L2 Race Heats up in September: Base Leads the Way | Layer 2 Review

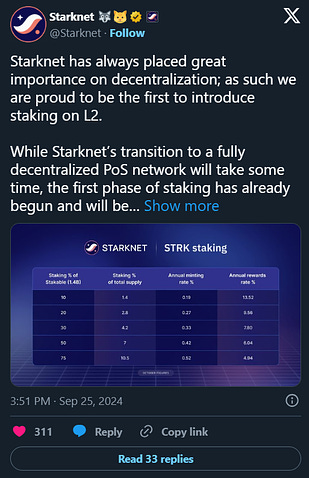

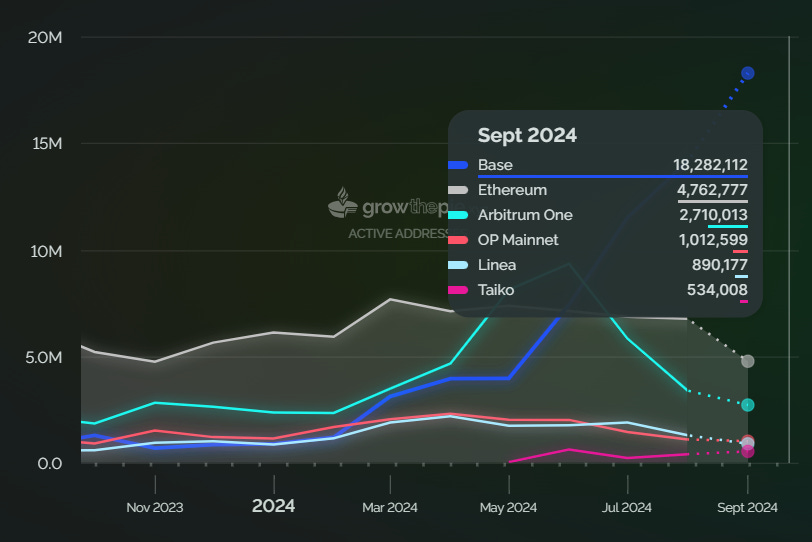

L2 Race Heats up in September: Base Leads the Way | Layer 2 ReviewQuick Reads and Hot Links Covering the People and Projects Who Are Scaling EthereumDear Frens, Welcome to the L2 Review, where we provide the latest developments, insights, and emerging trends in the dynamic Layer 2 ecosystem. Optimism’s Retroactive Public Goods Funding (RetroPGF) 6 will see up to 3.5 million OP distributed among contributors to Optimism Governance during Season 5 and Season 6. This covers impact between October 2023 and September 18, 2024. The focus includes infrastructure and tooling, governance analytics, and leadership within the superchain governance. Applications were opened today and will run till October 10. For more details on eligibility and the application process, click here. Base is rolling out a global series of regional buildathons, targeting Africa, India, Southeast Asia, and Latin America. From September 27 to October 13, these events will offer a total prize pool of 100 ETH for teams building onchain applications that address local community challenges. This initiative shows Base's commitment to empowering non-US builders and driving the adoption of onchain tech for impactful solutions. This issue’s editorial takes you through the highs and lows of top Ethereum L2s this September. L2s are pushing boundaries across onchain activity, governance, innovation, and beyond with no sign of them slowing down. Count on us to bring you timely updates and insights into these advancements as they unfold. Contributors: Lucent, Melasin, Tonytad, Boluwatife, Kornekt, WinVerse This is an official newsletter of BanklessDAO. Please subscribe and share to help us grow our audience as we fulfill our mission to build user-friendly crypto onramps. 🗞️ Ecosystem Updates⛓️ OptimismGov approves Bases’s grant request of 3 million OP. 🔀 Track every time Ethereum was declared dead since 2014, using Ethereum Obituaries. ➿ Sign-ups for Retroactive Funding 6 for Optimism Governance nerds have commenced! ⚡Bridged USDC Standard is now available for all Arbitrum Orbit chains. ⭕ The 5th edition of Phase 2 Arbitrum Ambassador Weekly is here 🔒 The upgrade to ArbOS 32 is now completed on Arbitrum One, Nova, and Sepolia. 🔥 Hot NewsStarknet Takes Big Step in Layer 2 StakingStarknet is making waves by being the first to offer staking services on Ethereum Layer 2, showing its commitment to decentralization. This means users can now earn rewards by staking their STRK tokens, participating in the network’s security. The community got to vote on important details about how the staking will work. Starknet plans to test this new system later this year, with the live version launching around the same time. Currently, experts are auditing the staking contract to ensure it's safe to use. Interested in learning more? Check the X post below for more details. 🏛 Governance💬 Proposals in DiscussionArbitrumOptimismPolygonStarknetL2 Race Heats up in September: Base Leads the WayAuthor: Kornekt Activity on Ethereum’s Layer 2 networks has been nothing short of phenomenal. Top projects like Base, Arbitrum, and Optimism are stealing the show from Mainnet, bringing to life the scalability vision. Base L2 is making and breaking records, hitting new highs in terms of onchain metrics. Following the broader market recovery, top L2 native tokens like ARB and OP have also risen from their lows. In this article, we review activity so far among the top three Layer 2 projects this month, especially focusing on onchain metrics and developer activities. What do the numbers tell us about Layer 2 progress in these past weeks? Let’s find out! Onchain MetricsWe can measure onchain activity using several yardsticks. Among them, two stand out to give a picture of the extent of usage, they include the number of active addresses and transaction count. The number of active addresses on a network tells of the number of addresses trafficking the chain within a specified amount of time. It indicates the number of unique addresses that are involved in a successful transaction (as a sender or receiver) within the network and can be a major indication of activity. Transaction count, on the other hand, is the total amount of unique transactions that occurred on a network within a particular timeframe. Both metrics are not perfect indicators of human onchain activity as several factors can influence the number of active addresses and transaction count including market sentiment and bot activity. Nevertheless, they are still significant enough to describe the extent of usage. What Do the Numbers Say?According to data from GrowThePie, so far in September, Base has stood tall with over 18M active addresses, a steady increase from the previous month. The network hit a new all-time high in active addresses on Sep. 21 with about 1.5M addresses engaging in over 4.7M transactions on that single day. Base is the first Ethereum L2 to hit these numbers. Arbitrum One and OP Mainnet on the other hand have so far had 2.7M and 1.01M active addresses respectively this month. At the time of writing, transaction count on both networks in the past day were 1.78M and 751k respectively. In comparison, Ethereum mainnet has recorded 4.7M active addresses so far in September with 1.1M transactions in the past day. It’s no news that Base has been on an explosive run this year in terms of onchain metrics. The recently concluded Onchain Summer event, the launch of basenames, smart wallets and other factors could be further fueling the growth of the network.

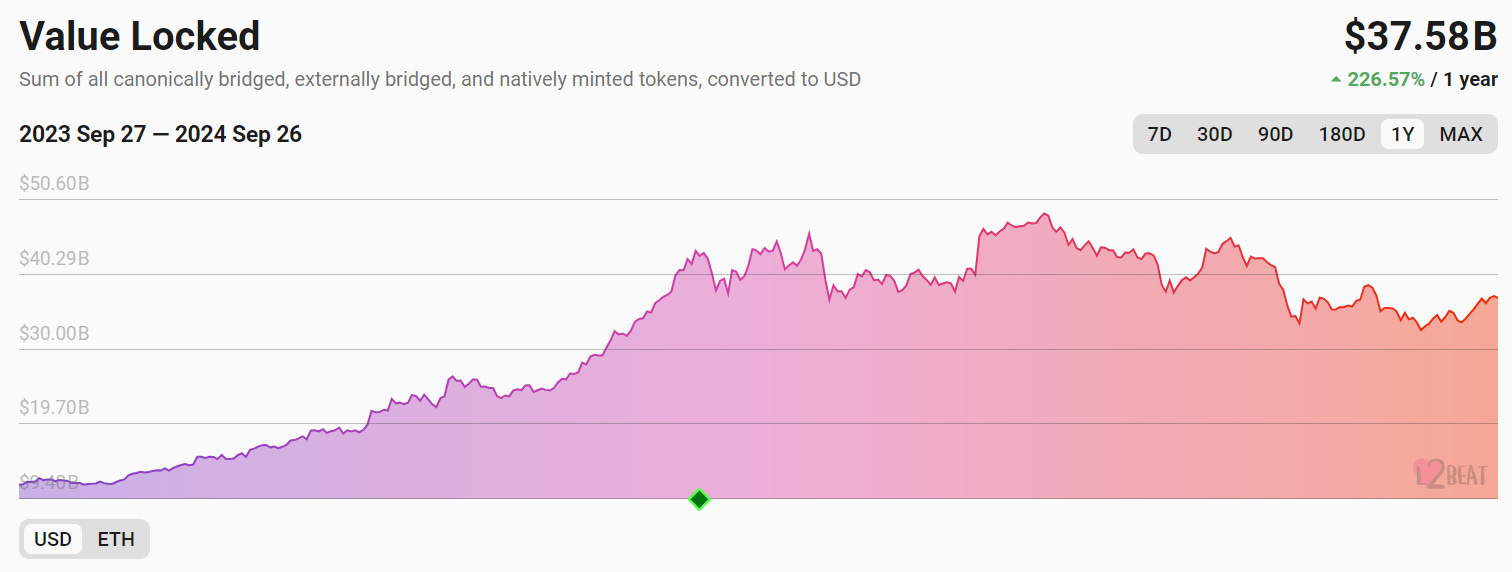

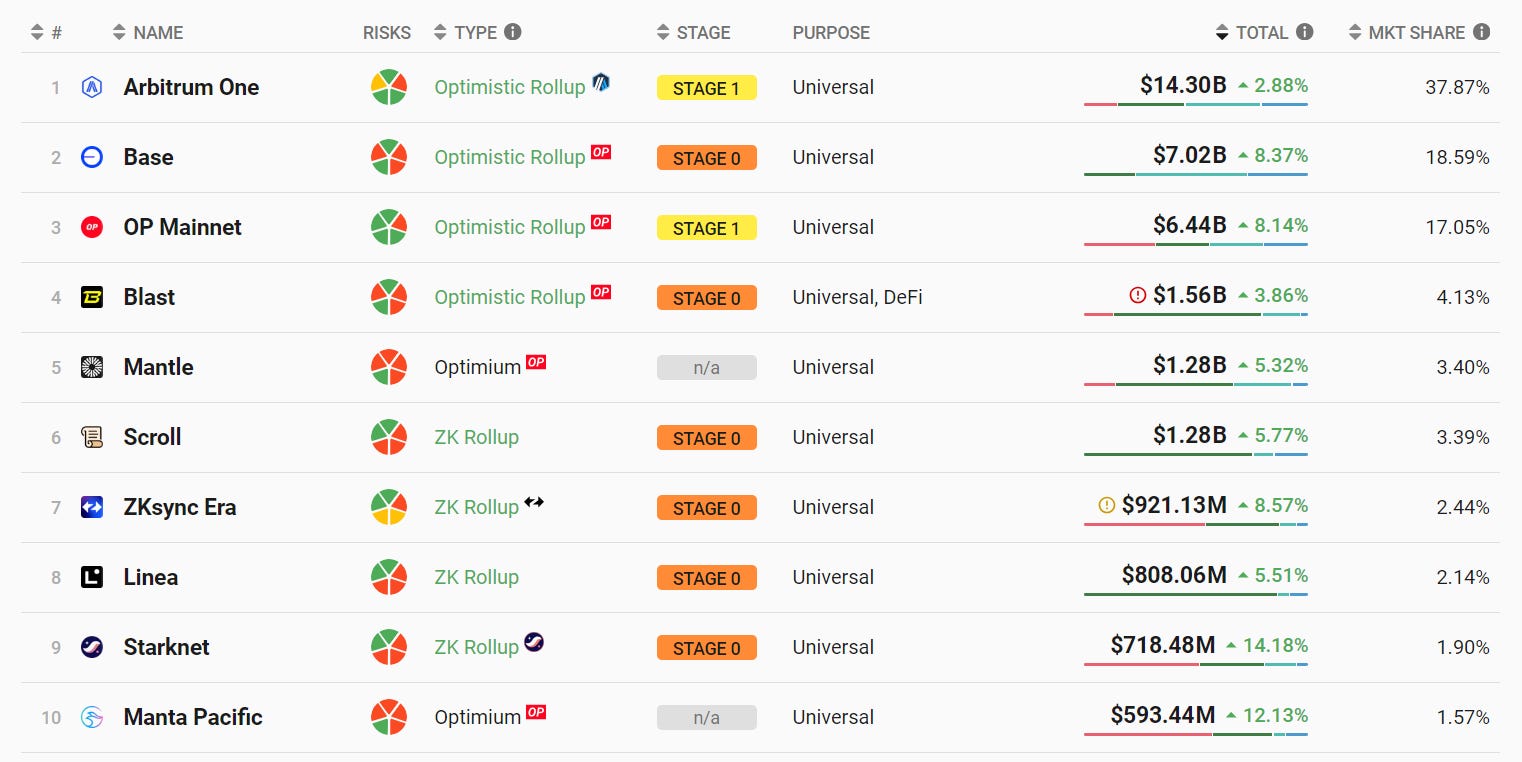

The chart of active addresses and transaction count on the top L2 networks are proceeding in opposite directions as Base seems to be soaring on a lane of its own. The question is, can Base sustain the heat? Developer ActivityThe number of devs actively working on a project and building on the network is an important metric to determine how a blockchain network is evolving. More developer activity signals faster development; and new and improved initiatives would attract more users, ultimately boosting the network’s activity. As such, many networks put up several programs and incentives to attract devs. The aim as always is to make the chain as builder-friendly as possible. Developer activity can be in the form of core devs building and maintaining the network’s underlying infrastructure and dApp or smart contract devs using the network’s tools to spin out several use cases. According to data from DeFiLlama, Base has 14 core devs working on the network in September. In contrast, Arbitrum and Optimism have 39 and 47 core devs respectively. Ethereum mainnet remains the central hub for devs with 352 core devs. On the scene of smart contract deployment, according to data from Nansen, daily deployment on Base has hit a peak of 644k and a low of 102k since the beginning of September. On Arbitrum, deployments have ranged between 4.4k and 32k so far this month, that of Optimism was between 12k and 131k. Ethereum mainnet on the other hand had a high of 88k and had dipped to about 3.5k smart contract deployments. This data shows that more smart contract devs are trooping to Base to launch their projects. It’s not surprising as Base currently offers the fastest throughput in the entire Layer 2 ecosystem and offers one of the lowest (near zero) transaction fees. The Future is Here?On several fronts, from active addresses to transaction count, Layer 2 solutions are displaying the scalable potential of Ethereum, flinging the doors wide open for global adoption. It’s interesting to see the rapid development of projects like Base, taking over the stage in a very short time. As Ethereum continues to build on its rollup-centric model for scaling, we will most likely see new developments that will outpace the current standards. We are not in the future yet but it’s closer than it had ever been. 📈 DataTotal Value Locked on L2s surpasses $35 billion!

Top Ten Projects by Total Value Locked:

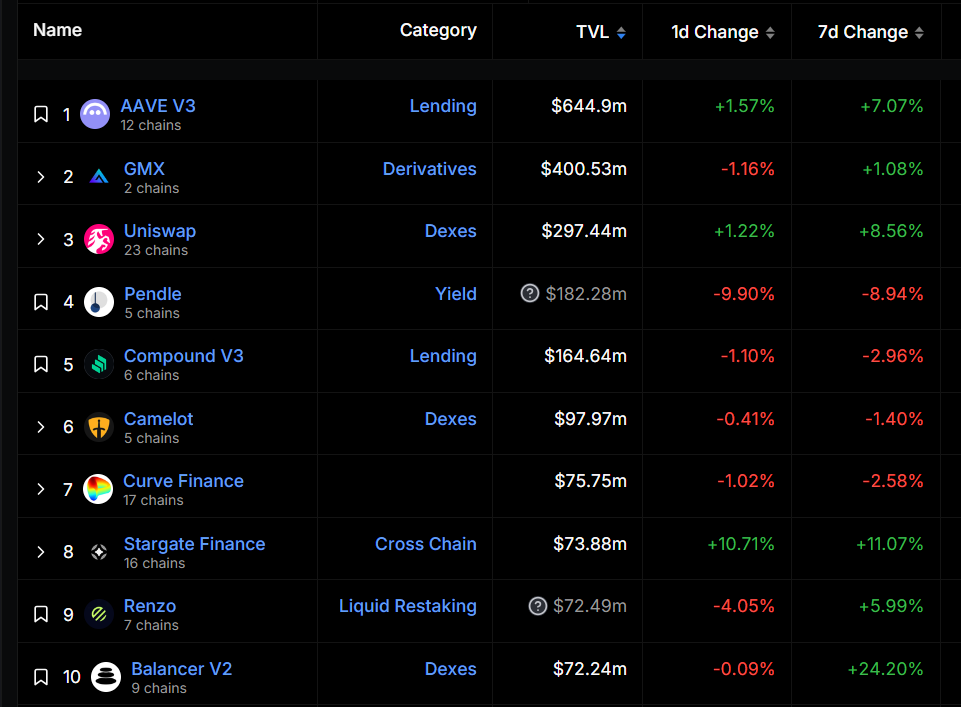

🔭 Project WatchArbitrumTop Projects by TVL in the Last 7 Days

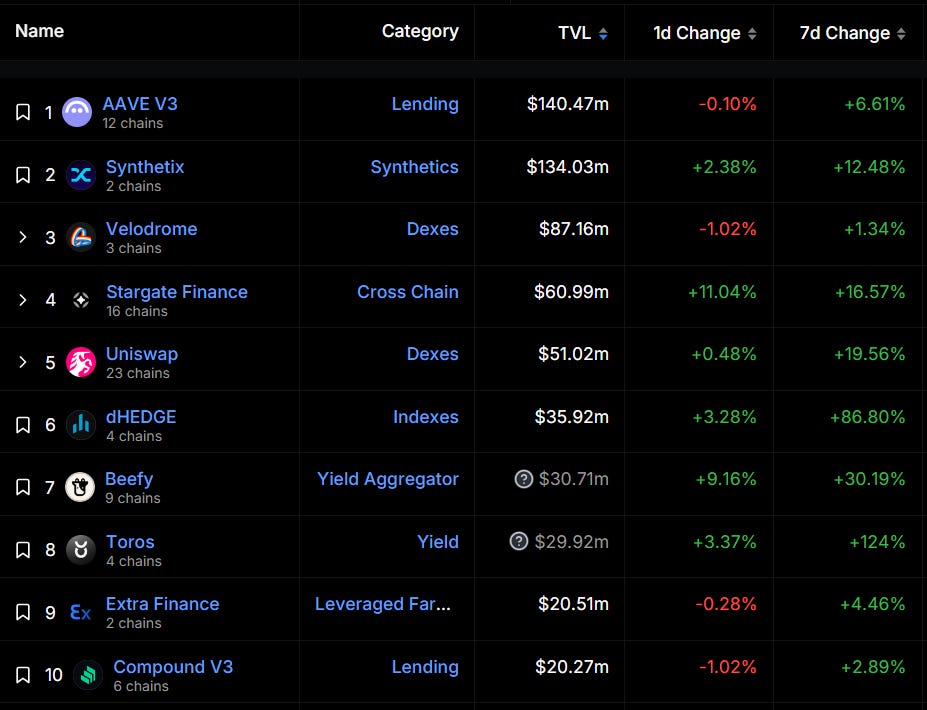

OptimismTop Projects by TVL in the Last 7 Days

BaseTop Projects by TVL in the Last 7 Days

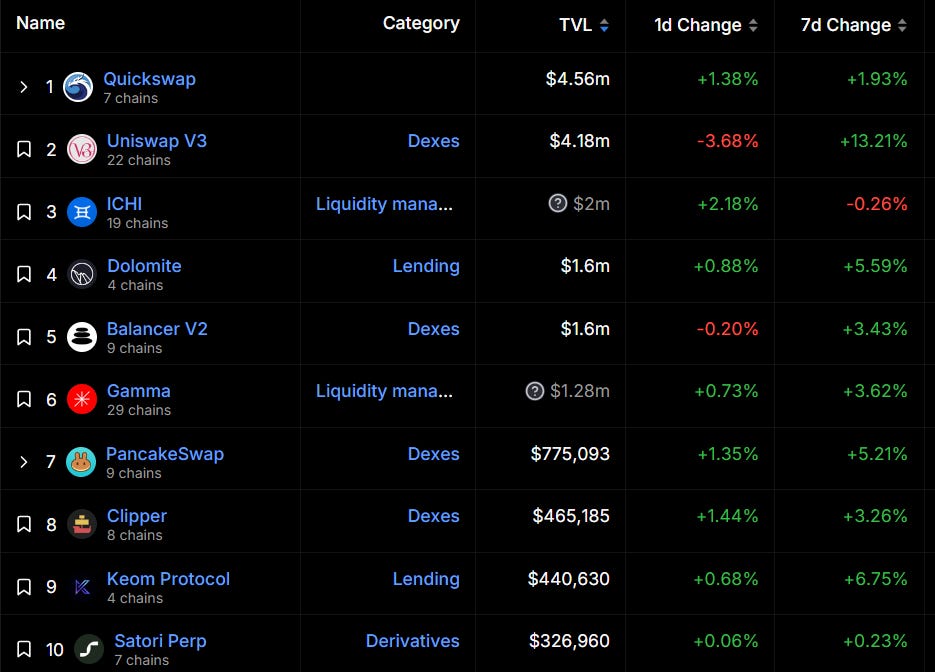

zkEVMTop Projects by TVL in the Last 7 Days

🔥 L2 Fees and Costs UpdateTransaction Fees as of September 26, 2024:

|

Older messages

A Defined Purpose to Create a New Identity | BanklessDAO Weekly Rollup

Saturday, September 21, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Navigating Growth, Community, and Accountability | BanklessDAO Weekly Rollup

Saturday, September 14, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is It Morphing Time Yet? | Layer 2 Review

Friday, September 13, 2024

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Growth Through Participative Ideation | BanklessDAO Weekly Rollup

Saturday, September 7, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What Is Our Narrative? | BanklessDAO Weekly Rollup

Saturday, August 31, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏