Coin Metrics - An Overview of the Flow Blockchain

Get the best data-driven crypto insights and analysis every week: An Overview of the Flow BlockchainBy: Tanay Ved Key Takeaways:

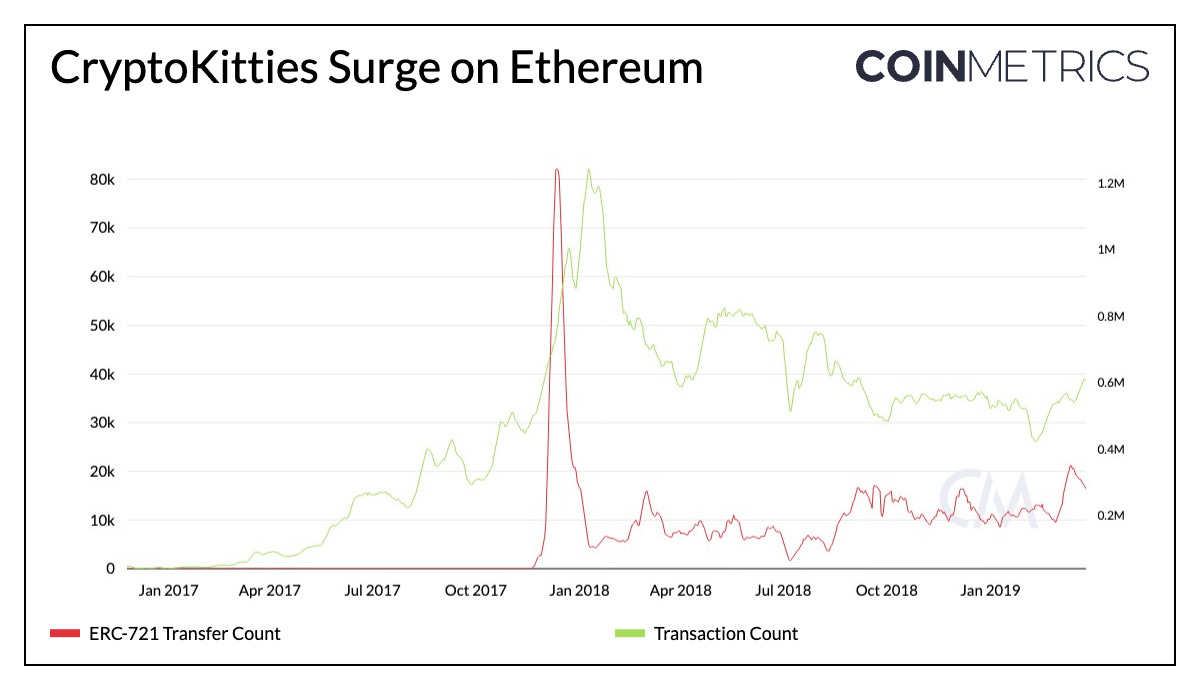

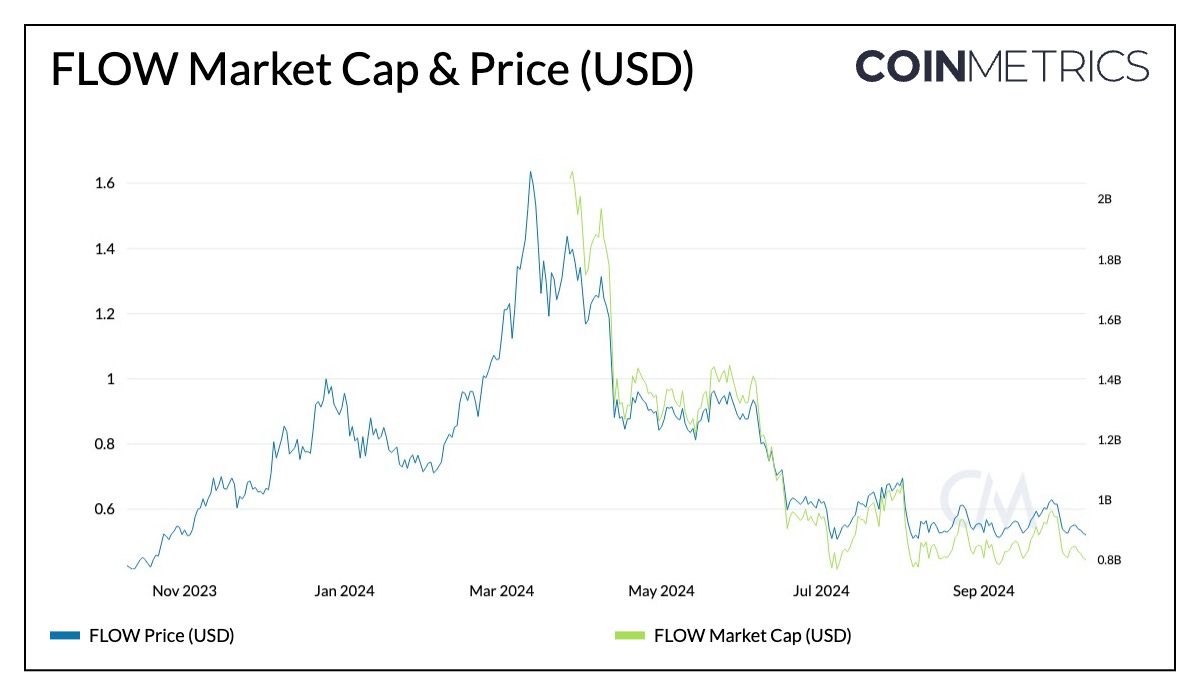

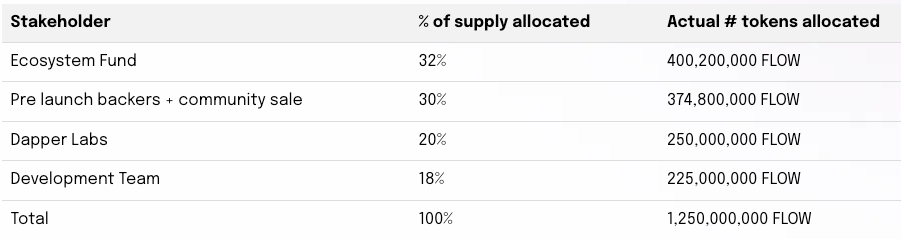

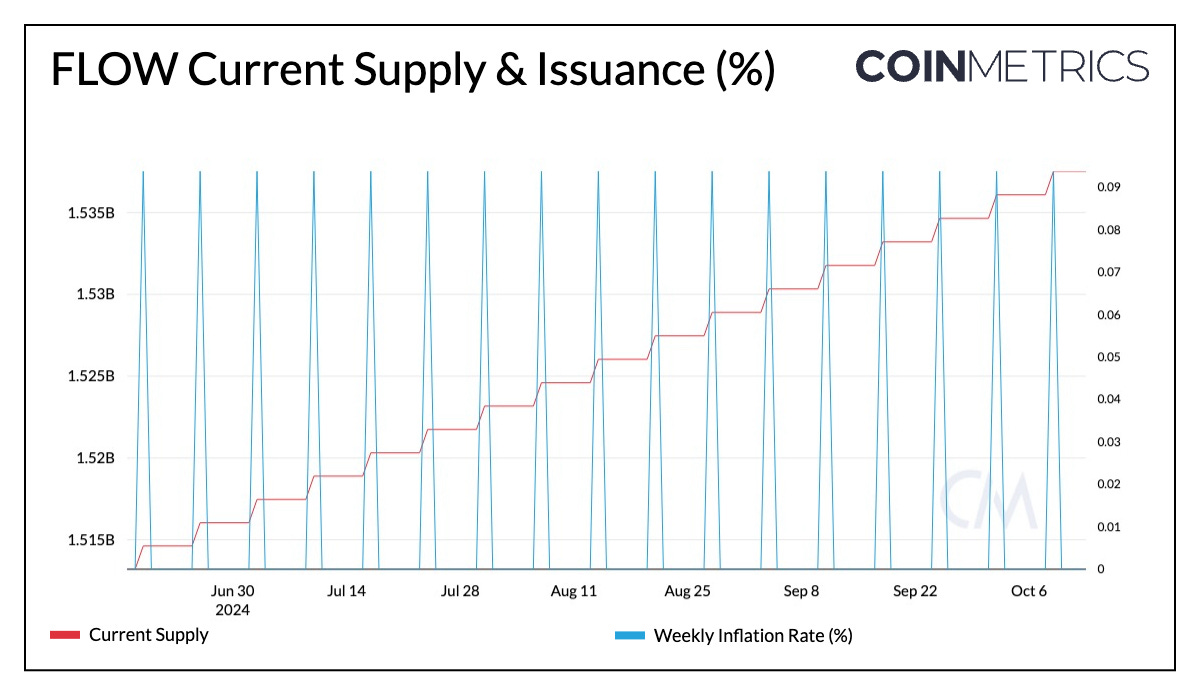

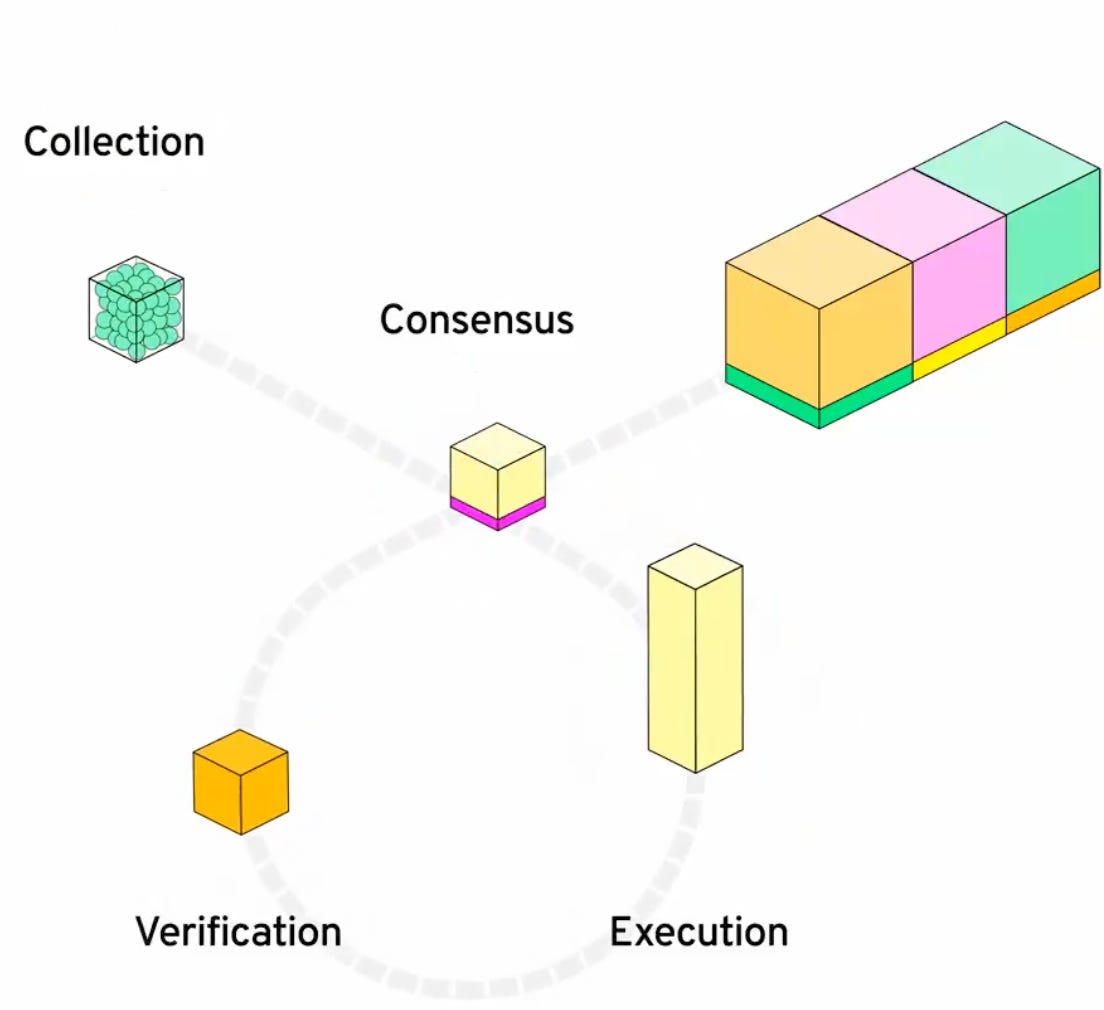

IntroductionAs the foundational infrastructure of the on-chain ecosystem, Layer-1 blockchains—which serve as the settlement layer for scaling solutions and the execution environment for smart contracts and decentralized applications—continue to act as the linchpin of the crypto ecosystem. We’ve seen Layer-1s progressing on several fronts, with Ethereum pursuing a rollup-centric scaling roadmap, Solana enhancing throughput with new validator clients, Sui and Aptos leveraging Move-based virtual machines, and Monad combining EVM compatibility with parallel execution. In essence, Layer-1 projects aim is to strike a delicate balance between various tradeoffs, prioritizing on scalability, performance, application-specific use cases and developer-friendliness. One such blockchain is Flow, a Layer-1 that’s focused on mass-market consumer applications and developer accessibility. Flow introduced Cadence, a resource-oriented programming language that powers a diverse ecosystem of applications—from digital collectibles to marketplaces. With its recent Crescendo upgrade, Flow has achieved EVM equivalence, allowing it to tap into the vast array of tooling and applications available within the Ethereum ecosystem. In this issue of Coin Metrics’ State of the Network, we explore the Flow blockchain, examining its unique features, the implications of the Crescendo upgrade, and network data metrics to assess the adoption of its application ecosystem. Overview & Origins of FlowThe origins of Flow interestingly begin on Ethereum. In 2017, Dapper Labs, the creator of the Flow blockchain, developed the then wildly popular “CryptoKitties” game. CryptoKitties was a platform that allowed users to buy, sell, collect and breed unique digital cats represented as non-fungible tokens (NFTs) on the Ethereum blockchain—following the ERC-721 token standard. However, the craze that followed led to a spike in ERC-721 associated transfers and transactions (up to 80K and 1.2M), alongside a congestion induced gas surge (back when the Ethereum network used a first-price auction model for transaction fees). Source: Coin Metrics Network Data Pro This brought Ethereum’s scalability challenges to the fore, leading Dapper Labs to conceptualize their own Layer-1 blockchain with cheap transaction fees and scalability under heavy usage. What is Flow?The Flow blockchain mainnet launched in 2020, designed as the foundation for consumer-centric applications, and the digital assets that power them. Flow is a fast and developer friendly proof-of-stake (PoS) Layer-1 blockchain built for mass-scale decentralized applications based on a multi-role architecture for scalability as well as Cadence, a resource-oriented programming language designed specifically for smart contracts. The network uses Cadence as its main execution environment, which has served as the foundation for Flow’s ecosystem of applications—from digital collectibles and officially licensed platforms like NBA Top Shot to marketplaces, DeFi services and digital experiences in collaboration with Disney. Crescendo Upgrade: EVM on FlowIn September 2024, Flow underwent its largest change with the “Crescendo” upgrade, making the network fully EVM compatible. The network now supports two environments: a native Cadence-based chain (FLOW_NATIVE) and an EVM-compatible chain (FLOW_EVM). With this upgrade, any smart contract or protocol running on Ethereum or an EVM Layer 2 can now be deployed on Flow, leveraging the flexibility of its account model. Flow introduces Cadence Owned Accounts (COAs), which, unlike traditional externally owned accounts (user wallets), function as smart contracts. This allows for native features like Account Abstraction, multi-signature authentication, and custom key management, enhancing both security and user experience. Flow can now leverage the network effects of EVM tooling, such as Metamask and integrate applications like Uniswap and Chainlink, further expanding its developer, application, and user ecosystem. Since the upgrade on September 4th, over 1000 new EVM contracts have been deployed on Flow. Notably, this change will allow for composability across both environments, with the FLOW token as gas for transactions and a native VM token bridge allowing for fungible and nonfungible token transfers between environments. FLOW Token & TokenomicsFLOW is the native token of the Flow blockchain. It serves as a means of rewarding staked participants of the network, as a medium of exchange within the Flow ecosystem, and to cover transaction fees. Furthermore, FLOW is also used as a form of collateral on lending applications like Increment Finance, as well as governance voting on future protocol and ecosystem development. At a current price of $0.53 per token, FLOW’s market capitalization sits near $800M. Source: Coin Metrics Network Data Pro Flow’s genesis block was created in October 2020, with 1.25B FLOW, of which supply has been allocated across stakeholders in the ecosystem. Since genesis, the supply of FLOW has increased by approximately 22% as a result of newly issued tokens for the distribution of validator rewards. The current total supply of FLOW tokens is 1.53B, with a weekly inflation rate of approximately 0.09% and an annual reward rate of ~5%. Source: Coin Metrics Network Data Pro Scaling Through a Multi-Node ArchitectureAchieving scalability for mass adoption has been the north-star for all blockchains. Several Layer-1s currently rely on sharding (splitting a blockchain network into smaller parts) or rollups (processing transactions off the main chain) for scalability. Flow applies pipelining to blockchains by specializing the jobs of a validator node into four different roles: Collection, Consensus, Execution, and Verification. This separation of duties (across different validation stages for each transaction) increases the efficiency of processing transactions.

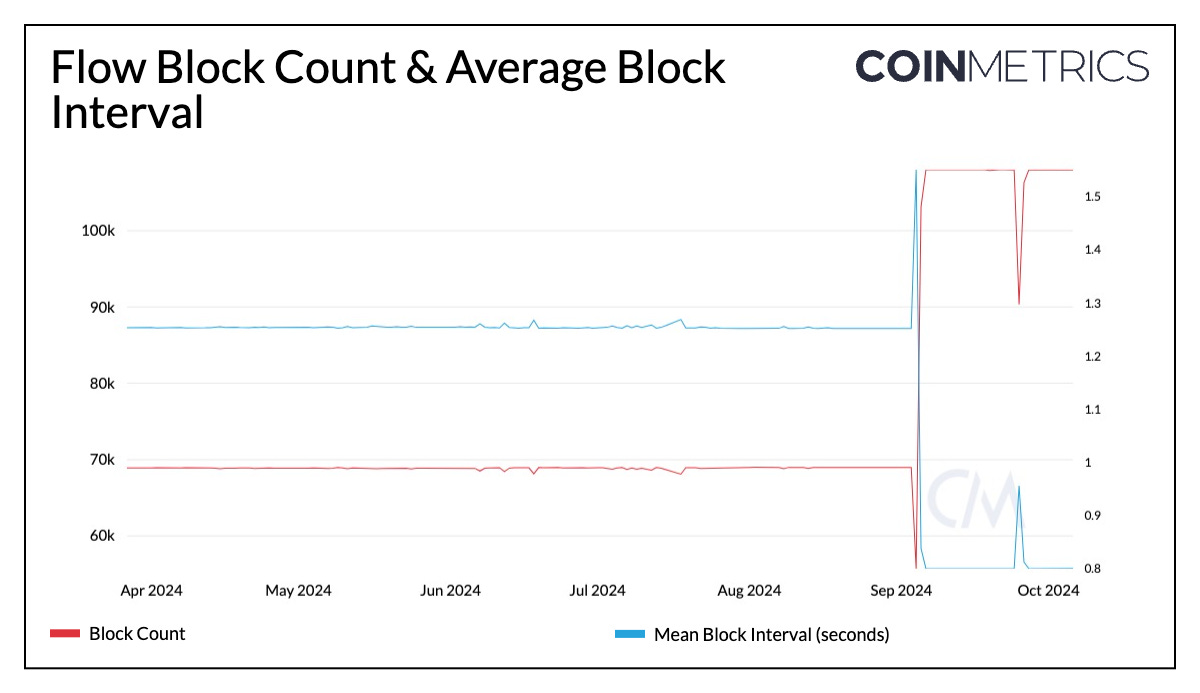

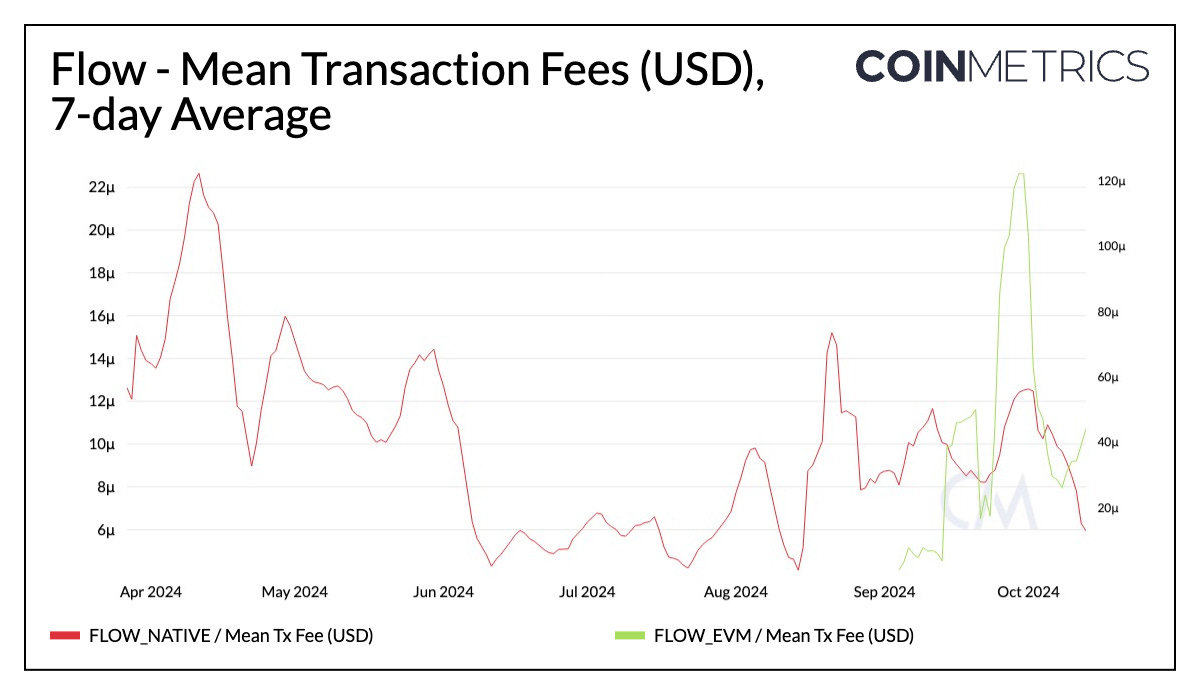

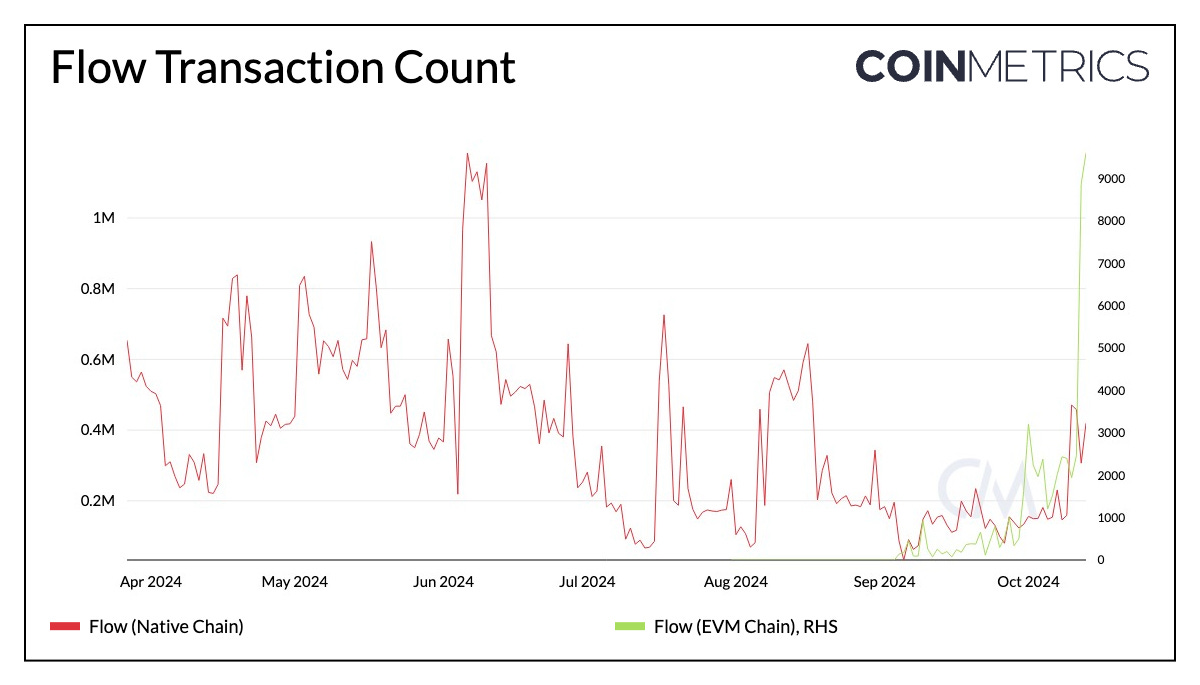

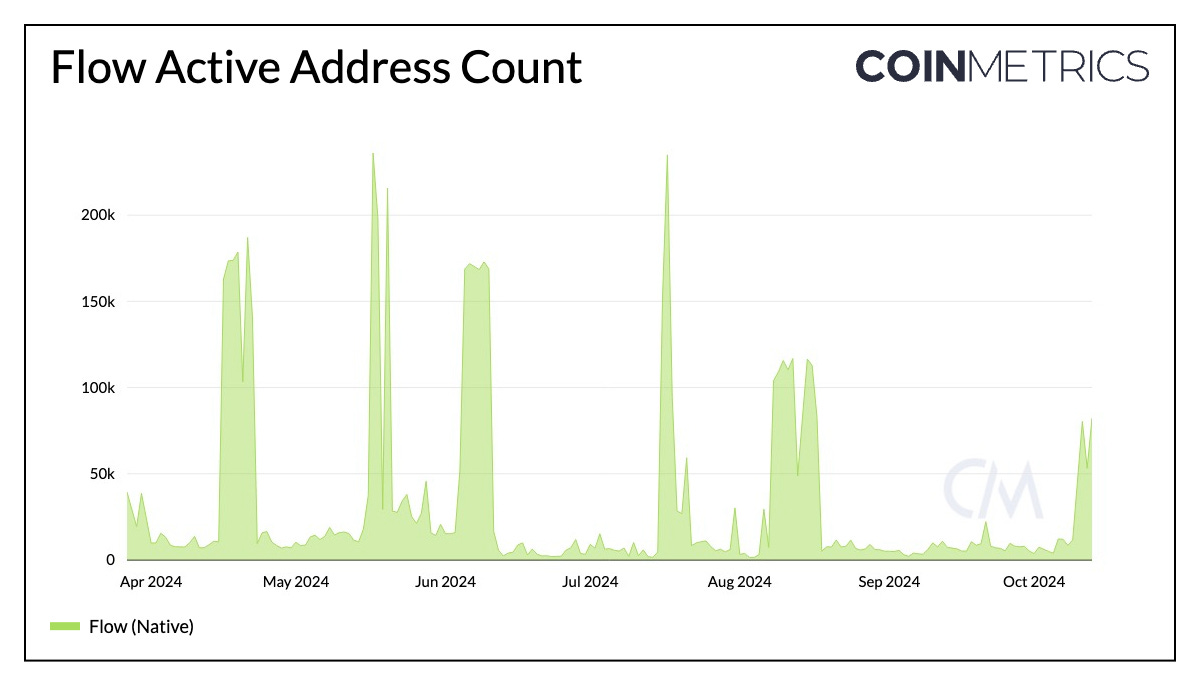

Source: Flow Blockchain Block Time & MEV ResilienceThe separation of block production across different node types provides strong maximal extractable value (MEV) resilience. Each node type has access only to the information it needs, without visibility into the state of block production, allowing for more predictable gas fees and improved user experience. This architecture contributes to Flow’s ability to maintain block times as low as 1.3, decreasing to 0.8 seconds with its upgrade. This positions Flow as one of the lowest in average block time among other Layer-1’s. This fast finality creates a better user experience, making it well-suited for apps that require quick transaction processing and confirmation of user actions. Source: Coin Metrics Network Data Pro Network Data (On Chain) MetricsCoin Metrics recently onboarded network data metrics for Flow, including its Cadence and EVM chain. This allows us to understand the nature of usage of the network and gauge adoption of applications in the Flow ecosystem. Source: Coin Metrics Network Data Pro Flow imposes storage fees and transaction fees on the network, aiming to deter malicious actors and manage computational resources. As on other networks, users are required to pay transaction fees to execute actions on the blockchain. These are determined based on an inclusion fee that accounts for usage of resources, an execution fee and a surge factor based on market conditions. Average transaction fees on Flow (native) are as low as $0.000015 as a result of Cadence’s resource oriented design and $0.000070 on Flow (EVM), making it suitable for high-frequency, low-value transactions such as gaming or DeFi applications. Source: Coin Metrics Network Data Pro Transaction count peaked near ~1.2M in June, and has averaged around ~300K in daily transactions, with a recent spike to 470K. As the EVM implementation gains traction, it has seen up to 12K in daily transactions. Source: Coin Metrics Network Data Pro As measured through daily active addresses, activity on Flow (native chain) exhibits a cyclical pattern characterized by periodic spikes followed by periods of lower activity. There have been multiple short-lived spikes to over 170K active addresses, failing to sustain those levels. These coordinated boosts in activity could likely be influenced by Flow’s technical architecture, including batched execution of transactions and contract-based execution through Cadence Owned Accounts (COA’s). ConclusionFlow’s distinctive multi-role architecture, capabilities of the Cadence programming language and EVM compatibility position it uniquely within the layer-1 landscape, addressing the complex tradeoffs of scalability and interoperability. With the Crescendo upgrade bringing EVM equivalence to Flow, its existing features and ecosystem of applications can be complemented by the EVM ecosystem, growing developer flexibility, user-experience and ultimately, its user-base. The network data metrics highlighted in this report will continue to provide transparency into the usage, adoption and economics of the Flow blockchain. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

State of the Network’s Q3 2024 Mining Data Special

Tuesday, October 8, 2024

Get the best data-driven crypto insights and analysis every week: ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q3 2024 Wrap-Up

Tuesday, October 1, 2024

A data-driven overview of events shaping crypto markets in Q3–2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Real World Assets (RWAs) & Tokenization

Tuesday, September 24, 2024

Coin Metrics' State of the Network: Issue 278 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Crypto Universe Through the Lens of datonomy™

Tuesday, September 17, 2024

Coin Metrics' State of the Network: Issue 277 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A Primer on Blockchain Network Health

Tuesday, September 10, 2024

Coin Metrics' State of the Network: Issue 276 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏