Not Boring by Packy McCormick - Blackbird

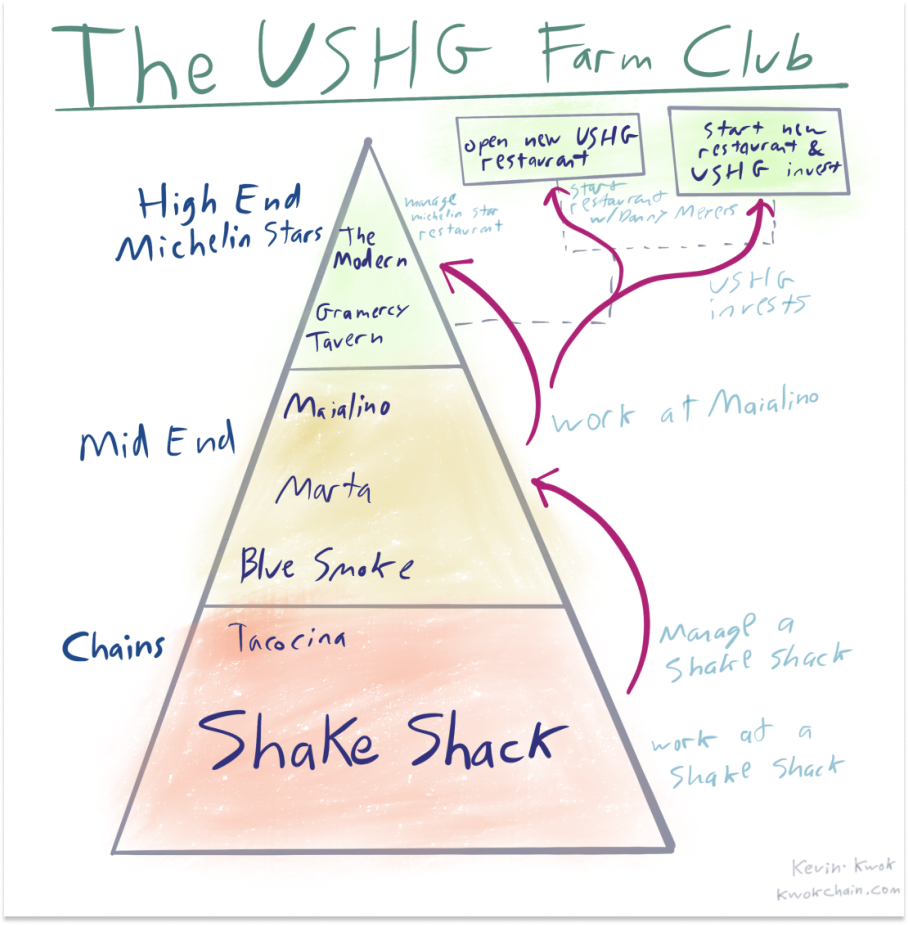

Welcome to the 217 newly Not Boring people who have joined us since last week! If you haven’t subscribed, join 230,197 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… Write of Passage If you want to become a better writer, you should take Write of Passage with David Perell. I did in 2019, and it set me on the path that led to Not Boring. Best money I ever spent. David is the writing teacher you secretly wish you had growing up. He’s insanely passionate, obsessed with quality, and has a way of making writing fun in a way your English teacher probably didn’t. Write of Passage was great when I took it, and it’s only gotten better since. Why write? Paul Graham wrote that “someone who never writes has no fully formed ideas about anything nontrivial.” Writing sharpens thinking. Whether you want to share your ideas with the world or just give them a good workout, writing is how. If you’ve thought about becoming a better writer, I highly recommend Write of Passage. Hi friends 👋, Happy Tuesday! Coming to you live from sunny NYC with a piece I’ve wanted to write for a while. Blackbird is the first app I’ve used that’s onchain but doesn’t feel like it is. It feels like a restaurant app. I use it to discover places to eat, and to earn loyalty for eating there. Starting today, I’ll be able to use it to pay my tab — automatically, without getting the check — using credit card, debit card, or Blackbird’s $FLY token. Late last year, I wrote that more great entrepreneurs would build products onchain as the trade-offs for doing so shrunk. Blackbird is the best example of that thesis that I’ve seen. It’s an app I’d use whether it was onchain or off, and a tool that restaurants use even if they’ve never heard of crypto, even if they don’t particularly like crypto, because it can help them build a more profitable business. But it’s also an app that wouldn’t be able to do the things it wants to do for restaurants and diners without crypto. It’s notoriously hard to run a restaurant. 60% fail in their first year. The ones that survive do so on razor thin margins. But restaurants make cities and neighborhoods feel vibrant, cozy, and familiar. We want them to survive and thrive. So this is a Deep Dive into Blackbird, the challenges of running a restaurant, and how crypto, in the right entrepreneur’s hands, can help make restaurants better businesses. This isn’t a sponsored deep dive, and I’m (unfortunately) not an investor, although a16z crypto (where I’m an advisor) is. I’m just a fan and user, and a New Yorker who would like my favorite restaurants to stay open, and maybe give me a free drink. Let’s get to it. BlackbirdThe restaurant industry operates on a fundamental paradox: it's a business of hospitality, predicated on making each customer feel special, yet it's also a volume business that requires serving as many customers as possible to remain profitable. If you’ve watched season three of The Bear, you’ve watched this paradox play in excruciatingly high fidelity. It’s Richie versus Computer. Five-star hospitality versus cold-hard numbers. Blackbird is what you’d get if Richie and Computer had a baby: scaling personalized hospitality with data. Blackbird is a loyalty and payments platform built for the restaurant industry. For diners, it offers the opportunity to “be a regular, everywhere.” The company was born to resolve this fundamental paradox, to make good hospitality good business. At its core, Blackbird is attempting to scale the "regular" experience – that feeling of being recognized, valued, and treated like an old friend – across multiple establishments. In the process, it wants to reshape the economics of an entire industry whose economics need reshaping. Restaurants are weird in a lot of ways. In aggregate, they’re formidable: restaurants did over $1 trillion in US sales last year and account for nearly 5% of GDP. But each individual restaurant is a famously difficult business proposition: 60% go out of business in their first year, and 80% fail within five years. In 2023, 38% of restaurants reported that they were not profitable. There are as many reasons for the difficulty as there are ingredients in the pantry, and all of them blend together in one big difficulty stew. Rent keeps going up, and all of a sudden, there’s a Chase Bank where your favorite dive bar with surprisingly good cocktails used to be. Labor is hard to come by and harder to keep. Kitchens are chaotic. Inventory expires. Fucking Instagram kids make a reservation just to order the cheapest thing on the menu to snap a shot. Then a newer, sexier spot opens up down the street and all the cool kids stop showing up. More people just order in, and delivery services take a healthy cut of your revenue. Reservations no-show, leaving valuable tables empty. When they show up, reservation platforms take a healthy cut of your revenue, too, then payment processors take a healthy cut of your revenue, too. And when all is said and done, if you’re still alive, you’re left with an average 4% profit margin, down from 20% twenty-five years ago, and very little to reinvest back into the top-notch service and photogenic scenes people now expect from their dining establishments. Mamma mia. Ben Leventhal knows all of this as well as anyone in the world, and he wants to fix it. There’s this book I really like, The City We Became, in which author N.K. Jemisin personifies each of the boroughs with a human avatar. Manhattan is a young, brash, multiracial guy. Brooklyn is a middle-aged Black woman and former rapper. The Bronx is a street-smart Afro-Latina woman. Queens is an Indian immigrant math student. Staten Island is a sheltered and kinda racist white woman. If Jemisin had personified New York's restaurant scene, she would have chosen Ben Leventhal. “Ben is so New York in a way that’s hard to articulate,” Jay Drain, one of the a16z crypto Deal Partners who worked on the Blackbird investment, told me. “He just looks like he belongs in a restaurant.” Ben grew up in New York. He attended Horace Mann, the school that inspired Gossip Girl. After a brief stint outside the city for college, he came back and threw himself into the intersection of restaurants and technology. In 2005, he founded the restaurant discovery blog Eater. Before Eater, people trusted print guides that became dated the second they hit bookshelves, or haughty professional critics who reviewed the fancy spots. Eater embraced the internet, and won. He sold it to Vox Media in 2013. In 2014, he founded the reservation platform, Resy. Before Eater, people made reservations on OpenTable, a 1998-era product built for the desktop. “The advent of smartphones had come and gone without OpenTable really doing anything to update the basic ideas of the product,” he said on the Serious Eats podcast. Resy embraced mobile, and won. He sold it to American Express in 2019. After a couple of years inside of American Express, the $170 billion payments and loyalty behemoth, Ben started talking to some friends about what was next. One of those friends was Fred Wilson, the Union Square Ventures partner and early Coinbase investor. Ben had an idea around building something in payments and loyalty for the restaurant industry, and Fred encouraged him to consider building it onchain. He did, USV committed to co-lead an $11 million financing alongside Shine Capital, and Blackbird was born. Reading the last few paragraphs, you might have picked up on a few themes. First, there’s the progression of products that mirrors the diner’s journey. Discover a place to eat (Eater), make a reservation (Resy), enjoy the experience, pay, and come back (Blackbird). Second, there’s the embrace of a new technology platform before anyone else in an industry. Eater replaced print with a blog on the internet. Resy replaced desktop (and the glued-together suite of reservation management “tools” like paper notes, spreadsheets, and emails) with a mobile app. Blackbird is replacing fragmented loyalty programs and expensive payment systems with crypto rails. In this and other ways, Blackbird is running the Ben Leventhal Playbook with some new twists. There’s one big difference here, though. While Ben sold Eater and Resy to centralized companies, that’s not an option for Blackbird. Instead, ownership of the network of restaurants will primarily go to the restaurants themselves as the company progressively decentralizes. “Overall, the restaurant industry should own roughly half of the network,” Ben told me. That’s one of the things that’s newly possible because Blackbird uses crypto, but Blackbird works because it’s not a crypto app. It’s a restaurant platform and consumer app, built by restaurant people, that only uses crypto and whatever other tools it needs to use to make restaurants more profitable, help them understand their customers better, and build a healthier industry. When I asked Ben what I couldn’t miss in telling the Blackbird story, he said that they’re just really excited about the long term prospects for the industry. “We’re a couple of core unlocks away from a much better industry.” This is a deep dive into the industry and those unlocks. How to Think About BlackbirdThere are a few different ways to think about Blackbird. They’re all connected, but it’s worth unpacking them separately before bringing them back together. One way to think about Blackbird is from the industry perspective: as a tool to help restaurants drive better unit economics through payments, loyalty, and customer insights. A second way to think about Blackbird is from the diner perspective: as a way to discover somewhere to eat and get magical, personalized dining experiences that scale alongside your loyalty. Another way to think about Blackbird is as a business itself: as an onchain AmEx, similar in many ways and different in a few important ones. A fourth way to think about Blackbird is as a blockchain network: as a decentralized platform that enables new forms of value creation and distribution in the restaurant ecosystem, and potentially, beyond it. It’s all of those things, but to understand them, we need to start by understanding the restaurant business. The Restaurant BusinessRestaurants are one of those things that we don’t really want to think about as a business. Businesses need to make trade-offs. We don’t want restaurants to make trade-offs. We want great food and great service every time we walk in the door, because from our perspective, restaurants are an occasion. They’re the rare chance to be taken care of, treated like royalty, served. A little treat. But, alas, restaurants are a business, and their business model directly impacts the level of service they’re able to provide. When Kevin Kwok wrote Aligning Business Models to Markets in 2019, he used a restaurant group, Danny Meyer’s Union Square Hospitality Group (USHG), as his primary example. USHG is undoubtedly one of the great success stories in the restaurant industry. Meyer made Union Square what it is today. The Modern, Union Square Cafe, Manhatta, Gramercy Tavern, and ci siamo rank consistently among New Yorkers’ favorite places to eat. Shake Shack, which spun out of USHG, has a $3.4 billion market cap. In such a challenging industry, USHG’s consistency stands out. How does Danny do it? Kwok explains: “In his business memoir Setting the Table, Meyer attributes his outsized success to an uncompromising focus on employees that leads to differentiated service.” So, Kwok asks, “If Danny Meyer’s employee-first approach is so effective, why haven’t we seen more restaurant groups adopting it faster? Or even more service-first approaches?” And answers, “Providing a high level of service is a choice that must be supported by your business model.” I highly recommend reading the whole essay, but the long and short of it is that a high level of service requires investing in training employees, training employees is expensive, and most restaurants can’t afford to make the investment because employee churn is too high, ranging from 50% to 110% annually. Once you’ve paid to train someone, they’re gone. USHG, however, can afford to train its employees, because the group operates restaurants from fast casual up to fine dining and can therefore offer its employees a clear career progression. You could start behind the counter at Shake Shack and end up managing the Modern. Because employees stick around longer, USHG can afford to invest more in training them, which creates the differentiated service that makes USHG’s restaurants so good and allows the group to continue to open new restaurants and create even more career opportunities for its employees. The takeaway is that the quality of a restaurant’s experience, and therefore its profitability, is a function of its business model. But why, Kwok wonders, did something like USHG take off now when you could have made a similar case at any point in the restaurant industry’s centuries-old history? In the old days, people didn’t have much choice. They went to the local restaurant because it was local. The restaurant industry was supply driven. Now, consumers have hundreds of choices and dozens of internet sources to discover them, “and being a place consumers want to come back to becomes more important.” The restaurant industry is now demand driven. As Kwok writes:

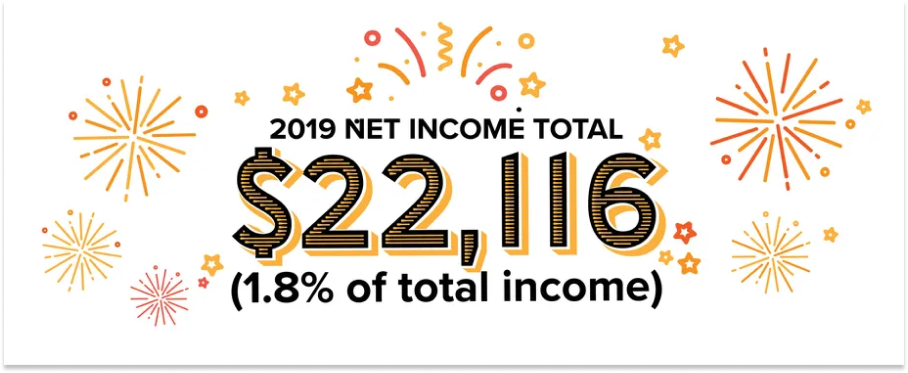

So great service is necessary in today’s restaurant market, but great service requires a level of investment that most independent restaurants can’t afford given employee turnover, but really given the fact that most independent restaurants operate at razor thin profit margins. Earlier, we discussed the fact that restaurant industry average margins have dropped from 20% to 4%. That’s thin. But high-level numbers are sterile, so I read a couple of restaurant owners’ breakdowns of their margins to get a better understanding of what it’s like on the ground. In The Financial Reality of Restaurant Ownership, Charlie Anthe, the co-owner of Seattle’s Moshi Moshi Sushi & Izakaya, broke down his restaurant’s economics at the line-item level. In 2019, Moshi Moshi did topline sales of $797,365 across food and drinks. It paid $192,168 in food cost and pour cost (-24.1%), $200,165 in Back of House labor (-25.10%), $60,932 in Front of House labor (-7.64%), and with other payroll-related expenses, Total Labor cost $328,793 (-41.23%). Gross Profit after “Prime Costs” came in at $276,404 (34.66%). Then it has fixed and semi-variable costs. Direct Operating Costs for things like aprons, uniforms, pest control, kitchen supplies, and paper products were $37,973 (-4.76%), Advertising & Promotions (including 3rd Party Delivery Fees) came in at $27,134 (-3.40%), General & Administrative, for things like credit card processing fees, legal fees, and accounting fees were another $42,875 (-5.38%), Maintenance Costs were $9,932 (-1.25%), Occupancy (primarily rent) was $75,790 (-9.51%). If you’re keeping track at home, that leaves Moshi Moshi Sushi & Izakaya with an Operating Net Income of $82,697 (10.37%). Not bad! Well above average. But then come Other Expenses – Interest Expense and Owners Salaries – at $70,772 (-8.88%), bringing Net Profit to a hair's-width $11,928 (1.50%). Still profitable! Ok! Wait. We still need to include cash flow hits that don’t show up on the P&L. A new outdoor sign cost $4k, and SBA loan principal payments cost $17k, and, in Charlie’s words, “Just like that our (barely) profitable restaurant ended the year with $8,000 less in cash than we started with.” I put it all into a spreadsheet and included a running balance column for the same reason I included so much detail in the last few paragraphs: so you can feel the tiniest bit of the anxiety that a restaurant owner feels watching the cash whittle away. On the other side of the country, in Boston, Irene Li is the chef and owner of Mei Mei Dumplings. Mei is a serious chef: “In 2016, she was the recipient of an Eater Young Gun award; she’s been a Zagat 30 Under 30 winner, and a six-time James Beard Rising Star Chef semifinalist.” She shared her restaurant’s economics with Eater. I’ll spare you the gory details, but on $1,215,037 in income from the restaurant and catering business, Mei Mei ended 2019 with… That’s before, Li said, debt repayment and taxes. “It’s not nothing. It’s not great. But this is where we are.” Both of those examples are from 2019. Then COVID hit. Then food prices inflated. If anything, the situation has gotten worse. So what do you do? Do you skimp on food costs or labor? Do you move to a cheaper neighborhood? How in the world do you invest in training, when any minute an employee is being trained is a minute they’re being paid to not generate revenue? How do you invest in guest experience when you have no idea whether that guest will ever come back? One answer that the industry has come up with is consolidation. In Refactoring Restaurants, Byrne Hobart wrote that:

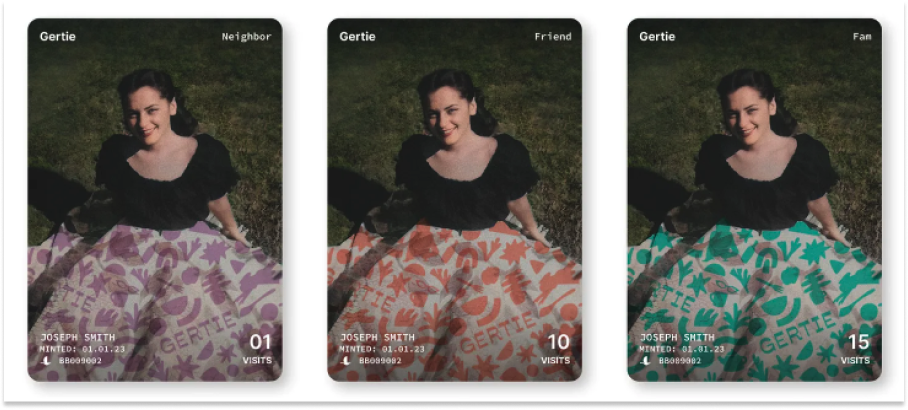

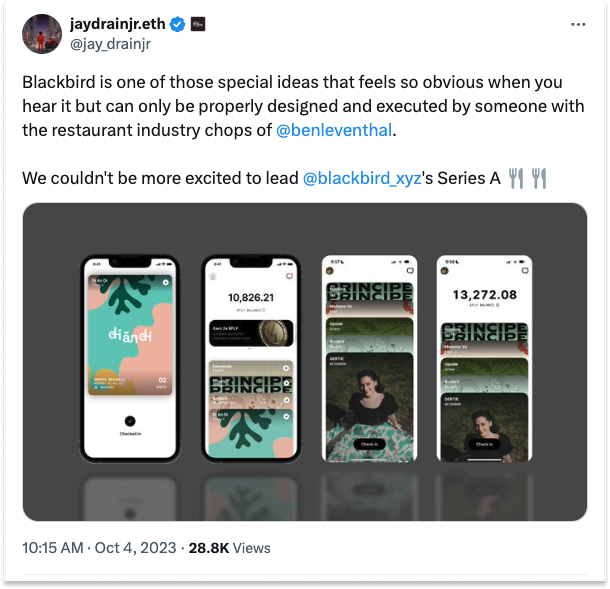

I don’t know, man. A world in which we have cheap energy, flying cars, miracle cures, and an increasingly homogenized set of dining options, prepared and served by robots, seems a bit dystopian. We want the opposite. Thousands of thriving independent restaurants, each offering something unique, each offering magical personalized experiences to guests. We want to become locals at the places we love and know that our favorite restaurants will stick around as long as we do. Blackbird wants to help make that happen, too. How Blackbird WorksBlackbird launched in April 2023 with one restaurant and a simple premise: well-designed loyalty programs could create direct connectivity between restaurants and their customers, “Where guests know that the more they show up, the better their experience is going to be.” Blackbird would partner with restaurants to set up bespoke loyalty programs, or memberships. Customers would sign up for a restaurant’s membership, receive a membership card in the form of an NFT in their Blackbird app, and use that to check-in by tapping Blackbird’s NFC chip whenever they went to the restaurant. Restaurants could reward customers for coming in a certain number of times with various perks. Gertie, the Williamsburg diner that was the first restaurant on the platform, decided to launch a Friends & Family program, which Ben described in a blog post.

One restaurant’s membership cards don’t need to be NFTs. They could simply exist in the app, as long as you trusted the app to continue operating, and Blackbird could simply share customer data with the restaurants in a database or spreadsheet in case it doesn’t. But from the beginning, the plan was bigger than one restaurant, or just memberships. Soon, Blackbird added more restaurants around New York City and new tools to connect them with, learn about, and incentivize customers. In May, it announced its native token, $FLY, via a whitepaper and blog post. While memberships were restaurant-specific, $FLY would be a “pan-industry loyalty currency.” Every time you check in at Gertie, for example, you might receive 1,000 $FLY or 5,000 $FLY. Restaurants might incentivize certain behaviors – checking in at times that are typically slow – with greater $FLY rewards. So each time you check in at a specific restaurant on the Blackbird network, that particular restaurant knows you’re becoming more regular, but the rest of the restaurants on the network learn that you’re a valuable customer, too. In the blog post announcing $FLY, Ben spoke with Blackbird Labs board member and Momofuku CEO Marguerite Mariscal, who described what she thought $FLY might unlock:

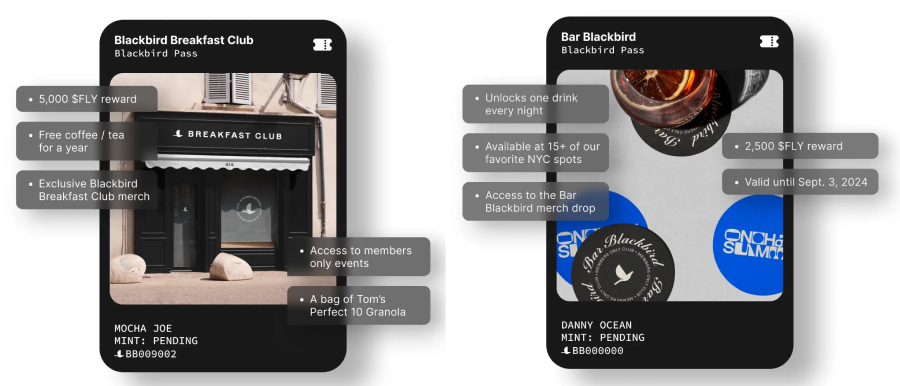

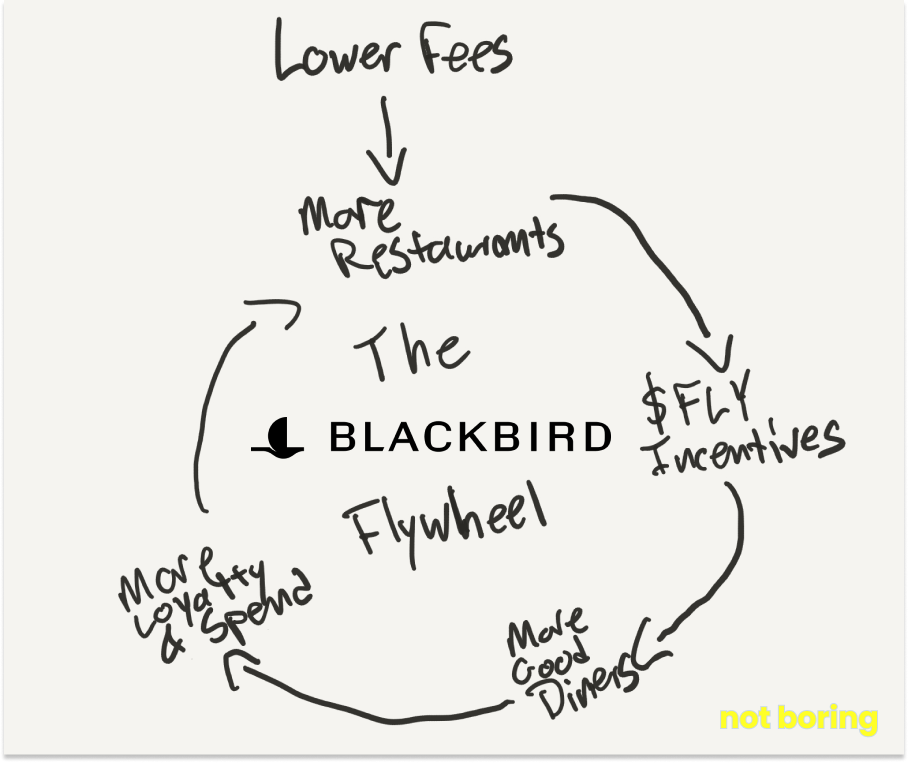

This is what I mean by “scaling the ‘regular’ experience,” from the customer perspective. Walk into any restaurant in the network, get treated like a regular. From the restaurant perspective, Mariscal noted that the flow of information about a customer – “Still or sparkling water? Left-handed? What's the last bottle of wine?” – is still a manual process, which means that it’s inherently hard to scale. In that same vein, a16z crypto’s Jay Drain told me that Blackbird would “eat all the things that when you go to Don Angie, the staff writes on a piece of paper or in a spreadsheet, the customer notes that front of house leave in Resy” when they have time. With better tools, Mariscal said, “We're increasing the number of regulars because of the level of service and attention.” The key insight here is that the "regular" experience is a form of capital – social capital, to be precise. It's valuable to both the restaurant (which benefits from repeat business and word-of-mouth marketing) and the customer (who enjoys better service and status). However, this capital has traditionally been illiquid and non-transferable. You can't sell your status as a regular at one restaurant to become a regular at another. With $FLY, you can. Beyond memberships and $FLY, Blackbird has continued to experiment with new ways to help restaurants acquire customers and scale the guest experience. “Blackbird is a young company,” Ben explained. “It’s in our nature to do lots of experimentation and iteration as a path to solutions. In February, for example, it launched Gjelina House Accounts. Gjelina Group, which operates popular LA spots Gjelina and Gjusta, opened its New York restaurant last year for 30 days before a fire shut it down. When Ben was having dinner with Gjelina Group CEO, Shelley Armistead, she mentioned that they were short the funds to reopen. Ben proposed they team up: Gjelina could sell House Accounts on Blackbird to raise the funds to reopen, and Gjelina would treat its backers like regulars with coveted House Accounts. I thought the idea was awesome, and participated on the first day. For $5,000 upfront, I’d get a $5,000 house account to spend at the restaurant once it opened, access to a reservation line to reserve hard-to-get tables, a gift (they sent a Gjelina hat and delicious granola), and 50,000 $FLY. It was a no-brainer: I’d have a spot where I could be a regular, and enough $FLY that other restaurants in the network might treat me like one. Win-win. In March, Blackbird launched Breakfast Club with a different, but equally compelling, proposition: pay $85 for a membership, get free coffee or tea at 14 coffee shops around the city for a year, plus merch, event access, and 5,000 $FLY. Plus, because you’re more likely to get your coffee from just one of those spots in your neighborhood, restaurants get repeat customers and you’ll run into the same people over and over, the kind of people who would join a Breakfast Club, like you. Win-win. Carra Wu, a partner at a16z crypto, tweeted that she made new friends at her local spot, Fairfax: In June, Blackbird launched its newest club: Bar Blackbird. Similar deal: $50, one free drink at each of 15+ NYC bars every night (with the purchase of a second drink), 2,500 $FLY. Members get free drinks and the experience of the “Buy Back” every time they walk into their favorite bar. Restaurants get new customers who turn into repeat customers. Win-win. There will be more win-win experiments. Earlier this month, Blackbird teamed up with Miami’s Cowy Burgers for a three-day pop-up at the Standard Biergarten, available only to Blackbird users who’d picked up the (free) Blackbird x Cowy Burger access pass. There may be a Burger Club in the offing 👀 But Blackbird’s biggest new launch is decidedly not an experiment. It’s core to their business, and to their mission to help restaurants get more profitable. Today, Blackbird is formally launching Blackbird Pay after rolling out features over the past couple of months. “Blackbird started with loyalty, which is a nice-to-have,” Fred explained when we spoke last week, “and when combined with payments, becomes a need-to-have" Here’s how it works. When you check-in at a Blackbird restaurant, it opens a tab. You can decide to split the bill with your friends, use a debit or credit card in the app to pay, or even pay with $FLY. From the diner’s perspective, it converts your social capital into actual capital that you can use to eat. One more thing… In some restaurants, you can simply tap in, order whatever you want, and walk out. The bill is paid automatically. I’ve had this experience exactly once in my life, five or six years ago, and it was so magical that I remember the details. It was a summer night in New York. Puja and I went out to dinner at Bar Primi on Bowery. We sat outside. Ordered pasta and drinks. Waited to pay the bill. The waiter came to our table with a receipt: the bill had been paid. We were free to go. Magic. I even remember which app I used to make the reservation: Resy. My credit card was on file, it just paid the bill. Magical experience for me, faster turnover for the restaurant. Win-win. I haven’t had that experience since. It seems like Resy didn’t pursue it once it got acquired by AmEx. But Ben is bringing it back with Blackbird and I can’t wait. One more quick aside on this. I also remember the first time I used Uber, back in like 2011. Friends and I were pregaming a concert at my apartment, and I tried calling us an SUV to go to the show. It just showed up, we all got in, and each of my friend’s downloaded Uber on the ride. I would bet that the no-check Blackbird Pay experience will have the same word-of-mouth effect. But getting Blackbird Pay rolled out requires restaurant adoption, training employees on new systems and new processes. What’s in it for them? Blackbird Pay offers restaurants a flat 2% fee on payments, versus an industry average of 3-4%. Payments is how Blackbird will make the majority of its revenue. Ben explained that, in the short-term, they’ll lose money on some transactions (when users choose to pay with credit card and Blackbird eats those fees), and make money on others (when they pay with $FLY and Blackbird pays basically zero fees), but that “On a blended basis, we love how it looks at 2%.” Win-win-win. You can start to see how it all fits together. Earn social capital, spend it as actual capital. Restaurants get data, good repeat customers, and lower fees. You get to be a regular anywhere. The hope is that these are the first steps towards making great, independent restaurants more profitable again. Helping Restaurants Get ProfitableThat brings us to the first of the four ways to think about Blackbird: as a tool to help restaurants get more profitable. Within the hospitality-volume paradox, there’s another key tension in the restaurant business: short-term versus long-term. Actions that might improve profitability in the short-term might damage it in the long-term. That tension is present in any business, of course, but it’s particularly acute in restaurants, and restaurants are especially poorly equipped to balance it. Take USHG’s focus on employee training. Other restaurants could train their employees more and better, which would lead to a better experience in the short-term, but as those employees leave, that decision might kill the restaurant’s already tenuous economics. Or take ingredient quality. Restaurants could choose to lower the quality of their ingredients to save on costs and become more profitable in the short-term, but diners would notice and choose to go elsewhere, dooming the restaurant over the long-term. Or take something like providing a consistently excellent experience to all customers. Restaurants could comp everyone a free drink, overhire staff to make sure that everyone is served timely, and learn about each customer’s wants and desires and strive to fulfill them. That might be a profitable decision in the long-term if the restaurant had unlimited funds, just like the strategy of doubling down on every black jack hand until you win your money back works if you have an infinitely deep bank account, but unfortunately, the restaurant would probably die long before learning whether the investment had a positive ROI, if it could even track ROI at all. That’s an extreme example, but it speaks to a point that Ben thinks is critical to understanding why restaurants are struggling: compared to the typical company we cover in Not Boring, independent restaurants have very little sophistication around things like acquisition, retention, and customer lifetime value. There are many things in restaurants that cost what they’re going to cost. Food and drinks cost what they’re going to cost, given a certain level of quality. Rent will cost what it’s going to cost, given a certain location you want to be in. Labor will cost what it’s going to cost, assuming a certain level of service you want to provide. But there are things that the restaurant can control, assuming it has the data and tools to do so. Those are the things that Blackbird wants to help with. Blackbird Pay is the Trojan Horse into those things. Blackbird Pay is a no-brainer. Lowering payment processing fees from 3-4% to 2% improves profitability in both the short-term and long-term. Faster turnover improves profitability in both the short-term and long-term. Restaurants will adopt Blackbird for Blackbird Pay, in order to get back 1-2% of margin, which in some cases, might mean doubling margin. Once Blackbird is in place, it can help restaurants get smarter about acquisition, retention, customer lifetime value, and marketing more generally. To start, restaurants can design their own membership programs and incentives. They might encourage people to come back five times by offering free drinks on the fifth check-in, offer bonus $FLY for grabbing lunch when dinner is typically more crowded, or give free merch to their most loyal customers. Because Blackbird customers check in each time, and because the check-in opens up the tab, restaurants can directly track how these actions tie to spend. Unlike a typical reservation system, which only tracks the person who made the reservation, Blackbird can collect data on each Blackbird customer at the table, because they will have also checked in in order to earn $FLY. As importantly, while guest data has traditionally been siloed by individual restaurants and third parties, Blackbird’s data is shared among all of the restaurants in the network, allowing them to build up a more complete profile of each guest. According to its updated Flypaper, Blackbird’s Guest Profile has four components:

At every check-in, Blackbird shares a Guest Profile with the restaurant so they have a more complete picture of who they’re serving. And each restaurant can cater the experience they provide to the individual guest they’re serving. Restaurants can even use this information to decide who they prioritize giving reservations to. Already, Blackbird members can DM restaurants to request tables or make other special requests (all of which go into your Guest Profile). Once there’s enough liquidity in the system, it wouldn’t be surprising to see restaurants hold back tables for high-value Blackbird members – ones who are known to spend more, or tip more, or eat quickly, or come back more often, or invite people who then become regulars themselves – in order to generate more value from each table, and ultimately, become more profitable. There’s a lot of work to be done between there and where things stand today. One of the biggest risks that Jay described to me is that, “Blackbird can provide restaurants a powerful platform and guidance on how to use it, but it’s incumbent on the restaurants themselves to take all of the value Blackbird provides and leverage it to design effective, unique loyalty programs.” Ben made a similar point, saying that tooling around acquisition and retention is “the thing restaurants do that they understand least.” But, he said, Blackbird’s job is to help them build that muscle. “We intend to develop this skill with them over time, working with restaurants from a rollout, adoption, and product design perspective.” It’s on Blackbird, he said, to develop an interface that makes it as easy as possible for restaurants to “use $FLY, rewards, and information to get customers coming through the door and keep them coming back profitably.” To start, they’ll get 1-2% back in breathing room from Blackbird Pay. Over time, the plan is to resolve the short-term / long-term tension by helping restaurants measure which decisions they can make today that will make them more profitable now and in the future. The big lesson from USHG is that business model and guest experience are intricately linked, and Blackbird hopes to make it easier for each restaurant to understand and act on that relationship. Magical Regular ExperiencesThe great news for customers is that Blackbird gives restaurants the tools and incentives to make all of our experiences better (unless you’re an asshole to servers or just there for the pics, in which case, you’re in trouble). If you’re in New York, you really should just try it out. The Blackbird team has generously offered 500 bonus $FLY for any Not Boring reader on your next check-in, just sign up for Blackbird and add your name, email, and number here. I covered a lot of the benefits of Blackbird from the customer perspective today in How Blackbird Works, so I won’t belabor the point here, but I did ask Ben what he thinks the experience will be like in a couple years as the network scales. Here’s what he described: You open the Blackbird app. Based on what it knows about you, where you are, and any specific queries you make, it will suggest two or three places nearby. That will be the last experience you have with the tech. You’ll just walk in, the restaurant will know who you are and what you prefer. Everyone knows your name. They might give you a free round of drinks, cook your steak just the way you like, or bring out a special dessert for your birthday. Then you simply get up and walk out. The check is paid from your $FLY balance, and you earn a little extra $FLY for coming in. The idea is to use tech to get you out of the tech and into a magical in-person experience, one that makes you feel like a regular wherever you go. Blackbird as Onchain AmExMore profitable independent restaurants, more magical dining experiences. Sounds pretty great. For this to be how the future of restaurants plays out, though, Blackbird will need to be a successful business itself. It will need to grow while maintaining the magic of the small, early thing. Just like restaurants themselves, the better a business Blackbird builds, the better it can serve its customers. From that perspective, the best way to think about Blackbird is as onchain AmEx. It monetizes through payments, and increases payments volume by creating loyalty. It’s not a coincidence that Blackbird looks like AmEx – both are payments and loyalty businesses. Fred Wilson said that Ben’s experience at AmEx after the Resy acquisition directly influenced the ideas that would become Blackbird.

There are similarities between the two businesses, and important differences. AmEx has built a $170 billion juggernaut on the back of a closed loop loyalty and payments system, in which it is both the issuer and merchant acquirer. Its flywheel looks something like this:

Blackbird, if it succeeds, will look like AmEx in a funhouse mirror:

There’s another wrinkle, which I haven’t mentioned. While $FLY is meant to maintain a stable value or a set exchange rate, usage of $FLY earns both diners and restaurants ownership in the network, via Blackbird’s second token: $F2. The more $FLY you hold and spend (as a diner) or hold and receive (as a restaurant), the more ownership you earn. What I like about Blackbird’s approach is that ownership is secondary to experience. It doesn’t kick off the flywheel, it should just make the one it has going spin faster by providing an additional incentive to both diners and restaurants. That Blackbird is giving control to restaurants and their customers speaks to a key contrast in approach between AmEx and Blackbird: AmEx’s value is derived from its closed loop payments system at all merchants; Blackbird’s is derived from its open system focused on a specific type of merchant. Over time, other industries might build vertical-specific products that tap into $FLY and $F2, expanding the usefulness of the rewards and the size of the ecosystem. But Blackbird Labs itself is specifically focused on restaurants, and given its business model, the alignment is clear. Blackbird needs to make it as easy as possible for restaurants to provide great experiences using Blackbird’s tools. Those great experiences drive more volume to restaurants, which increasingly gets transacted on Blackbird Pay. Blackbird takes 2% of all of that volume, and is able to capture more as net revenue the more widely $FLY is used. Great experience → more volume → more profit. True for restaurants, true for Blackbird, and possible, in part, because of crypto. Crypto Fixes ThisWe’ve talked about crypto very little thus far. Blackbird’s membership cards are NFTs, its loyalty token is $FLY, and network participants can earn ownership in the network with $F2, but we’ve focused on what those different products do for restaurants and their customers, not on the nitty gritty of the tokens themselves. That is a great thing. Blackbird is one of the first “crypto” apps that’s gotten adoption from mainstream users and businesses who might not have any idea that they’re using a “crypto” app. When I asked Ben why he thinks that is, he pointed to two reasons:

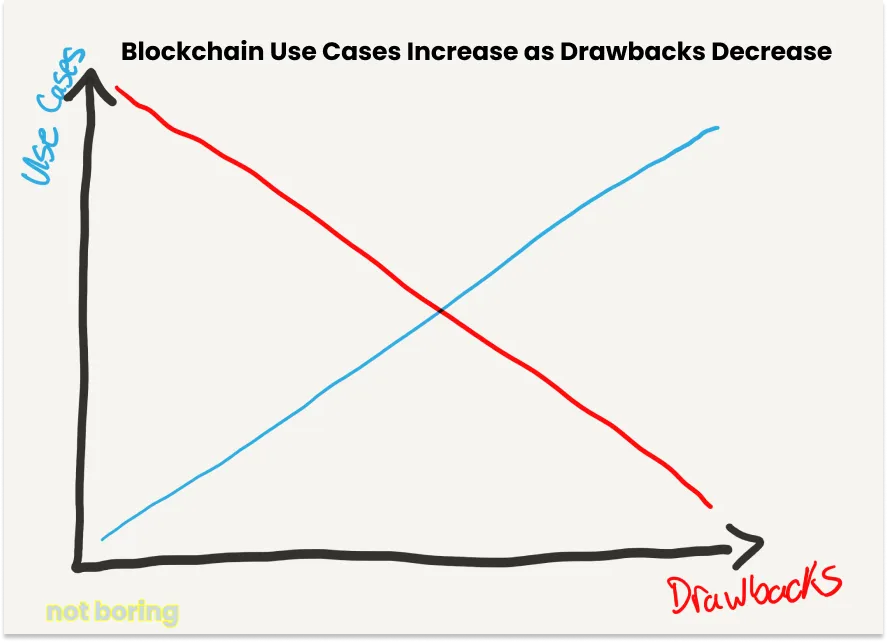

But, having built traditional software products, Ben chose to bring crypto into the mix at Blackbird, despite the regulatory complexity and technical challenges. This is someone who doesn’t need to work after selling two companies, who is dedicated to helping the restaurant industry, and who wouldn’t have built on blockchain rails if it didn’t serve that goal. So why bring crypto into it? Last November, in Blockchains as Platforms, I argued that blockchains are just platforms that offer some unique benefits and come with certain drawbacks, and that as the infrastructure improved and those drawbacks were eliminated, more developers would build onchain. When transactions cost $50 each and take minutes to settle, or customers have to deal with the complexity of setting up a wallet and signing a transaction to use a product, a lot of consumer developers would decide that the trade-off wasn’t worth it. “But,” I wrote, “With cheaper, faster transactions and UX improvements, those products start to make sense.” Blackbird was actually the example I used in that piece. You couldn’t have built Blackbird onchain even five years ago. That’s obvious. Which means that you couldn’t have built a product like Blackbird even five years ago. That’s less obvious, but more important. Blackbird works because it’s able to perform like a normal consumer app while doing things that a normal consumer app can’t. Let’s dive into a little bit about how Blackbird is structured under the hood, courtesy of the new Flypaper, to understand why and how. Earlier, I mentioned that Blackbird’s restaurant membership cards are NFTs. They’re currently the only part of the app that’s onchain, and it’s not very important that they’re onchain. For now, they’re non-transferrable (“we don’t think your identity is transferable”) and can only be used within the Blackbird app. They could just as well be an entry in Blackbird’s database, for now, aside from the fact that if Blackbird disappeared tomorrow, I could walk into Gjelina and show them that I do own my House Account NFT. $FLY tokens do exist as entries in Blackbird’s database, for now. When you check-in to a restaurant that offers $FLY for check-ins, Blackbird simply moves $FLY from the restaurant’s allocation to your account in its database. When you use $FLY to settle your tab with Blackbird Pay, it simply moves it from your account’s to the restaurant’s in its database. Going forward, $FLY will be used as an on-platform rewards and payments token, and restaurants will be able to exchange $FLY with Blackbird at a pretty steady exchange rate. It won’t be tradeable, transferable, or redeemable for cash outside of the app. You won’t be able to get rich speculating on $FLY. Blackbird users have speculated that, in addition to serving as a reward and payments token, $FLY would also serve as the gas token and representation of ownership in the network once it moved onchain. That is not the case. Instead, the Flypaper introduces a new token, $F2, which will serve as the gas and governance token for the network. The network itself will be a Layer 3, Flynet, built on top of Coinbase’s Base L2 (which itself is built on top of Ethereum). You don’t need to understand all of that, just that it means a couple of things:

There will be a relationship between $FLY and $F2. When the chain launches, all $FLY balances that exist in Blackbird’s database will be moved onchain into users’ Blackbird spending wallets on a 1:1 basis. $F2 will be allocated to both diners and restaurants based on their $FLY throughput – the amount of $FLY they hold plus the amount of $FLY they’ve burned by spending or redeeming rewards – divided by the total $FLY throughput on the network. If you somehow hold or have used 10% of the $FLY on the network in a given period, you get 10% of that period’s $F2 allocation. This is a simple and beautiful mechanism for distributing ownership in the network, and one of the reasons that Blackbird couldn’t have been built offchain. First, network participants (mainly diners and restaurants) will receive 251 million of the 500 million total $F2 tokens, which means they’ll own and control a little over half the network. Second, because $F2 allocation within that 251 million tokens is measured by $FLY throughput, the restaurants and diners that are most active in the network will get more ownership of the network. Third, restaurants should naturally earn more than diners given that most people can only eat at one restaurant per night, and most restaurants can serve hundreds of people per night. Fourth, it incentivizes diners and restaurants to join the network and be active early. Since allocations are based on individual throughput over total network throughput, it will be easier to earn more $F2 early. It’s an elegant way to get over the marketplace cold start problem. And finally, because restaurants can reward diners with the $FLY it receives from Blackbird Labs in ways they believe will help the restaurant, and because restaurants are physical, it will be impossible for bots to come in and sybil attack the network to steal all of the tokens. Any bot that wants to make an off-peak reservation at Principe, physically check-in, spend $500 with friends, and settle the tab in $FLY to maximize their $FLY rewards is welcome to try. (Side note: I’d love to see the option to book hard-to-get reservations with $FLY.) Crypto makes diner and restaurant ownership of the network possible. It also makes instant, practically-zero-fee payments via $FLY on Flynet possible. Those are core components of what makes Blackbird special. Restaurants and diners don’t need to spend one second thinking about crypto or how any of it works behind the scenes. As a restaurant, it’s worth thinking hard about how to design a loyalty program that maximizes profitability, encourages the use of Blackbird Pay, and increases throughput. They might need to learn a little bit about digital acquisition and retention tactics, but they don’t need to know anything about L2s or L3s. As a diner, you just need to show up, check-in, enjoy, and leave. The same way some people work hard to maximize their credit card points or airline miles, or set up bots to snipe restaurant reservations, some people will scheme to maximize their $FLY. Great. As long as the restaurants develop programs that are good for the restaurant and the network, it’s a win-win. But diners won’t need to know a thing about crypto to get the “regular” experience at a growing number of restaurants. Crypto’s infrastructure is finally good enough that all of that can happen quietly and unnoticeably in the background. Jay pointed to two things in particular that help power Blackbird’s surprisingly intuitive UX:

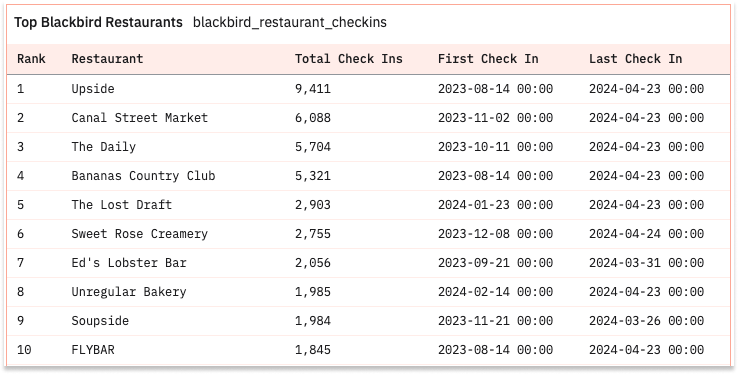

The result is that Blackbird can build a best-in-class consumer app with superpowers. Programmable incentives. Faster, cheaper payments. Restaurant ownership and control. And it means that others besides Blackbird will be able to build similar products to fix their industries. Fred Wilson pointed out that being onchain opens up the opportunity to build an AmEx-like loyalty program where all the loyalty points are onchain. “$FLY is like a stablecoin. It’s not something like Bitcoin where you buy it and hope it goes to $100k,” he said. “But the idea of taking loyalty points onchain is a big deal.” Specifically, it will allow any application to embrace $FLY. “Right now,” said Fred, “AmEx and their partners are the only ones who can participate in AmEx points. But $FLY is like USDC: hopefully, in time, any developer will be able to launch something that supports $FLY.” $FLY may become a rewards and payments token for all sorts of merchants beyond restaurants. If an airline wanted to treat $FLY the same way they treat credit card points, for example, they might be able to do that. If a luxury brand wanted to gate its new drop to only people who hold or have spent a certain amount of $FLY, they might be able to do that, too. The fun part, as always, is that developers and entrepreneurs will come up with much better ideas for how to use $FLY based on their own knowledge of what needs fixing, like Ben has for restaurants. To that end, Jay made a really interesting point about why the a16z team got so excited about Blackbird, aside from Ben himself. “Whenever there’s a huge market with a broken business model, it’s a ripe opportunity for someone to try to fix it with crypto.” Maybe, in Blackbird’s case, crypto really does fixes this, even if it does so behind the scenes. The Way We Eat NowThe future in which Blackbird succeeds just sounds more fun. It’s the world we want to live in, one in which technology is used to create better in-person human experiences instead of replacing them altogether. Getting to that future will take a lot of work. As it stands, according to @jhackworth’s Dune dashboard, 38,811 wallets hold Blackbird NFTs and diners have checked into 142 restaurants, all in NYC. Upside Pizza is the most popular by a wide margin.

Getting more restaurants onboard will take time. Restaurants are notoriously slow to adopt new technologies, and even when the restaurant owner gives the green-light, getting restaurant employees to buy-in requires another level of work. Blackbird is hard to pull off no matter who you are, but it’s especially hard if you aren’t Ben Leventhal. When I asked Ben if he and the team needed to have done Eater and Resy to do Blackbird, he replied, “Knowing restaurants and understanding how they function, speaking their language, is a humongous advantage that we have.”

If Blackbird succeeds, it will succeed because it builds a product that helps restaurants in the ways that they care about. The technology under the hood is a means, not an end. Each restaurant is, of course, like all people and all businesses, different. Some will be excited to try the new thing immediately. Some will take some convincing. But most want to provide their guests with a great experience that keeps them coming back, and all want more margin. If Blackbird can deliver on resolving that paradox for its early partners, more restaurants will come. What they do with that margin, just like the loyalty programs they design, will be up to the restaurants. “Today, for restaurants, it’s existentially unclear what the future holds,” Ben told me. “We want to give them more control of their own destiny.” Blackbird wants to give restaurants a more sophisticated understanding of their future based on the actions they take today, and additional margin that they can spend to act on that understanding in whichever way they think best. Some will give it back to consumers in the form of prices and perks. Some will give it to their employees in better benefits, wages, and training. Some will use it to experiment with new things: menu R&D, concept development, CapEx for new locations. The challenge and the opportunity is that restaurants are beautifully fragmented. That makes it harder to acquire customers and build products that serve their unique needs, but if you can pull that off, if you can give restaurants the tools and margin to thrive, it means richer, more fun, more unique experiences for everyone to enjoy. It means more opportunities to feel like a regular in the restaurant that’s just right for you. And it means local businesses that can thrive without consolidating or homogenizing, that can thrive because they’re not consolidated or homogenized. One of my favorite essays of all time is The Way We Live Now, which Colson Whitehead wrote in The New York Times two months after September 11th. Whitehead writes about New York City as a living, breathing, constantly evolving thing defined by the closing of old spots and the opening of new ones in their place, but always fixed in time and place by what was there when we first laid eyes on it.

It’s a defining characteristic of the city, of any city, that our local spots, the ones where everybody knows your name, get swallowed up by the struggle and churn. That death and rebirth is what makes a city vibrant. But it would be cool if those spots could ride the wave and evolve with the city and the people who live there. I hope Blackbird helps make that happen. As for you? Do your part. Go out and eat. Be a regular. Thanks to Ben, Vanessa, Rachel, Jay, and Fred for telling me the Blackbird story! That’s all for today. If you’ve had enough reading and want to start writing, check out Write of Passage. And try to get out and eat local this week. We’ll be back in your inbox on Friday with a Weekly Dose. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #104

Friday, July 26, 2024

HIV Prevention, AI Tsunami, Statecraft, GLP-1 Again, Olympic Exoskeleton ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Why the Democrats Lost Tech

Tuesday, July 23, 2024

And How to Win it Back ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #103

Friday, July 19, 2024

Genetic Roadmap, International Entrepreneurship Rule, Eureka, Bloody Build!, The Nuclear Company ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Make the Internet Fun Again

Tuesday, July 16, 2024

Slop, Creative Destruction, and What's Next for the Internet ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #102

Friday, July 12, 2024

Busy Beavers, Quantum Lasers, Edited Guts, Super Earths, Neuralink Update, KoBold ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month