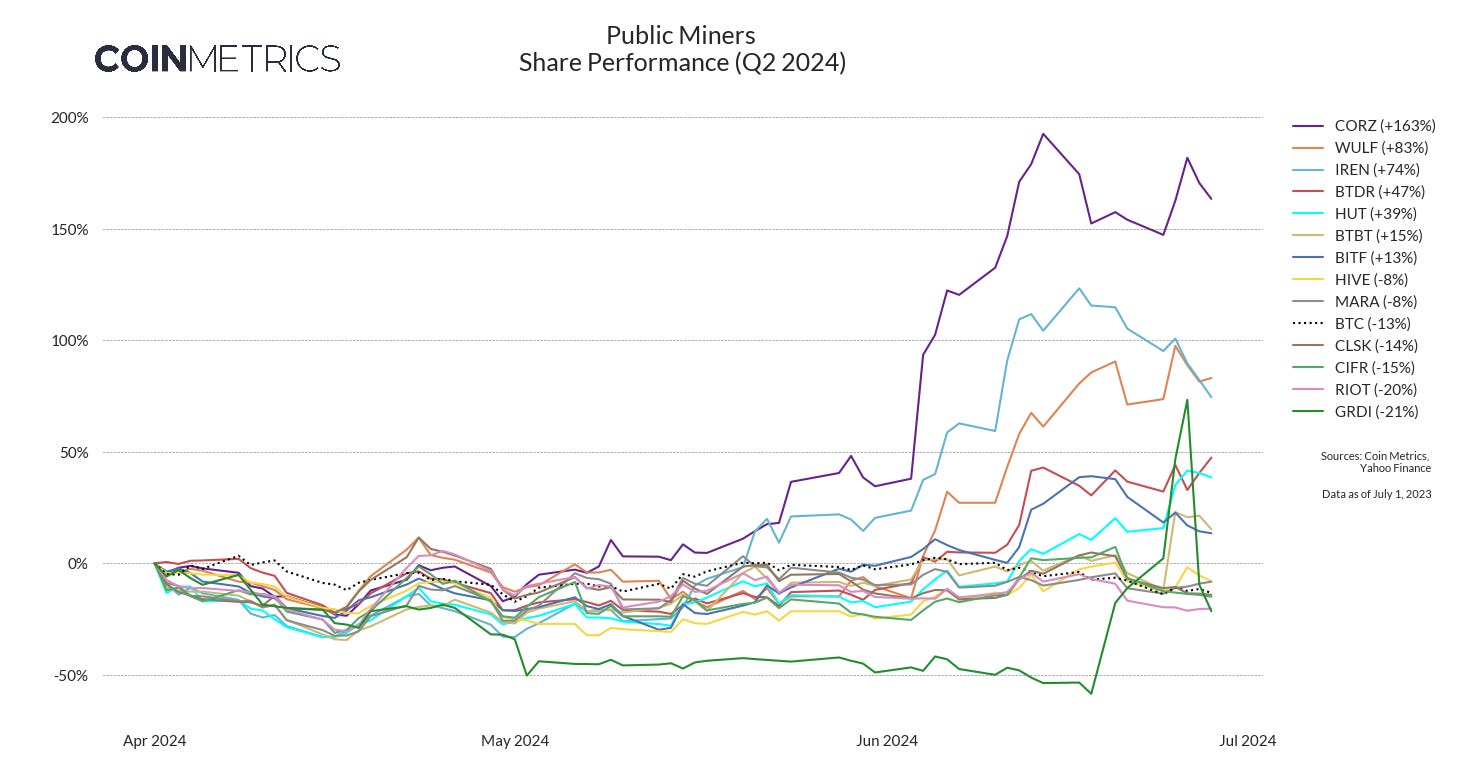

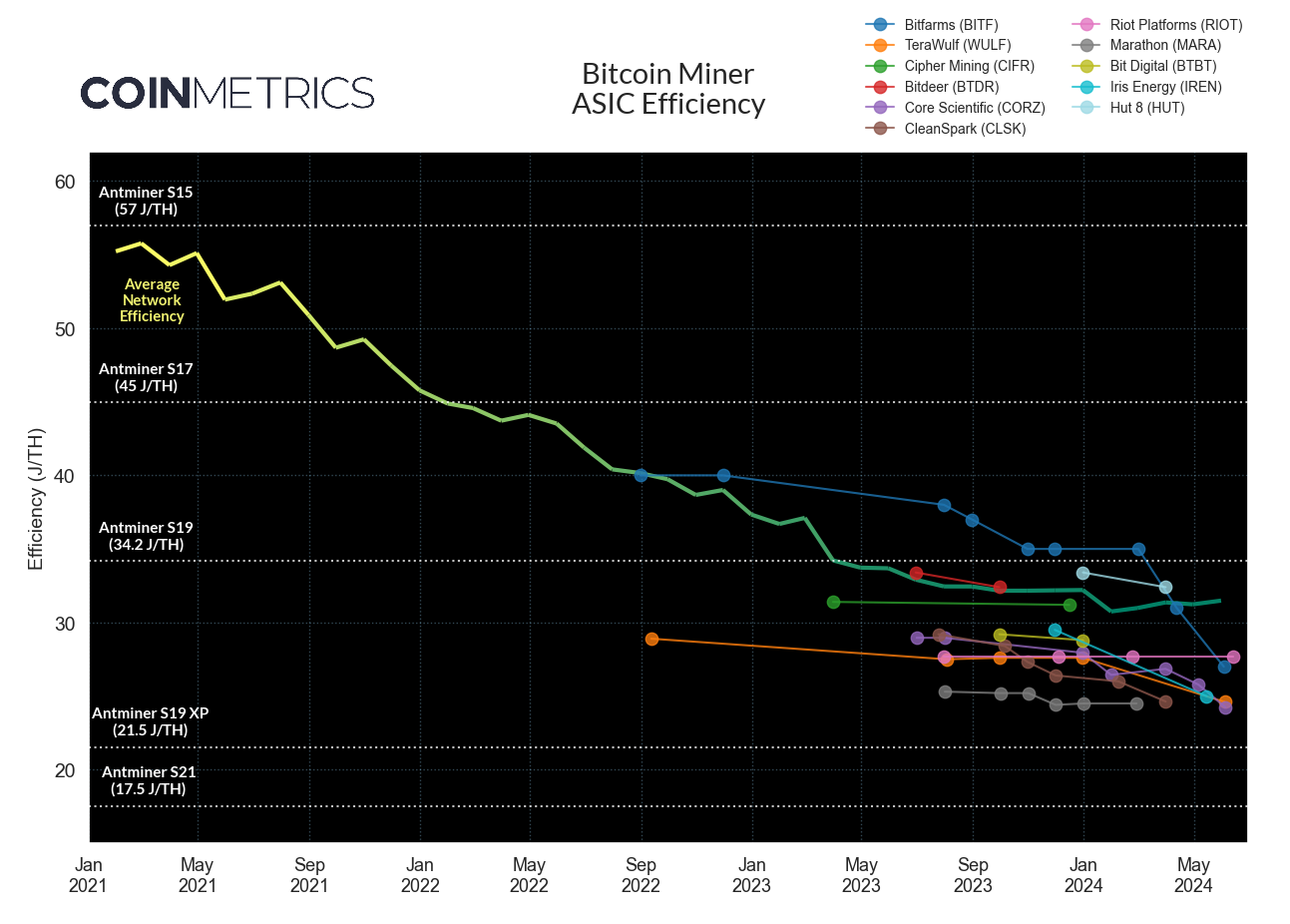

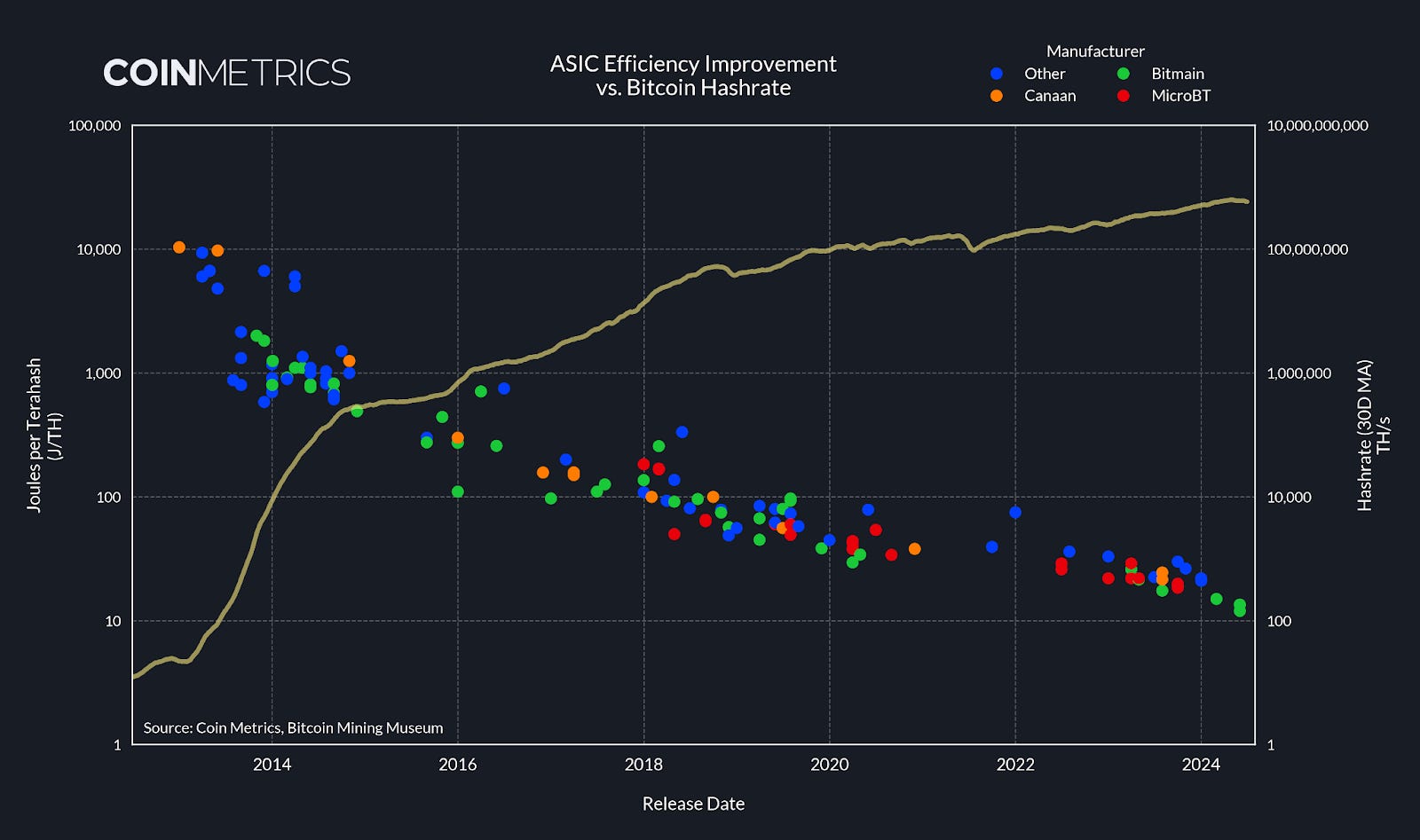

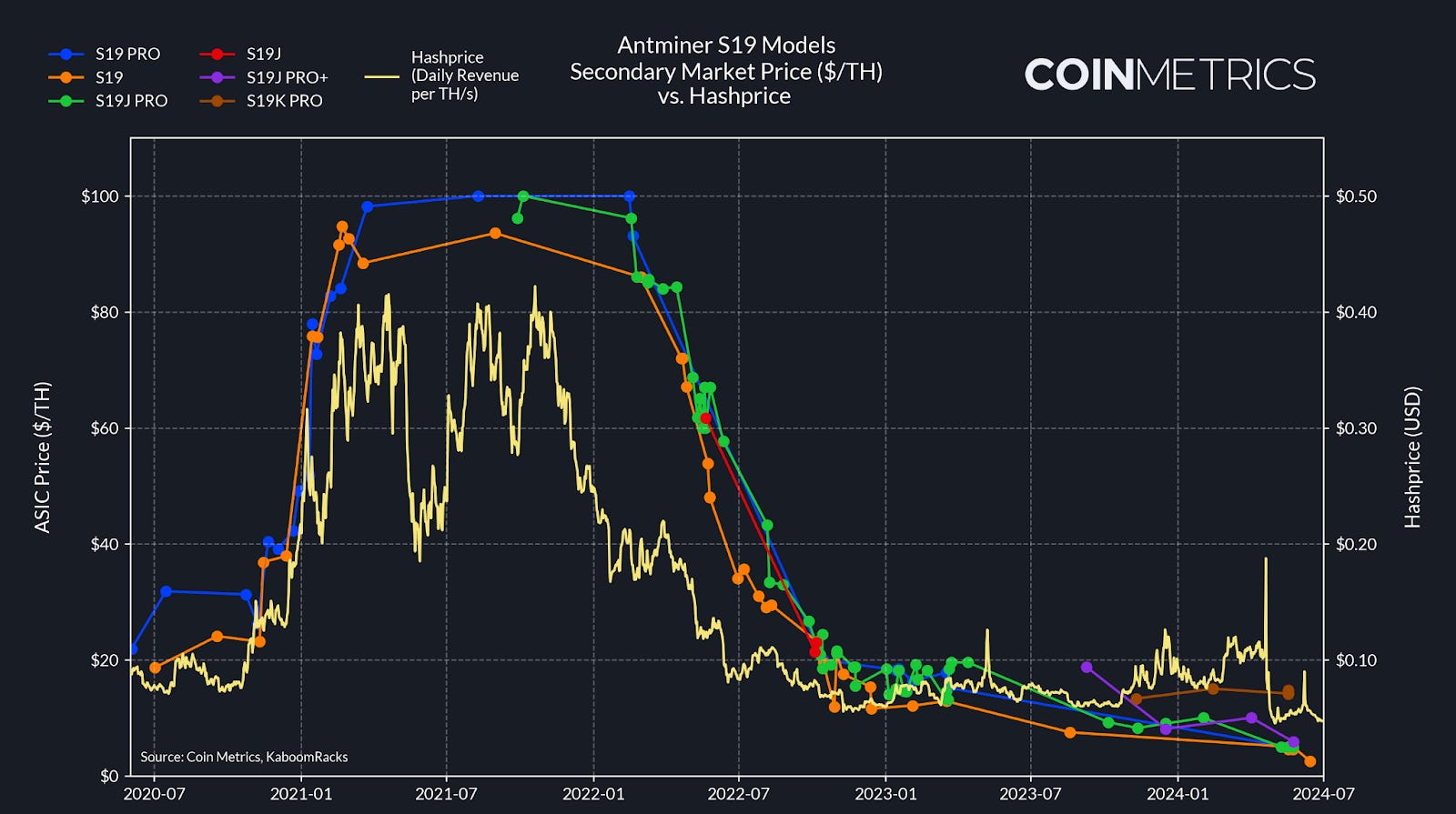

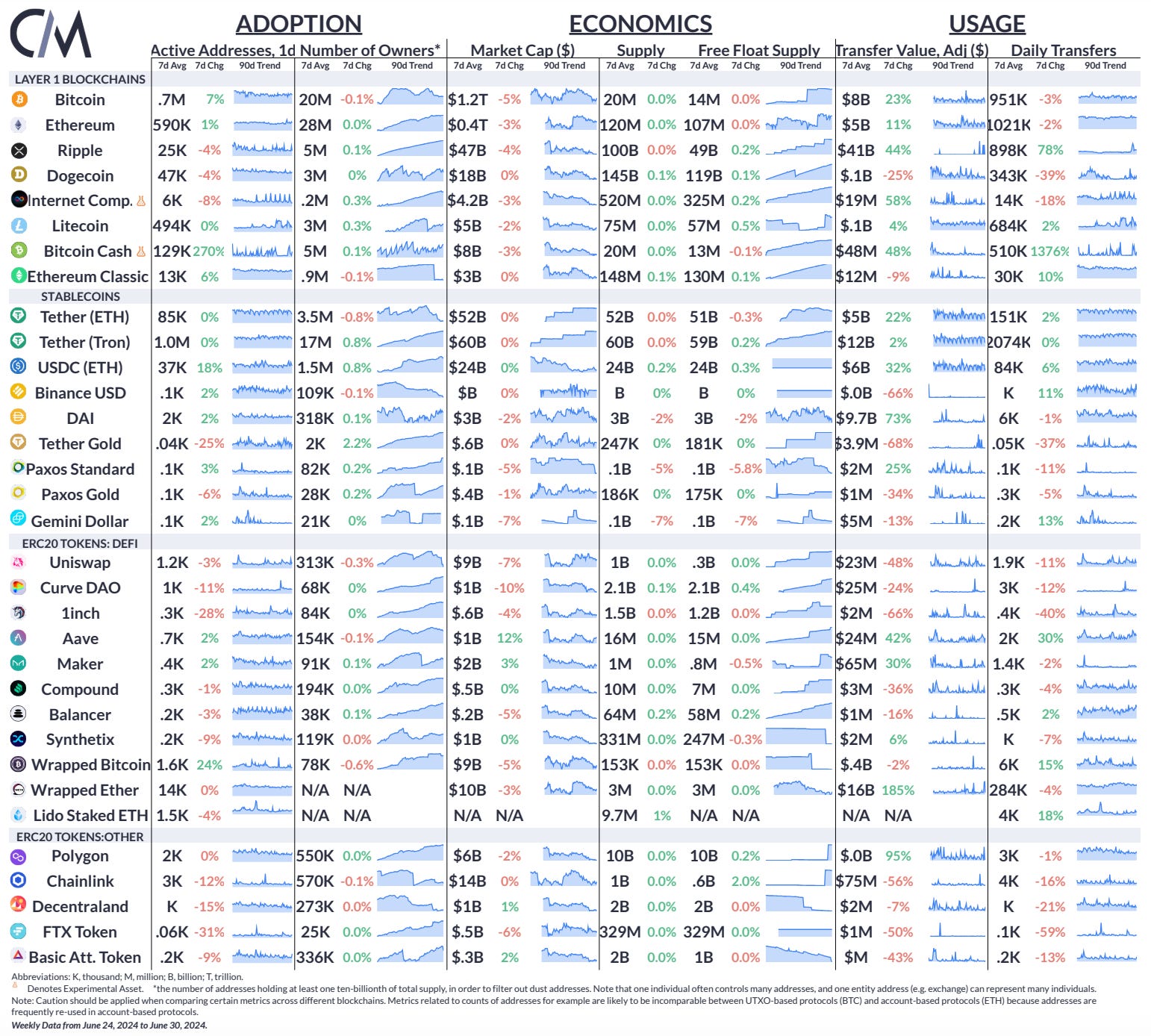

IntroductionThis week’s State of the Network revisits the Bitcoin mining landscape, continuing our series of quarterly updates on the state of proof-of-work stakeholders. Since the Bitcoin Halving in April, mining margins have faced pressure due to a stagnant BTC price and a subdued fee market, though short periods of on-chain congestion have provided some revenue relief. Many operators are diversifying beyond pure-play mining, reinventing themselves as generalized infrastructure providers in an attempt to secure hosting contracts for power-hungry AI applications. At the same time, improvements in chip efficiency continue unabated, forcing miners to contemplate whether to push forward with aging ASIC hardware or perform comprehensive fleet upgrades. In this report, we dive deeper into each of these factors, surveying the health of the mining sector beyond BTC price performance. Consolidation OperationsFrom a first glance, Q2 2024 was a relatively lucrative period for Bitcoin miners. Of the 18 quarters since Jan. 2020, this quarter ranks 5th in terms of total USD revenue earned, with miners bringing in $3.77B between block subsidies & transaction fees. Of course, due to the Halving, these earnings were front-loaded, with nearly half of the quarter’s revenue coming in during April alone. After the Bitcoin block reward dropped from 6.25 to 3.125 BTC on April 20 and the “Runes” token hype gradually eased in the weeks that followed, May and June were far more difficult months for miners. As a result, Bitcoin’s hashrate shows signs of miner capitulation— at 580 EH/s, the 30-day moving average of hashrate is -7% off the all-time-high of 626 EH/s. Source: Coin Metrics Network Data Pro Despite the overall loss of revenue momentum, unexpected increases in on-chain traffic have still offered miners some reprieve. In early June, the Bitcoin mempool was slammed with a massive influx of high-fee paying transactions, with the average hourly transaction fee reaching as high as $945 by mid-day June 7. The congestion provided a major boost to mining revenue, with hashprice (daily USD revenue per TH/s) spiking to $0.09 and fees contributing over 42% of earnings. Source: Coin Metrics Network Data Pro While fee spikes are often attributed to token protocols like Ordinals & Runes, the latest mining revenue boost was brought on by the internal operations of a single centralized exchange. OKX (the 4th largest exchange by BTC spot volume) performed a massive series of “UTXO consolidations,” cleaning up their books by combining fragmented fractions of Bitcoin into larger, more compact denominations. Because BTC transactions are priced according to the blockspace they consume, transactions involving many UTXOs are more expensive to transfer, whereas “consolidated” UTXOs unlock payments with a lighter and more cost-effective on-chain footprint. Source: Coin Metrics ATLAS The UTXO consolidation process is similar to dumping a jar of loose change into a coin-counting kiosk in exchange for a $20 bill. Like Coinstar, however, this service comes at a cost. While daily fee revenue typically ranges around $1-2M, miners raked in nearly $38M in the 3 days following OKX’s UTXO consolidation. In retrospect, OKX could have executed their accounting cleanup in a more efficient manner, having paid a significant premium for expedient settlement— but in the face of a quiet transaction queue and record-low hashprice, miners certainly aren’t complaining. All About the InfraIn the weeks since Bitcoin’s Halving, the majority of publicly-traded mining companies have meandered sideways alongside BTC. Shares of the 3 largest miners— Marathon Digital (MARA), CleanSpark (CLSK), & Riot Platforms (RIOT)— have struggled to outperform BTC in Q2, with only Marathon managing to eke out a small relative return. By far, the biggest gainers have been underdogs in the Bitcoin mining race, with Core Scientific (CORZ), Iris Energy (IREN), and TeraWulf (WULF) outperforming competitors by double-digit margins. It’s no coincidence these same companies are leaning heavily into the AI hype wave, each positioning themselves as an energy & infrastructure provider for broader compute applications. In June, Core Scientific inked a series of multi-billion dollar contracts with “AI Hyperscaler” CoreWeave, agreeing to employ hundreds of megawatts in power capacity to host the company’s high-performance computing (HPC) hardware. Shortly afterwards, Core Scientific received an “unsolicited proposal” from CoreWeave to buyout their entire business, rejected on the basis of Core’s “growth prospects” and “value creation potential.” IREN and WULF have also emphasized their unique positioning to host HPC infrastructure, making them attractive partners (and possible acquisition targets) for an increasingly energy-constrained group of AI-focused businesses. Source: Coin Metrics Reference Rates & Yahoo Finance For other miners, price action has been driven primarily by the industry’s internal M&A. Though micro-cap miner GRIID Infrastructure (GRDI) has lagged peers since listing this year, CleanSpark announced an acquisition of the firm in June, boasting the transaction would increase their power capacity by 400 MW within 2 years. In May, Riot Platforms revealed a 9.25% stake in Bitfarms (BITF), a slightly smaller miner undergoing corporate governance issues. Riot offered ~$950M to acquire Bitfarms wholesale, claiming the purchase would create the “largest publicly listed Bitcoin miner globally” by year’s end. Bitfarms promptly rejected the offer, holding Riot’s hostile takeover at bay by issuing a “poison pill” plan aiming to dilute entities angling for a buyout on public markets. Riot’s motivation for acquiring Bitfarms can be attributed to a number of factors, but one notable aspect is their sizable improvement in efficiency. Historically, Bitfarms has capitalized on access to low-cost hydroelectricity, utilizing older-generation ASICs rather than upgrading to the most cutting-edge hardware. This led them to lag competitors in metrics like fleet efficiency— measured in “joules per terahash” (J/TH)— representing the incremental amount of energy expended to generate hashrate. However, Bitfarms recently implemented a comprehensive fleet refresh, purchasing 16 EH/s worth of Antminer T21s (19 J/TH). In 2024, Bitfarms average fleet efficiency improved from 35 to 27 J/TH, leapfrogging Riot’s stagnant efficiency of 27.7 J/TH. Source: Coin Metrics MINE-MATCH & Public Disclosures Bitfarms isn’t alone in making impressive improvements to their average fleet efficiency. Iris Energy lowered average energy consumption -15% to 25 J/TH over the past 6 months, while TeraWulf made an -11% efficiency gain achieving 24.6 J/TH over the same period. Having emerged from Chapter 11 bankruptcy proceedings, Core Scientific now leads the pack at 24.23 J/TH, edging out incumbent efficiency leader Marathon Digital at 24.5 J/TH. With the race to streamline & optimize operations narrowing to single-decimal precision, miners now look towards the next generation of ASICs for their next chance to outstrip the competition. The Era of ASICsAfter more than a decade of chipmaking innovation, Bitcoin mining ASICs have experienced unprecedented enhancements in efficiency. The first commercially available ASIC— Canaan’s Avalon 1— came to market in Jan. 2013 with a meager 0.06 TH/s in hashrate. At a power consumption of 620 watts, this equates to an efficiency of 10,333 J/TH. At the time, this was a massive leap forward in raw hashrate output, with total network hashrate sitting at just 22 TH/s. Soon after the Avalon 1’s release, competing manufacturers aggressively entered the market, and continued technological progress drove hashrate up by a factor of 14,000x within 2 years. The magnitude of efficiency improvement has since tapered from its early period of exponential gains, but manufacturers continue to aggressively slash the energy required to produce an incremental unit of hashrate. In June, Bitmain announced their latest series of Antminer S21 XP models, with the hydro-cooled version reaching 473 TH/s at an efficiency of 12 J/TH. Though Bitmain remains the industry’s 800-pound gorilla, upstart entrants like Bitdeer— led by ex-Bitmain CEO Jihan Wu— have announced ambitious plans to produce a 5 J/TH ASIC by Q2 2025. Source: Coin Metrics Network Data Pro & Bitcoin Mining Museum As Bitcoin miners begin to liquidate their existing hardware fleets in favor of more efficient models, ASIC prices have tumbled in tandem. While nominal prices vary widely based on hardware specs, ASIC trading desks typically quote orders in “dollars per terahash” ($/TH) terms, providing an easily-comparable metric for measuring premiums across a variety of models. The 2021 bull run (paired with the China mining ban) precipitated a period of outsized profitability for BTC mining. This translated to sky-high premiums on Antminer S19 models (90-110 TH/s), with prices remaining elevated near $90-100/TH throughout the year. In 2022, however, collapsing revenue put major pressure on ASIC premiums, with S19 prices dropping over 80%. Post-Halving, capitulation continues in secondary markets like Kaboomracks, with lower-performing S19 models trading as low as $2.5/TH in June. Source: Coin Metrics Network Data Pro & Kaboomracks Despite losing their new-gen luster, ASIC fingerprinting techniques reveal the S19 series still contributes north of 50% of hashrate, indicating they’re being redeployed at lower-cost sites rather than retired entirely. Even the 2016-era Antminer S9 maintains a small foothold at the edges of the grid, reliably converting waste energy to electronic cash nearly a decade after its debut. Though the most efficient operators will undoubtedly opt to cycle out their fleets for the latest models, the hardy and highly-industrialized form factor of the modern Bitcoin mining ASIC ensures nearly every machine eventually finds its own niche in the proof-of-work ecosystem. ConclusionBitcoin’s 5th epoch looks likely to be characterized by consolidation, with well-capitalized miners buying up the assets of less-efficient operators. The AI sector is also enviously enamored with the industry’s unique access to energy infrastructure, and many publicly-traded miners have seen success in embracing a more generalized datacenter strategy. Others remain laser-focused on Bitcoin, treating the HPC sideshow as a momentary distraction. Regardless, surviving the onslaught of efficiency gains and competitive pressures requires all miners to turn their sights towards the future, with the long-term trajectory of BTC price remaining an unpredictable input to a highly capital-intensive business model. Make sure to check out our previous issues of the mining data special, as well as our June report The Signal & the Nonce: Tracing ASIC Fingerprints to Reshape our Understanding of Bitcoin Mining. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro USD transfer value (adjusted) increased by 23% on the Bitcoin network and 11% on the Ethereum network over the past week. Stablecoins also saw rising (adjusted) transfer values for Dai (+73%), USDC on Ethereum (+32%), and USDT on Ethereum (+22%). This week, Circle became the first stablecoin issuer to be compliant with the EU’s MiCA regulations, allowing them to issue USDC and EURC in Europe. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Mastering Crypto Derivatives

Tuesday, June 25, 2024

Explore how derivatives can transform your crypto trading strategy with indirect exposure, risk hedging, and market efficiency capitalization. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Floating On Thin Air

Tuesday, June 18, 2024

Decoding Crypto Tokenomics: Valuation, Distribution, and Impact ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Meme Coin Mania

Tuesday, June 11, 2024

Exploring the rise in meme coin activity and market trends driven by the sector ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Breaking Down Ethereum Blobs & EIP-4844

Tuesday, June 4, 2024

Evaluating the success of Ethereum's EIP-4844 upgrade & Layer-2 blob usage ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Exploring the Impacts of ETH ETF Approvals

Monday, June 3, 2024

Ethereum ETF Approvals: Market Reactions and Network Implications ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏