Charting the Course to Mt. Gox Repayments

Charting the Course to Mt. Gox RepaymentsTracing Mt. Gox's journey, analyzing wallet flows and BTC liquidity in the wake of Mt. Gox repaymentsGet the best data-driven crypto insights and analysis every week: Charting the Course to Mt. Gox RepaymentsBy: Matías Andrade & Tanay Ved Key Takeaways:

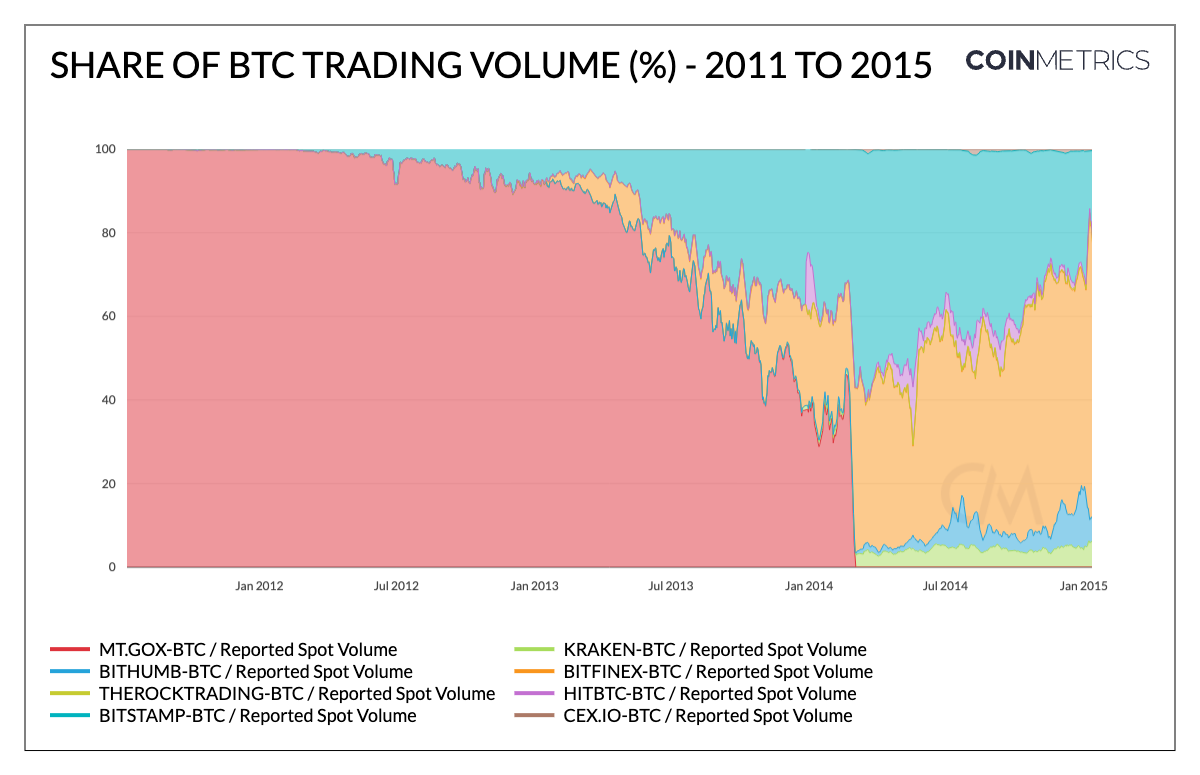

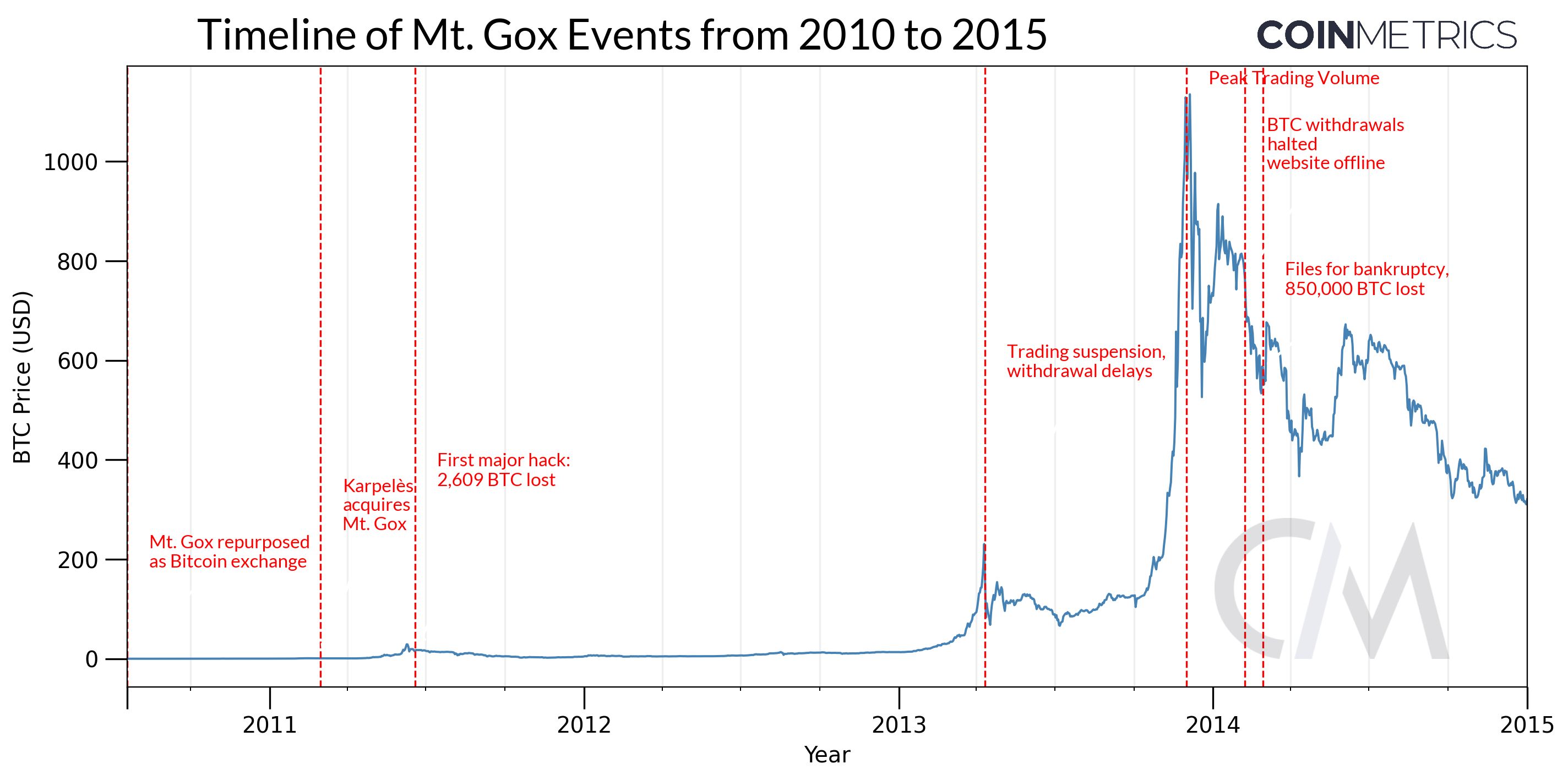

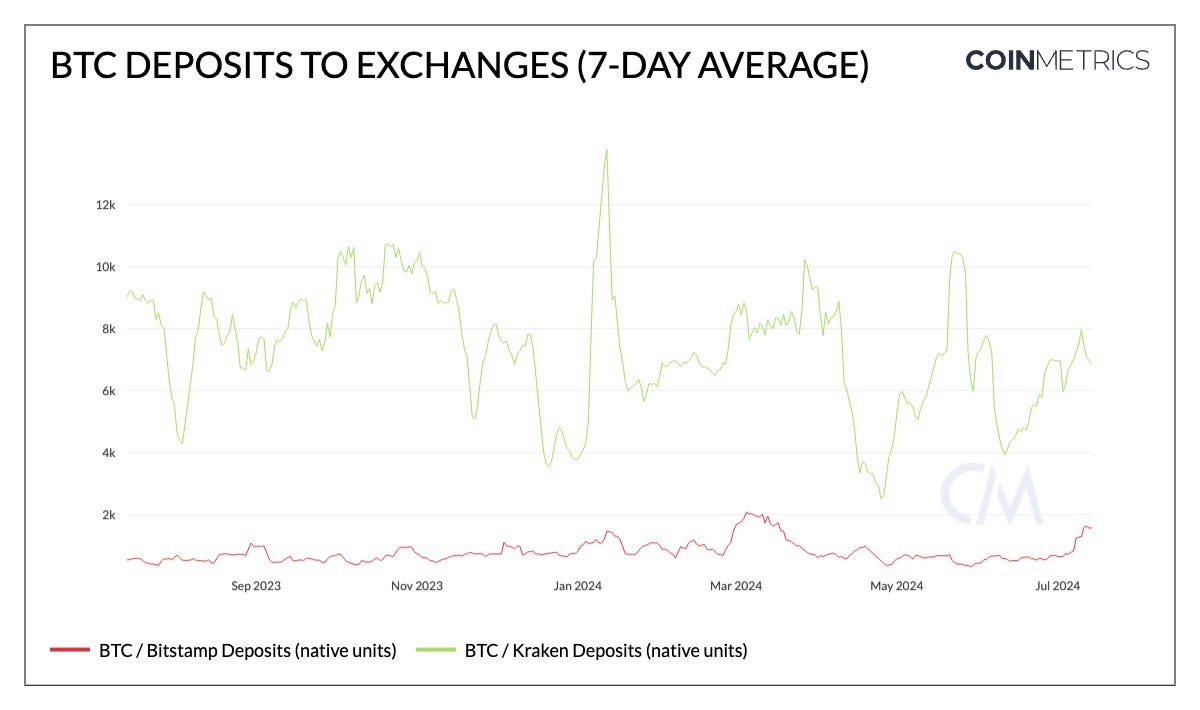

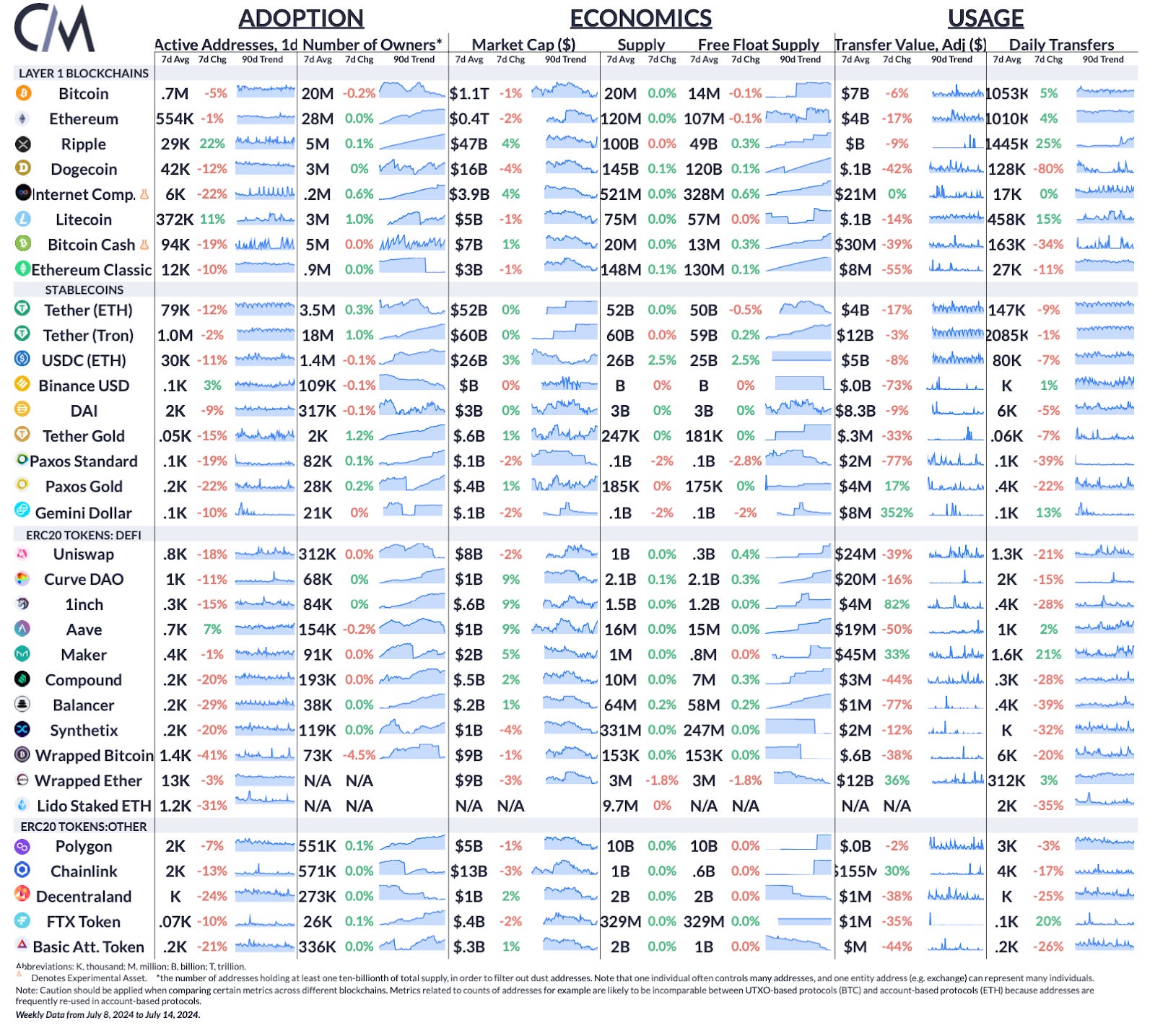

In the annals of cryptocurrency history, few events have left as indelible a mark as the collapse of Mt. Gox. Nearly a decade after its spectacular downfall, the defunct Bitcoin exchange is making headlines once again as creditors finally begin to receive their long-awaited funds. With approximately $9B worth of bitcoin set for distribution, alongside sales of 50K BTC seized by the German Federal Criminal Police (BKA), the resolution of the Mt. Gox saga represents a pivotal moment in the maturation of the cryptocurrency ecosystem. In this week’s issue of Coin Metrics’ State of the Network, we discuss the significance of Mt. Gox, its tumultuous history, and the far-reaching implications of its collapse and subsequent payout on the broader crypto market. Mt. Gox BackgroundMt. Gox, an acronym for "Magic: The Gathering Online eXchange," began its life far removed from the world of cryptocurrencies. Founded in 2006 by programmer Jed McCaleb, the platform was initially designed as a trading card exchange for the popular game Magic: The Gathering. In 2010, as Bitcoin began to gain traction, McCaleb repurposed the site into a Bitcoin exchange. Mt. Gox Exchange Interface The timing couldn't have been more fortuitous. As one of the first Bitcoin exchanges, Mt. Gox quickly became the go-to platform for those looking to buy and sell the nascent digital currency. In March 2011, McCaleb sold the platform to Mark Karpelès, a French programmer living in Japan, who would oversee the exchange during its meteoric rise and catastrophic fall. Under Karpelès' stewardship, Mt. Gox experienced explosive growth. By 2013, it had become the largest Bitcoin exchange in the world, handling an estimated 70% of all Bitcoin transactions. This dominance gave Mt. Gox an outsized influence on the Bitcoin ecosystem, effectively making it the central pillar of the early cryptocurrency market. Source: Coin Metrics’ Market Data Feed Despite its apparent success, Mt. Gox was plagued by security issues and operational challenges. The first major blow came in June 2011 when the exchange suffered a significant hack, resulting in the loss of 2,609 bitcoins, which were accidentally sent to a null address. Mt. Gox made a critical mistake in some of their transactions by using an incorrect script. Instead of including the proper Bitcoin address (a 160-bit hash) in the scriptPubKey, they mistakenly used the byte 0 (OP_0). This created a script that could never be satisfied, effectively making the bitcoins sent to this "address" permanently lost. On February 7th, the exchange halted all Bitcoin withdrawals, citing technical issues related to transaction malleability. As days passed without resolution, panic began to spread among users. The situation reached its breaking point on February 28th, 2014, when Mt. Gox filed for bankruptcy protection in Tokyo. In its filing, the company made the shocking announcement that it had lost track of 850,000 bitcoins, worth around $468.5 million at the time. Of these, 750,000 belonged to customers, while 100,000 were the company's own holdings. Source: Coin Metrics Market Data Feed This revelation sent shockwaves through the cryptocurrency community and beyond. Mt. Gox, once the titan of Bitcoin trading, had collapsed under the weight of what appeared to be years of mismanagement and security failures. The chart below encapsulates the timeline of events that unfolded and their impact on BTC’s price action from 2010 to 2015. Source: Coin Metrics Reference Rates Current State of Mt. Gox RepaymentsFast forward to today, 10 years after the exchanges collapse: the Japanese rehabilitation trustee on behalf of Mt. Gox, Nobuaki Kobayashi, issued a notice on June 24th stating that repayments of Bitcoin and Bitcoin Cash to creditors would begin in July. While this marks a long-awaited resolution for creditors, the prospect of asset distributions has caused jitters among market participants, concerned about potential supply pressure. Visualization of Fund FlowsIn culmination, Mt. Gox lost over 750K BTC from its users, and ~100K of their own holdings. Of this total, approximately 16% of these assets were recovered, making ~140K BTC eligible for redistribution. To understand the current state of affairs leading up to repayments, we can utilize Coin Metrics’ ATLAS, a blockchain search tool to illuminate the flow of funds between associated stakeholders and wallets. On-chain data suggests that wallets associated with Mt. Gox hold ~139K BTC in aggregate today (valued at ~$9B based on BTC’s market price as of July 15th). This amount was credited in a series of transfers on May 28th in what seemed to be a consolidation of balances to a single wallet. Visualizing the flow of funds for the account in question, we can see outflows of 47.2K BTC (valued at ~$3B) to 3 distinct wallets which occurred on the same day. Since then, there have been several internal movements of funds among Mt. Gox wallets indicating the small-scale commencement of repayments. Of the three accounts captured above, the (HoV68) wallet moved the 47.2K BTC to a wallet ending in (D5J6onk), which sent back 2701 BTC to the target account that initially received the recovered bitcoins (LAPs6). Subsequently, on July 5th, 1544 BTC (~$90M) was transferred to a hot wallet associated with Bitbank, one of the exchanges involved in the repayment process. As of now, a substantial portion of the recovered funds remains in Mt. Gox wallets, indicating that large-scale repayments have yet to commence. Importantly, distributions will take place through multiple exchanges such as Kraken, Bitstamp, Bitbank and others, decreasing the likelihood of an outsized market impact. Current data shows no material increase in deposits to these exchanges, a metric that may help gauge the progress of repayments. This absence of significant deposit activity suggests the distribution process is in its early stages and may be proceeding gradually. Source: Coin Metrics Network Data Pro Exploring Market ImpactTo assess the potential market impact from the repayment process, examining Bitcoin’s liquidity conditions can also be instructive. It is estimated that of the 140K BTC, closer to ~65K BTC is to be distributed to individual creditors. It will be critical to examine market liquidity during the following weeks when liquidation of Mt. Gox funds are likely to occur. Using Coin Metrics' comprehensive coverage of exchange liquidity, we can analyze the market's capacity to absorb potential sales. The chart provided below illustrates the Market Depth of BTC (±1%) for USD and other stablecoin pairs (USDC, USDT, BUSD, FDUSD) from January to July of 2024. Ask depth (colored in red) typically ranges between $50M and $100M for limit orders within 1% of the current price. Source: Coin Metrics Market Data Feed Given this market depth, and average daily volumes of around $15B for BTC alone, the distribution of ~65K BTC (worth approximately $1.95B at current prices) could potentially be absorbed by the market over a period of a couple weeks without causing severe disruptions, assuming the liquidations are done gradually and across multiple exchanges. These findings, however, are only suggestive of the depth and maturity of the BTC market, but should assuage fears of liquidity shortage in the near-term. ConclusionThe resolution of the Mt. Gox saga marks a significant milestone in cryptocurrency history. Nearly a decade after its collapse, the commencement of creditor repayments signifies both the maturation of the crypto ecosystem and the lengthy process often required to resolve complex financial failures in this space. Market participants will likely closely monitor conditions as these wallets potentially liquidate their holdings over the coming weeks. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro Following a rapturous weekend for American politics, the crypto market showed mixed signals. Bitcoin experienced a slight cooling, with active addresses decreasing by 5% and its market cap dipping 1% to $1.1T. In contrast, Ethereum demonstrated resilience with a 1% increase in active addresses to 554K. Wrapped Ether's 36% surge in transfer value to $12B potentially signals increased DeFi activity or cross-chain transactions amidst the political backdrop. Coin Metrics UpdatesThis quarter’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

State of the Network’s Q2 2024 Wrap-Up

Tuesday, July 9, 2024

A data-driven overview of events shaping digital asset markets in Q2–2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q2 2024 Mining Data Special

Tuesday, July 2, 2024

Our quarterly update on Bitcoin mining, focusing in on transaction fee spikes, public miner M&A, and ASIC efficiency improvements ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Mastering Crypto Derivatives

Tuesday, June 25, 2024

Explore how derivatives can transform your crypto trading strategy with indirect exposure, risk hedging, and market efficiency capitalization. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Floating On Thin Air

Tuesday, June 18, 2024

Decoding Crypto Tokenomics: Valuation, Distribution, and Impact ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Meme Coin Mania

Tuesday, June 11, 2024

Exploring the rise in meme coin activity and market trends driven by the sector ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏