Not Boring by Packy McCormick - Vertical Integrators

Welcome to the 669 newly Not Boring people who have joined us since our last essay! If you haven’t subscribed, join 231,376 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… Eight Sleep Eight Sleep helps you sleep better, and better sleep helps you do everything else better. I’m serious. The kids are at their grandparents’ and I had to wake up at an ungodly hour to finish today’s essay, so I slept in Dev’s bed last night. Dev does not have an Eight Sleep Cover. I slept TERRIBLY! I woke up three times, including at 4:59am, sweating, even though I had the thermostat set at 65. You should see me now, I don’t look good. It’s going to be a long day. I’ve been telling you about Eight Sleep for months. It cools, it heats, it elevates. I love it. I appreciate it even more this morning. Their Pod 4 Ultra is also clinically proven to give you up to one hour more of quality sleep every night, and I now have the anecdata to back it up. There’s no more impactful investment you can make than better sleep. Trust me. Just do it. Head to eightsleep.com/notboring and use code NOTBORING to get $350 off Pod 4 Ultra. Hi friends 👋, Happy Tuesday! Several articles on Not Boring this year have formed a semi-intentional series. In retrospect, there is a clear thread. Many of the companies I’m most excited about are doing the opposite of what tech companies have been taught to do. They’re vertically integrating. I’m splitting this essay into two parts. Part I today will set the foundation. It’s a rare Not Boring essay that fits within the email length limit. Part II next week will dive into specific case studies of Vertical Integrators, the advantages they have, the challenges they face, and some observations and predictions. Let’s get to it. Vertical Integrators: Part IOut of all of the Deep Dives I’ve written on Techno-Industrials over the past year, the one section that stands out most clearly in my mind comes from the piece on Base Power Company. “Base assembles and will soon manufacture battery packs itself, but it doesn’t make battery cells… Base believes that cells will be commoditized, and that pack assembly allows it to benefit from that commoditization and potentially integrate new cell types as better chemistries emerge.” It’s a concrete example of a trend I’ve noticed towards vertical integration among companies building physical products. Just as Aggregators built some of the biggest companies in the Internet era, Vertical Integrators will be the biggest winners of the Techno-Industrial Revolution. Vertical Integrators are companies that:

For Vertical Integrators, the integration is the innovation. Let’s go back to the Base example to unpack that. Battery pack assembly is one of the many activities the company does. As I wrote in the piece:

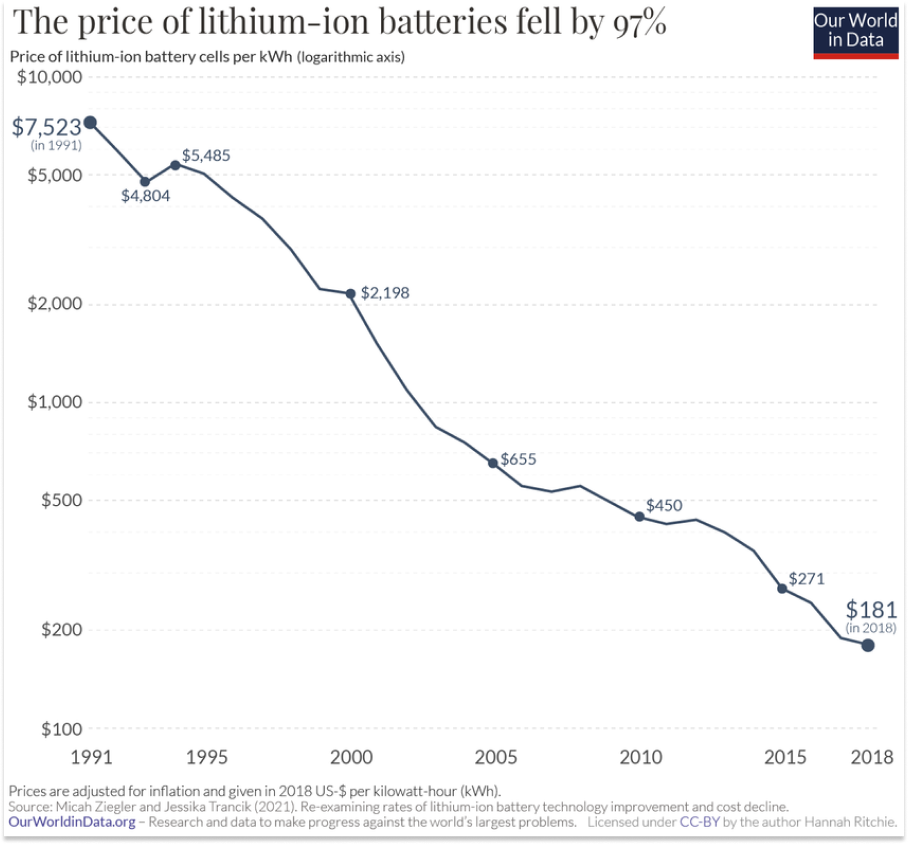

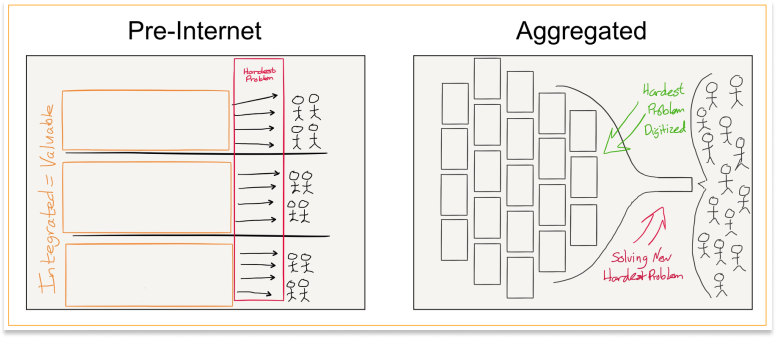

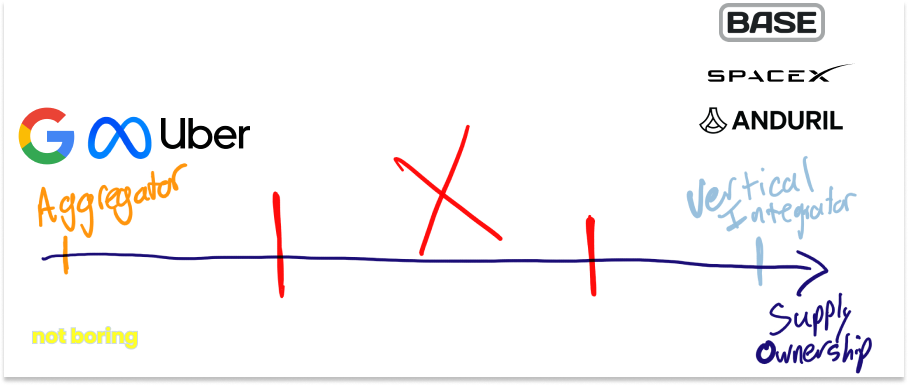

Each of those things is hard but achievable. What’s novel is their combination into one coherent product. I recommend reading the Deep Dive to understand how the company has thought about fitting them together. Each permutation comes with trade-offs: “Move one thing here, and something else changes there. Move that and something else shifts.” The decision to manufacture packs but not cells is one of many such decisions, and it highlights the difference between “deep tech” companies and Vertical Integrators. Let me explain. Battery cells are the basic unit of the battery, the place where the chemistry that stores and discharges electricity happens. There are a number of large companies, startups, and research labs working on improving the performance of the current most popular chemistry, lithium-ion, and on developing new chemistries altogether. As a result, the price of battery cells continues to drop. Today’s best battery cell technology may be surpassed by something better tomorrow. It’s a competitive, cutthroat market, one that China dominates. Battery cells are largely commoditized. You can buy cells, and essentially plug them into the battery pack. As cells get cheaper or more performant, or as new chemistries emerge, you can plug those new cells into new packs. The packs themselves consist of “multiple battery cells, the casing, the Battery Management System, cooling system, and connectors.” The design of the pack influences and is influenced by a number of other pieces in Base’s system. For example, the pack needs to be designed in such a way that it can be installed quickly and easily, since Base has identified installation as one of the key bottlenecks, so Base designs them with “connectors instead of wires that need to be cut and crimped.” “It’s not the way you’d design a specific battery for optimal performance,” the team told me, “but how you’d design the whole system for optimal performance.” That’s the difference to me between deep tech and Vertical Integrators. A deep tech company designs a product for optimal performance, taking on the risk of unproven science or technology to do so, while a Vertical Integrator designs a system for optimal performance, taking a risk on the combination of proven technologies. A deep tech company may work on a breakthrough cell chemistry; a Vertical Integrator may integrate that new battery cell once it’s proven. Graphically, I’d break it down like this: Legacy Industrials, or Incumbents, have vertically integrated supply chains designed around older technologies and processes. Deep Tech companies have unproven technologies that, if they work, could be a very powerful building block for many businesses. Vertical Integrators integrate a number of cutting-edge-but-proven technologies; what they need to prove is that they can integrate those technologies into a system that can compete with incumbents. This may seem like quibbling over semantics, but as more people build, invest in, and compete with startups building in the physical world, understanding the distinctions is important. They offer very different risk profiles and potential outcomes. Properly categorizing Vertical Integrators offers a sharper analytical framework for this era in tech, just as properly categorizing Aggregators did in the previous one. Aggregators and Vertical IntegratorsBen Thompson began his canonical Aggregation Theory post in 2015 with an observation, “The last several articles on Stratechery have formed an unintentional series.” The genius of Aggregation Theory was that it tied together seemingly disparate examples of the most promising tech companies of the era like Uber, Airbnb, Netflix, Google, and Facebook into one neat framework. Thompson realized that the companies he’d been writing about – while offering products ranging from connection with friends to movies to rides – were all representative of a new business model enabled by the Internet. Thanks to the internet, Thompson observed, Aggregators created value not by controlling scarce physical resources, but by aggregating user demand and attention, which then attracts suppliers to the platform. Aggregators, he later wrote, have three characteristics in common:

Those characteristics allowed them to steal value from the winners of the previous generation:

Incumbents owned supply, which made them valuable until owning supply became a liability. Aggregators won by owning demand, and using that demand to get supply to do what they wanted. Think: companies contorting their webpages to be SEO-optimized for Google. These were among the most successful of the internet businesses. Google and Facebook are worth a combined $3.4 trillion despite the fact that the global advertising market from with the companies pull most of their revenue was only worth $370 billion when Facebook was born in 2004. They, and the rest of the aggregators, left a trail of traditional businesses in their wake. At the end of the 2015 piece, Thompson predicted that Aggregators were coming for everything:

That didn’t end up happening. I tried to explain why I thought it wouldn’t back in 2019, before I wrote Not Boring, in Why There Won’t Be Any New Aggregators, and I think it holds up decently well. The short version is that Aggregators had already won the biggest categories that were susceptible to Aggregators, and that the remaining categories were too small to support the necessary model: spend a lot upfront, and make it back on small margin dollars over a huge amount of transactions. One addition to that hypothesis is that Aggregators worked for categories that were either digital – and therefore where marginal costs for new supply was practically zero – or where supply already existed, like cars or homes. Better allocating those existing resources was a coordination problem – an information problem – and therefore susceptible to Aggregators. Producing new physical things, however, is a physical problem, and it requires physical solutions. The companies that succeed in building physical solutions will do so in a way that’s opposite to Aggregators: by integrating supply. That is counterintuitive, that this generation of winners in tech will do so by throwing out the lessons of the last generation. But it also makes sense. Aggregators won the Internet by leaning as hard to one side of the business model spectrum as possible; Vertical Integrators will win the physical world by leaning as hard to the opposite side as they can. As with anything in the modern world, you don’t want to be stuck in the middle, attempting to solve physical problems with internet-inspired asset-light solutions. Or as Roald Dahl put it, via Matilda, “Never do anything by halves if you want to get away with it. Be outrageous. Go the whole hog. Make sure everything you do is so completely crazy it's unbelievable.” I’ll admit that Matilda is not an expert on the subject, but Peter Thiel is. And almost a decade ago, he made a similar observation: that the two ways to make money with new things are either software or “complex, vertically integrated monopolies.” Complex, Vertically Integrated MonopoliesOver the weekend, after I’d already started writing this essay, Elliot sent me his memo on our latest biotech investment. “A 23-page memo on [redacted] for your weekend enjoyment.” It hit my Slack as Puja and I were headed to Dan and Sienna’s engagement party (congrats lovebirds!), but as soon as we got home, Puja went to bed and I went to my office to read it. Elliot’s memo was an excellent analysis of a Vertical Integrator in biotech, and I can’t wait to tell you about it, but I bring it up here because on page 22, Elliot wrote, “[Redacted] and [Redacted] have a unique blend of experiences and talents that will enable them to execute on building a ‘complex, vertically integrated monopoly,’ as Peter Thiel would frame it.” I’d never heard Thiel talk about complex, vertically-integrated monopolies, and I was in the middle of writing this piece on complex, vertically-integrated companies, so I Googled it, and found an old talk that Thiel gave at Stanford:  “In my mind,” Thiel says to open the clip, “There probably are only two broad categories in the entire history of the last 250 years where people have actually come up with new things and made money doing so.” One is software. The other:

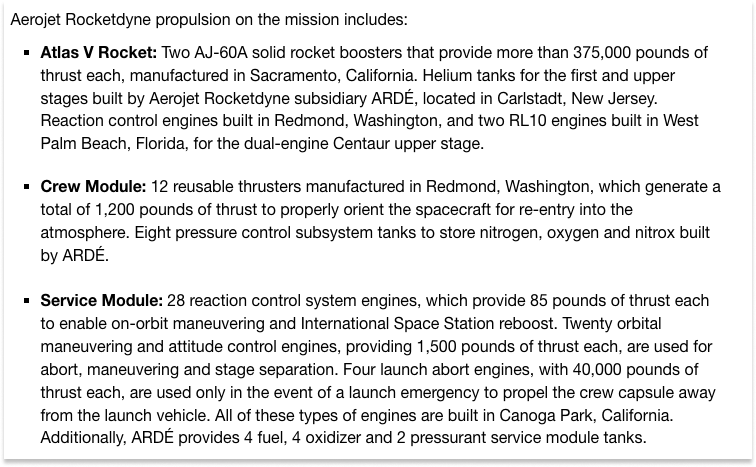

I’d had a couple of beers at Dan and Sienna’s party. This was me watching the clip: My whole thesis has been that we’re entering a period that will look more like the Second Industrial Revolution than the Internet Era. That the low-hanging software fruit has been picked, but there’s a lot of even juicier fruit in the higher branches if you’re willing to vertically integrate around both software and hardware to get up there. As Thiel explained, “If you look at Tesla or SpaceX, if you ask, you know, was there a single breakthrough? They certainly innovated on a lot of dimensions. I don't think there was a single 10x breakthrough in battery storage or maybe working on some things on rocketry but there was no sort of single massive breakthrough. But what was really impressive was integrating all these pieces together and doing it in a way that was more vertically integrated than most of their competitors.” It was exactly the distinction I’d made between Deep Tech and Vertical Integrators. The integration is the innovation. The clip was timely, first, because I was in the middle of writing this, and second, because on that very same morning, SpaceX gave us as clear a hand-off to the Techno-Industrial era as we’re going to get. When NASA determined that Boeing would be unable to retrieve the two US astronauts it left stranded on the International Space Station, it didn’t call in an Aggregator to bring them home. Nor did it call in a thruster startup to go up and replace Starliner’s faulty thrusters. It called in SpaceX, a Vertical Integrator, which can launch a full rocket with a Crew-9 Dragon capsule, dock to the ISS, and return them safely to earth. Boeing itself is a prime example of the fact that in physical industries, providing a thin coordination layer over others’ activities is a losing strategy. In the pursuit of an asset-light business model, the company outsourced so much of its supply chain that its planes’ doors routinely fly off and its rockets’ thrusters don’t thrust. Boeing’s faulty thrusters, for example, were made by Aerojet Rocketdyne, a division of L3Harris Technologies.

Elon is unique – he built both SpaceX and Tesla - and Boeing is on a particularly embarrassing run, but my suspicion is that there are a lot more Boeings out there. Boeing and its ilk will be replaced. Boeing is not the only one; it’s just the most visible. For every astronaut stranded in space, there’s a grid quietly struggling under its load. They are old companies with old systems designed around old technology. They can not be rebuilt piece-by-piece like the Ship of Theseus, the systems are too complex. “Move one thing here, and something else changes there. Move that and something else shifts.” They not be replaced by Aggregators. They will not be fixed with software. They will be replaced by Vertical Integrators that rebuild from the ground up. Vertical integration is an old business model whose time has come again, fueled by examples like SpaceX, a funding landscape featuring VCs with billions to deploy, new technologies with which to build, failed attempts to fix just part of the problem, and founders trained and willing to take on the full thing. Part III had planned to send a longer essay with a section on why software alone can’t fix physical problems, case studies on Vertical Integrators like Base Power Company, Hadrian, Earth AI, Radiant, and Fuse, the advantages and challenges of vertical integration, why Vertical Integrators are VC-backable, and even some spicy predictions. I’m not being lazy; those sections are mostly written. But I’m going to keep them safely tucked in another Google Doc for a Part II next week, because I want to make sure you leave with one takeaway: While Vertical Integrators are technology companies, their business models should be the opposite of the Aggregator model that won the Internet era. They should look like the business models that won the Second Industrial Revolution. Half-measures – attempts to retain the glory of software margins – are a road to nowhere. Building new physical things has, and will always have, marginal costs. Those who embrace that reality and vertically integrate will win. Next week, we’ll explore some of the companies that are doing it already. Thanks to Claude for editing! That’s all for today. We’ll be back in your inbox on Friday with a Weekly Dose. If you’re not sure what to do with the extra time I saved you by writing a shorter piece, consider buying an Eight Sleep Pod 4 Ultra. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #108

Friday, August 23, 2024

Sun Cable, AstroForge, aDBS, ElevenLabs Impact, Productivity Optimism ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #107

Tuesday, August 20, 2024

Solar Material, AI Scientist, Ozempic, Rent Control Afuera, Consciousness ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Eight Sleep

Tuesday, August 13, 2024

Waking Up in the Future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #106

Friday, August 9, 2024

Nudge, Alzheimer's Detection, Robotic Ping Pong, Samsung Batteries, Anduril Series F, Embrace Innovation ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #106

Friday, August 9, 2024

Nudge, Alzheimer's Detection, Robotic Ping Pong, Samsung Batteries, Anduril Series F, Embrace Innovation ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month