Exploring the Impacts of ETH ETF Approvals

Exploring the Impacts of ETH ETF ApprovalsEthereum ETF Approvals: Market Reactions and Network ImplicationsGet the best data-driven crypto insights and analysis every week: Exploring the Impacts of ETH ETF ApprovalsBy: Tanay Ved Key Takeaways:

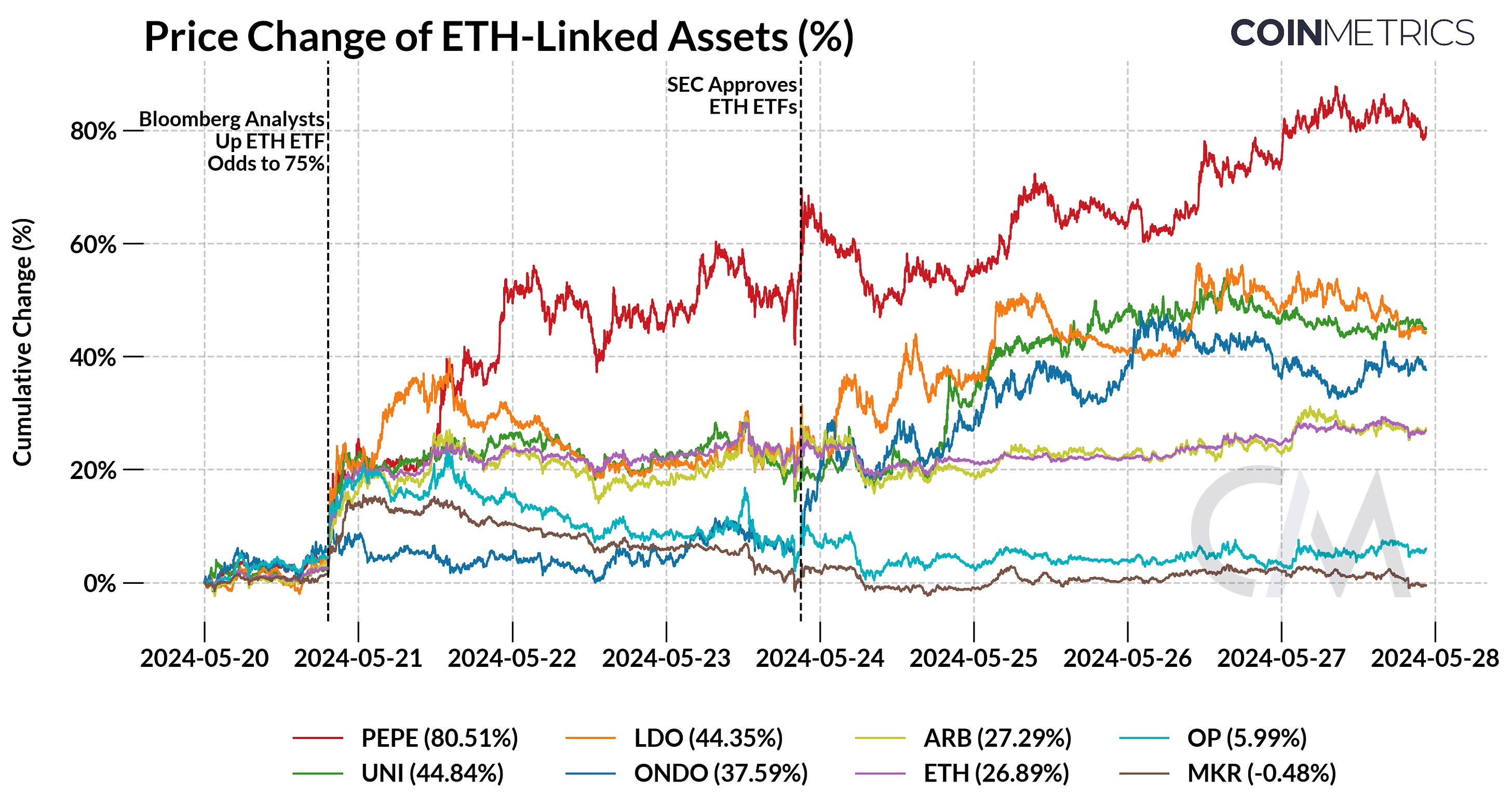

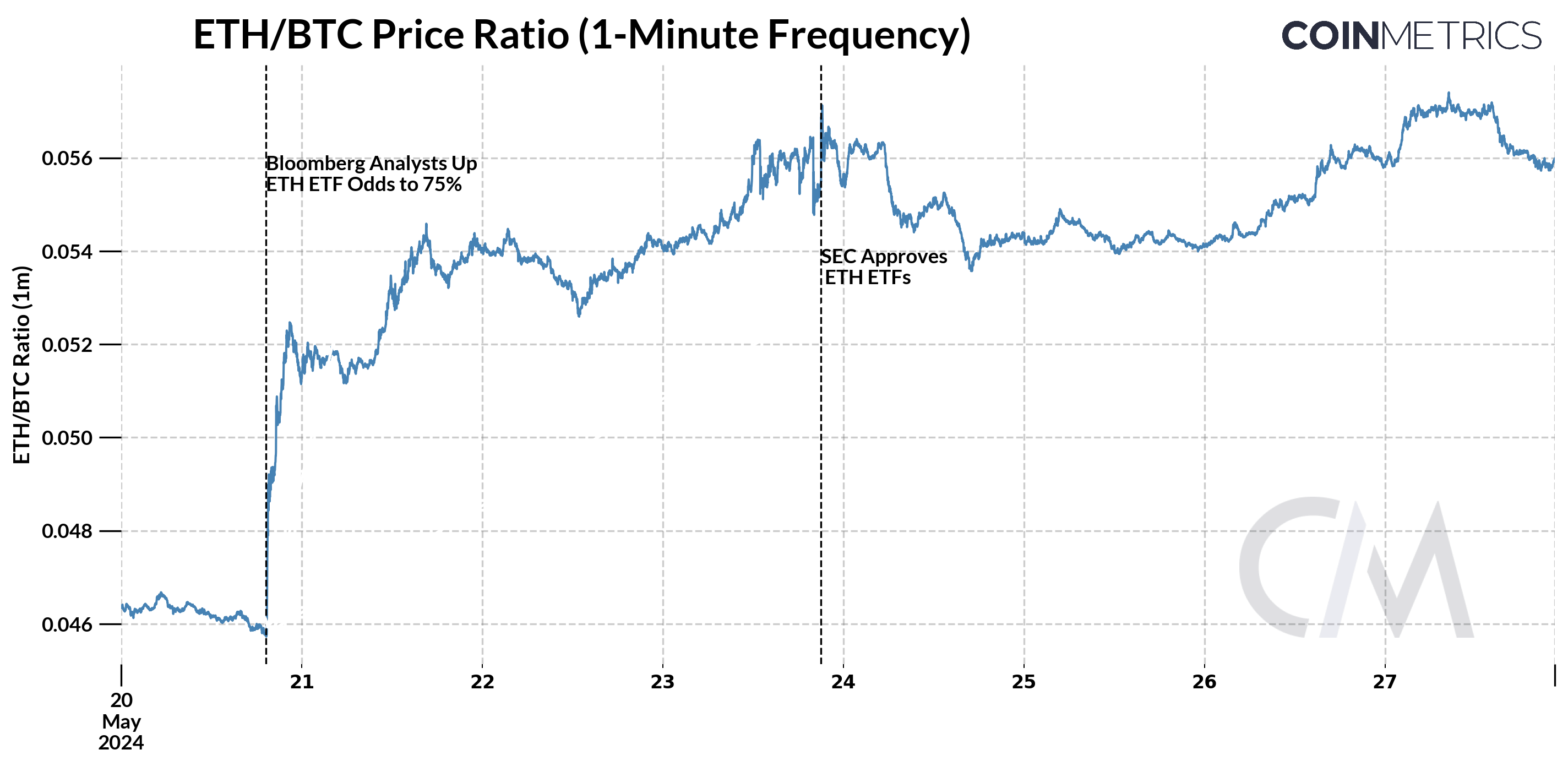

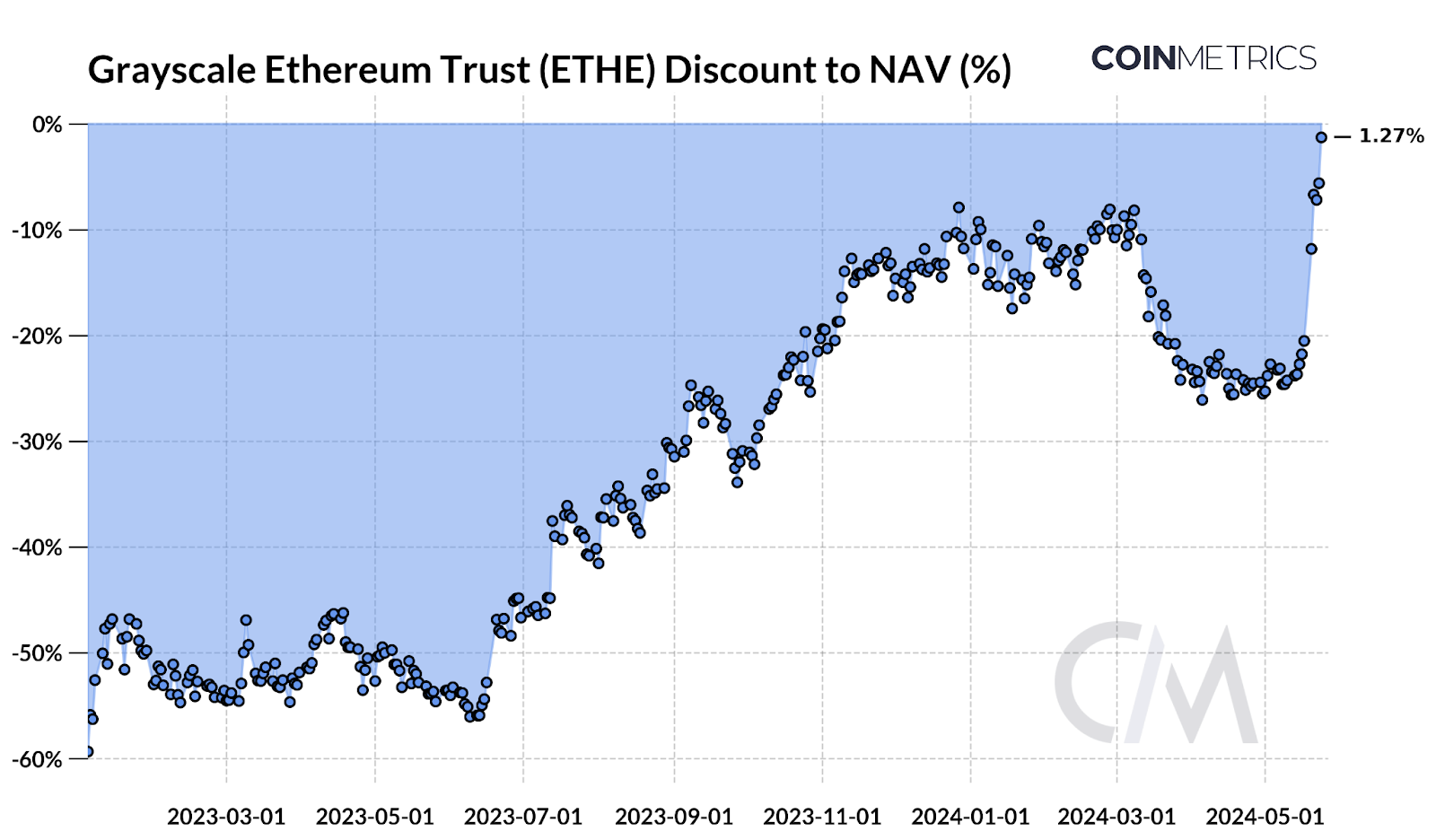

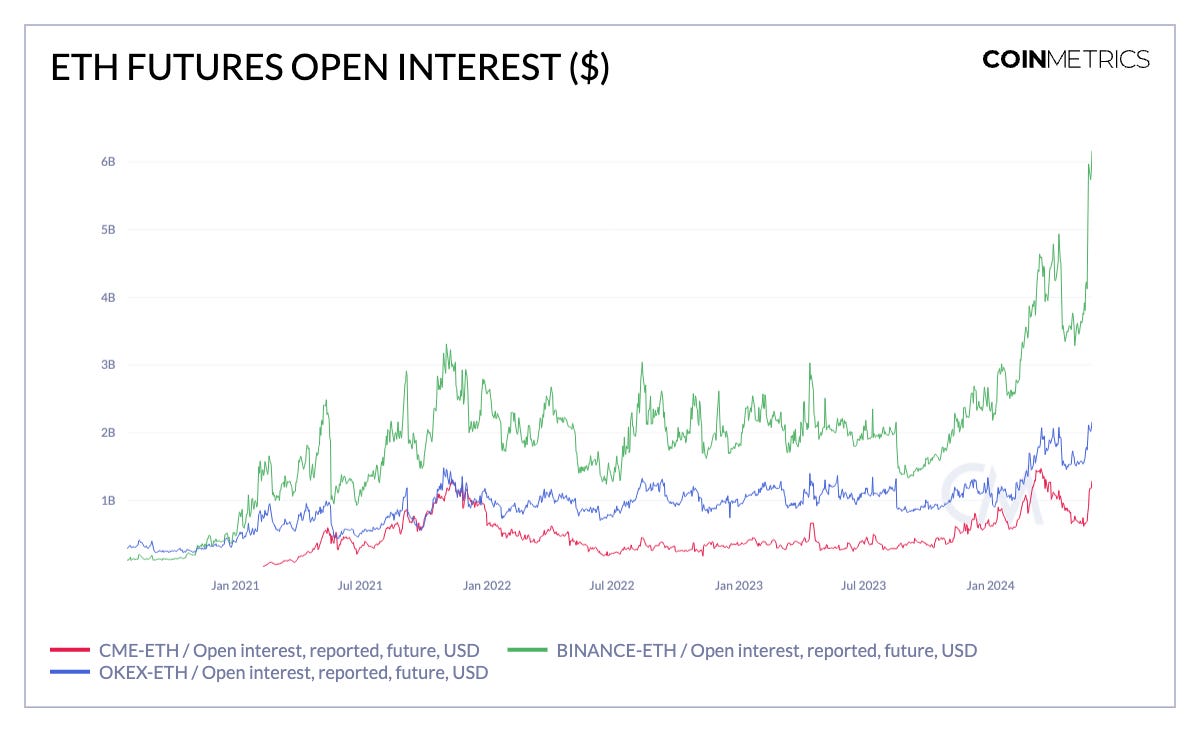

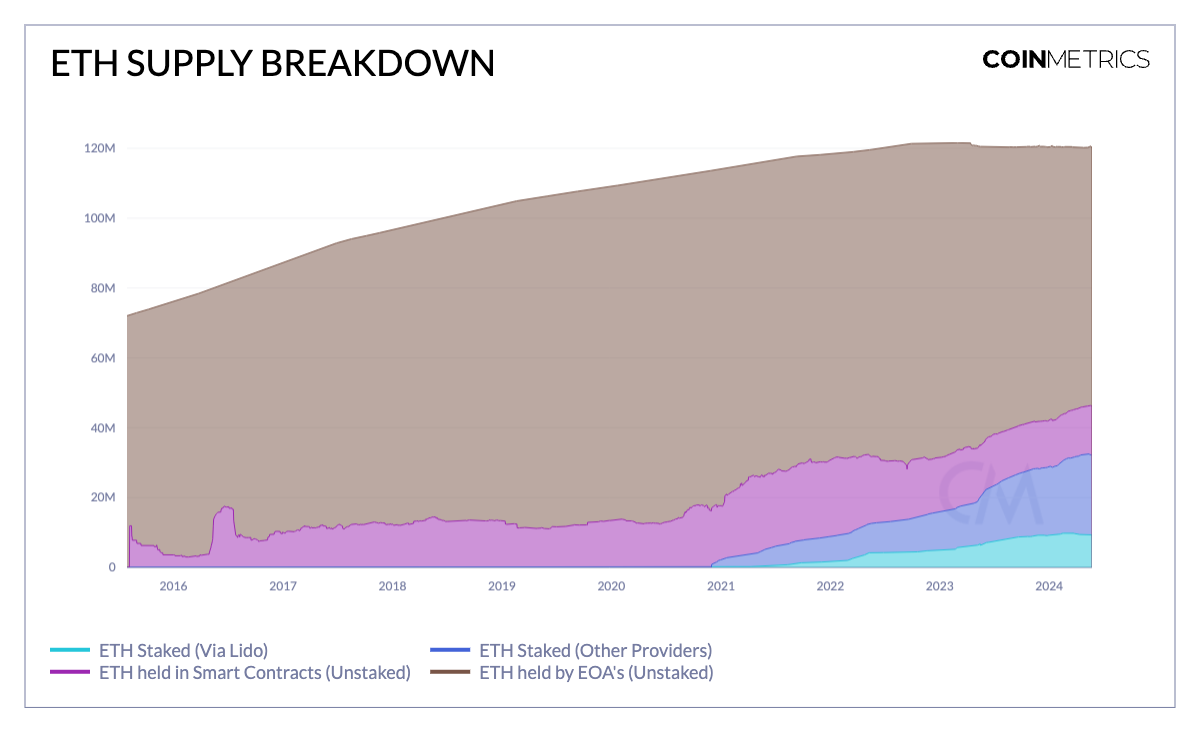

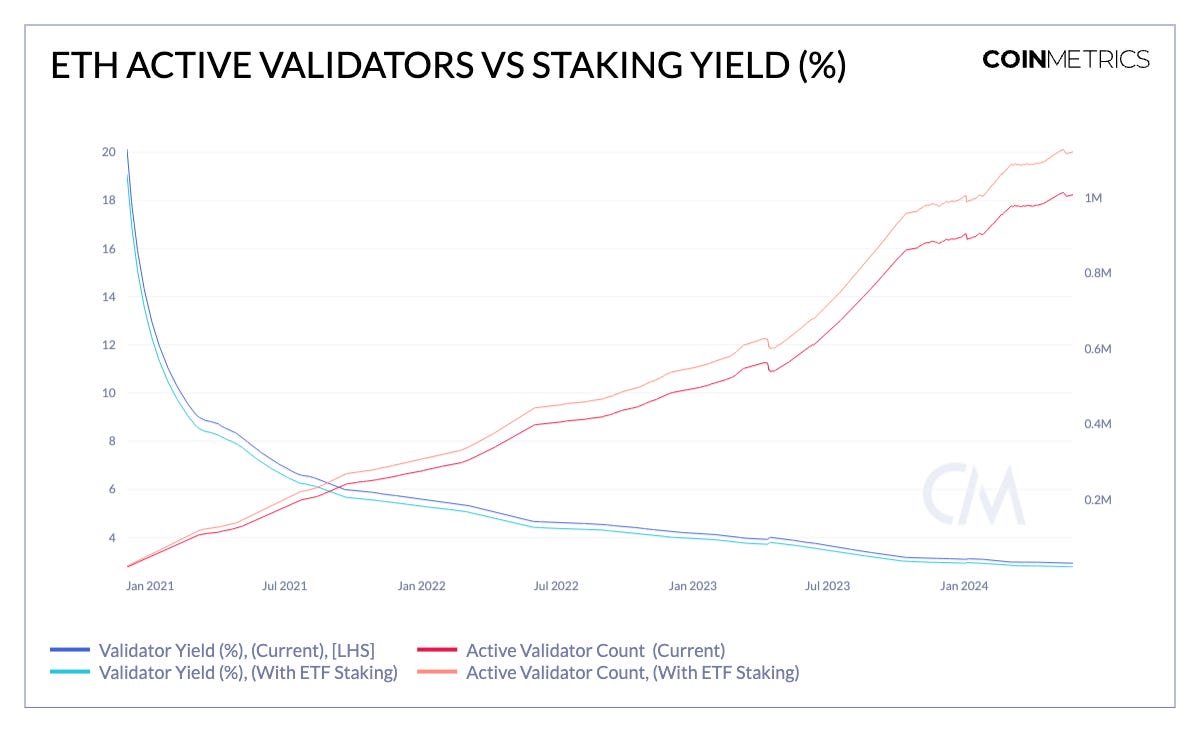

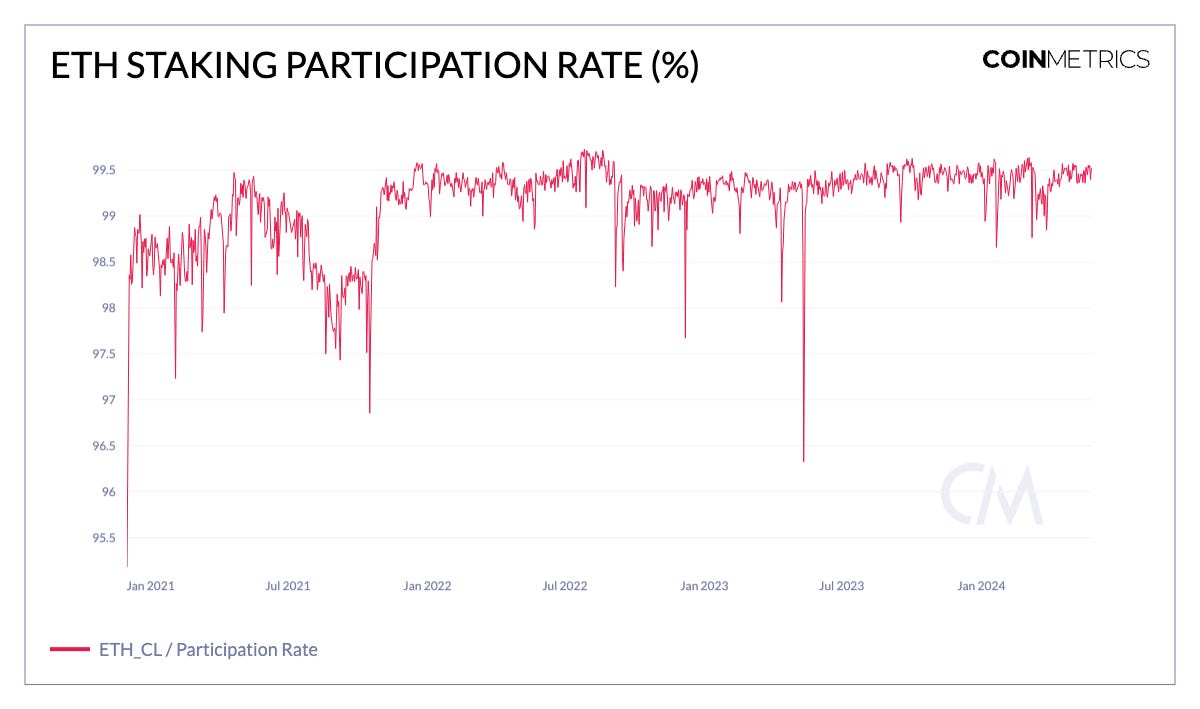

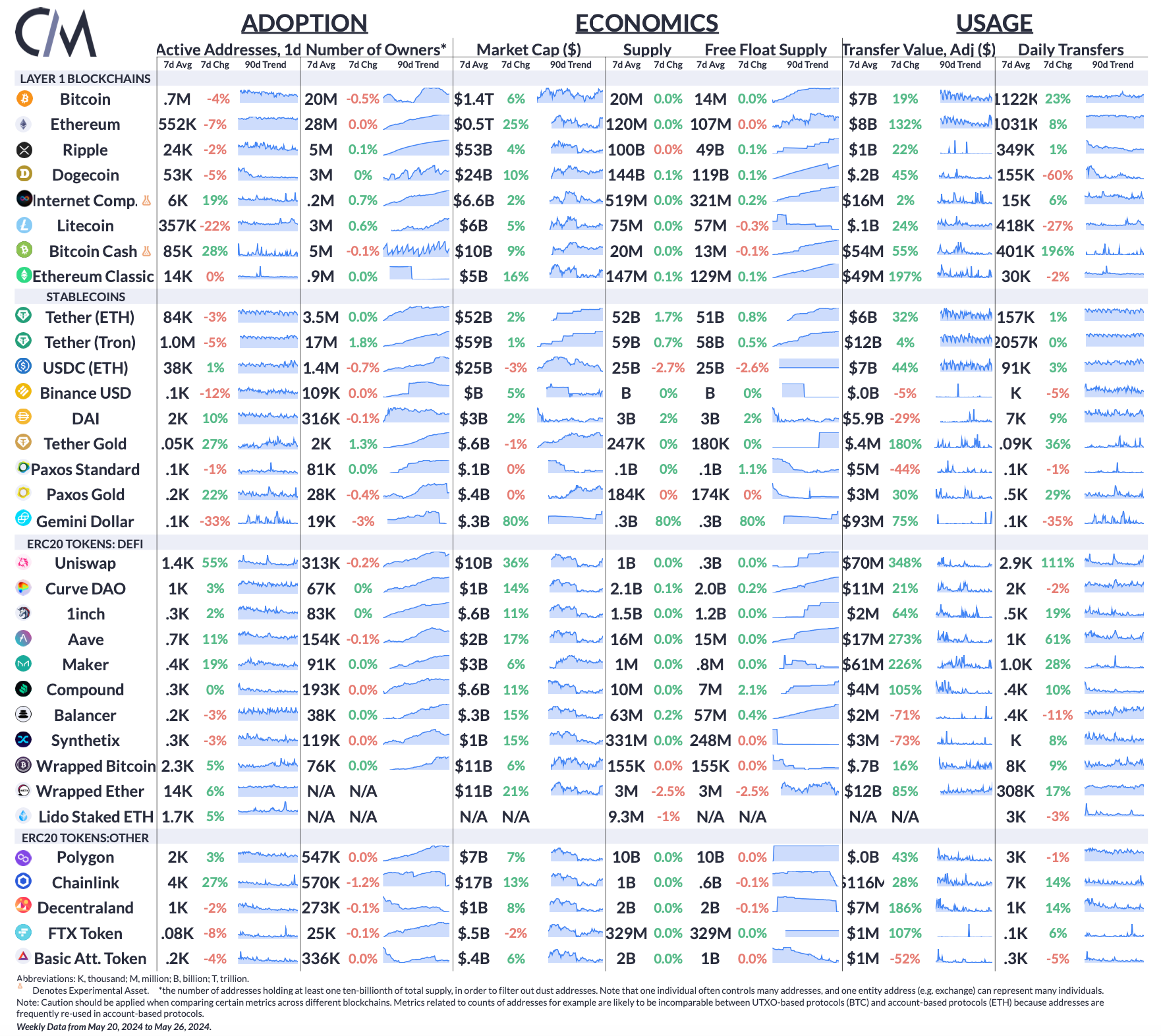

IntroductionIn a surprising turn of events, the U.S. Securities & Exchange Commission (SEC) has greenlighted spot exchange traded funds (ETFs) for the second largest digital asset—ETH. The 19b-4 proposals for 8 issuers were approved on May 23rd, including industry giants such as BlackRock, Fidelity, Bitwise, VanEck, and Grayscale. Just four months ago, we saw a decade long-quest for a spot bitcoin ETF come to an end, with 11 issuers entering the race dubbed the ‘Cointucky Derby’. Months of anticipation built up to the launch, subsequently attracting $12B in net flows, making it the fastest growing ETFs launch in history. In this issue of Coin Metrics’ State of the Network, we gauge the market reaction and network implications in the wake of SEC’s approval for spot Ether ETFs in the US. Market ReactionWith such a narrow time-window to price-in this development, the market reacted swiftly. Increased approval odds to 75% triggered an immediate reaction in the market prices of ETH and other Ethereum ecosystem tokens. PEPE (+80%) the largest memecoin on Ethereum, LDO (+44%) the governance token for the liquid staking provider—Lido, and UNI (+44%), the token behind the Uniswap decentralized exchange (DEX) provided the highest returns, while ETH followed with a (+27%) gain. Source: Coin Metrics Reference Rates The performance of ETH relative to BTC (ETH/BTC Ratio), which has been on a downtrend trend since September 2022, got a much needed boost from this news. Despite rising to 0.056 prior to the ETF approval, it needs to break past key resistance levels to resume its uptrend and recoup its underperformance relative to other large cap crypto-assets like BTC & SOL. While the approval of the 19b-4’s has not accelerated returns, the expected approval of S-1 registration statements and the subsequent launch of Ether ETFs should prove to be a strong tailwind for the wider acceptance of ETH as an investable “commodity” and mainstream adoption of the Ethereum network. Source: Coin Metrics Reference Rates Investor Sentiment & Market PositioningThe market sentiment around the approval of spot Ether ETFs is reflected in the narrowing discount to net asset value (NAV) for Grayscale's Ethereum Trust (ETHE). From a substantial ~50% discount just a year ago, ETHE's market price has converged to within 1.28% of its NAV, with 20% of this reduction occurring over a span of 5-days. Source: Coin Metrics Institutional Metrics, Grayscale The record-high $13.8B open interest (OI) in ETH futures contracts also signals the presence of elevated speculation around Ether ETFs. While still relatively lower than levels witnessed for BTC prior to the spot bitcoin ETF launch, increased value of outstanding ETH futures contracts across Binance, OKX and the Chicago Mercantile Exchange (CME), indicates higher levels of activity from retail and institutional participants alike. Source: Coin Metrics Market Data Feed How Does the ETH ETF Impact Staking?An important development concerning the approval of spot Ethereum ETFs is that they will exclude staking from these products. The inability for issuers to stake ETH, could have potential downstream implications for the supply dynamics of ETH, the health of Ethereum’s consensus layer and the staking ecosystem as a whole. Impact on Ethereum Supply DynamicsAs the native asset of the Ethereum ecosystem, Ether (ETH) serves as the backbone for its operations and security. It can function as a unit of account, store of value or form of collateral, with a diverse economy built around it. This includes the Proof-of-Stake (PoS) consensus mechanism utilizing ETH to secure the network through staking, depositing ETH into smart contracts that facilitate services like decentralized finance (DeFi), using ETH to pay transaction fees or simply holding ETH in user-owned accounts as a form of investment or store of value. Source: Coin Metrics Network Data Pro Currently, out of the total 120M ETH supply, 27% is staked on the consensus layer, 11% is held in smart contracts (unstaked), and 61% is held by externally-owned accounts (EOAs). As ETF issuers absorb more circulating ETH, a larger portion of the supply is expected to be locked up, potentially reducing the market's available supply. This reduction in circulating supply, coupled with robust demand, could increase the likelihood of price appreciation for ETH. Impact on the Ethereum Consensus LayerCurrently, 32 million ETH, accounting for 27% of the total supply, is staked on the Ethereum Beacon Chain through solo staking, staking pools like Lido or custodial staking providers like Coinbase. However, with the exclusion of staking from ETH ETFs, the ratio of 27% staked to 73% unstaked is unlikely to change drastically. Staking yield is a key component of the returns on holding ETH. Therefore, the exclusion of ETFs from staking could be beneficial for existing stakers, as it prevents the dilution of staking returns that would occur if institutional capital were to enter the staking ecosystem. Source: Coin Metrics Network Data Pro The potential impact on validator yields from consensus rewards (excluding tips and MEV) can be visualized in the chart above. Assuming Ethereum ETF issuers acquire 10% of ETH supply (12M ETH) and stake 30% of that amount, the number of active validators on the consensus layer would increase by 11.25%, from the current 1.00M to 1.12M. Following an inverse relationship, this influx of validators and staked ETH would result in lower annual percentage yields (APY’s) for stakers, decreasing from approximately 2.9% to 2.7%. While this does not provide an exact measure, it illustrates the potential impact on staking yields if additional ETH were staked by ETF issuers. It’s also important to consider that changes to Ethereum’s maximum effective balance per validator—currently set at 32 ETH—is set to increase to 2048 ETH in the forthcoming Electra upgrade, which may alter validator and network security dynamics. Furthermore, the absence of staking from ETH ETFs could have positive implications for Ethereum's staking ratio and decentralization. Currently, with the rapidly growing staking ratio, providers like Lido and Coinbase hold a 28% and 13% market share of staked ETH, respectively. If institutional capital were to participate in staking, Coinbase, as a major ETF custodian, would likely become the primary beneficiary of staked ETH, exacerbating these centralization risks. These concerns have prompted discussions in the Ethereum community about adjusting ETH’s issuance rate to mitigate negative externalities such as stake centralization, lower competitiveness of solo stakers and inflationary pressures on non-stakers. It remains to be seen whether the SEC will allow staking for Ether ETFs in the long run. However, by not staking ETH, ETFs could indirectly help maintain a balanced staking ratio and promote a healthier staking distribution for the time being. Source: Coin Metrics Network Data Pro The Ethereum consensus layer’s participation rate of 99.5% suggests that a large proportion of validators are attesting (voting on) and proposing blocks to maintain the security of the network. It also means that staking rewards are being distributed among a larger pool of validators, ensuring decentralization. Going forward, the proposed changes to issuance and the effective balance, alongside the SEC’s stance on ETFs with staking will shape things to come for the Ethereum staking ecosystem. ConclusionThe past week marked a pivotal shift in the US regulatory landscape for digital assets with the approval of the FIT21 crypto market structure bill and the green light for Ether ETFs, to name a few. Still, several questions remain unanswered: Will Ether ETFs garner investment flows comparable to Bitcoin ETFs? How will staking dynamics evolve in light of these developments? And what will be the broader impact for the rest of the crypto market? While these remain to be seen, the regulatory clarity and increased accessibility are poised to attract wider demand to ETH and its ecosystem. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro The market capitalization of Ethereum (ETH) rose by 25% over the week, while adjusted transfer value increased by 132% to $8B. Several ERC-20’s saw elevated activity and rising valuations on the back of ETH ETF approvals. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Decoding the Digital Dollar

Tuesday, May 21, 2024

Exploring the growth, diversity and usage patterns of the $160B+ Stablecoin market ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin's Halving Aftermath

Tuesday, May 14, 2024

Bitcoin's 2024 Halving was the most consequential in its history, kickstarting a new token protocol & stress-testing balance sheets across a multi-billion dollar industry ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Usage & Evolution of Decentralized Exchanges (DEX’s)

Tuesday, May 7, 2024

Checking in on liquidity pools, trading volumes and adoption across Ethereum DEX's ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Measuring Exchange Quality And ‘Fake Volume’

Tuesday, April 30, 2024

Crypto data for the decentralized economy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Layer-1 Landscape

Tuesday, April 23, 2024

A data-driven look across Layer-1 ecosystems ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏