Analysis: Insights from Hong Kong and European Stablecoin Legislation

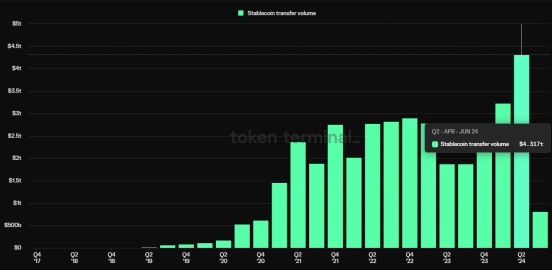

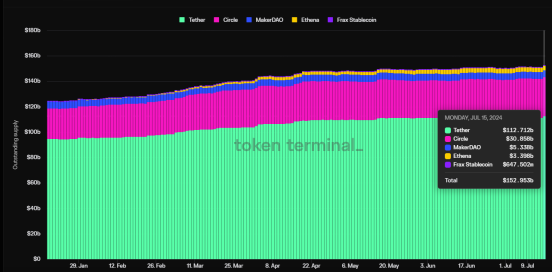

By Jeffery, HashKey Group Chief Analyst Stablecoins have always been an indispensable part of the cryptocurrency ecosystem. Data shows that over the past four years, quarterly stablecoin transaction volume has increased seventeenfold, rising from $17.4 billion in the second quarter to $4 trillion. As of July 17, 2024, the total transaction volume of the entire inter-currency market was $94.8 billion, with stablecoins accounting for 91.7% of the total cryptocurrency market volume, reaching $87 billion, with USDT being the largest at 83.3%. However, due to the lack of endorsement from major financial institutions, stablecoins have struggled to be truly “stable” for users. With the era of compliance upon us, governments in Hong Kong, Europe, Singapore, the United States, and other regions are beginning to issue local stablecoins, which could reshape the stablecoin market landscape. This article will discuss how the stablecoin market landscape in Hong Kong will be reshaped in the era of compliance and the potential future developments. token terminal_ : Stablecoin transfer volume token terminal_ : Stablecoin outstanding supply Hong Kong to Become the First Region in the World to Allow Banks to Issue Stablecoins The Hong Kong government has recently been actively promoting the establishment of a stablecoin regulatory regime to maintain financial stability and protect consumer rights. Following the licensing regime for virtual asset service providers, which came into effect last June, the Treasury Bureau and the Hong Kong Monetary Authority (HKMA) consulted the public on the proposed regulatory regime for stablecoin issuers at the end of last year and will soon publish a consultation summary. We can broadly understand the direction of Hong Kong’s stablecoin regulatory policy. Currently, Hong Kong has a strict regulatory regime for fiat-backed stablecoin issuers, mainly including reserve management and stabilization mechanisms, requiring issuers to ensure that fiat-backed stablecoins are fully backed by high-quality and highly liquid reserve assets; redemption requirements; and regulatory requirements. As for stablecoin suppliers, only licensed fiat-backed stablecoin issuers, recognized institutions, licensed corporations, and licensed virtual asset trading platforms can offer stablecoins. Issuers may include exchanges, banks, and licensed investment parties such as USDT, USDC, etc. According to the list of sandbox participants released today by the HKMA, the institutions participating in the sandbox include RD InnoTech Limited,JINGDONG Coinlink Technology Hong Kong Limited, and Standard Chartered Bank (Hong Kong) Limited, Animoca Brands Limited, and Hong Kong Telecommunications (HKT) Limited. These institutions are able to demonstrate their genuine intentions and reasonable plans to develop stablecoin issuance business in Hong Kong during the evaluation process, and their proposed operations within the sandbox will be conducted within controlled risks and constraints. In February this year, Hong Kong’s largest licensed exchange Hashkey Exchange, RD InnoTech Limited, and Allinpay International announced a cooperation agreement, relying on their respective business and product advantages to cooperate, including compliant and secure digital currency trading services, extensive and diverse offline merchant acceptance networks, and advanced stablecoin development technology. However, as for the currently most widely adopted USDT and USDC, whether they can trade in Hong Kong in the future depends on their ability to transition successfully. The first issue is that only issuers with a physical presence in Hong Kong can apply. The second issue, from the perspective of Europe’s MiCA stablecoin regulatory policy, is that only issuers who support placing reserves in banks may be recognized under the changing regulations. This part will be discussed in detail later. On the other hand, Hong Kong might witness a scenario where stablecoins “blossom in many forms.” For instance, banks may have their own stablecoins, and exchanges may have their own stablecoins. If banks successfully launch their stablecoins, Hong Kong will be the first place for banks to launch stablecoins, setting an example for other regions. According to media reports, State Street Global, the world’s largest ETF SPY issuer, is currently showing interest in stablecoins and tokenized deposits. Although Hong Kong’s cryptocurrency ecosystem is still developing, such as the general public not being able to directly use bank money to purchase stablecoins, and the lack of sufficient payment systems and stored value methods to cover stablecoins. Additionally, in terms of accounting, there are no comprehensive regulations to determine whether crypto assets can be part of a company’s assets. Regarding licenses, an entity must have a physical presence in Hong Kong to apply, so USDT and USDC need to consider more since they have to establish a company in Hong Kong to issue, which may deter them. Moreover, there has been no cooperation with other jurisdictions so far, so these issues are worth considering in the future. Insights from Hong Kong’s Stablecoin Regulatory Policy and Europe’s MiCA Regulations How Hong Kong’s stablecoin policy will develop might gain some insight from the regulatory policies of European stablecoins. Currently, Europe’s MiCA is very similar to Hong Kong’s stablecoin regulations, and even more comprehensive, making it the most comprehensive cryptocurrency regulatory act in Europe. On April 20, the European Parliament passed MiCA, which is expected to be fully implemented by early 2025. From July 2024, the most important regulations have already begun to be implemented, including that stablecoin issuers will need to maintain adequate reserves, such as keeping at least one-third of all funds in banks to meet large withdrawal requests. In addition, they will need to set transaction limit restrictions. This is a significant challenge for stablecoin issuers. Tether, the largest stablecoin supplier, has no plans to accept MiCA regulations in the near term, as its CEO Paolo Ardoino has expressed concerns about MiCA’s requirements. He believes that stablecoins should be able to keep 100% of their reserves in treasury bills, rather than placing large reserves in uninsured cash deposits, which exposes them to the risk of bank failures and harms their interests. However, Tether stated that it will continue to communicate with relevant agencies to reach a consensus. Many exchanges are delisting unlicensed stablecoins in Europe, with several cryptocurrency exchanges taking measures. For example, OKX delisted Tether’s USDT for EU users in March but continues to support Circle’s USDC, which values regulation. Some companies, such as Kraken, continue to list USDT in Europe, understanding the importance of USDT to European customers, so they have no plans to delist it for now. Circle’s USDC might become the biggest beneficiary under the new European digital asset management regulations effective from July. As the first stablecoin under the MiCA regulations, its market share in Europe could soon surpass USDT, becoming the largest stablecoin supplier in Europe. MiCA regulations may impact European users’ transactions in the short term, but in the long run, successful implementation of MiCA could encourage other jurisdictions to adopt similar regulatory measures, such as Hong Kong, promoting higher standards of market integrity and consumer safety globally. This coordination reduces regulatory arbitrage, helps form a more consistent and stable global cryptocurrency market, and promotes cross-border transactions and investments. MiCA may enhance international cooperation and standardization of digital asset regulation. Observing the benefits of a well-regulated stablecoin market in the EU, other countries may implement similar frameworks, enhancing the resilience and transparency of the global financial system. This shift towards unified regulatory standards attracts institutional investors seeking clarity and stability, further legitimizing the crypto industry and fostering global growth. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

EP-28 Conversation with NAVI: Building a DeFi Project in the Sui Ecosystem

Tuesday, August 20, 2024

In this podcast episode, Elliscope, a core contributor to the NAVI Protocol project, provides a detailed overview of NAVI Protocol's development journey, core business, and future plans. ͏ ͏ ͏ ͏ ͏

Unveiling HSK Token: HashKey's Ecosystem Strategy

Tuesday, August 20, 2024

We speak with Kay, CEO of HSK Eco Labs. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Access Protocol: Everything About Solana Blinks

Tuesday, August 20, 2024

In this episode, Andreas, the founder and CEO of Access Protocol, shares the background, technical details, and future plans of the project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: Vitalik Donates All Animal Coins, Ethereum Gas Fees Hit Five-Year Low, Goldman Sachs and Morg…

Tuesday, August 20, 2024

1. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: WBTC Faces Trust Crisis, Arbitrum to Introduce ARB Staking, Grayscale Launches MKR Trust, …

Tuesday, August 20, 2024

BA Labs published a paper on MakerDAO's forum, highlighting that BitGo has announced plans to transfer control of the WBTC product to a joint venture with BiT Global. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏