Bitcoin Is Officially Older Than The Fiat Era Stock Market

Today’s letter is brought to you by Unbound Golden Visa!What if you could use Bitcoin as a tool to unlock future freedom for you and your family? Well, now you can. m Unbound is the Portuguese Golden Visa Fund that invests in local companies 100% owned by the fund, which in turn invest in Bitcoin via SEC-compliant ETFs. The Portuguese citizenship by investment program is the top European choice. With extensive experience, the team facilitates EU citizenship, unlocking freedom across 27 countries. This incredible offering went viral receiving hundreds of applications in 48 hours. I recently spoke with co-founder Ale Palombo about this initiative here. To unlock your future visit Unbound’s website or simply write to hi@unboundcap.com. To investors, The world changed on August 15, 1971 — President Nixon implemented a number of changes to the US economy in response to high inflation. These changes became known as the “Nixon shock.” Changes included:

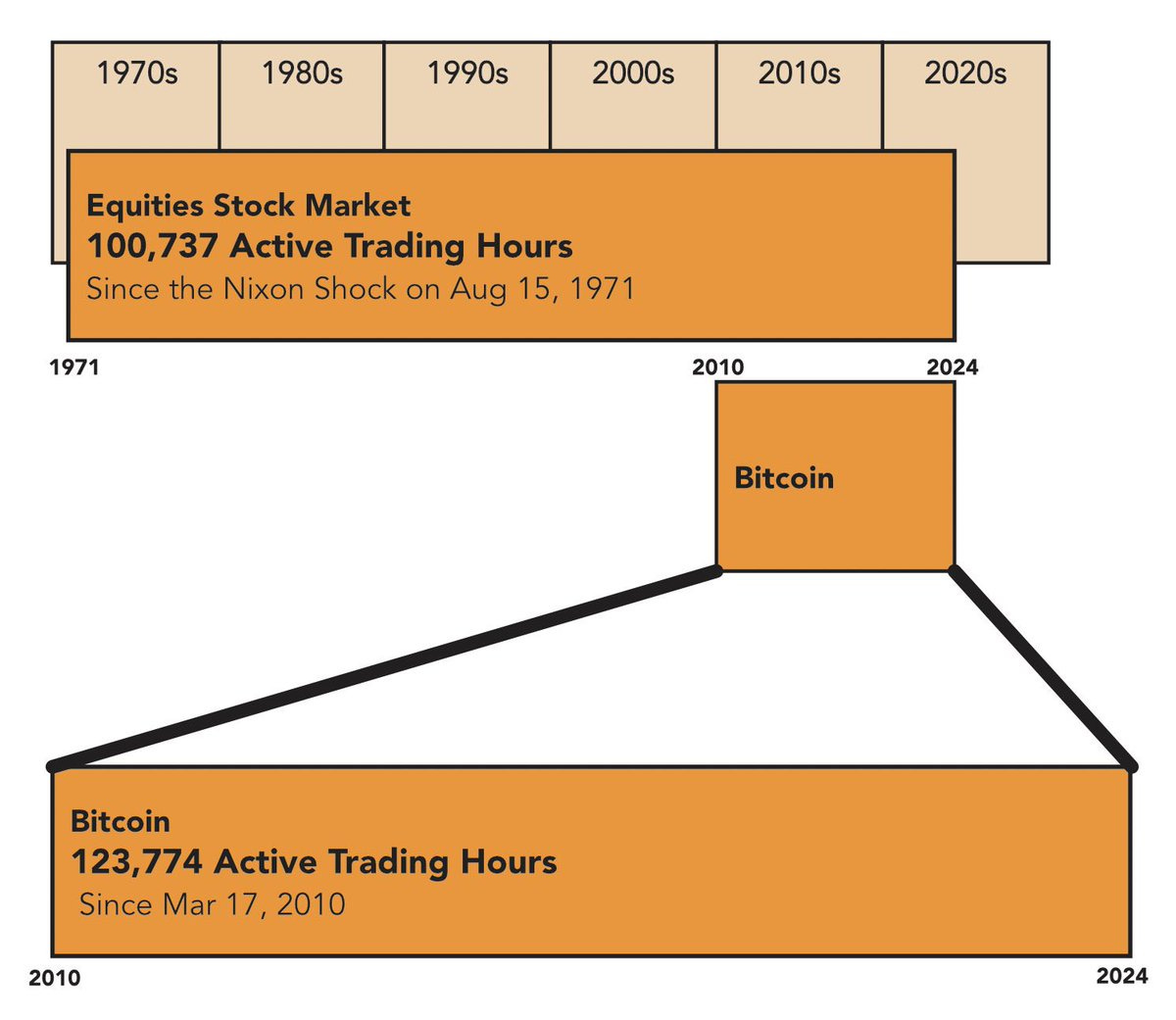

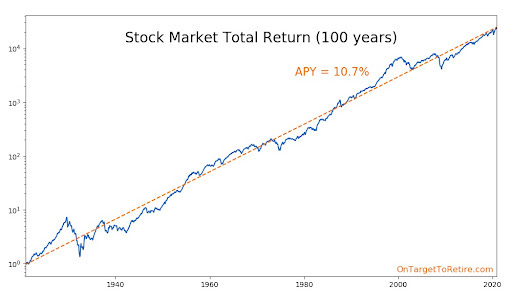

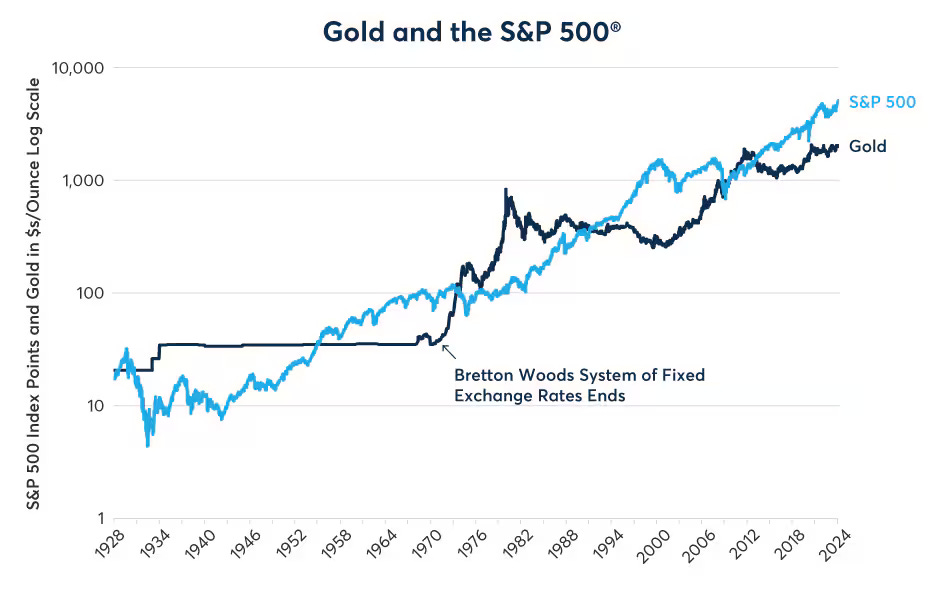

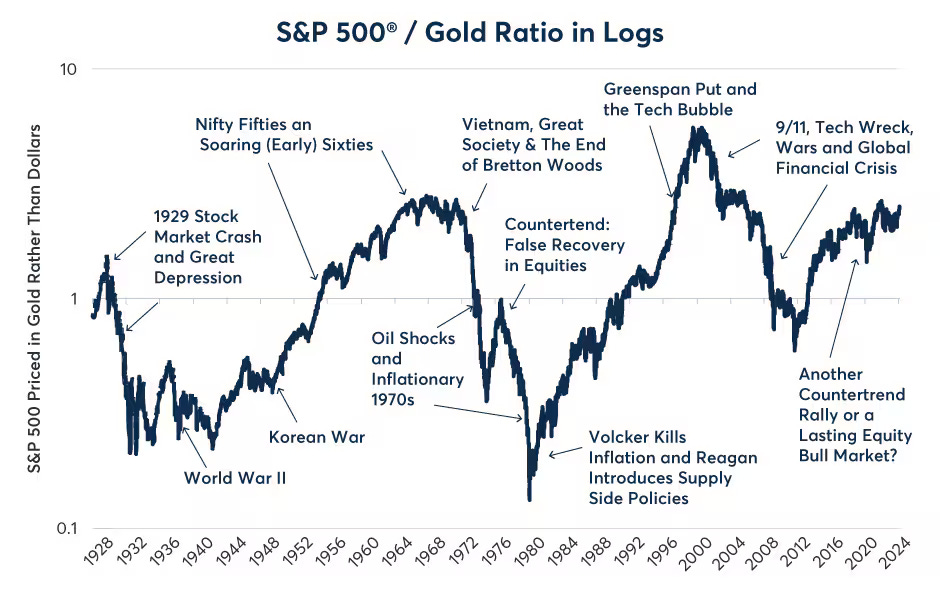

The Nixon shock kicked off a new era for the United States — the fiat currency regime had begun. Since that day, the US stock market has been open for trading in just over 100,700 hours. That may seem like a useless data point, but Cory Bates points out something interesting happened this year that made the fiat era US stock market hours of operations noteworthy. Bitcoin, which was only launched in 2009, officially eclipsed the US stock market in terms of hours of trading. Bitcoin now stands at more than 123,000 hours of trading, which is nearly 25% higher than the fiat era for public equities. There are two takeaways from this information — first, it is insane that the US stock market is closed more hours per week than it is open. It is quite eye-opening that bitcoin, which started public trading less than 15 years ago, has been more accessible than public equities in the last 50 years. Second, you could argue that bitcoin is older than the fiat era stock market. The digital currency may not be older in terms of total years, but it is definitely more mature in terms of trading hours. Some people will disagree and likely claim that the US stock market dates back to before 1971. While that is true, the regime change in the Nixon shock is all that matters in today’s stock market. Why is the Nixon shock mainly what matters? The US stock market gains are largely driven by fiat debasement. The more the dollar is devalued, the faster the stock market accelerates. How can you tell? The CME Group has two great charts highlighting (1) gold’s relative performance to equities and (2) the US stock market denominated in gold. Let’s bring this back to my main point — the US stock market materially changed in 1971 even though Nixon didn’t explicitly predict it. If you take the market since this new era started, it has traded less hours than bitcoin. Bitcoin’s robust system has been tested more than the US stock market. That statement will put the legacy finance folks’ brains in a blender. But it is true. The only time a system is tested is when it is in use. Bitcoin’s market has been used more than the fiat era stock market. That is a narrative that should be spread far and wide. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Reader Note: BUILD Summit, our annual conference in NYC for founders, is coming up next month on September 26th. The event will provide top tier speakers, networking opportunities, and insightful business discussions on raising capital, scaling businesses, and building products. Current speakers include angel investor Balaji Srinivasan, Khosla Ventures’ Keith Rabois, Perplexity CEO Aravind Srinivas, Eight Sleep Founders Matteo Franceschetti & Alexandra Zatarain, and Passes CEO Lucy Guo. The event is free to attend and will be full of insights on how to operate a company at world-class level. Phil Rosen, the Co-Founder of Opening Bell Daily, and Anthony Pompliano, CEO of Professional Capital Management, discuss why stocks and bitcoin are down, economic policies for Trump & Kamala, proposed capital gains tax increase, and outlook on asset prices during interest rate cuts. Listen on iTunes: Click here Listen on Spotify: Click here Why Bitcoin and Stocks Have Been Crashing Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

Podcast app setup

Sunday, September 8, 2024

Open this on your phone and click the button below: Add to podcast app

Americans Are Very Long The Stock Market And It Is Making Them Millionaires

Wednesday, September 4, 2024

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Did The Government Push Rents To All-Time High Prices?

Tuesday, September 3, 2024

Listen now (4 mins) | Today's letter is brought to you by Domain Money! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Monday, September 2, 2024

Open this on your phone and click the button below: Add to podcast app

The Fed Just Got The Certainty They Needed For Interest Rate Cuts

Friday, August 30, 2024

Today's letter is brought to you by Domain Money! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these