Chinese game developers are flocking to TON blockchain games

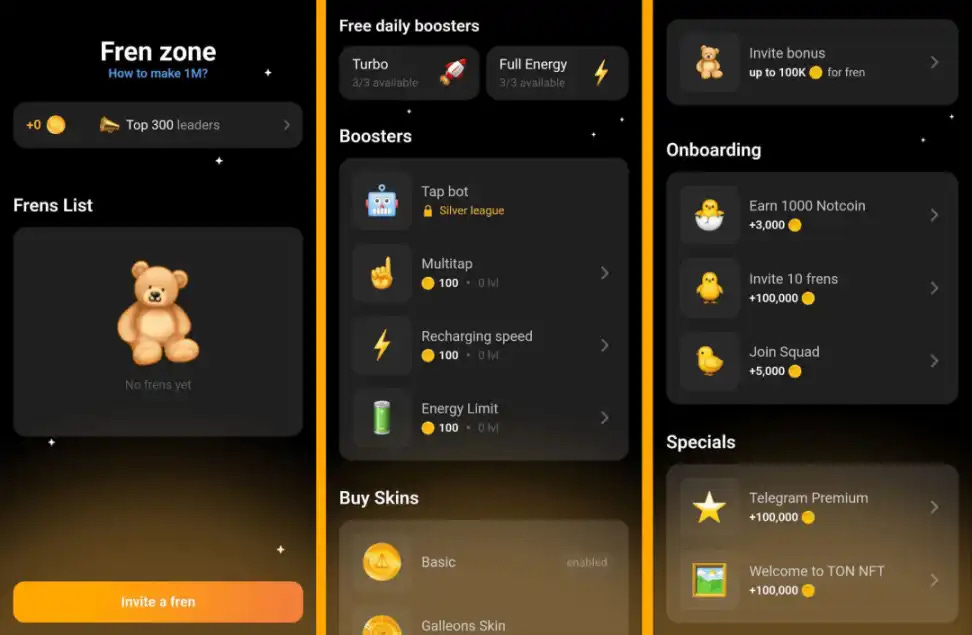

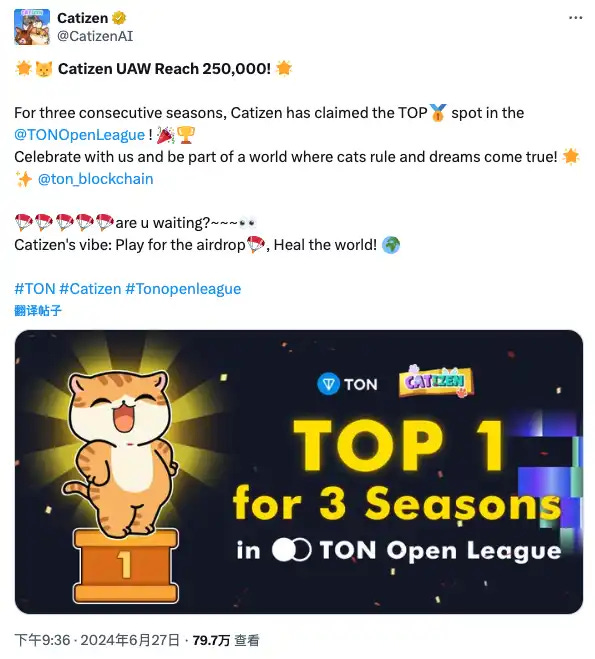

By Jaleel, BlockBeats Source: https://www.theblockbeats.info/news/54275 Before meeting me, xiaoze had just finished a meeting with a client, discussing the sale of the source code for a small game he developed. Compared to last year, xiaoze's demeanor was completely different this time—no longer dejected but instead ambitious, like a teenager reborn. Last year, he confided in me his confusion and helplessness while working on a large-scale blockchain game project. "I've been in the blockchain game industry for three years and haven't achieved anything. This is very different from my initial ideals when I entered the field. It might be a midlife crisis. I'm over thirty and haven't accomplished anything significant; it's quite a failure." More than half a year later, he finally regained his composure, smiling throughout our conversation. Recently, many game development platforms on the TON chain have contacted them, wanting to buy their small game's source code, with the highest offer being 100,000 USD. The TON chain is a blockchain project developed by Telegram. Although the Telegram team ceased development midway, the TON Foundation continued to develop it, leading to its prosperity since the launch of the trading BOT last year, providing more opportunities for small game BOTs today. xiaoze, who had faced two severe downturns in the traditional gaming industry and had fallen into the blockchain gaming pit, shared his insights: "Jaleel, you might not know, but the traditional gaming industry has been in decline since 2018, though people didn't realize it back then." xiaoze has been in game development for nearly ten years, initially working at a small to medium-sized traditional gaming company. Since the implementation of the game approval policy in 2018, the issuance of domestic game licenses has steadily decreased, with two significant pauses, leading to two severe downturns for game developers. "At that time, people also said, 'The higher you stand, the harder you fall.' At the end of 2018, Tencent's stock price plummeted, losing over 80 billion USD in market value." A former Tencent employee, Lao Si, vividly recalls that period. "From the third month after the suspension began, people became increasingly pessimistic and despondent. The scary part was that no one knew how long it would last," xiaoze recalled, showing me his gloomy social media posts from that time. When the suspension started, no one expected it to last eight months, nor did anyone realize the massive impact it would have. But the dominoes had already started to fall silently. The 2018 suspension directly or indirectly led to the loss of at least 1,000 new games in the industry, with over 600 game companies shutting down within the year. According to data from Qichacha, by the second half of 2021, 14,000 domestic game-related companies had deregistered. "This impact lasted for many years. My game company kept downsizing until it couldn't hold on any longer, which led to my first unemployment in 2021." xiaoze became one of the thousands of laid-off game developers. "That was five or six years ago, but I remember it clearly. It was a low point in my life. I thought I might never make games again. I cried a lot," he said, adding that he cried for two whole weeks, "I cried every day during those two weeks. I did nothing and was very anxious, not knowing what to do." Blockchain games: a "shelter" for "game refugees" During the policy-induced winter, game companies began exploring new paths. At that time, all game companies faced two options: creating premium games or going overseas. Facing license restrictions and increasing market competition, game companies realized that only by improving product quality and creating premium games could they survive in the market. Creating premium games meant not only improving graphics and gameplay but also excelling in game design, user experience, and creative content to meet players' high expectations. However, for most small to medium-sized companies, creating premium games was not an easy path. It required more and better resources concentrated on a few games, leading to more intense competition in the domestic market. Therefore, going overseas was the only remaining solution and the choice for many companies. "Maybe it was another chance from heaven. After being laid off, because I was good at English, my former boss took me to a game company with resources to explore overseas markets." xiaoze could continue making games again. "Tencent also did a lot of overseas business, focusing significant resources on creating overseas versions of games, setting up offices abroad, and directly acquiring and investing in overseas game companies." Lao Si analyzed, noting that Tencent's stock price had returned to a peak by 2021, thanks to its control over most of the industry's resources. During that time, Tencent's acquisition deals set records. Timi Studios established offices in Los Angeles, Seattle, and Montreal, owning Riot Games, Funcom, and Sharkmob, and holding stakes ranging from 4% to 84% in companies like Remedy, Epic Games, Activision Blizzard, Ubisoft, Krafton, Supercell, and Frontier Developments. After three years, the ceiling for blockchain games is still Axie from back then. Unlike "game giants" like Tencent, the overseas ventures of small to medium-sized game companies were not smooth. They required substantial resource investments in channels, promotion, and revenue sharing, resources that these companies lacked. Even so, some small to medium-sized companies still attempted to go overseas but faced many challenges. Due to a lack of experience and resources in the overseas market, they encountered numerous obstacles such as cultural differences, different laws and regulations, and difficulties in local operations. It was during this time that "blockchain games" broke out of their niche. This seemingly unfamiliar concept not only attracted the attention of many game giants but also unexpectedly became a "shelter" for "homeless" game developers. After two years of accumulation, the most popular blockchain game on Ethereum, Axie Infinity, exploded in May 2021. Its daily revenue grew exponentially, reaching over 334 million USD in monthly revenue by August, far exceeding Honor of Kings' 231 million USD in July. "Actually, Tencent also had plans to develop Web3 games at that time, including many domestic companies like Zhong Qing Bao working on metaverse concept games," Lao Si told BlockBeats. There are many ways to go overseas, but blockchain games might have been the best choice at the time. This emerging game form attracted significant capital investment, allowing some developers to continue working in the game industry. "It seems like we chose blockchain games back then, but in fact, blockchain games chose us." In xiaoze's memory, blockchain games attracted many professionals who had been hit hard in the traditional game industry, hoping to be reborn through blockchain games. "However, after three years, nothing has happened. The ceiling for blockchain games is still the Axie of that time." What seemed like a chance for rebirth back then now feels like a long detour for xiaoze over the past three years. Blockchain game players are mostly speculators, with a strong purpose of making money, lacking interest in the games themselves, and paying little attention to the long-term development of the games. For speculative Web3 players, the initial investment in blockchain games is high, including time and transaction costs. Traditional game players find it difficult to integrate into blockchain games due to high learning costs. For these reasons, according to CoinGecko's report, the average annual failure rate of Web3 games from 2018 to 2023 is as high as 80.8%, which is not surprising. Finally, it's time for blockchain games to "turn around". xiaoze hadn't opened his social media for more than half a year because it was uncomfortable seeing classmates and relatives doing better than him. "I was thinking, when I was laid off back then, should I have given up on making games? Large-scale blockchain games are the second pitfall for game developers, and the first pitfall is becoming a game developer," xiaoze said that when he couldn't hold it in, he would go drinking to vent, but every time after drinking, these thoughts would flood his mind. When he was laid off five or six years ago, xiaoze was still relatively young, but now it's different. He has a family to consider, and the lack of understanding from his family and the "contempt" from former colleagues put him in a precarious position as a game developer. Unlike the anxiety and confusion he felt when abandoned by the traditional game industry, xiaoze's experience with blockchain games has brought him more despair. xiaoze is not alone in feeling despair. According to him, most of the people around him have already left blockchain games, including those from Tencent, with the remaining ones having one foot out the door. In early 2022, the hope and dream of most blockchain game developers was a world without dominant platforms like Apple or Steam. They envisioned a decentralized world where anonymous community members could influence the development of their favorite games. Of course, this dream was somewhat naive and lacked a solid foundation. Having the right distribution method is crucial for a game's success. Developing an excellent game does not guarantee success; you need to find a large group of users interested in playing your game and willing to pay for it. In traditional games, platforms like Steam and Epic are the traffic gold mines for distributing PC and console games, while App Store and Play Store are the traffic gold mines for mobile games. "Not having a centralized review platform is good, but on the other hand, blockchain games have always lacked a suitable platform to attract users." In the past three years, xiaoze participated in the development of five or six blockchain game projects, but none of them turned out as he had initially imagined. Now, xiaoze has become disillusioned with blockchain games; he doesn't believe blockchain games can produce a game that people will play, at least not in the next five years. Until this year, after visiting Mount Wutai with his family, xiaoze's miserable life finally started to turn around. Because at the beginning of this year, a click game on the TON chain, Notcoin, went viral. Simply by clicking, players can earn tokens. The game is easy to operate, quick to learn, and spreads rapidly, making it ideal for playing in fragmented time. The gameplay of Notcoin is even simpler than Snake; all you have to do is keep clicking. This low-threshold game design allows users to quickly get started without any learning cost. After its launch, Notcoin quickly attracted a large number of users. According to statistics, Notcoin currently has over 5 million daily active users and generates more than 300,000 USD in monthly revenue. This rapid accumulation of users in a short time has shown xiaoze more possibilities. "It felt like I had been swimming in the sea for a long, long time, and just when I was about to run out of strength, the TON chain pulled me ashore." After connecting with some friends making games on the TON chain, xiaoze finally realized there was a huge business opportunity here. Following Notcoin, more Tap to Earn games have launched, with gameplay becoming more diverse. For example, the hottest blockchain game project right now, Catizen, operates through a Telegram bot, where players merge two low-level cats into a higher-level one to attract more guests and earn money. At the end of June, Catizen announced that its total user count had exceeded 20 million, with over 250,000 daily active players. It has topped The Open League leaderboard for three consecutive seasons and generates over 500,000 USD in monthly revenue. These games are not only simple and easy to understand but also utilize fragmented time for operation, greatly increasing user stickiness. Although everyone knows that the data released by the projects themselves may be exaggerated, it is an undeniable fact that there are more and more players and games on the TON chain. More importantly, blockchain game developers have finally found their traffic gold mine. Telegram's large user base has brought a huge potential user base to the TON chain. Compared to WeChat's 1.1 billion active users, Telegram's 900 million users may be slightly less, but due to Telegram's global reach and high activity, TON chain games are easier to spread and promote. Not only small and medium-sized game developers like xiaoze, but the TON chain's mini-game market has also attracted more traditional game companies, bringing back domestic small and medium-sized games that had been shelved. Traditional game companies entering the TON chain After working on several Web3 projects, Sunny is now focusing on TON games. She has several mini-game projects in progress, including a shooting game. "Recently, I've been talking to various traditional game companies, and they are all very interested in the current mini-game market on the TON chain, including Shanda Games," Sunny revealed to me. As everyone knows, Shanda Games is invested in by Tencent. According to Lao Si, a data center under Shanda is mainly engaged in mining. At the same time, Lao Si confirmed Sunny's words from another angle. Not only Shanda but also companies like Glacier, Weiyou, and 37 Interactive Entertainment, which are Web2 game developers, have started projects in the TON ecosystem. It shows that it is easy for these traditional game companies to enter the scene because they have always been watching and looking for opportunities on the edge of the cryptocurrency circle. Therefore, it is not surprising that they are now participating in TON mini-games. "As for Tencent, I think it's unlikely they will directly participate. At most, Tencent might let its subsidiaries or invested companies do it, like Shanda." In Lao Si's view, Tencent might also allocate some resources for support, including resources from mini-game developers on WeChat. "If Tencent really wanted to do it, no one could do it better than Tencent. But the problem is, if Tencent does it, wouldn't they just be driving traffic to Telegram and making a wedding dress for them?" Lao Si believes that supporting Shanda in developing TON games is already Tencent's biggest compromise. "They are all trying their best to push mini-games onto the TON chain. For example, those previously discarded or unlisted games." Reflecting on the last cycle, Sunny said traditional game companies had considered participating in GameFi but did not easily invest due to the long cycle of GameFi. "But these mini-games, a single company might have hundreds or thousands of them, and everyone wants to rush in." Back to the beginning of the article, getting a license to make games in China is a "torturous" process, with various review procedures taking a long time. However, the TON chain does not have these restrictions, and with Telegram's 900 million active users, it is a huge traffic gold mine. "The big GameFi cycle logic in Web3 won't work in this round, but mini-games can, mini-apps can." Like xiaoze, Sunny also believes that large-scale blockchain games won't have a chance in this cycle. "For massive adoption, GameFi is a false proposition; the timing hasn't come yet. Let's look at it in the next cycle." "Blockchain games might have been the best choice at the time, but the time for large-scale blockchain games hasn't come yet. I don't think it's anyone's fault; it's just the choice of the industry and market." Lao Si also told BlockBeats that some large blockchain games, which have almost burned through their funding, are considering modifying their code and launching a TON mini-game first to warm up or generate some data and achievements to secure the next round of funding for their large game. Start small, don't aim to change the world immediately. More and more people are playing games on the TON chain, and xiaoze is once again secreting dopamine, rediscovering his passion and drive. "In the past, everyone wanted to do something big, something great that could change the world, so mini-games were always looked down upon until NOTCOIN became popular on the TON chain." Indeed, the mini-game market looks simple, essentially retracing the path of PC and mobile games, making previously popular genres popular again. Web3 mini-games are even simpler, retracing the path of WeChat mini-games, making games that were once popular in WeChat mini-games popular again. Although most of the TON games on the market currently lack playability, with more developers and big companies joining, we can soon expect to see former best-selling WeChat mini-games on the TON chain, such as "Seeking Immortal Daxian," "Xianyu King," "Sheep A Sheep," "Happy Eliminate," "Plants vs. Zombies," "Protect the Carrot," and even "Arknights." "Last month, when I sold my first mini-game, I immediately started frantically calling my former colleagues and friends who were working on large-scale blockchain games to confirm that my idea of making games on the TON chain was correct. Now, I am very happy, extremely happy." As he took a call from his development colleague about some code details before rushing off, I told him, "Your state is completely different from last year, like you've been reborn." xiaoze waved his hand and said, "I'm just not pretending anymore. Whether in the game industry or the blockchain industry, you don't have to make big things to be impressive. Starting with small things is good enough, so just to hell with huge games." Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Talk with Solv: From WBTC Trust Crisis to New Opportunities with Babylon

Wednesday, August 28, 2024

In this episode, we discuss with Solv co-founder Ryan about the market concerns arising from the transfer of WBTC control, alternatives to WBTC, and the potential of BTCFi. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Deep Conversation: How to Prevent Security Risks in On-Chain Transactions? Evaluation Dimensions for CEX Listings …

Tuesday, August 27, 2024

We invited Tommy, a researcher from Bitget, and Lisa, the operations head of the SlowMist security team, to discuss CEX listing risk assessments, on-chain security issues, and how investors can protect

Investor:The Stories Behind Popular Blockchain Games such as Catizen and Matr1x

Monday, August 26, 2024

As several popular Web3 Game projects have been listed on major exchanges such as Binance, OKX, and Bybit, the wealth effect has begun to show. Many community users who have grown alongside these games

Asia's weekly TOP10 crypto news (Aug 19 to Aug 25)

Sunday, August 25, 2024

Malaysian authorities have dismantled 985 Bitcoin mining machines in a nationwide crackdown on electricity theft related to cryptocurrency mining. A circulating video shows a heavy-duty roller slowly

Weekly Project Updates: Babylon Mainnet Goes Live, Magic Eden Launches Token, Starknet to Enable STRK Staking Func…

Saturday, August 24, 2024

Babylon has announced the official launch of its Bitcoin staking mainnet, now open for its first phase of staking activities. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏